0001570562false00015705622024-05-072024-05-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 7, 2024

EVOLUS, INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

Delaware | | 001-38381 | | 46-1385614 |

(State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) |

520 Newport Center Drive, Suite 1200

Newport Beach, California 92660

(Address of principal executive offices) (Zip Code)

(949) 284-4555

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of Class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $0.00001 per share | EOLS | The Nasdaq Stock Market LLC (Nasdaq Global Market)

|

Indicate by check mark whether the registrant is an emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 2.02 Results of Operations and Financial Condition.

On May 7, 2024, the Company issued a press release announcing its financial results for the quarter ended March 31, 2024. The press release is being furnished as Exhibit 99.1 to this Current Report on Form 8-K.

As provided in General Instruction B.2 of Form 8-K, the information in this Item 2.02 of this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be incorporated by reference into any registration statement or other document filed under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

Exhibit Number | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| Evolus, Inc. |

| | |

Dated: May 7, 2024 | | /s/ David Moatazedi |

| | David Moatazedi |

| | President and Chief Executive Officer |

Evolus Reports First Quarter 2024 Results and Provides Business Update

•Q1 2024 Net Revenue of $59.3 Million, Up 42% from Q1 2023

•Non-GAAP Loss from Operations of $0.9 Million, on Track to Non-GAAP Profitability1 in Q4 2024 and Full Year 2025

•U.S. Clinical Trials Completed for Evolysse® Lift and Smooth fillers, FDA Submission Expected within Next 90 Days

•Reaffirms Full-Year 2024 Net Revenue Guidance of $255 Million to $265 Million, Representing a 31% Growth Rate at the Top End

•Remains on Track to Achieve Projected Total Net Revenue Goal of At Least $700 Million by 2028

NEWPORT BEACH, Calif., May 7, 2024 – Evolus, Inc. (NASDAQ: EOLS), a performance beauty company with a focus on building an aesthetic portfolio of consumer brands, today reported financial results for the first quarter ended March 31, 2024, and provided a business update.

“Coming off a record year in 2023, we’re proud to carry the momentum into 2024 with our first quarter performance multiples above the market,” said David Moatazedi, President and Chief Executive Officer. “We are building a performance beauty company dedicated to cash-pay and focused on millennials. This creates a unique advantage in the market and is driving high customer and consumer satisfaction. These results underscore the continued growth of our brand awareness and the loyalty of our customers, who continue to choose Evolus.”

Moatazedi continued, “As we look ahead, we are committed to delivering innovative solutions that empower consumers within performance beauty. With our focus on excellence, we remain poised to seize the opportunities ahead, driving sustained growth with our expanded global portfolio, delivering on profitability milestones toward our total net revenue goal of at least $700 million by 2028, and solidifying Evolus’ position as a leader in its industry.”

First Quarter 2024 Highlights and Recent Developments

•The company’s key performance indicators demonstrated continued strong momentum during the first quarter.

◦Evolus added over 700 new customer accounts in the quarter, bringing the total number of customers purchasing since launch to over 13,000. The reorder rate among customers remains approximately 70%.2

◦Members in the Evolus Rewards consumer loyalty program grew by over 75,000 to approximately 825,000.3

◦Total Evolus Rewards redemptions for the quarter hit an all-time high of nearly 180,000 driven by continued demand from existing patients receiving repeat treatments at the rate of approximately 60%, which demonstrates sustained brand loyalty.

First Quarter 2024 Financial Results

•Total net revenues for the first quarter of 2024 increased 42% to $59.3 million from $41.7 million in the first quarter of 2023 driven primarily by higher volumes of Jeuveau®.

•Gross profit margin and adjusted gross profit margin were 68.3% and 69.5%, respectively. Adjusted gross profit margin, which excludes amortization of intangible assets, was in line with company guidance for the full year, as noted below.

•Operating expenses for the first quarter of 2024 were $68.3 million, compared to $69.6 million in the fourth quarter of 2023.

•Non-GAAP operating expenses for the first quarter of 2024 were $42.1 million, compared to $45.5 million in the fourth quarter of 2023. Non-GAAP operating expenses exclude product cost of sales, stock-based compensation expense, revaluation of the contingent royalty obligation, and depreciation and amortization.

•Loss from operations for the first quarter of 2024 was $8.9 million, compared to $8.6 million in the fourth quarter of 2023. Non-GAAP loss from operations in the first quarter of 2024 was $0.9 million compared to $3.7 million in the fourth quarter of 2023 representing continued progress toward achieving profitability 1. Non-GAAP loss from operations excludes stock-based compensation expense, revaluation of the contingent royalty obligation, and depreciation and amortization.

•Cash and cash equivalents at March 31, 2024 were $97.0 million compared to $62.8 million at December 31, 2023. The cash balance includes $47.0 million of net proceeds from the underwritten offering of common stock in March 2024. For the first quarter of 2024, net cash used for operating activities was $10.6 million, which was $10.0 million lower than the first quarter of 2023, representing continued progress toward cash flow breakeven.

•Evolus continues to expect its existing liquidity will fully fund it to non-GAAP profitability1 for the fourth quarter of 2024 and the full year 2025.

Outlook

•Evolus continues to expect total net revenues for the full year 2024 to be between $255 million and $265 million, representing year-over-year growth of 31% at the top end.

•The company continues to expect its adjusted gross profit margin for the full year 2024 to be between 68% and 71%.

•Evolus continues to expect its full-year non-GAAP operating expenses to be between $185 million and $190 million.

•The company continues to expect to achieve positive non-GAAP operating income on a consolidated basis for the fourth quarter of 2024 and for the full year 2025.

•During 2024, Evolus expects to broaden its global footprint by expanding into additional countries with Nuceiva®, most notably Australia and Spain.

•Evolus expects to submit Premarket Approval (PMA) applications for the first two Evolysse™ dermal filler products with the FDA within next 90 days and anticipates regulatory approvals for the remaining Estyme® dermal filler products in Europe in late 2024.

•The company projects its total net revenue can reach at least $700 million by 2028, a compound annual growth rate of 28% from 2023, based on the combination of its existing aesthetic neurotoxin business and anticipated launch of the Evolysse™ HA dermal filler product line beginning in 2025.

Conference Call Information

Management will host a conference call and live webcast to discuss Evolus’ financial results today at 4:30 p.m. ET. To participate in the conference call, dial (877) 407-6184 (U.S.) or (201) 389-0877 (international) or connect to the live webcast via the link on the Investor Relations page of our website at www.evolus.com.

Following the completion of the call, an audio replay can be accessed for 48 hours by dialing (877) 660-6853 (U.S.) or (201) 612-7415 (international) and using conference number 13746068. An archived webcast, which will remain available for 30 days, can also be accessed on the Investor Relations page of our website at www.evolus.com.

About Evolus, Inc.

Evolus (NASDAQ: EOLS) is a global performance beauty company evolving the aesthetic neurotoxin market for the next generation of beauty consumers through its unique, customer-centric business model and innovative digital platform. Our mission is to become a global, multi-product aesthetics company based on our flagship product, Jeuveau® (prabotulinumtoxinA-xvfs), the first and only neurotoxin dedicated exclusively to aesthetics and manufactured in a state-of-the-art facility using Hi-Pure™ technology. Evolus is expanding its product portfolio having entered into a definitive agreement to be the exclusive U.S. distributor of Evolysse™, and the exclusive distributor in Europe of Estyme®, a line of unique dermal fillