FBIZ: Shaving 2012 Estimate, but Continuing Outperform - Analyst Blog

March 15 2012 - 12:23PM

Zacks

FBIZ: Shaving 2012 Estimate, but Continuing Outperform

Ann Heffron, CFA

First Business Financial Services, Inc.

(FBIZ) posted fourth quarter diluted EPS

of $0.90, up 275% from the $0.24 EPS reported last year, and $0.03

above our $0.87 estimate. Relative to our estimate, this largely

reflected lower-than-expected compensation expense due to reduced

bonus accruals as some divisions fell short of their targets,

partly offset by a higher-than-expected loss provision.

Compared to the year-ago quarter, fourth quarter results were

boosted by a gain in net interest income from a higher net interest

margin, sharp growth in service charges on deposits and loan fees,

a significantly reduced loan loss provision, strong control over

operating costs, and a lower effective tax rate.

The Company continued to make excellent progress in reducing

problem assets and indications are that it has turned the corner

regarding asset quality. Nonaccrual loans fell $5.2 million, or

19%, sequentially to $21.8 million, while foreclosed assets rose

$0.2 million, or 9%, to $2.2 million. As a percentage of total

loans and OREO, nonperforming assets fell 56 basis points

sequentially to 2.81% from 3.37% at the end of the third quarter

and 175 basis points year over year from the 4.56% at the end of

2010.

For the year, FBIZ earned $7.7 million before a $0.7 million

one-time tax benefit related to a change in regulation for net

operating loss carryforwards by the state of Wisconsin, or $2.94

per diluted share, up 107% from the $3.6 million before a $2.7

million goodwill impairment charge, or $1.42 per diluted share,

posted in 2010.

This year-over-year gain primarily stemmed from an 11% rise in net

interest income to $35.5 million on a 25 basis-point increase in

the net interest margin (average loans rose only 0.5%), a 40%

decline in the loan loss provision to $4.3 million, and modest 3%

growth in noninterest expense, largely due to lower credit costs

from collateral liquidations and foreclosures, which combined fell

about 12 % to $1.2 million, and a 21% drop in FDIC insurance

premiums to $2.5 million, due to changes in premium calculations

required by the Dodd-Frank Act that became effective on April 1,

2011. This was partly offset by a 12% increase in compensation

expense to $14.9 million stemming from FBIZ’s better operating

performance, as well as a 33% jump in marketing costs to $1.0

million, reflecting increased emphasis on gathering in-market core

deposits.

We are reducing our 2012 diluted EPS estimate to $3.25 from $3.40,

principally due to three factors: (1) increased compensation

expense as the Company intends to hire new business development

officers during 2012 to drum up new business, (2) a higher

effective tax rate than we estimated previously, and (3) a modestly

higher loan loss provision than our prior estimate. Despite the

reduction, our $3.25 estimate in 2012 still represents an 11% gain

over 2011’s $2.94.

First Business Financial Services, Inc. (FBIZ or the Company) is a

bank holding company headquartered in Madison, Wisconsin, with $1.1

billion in total assets at December 31, 2011. FBIZ specializes in

business lending for small-medium-sized companies with sales

ranging from $2-50 million. As an adjunct to these services, FBIZ

also offers banking services to business owners, executives,

professionals, and high net worth individuals, though this is a

less significant part of its business.

To view a free copy of our most recent research report on

FBIZ, visit Ann Heffron's page at

http://scr.zacks.com/ .

FIRST BUS FINL (FBIZ): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

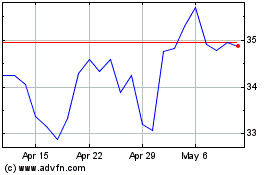

First Business Financial... (NASDAQ:FBIZ)

Historical Stock Chart

From Jun 2024 to Jul 2024

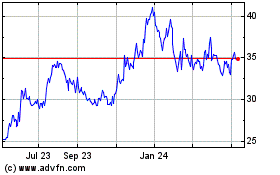

First Business Financial... (NASDAQ:FBIZ)

Historical Stock Chart

From Jul 2023 to Jul 2024