AUSTIN, Texas, July 24 /PRNewswire-FirstCall/ -- EZCORP, Inc.

(NASDAQ:EZPW) announced today results for its fiscal third quarter

and nine-month period, which ended June 30, 2008. EZCORP's net

income for the quarter ended June 30, 2008 increased 60% to

$10,827,000 ($0.25 per share) compared to $6,762,000 ($0.16 per

share) for the quarter ended June 30, 2007. Total revenues for the

quarter increased 24% over the prior year period to $108,070,000

with pawn service charges up 34%, total sales (merchandise and

jewelry scrapping) up 26%, and signature loan revenues (payday loan

and credit service fees) up 16%. In EZCORP's U.S. EZPAWN

operations, store level operating income improved 47% to

$19,474,000; and in its EZMONEY operations, store level operating

income improved 36% to $9,067,000. EZCORP's 30 store Empeno Facil

operation contributed $931,000 compared to a slight loss in the

prior year period. After administrative expense and depreciation

and amortization, consolidated operating income for the quarter

improved 78% to $16,584,000 (22% of net revenue) compared to

$9,307,000 (15% of net revenue) for the prior year quarter.

EZCORP's net income for the nine-month period ended June 30, 2008

increased 36% to $36,398,000 ($0.84 per share) compared to

$26,719,000 ($0.62 per share) for the prior year nine-month period.

Operating income for the nine-months improved 43% to $55,669,000

(24% of net revenues) compared to $38,810,000 (21% of net revenues)

for the prior year nine-month period. Commenting on these results,

President and Chief Executive Officer, Joe Rotunda, stated,

"Overall, our third quarter was a great quarter for EZCORP and was

our twenty-fourth consecutive quarter of year-over-year earnings

growth. Particularly gratifying is that these results are after a

two cents per share impact from two non-recurring charges. Once

again our results were generated by solid contributions from each

of our business segments -- EZPAWN and EZMONEY in the U.S. and

Empeno Facil in Mexico." Rotunda continued, "I think it's

noteworthy to point out how we believe our business was impacted,

both favorably and unfavorably, by the economic stimulus checks,

which began distribution in May. During May and June, we realized a

slightly lower than expected seasonal demand for loans; however, we

saw a favorable impact on retail sales and loan redemptions in our

EZPAWN locations and lower levels of bad debt in our EZMONEY

locations. While difficult to quantify, we do believe these checks

had a net favorable impact on our results in the quarter." Rotunda

concluded, "As announced on July 8th, we expect earning per share

for our September quarter to be approximately $0.35 per share

compared to $0.26 in the prior year period. Included in this

guidance is an approximate one cent benefit from our pending Value

Financial Services acquisition. This will give us earnings per

share of approximately $1.19 for our fiscal 2008 compared to $0.88

for our fiscal 2007. For the fiscal year, we expect to open 70

EZMONEY locations, including 47 opened through June, and twelve

Empeno Facil locations, including six opened through June." EZCORP

is primarily a lender or provider of credit services to individuals

who do not have cash resources or access to credit to meet their

short-term cash needs. In 294 U.S. EZPAWN and 30 Mexico Empeno

Facil locations open on June 30, 2008, the Company offers

non-recourse loans collateralized by tangible personal property,

commonly known as pawn loans. At these locations, the Company also

sells merchandise, primarily collateral forfeited from its pawn

lending operations, to consumers looking for good value. In 461

EZMONEY locations and 71 EZPAWN locations open on June 30, 2008,

the Company offers short-term non-collateralized loans, often

referred to as payday loans, or fee based credit services to

customers seeking loans. This announcement contains certain

forward-looking statements regarding the Company's expected

performance for future periods including, but not limited to, new

store expansion, anticipated benefits of acquisitions and expected

future earnings. Actual results for these periods may materially

differ from these statements. Such forward-looking statements

involve risks and uncertainties such as changing market conditions

in the overall economy and the industry, consumer demand for the

Company's services and merchandise, changes in the regulatory

environment, and other factors periodically discussed in the

Company's annual, quarterly and other reports filed with the

Securities and Exchange Commission. You are invited to listen to a

conference call discussing these results on July 24, 2008 at 3:30pm

Central Time. The conference call can be accessed over the Internet

or replayed at your convenience at the following address.

http://www.videonewswire.com/event.asp?id=49784 For additional

information, contact Dan Tonissen at (512) 314-2289. EZCORP, Inc.

Highlights of Consolidated Statements of Operations (Unaudited) (in

thousands, except per share data) Three Months Ended June 30, 2008

2007 1 Revenues: 2 Merchandise sales $35,728 $30,607 3 Jewelry

scrapping sales 17,907 12,069 4 Pawn service charges 22,691 16,978

5 Signature loan fees 31,223 27,024 6 Other 521 315 7 Total

revenues 108,070 86,993 8 Cost of goods sold: 9 Cost of merchandise

sales 20,706 17,745 10 Cost of jewelry scrapping sales 10,754 7,676

11 Total cost of goods sold 31,460 25,421 12 Net revenues 76,610

61,572 13 14 Operations expense 38,593 31,595 15 Signature loan bad

debt 8,545 10,142 16 Administrative expense 9,807 8,033 17

Depreciation and amortization 3,081 2,495 18 Operating income

16,584 9,307 19 20 Interest income (165) (618) 21 Interest expense

72 67 22 Equity in net income of unconsolidated affiliate (997)

(720) 23 (Gain) / loss on sale/disposal of assets 284 (155) 24

Other 11 - 25 Income before income taxes 17,379 10,733 26 Income

tax expense 6,552 3,971 27 Net income $10,827 $6,762 28 29 Net

income per share, diluted $0.25 $0.16 30 31 Weighted average

shares, diluted 43,325 43,482 EZCORP, Inc. Highlights of

Consolidated Statements of Operations (Unaudited) (in thousands,

except per share data) Nine Months Ended June 30, 2008 2007 1

Revenues: 2 Merchandise sales $120,902 $107,993 3 Jewelry scrapping

sales 49,570 33,695 4 Pawn service charges 67,384 51,496 5

Signature loan fees 94,917 74,132 6 Other 1,228 1,007 7 Total

revenues 334,001 268,323 8 Cost of goods sold: 9 Cost of

merchandise sales 72,122 63,903 10 Cost of jewelry scrapping sales

29,610 21,715 11 Total cost of goods sold 101,732 85,618 12 Net

revenues 232,269 182,705 13 14 Operations expense 113,185 94,087 15

Signature loan bad debt 24,847 19,086 16 Administrative expense

29,541 23,528 17 Depreciation and amortization 9,027 7,194 18

Operating income 55,669 38,810 19 20 Interest income (359) (1,499)

21 Interest expense 228 214 22 Equity in net income of

unconsolidated affiliate (3,162) (2,185) 23 (Gain) / loss on

sale/disposal of assets 527 (131) 24 Other 11 - 25 Income before

income taxes 58,424 42,411 26 Income tax expense 22,026 15,692 27

Net income $36,398 $26,719 28 29 Net income per share, diluted

$0.84 $0.62 30 31 Weighted average shares, diluted 43,269 43,393

EZCORP, Inc. Highlights of Consolidated Balance Sheets (Unaudited)

(in thousands, except per share data and store counts) As of June

30, 2008 2007 1 Assets: 2 Current assets: 3 Cash and cash

equivalents $29,812 $31,686 4 Pawn loans 68,022 58,053 5 Payday

loans, net 6,598 4,514 6 Pawn service charges receivable, net

10,061 8,150 7 Signature loan fees receivable, net 5,086 5,439 8

Inventory, net 39,444 33,641 9 Deferred tax asset 9,007 7,344 10

Federal income taxes receivable 454 - 11 Prepaid expenses and other

assets 5,622 5,197 12 Total current assets 174,106 154,024 13 14

Investment in unconsolidated affiliate 37,248 21,250 15 Property

and equipment, net 38,661 31,895 16 Deferred tax asset, non-current

5,620 4,536 17 Goodwill 24,779 16,211 18 Other assets, net 5,585

3,448 19 Total assets $285,999 $231,364 20 Liabilities and

stockholders' equity: 21 Current liabilities: 22 Accounts payable

and other accrued expenses $24,120 $21,658 23 Customer layaway

deposits 2,254 1,888 24 Federal income taxes payable - 1,255 25

Total current liabilities 26,374 24,801 26 27 Deferred gains and

other long-term liabilities 2,909 2,977 28 Total stockholders'

equity 256,716 203,586 29 Total liabilities and stockholders'

equity $285,999 $231,364 30 31 Pawn loan balance per ending pawn

store $210 $195 32 Inventory per ending pawn store $122 $113 33

Book value per share $6.19 $4.93 34 Tangible book value per share

$5.50 $4.47 35 EZPAWN store count - end of period 324 298 36

EZMoney signature loan store count - end of period 461 390 37

Shares outstanding - end of period 41,441 41,300 EZCORP, Inc.

Operating Segment Results (Unaudited) (in thousands, except store

counts) EZPAWN United EZPAWN Three months ended States Mexico

EZMONEY June 30, 2008: Operations Operations Operations

Consolidated 1 Revenues: 2 Sales $51,799 $1,836 $ - $53,635 3 Pawn

service charges 21,378 1,313 - 22,691 4 Signature loan fees 650 -

30,573 31,223 5 Other 521 - - 521 6 Total revenues 74,348 3,149

30,573 108,070 7 8 Cost of goods sold 30,301 1,159 - 31,460 9 Net

revenues 44,047 1,990 30,573 76,610 10 11 Operating expenses: 12

Operations expense 24,371 1,059 13,163 38,593 13 Signature loan bad

debt 202 - 8,343 8,545 14 Total direct expenses 24,573 1,059 21,506

47,138 15 Store operating income $19,474 $931 $9,067 $29,472 16 17

EZPAWN store count - end of period 294 30 - 324 18 EZMoney

signature loan store count - end of period 6 - 455 461 19 20 Three

months ended June 30, 2007: 21 Revenues: 22 Sales $42,623 $53 $ -

$42,676 23 Pawn service charges 16,955 23 - 16,978 24 Signature

loan fees 782 - 26,242 27,024 25 Other 315 - - 315 26 Total

revenues 60,675 76 26,242 86,993 27 28 Cost of goods sold 25,395 26

- 25,421 29 Net revenues 35,280 50 26,242 61,572 30 31 Operating

expenses: 32 Operations expense 21,481 117 9,997 31,595 33

Signature loan bad debt 559 - 9,583 10,142 34 Total direct expenses

22,040 117 19,580 41,737 35 Store operating income $13,240 $(67)

$6,662 $19,835 36 37 EZPAWN store count - end of period 295 3 - 298

38 EZMoney signature loan store count - end of period 6 - 384 390

EZCORP, Inc. Operating Segment Results (Unaudited) (in thousands,

except store counts) EZPAWN United EZPAWN Nine months ended States

Mexico EZMONEY June 30, 2008: Operations Operations Operations

Consolidated 1 Revenues: 2 Sales $165,749 $4,723 $ - $170,472 3

Pawn service charges 64,089 3,295 - 67,384 4 Signature loan fees

2,131 - 92,786 94,917 5 Other 1,224 4 - 1,228 6 Total revenues

233,193 8,022 92,786 334,001 7 8 Cost of goods sold 98,853 2,879 -

101,732 9 Net revenues 134,340 5,143 92,786 232,269 10 11 Operating

expenses: 12 Operations expense 71,399 2,781 39,005 113,185 13

Signature loan bad debt 741 - 24,106 24,847 14 Total direct

expenses 72,140 2,781 63,111 138,032 15 Store operating income

$62,200 $2,362 $29,675 $94,237 16 17 EZPAWN store count - end of

period 294 30 - 324 18 EZMoney signature loan store count - end of

period 6 - 455 461 19 20 Nine months ended June 30, 2007: 21

Revenues: 22 Sales $141,621 $67 $ - $141,688 23 Pawn service

charges 51,464 32 - 51,496 24 Signature loan fees 2,486 - 71,646

74,132 25 Other 1,006 1 - 1,007 26 Total revenues 196,577 100

71,646 268,323 27 28 Cost of goods sold 85,583 35 - 85,618 29 Net

revenues 110,994 65 71,646 182,705 30 31 Operating expenses: 32

Operations expense 64,641 243 29,203 94,087 33 Signature loan bad

debt 1,043 - 18,043 19,086 34 Total direct expenses 65,684 243

47,246 113,173 35 Store operating income $45,310 $(178) $24,400

$69,532 36 37 EZPAWN store count - end of period 295 3 - 298 38

EZMoney signature loan store count - end of period 6 - 384 390

DATASOURCE: EZCORP, Inc. CONTACT: Dan Tonissen of EZCORP, Inc.,

+1-512-314-2289 Web site: http://www.ezcorp.com/

Copyright

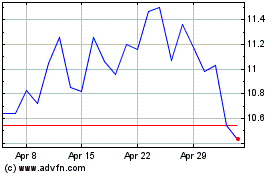

EZCORP (NASDAQ:EZPW)

Historical Stock Chart

From Sep 2024 to Oct 2024

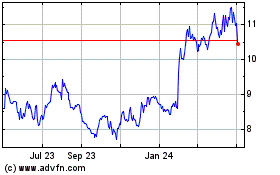

EZCORP (NASDAQ:EZPW)

Historical Stock Chart

From Oct 2023 to Oct 2024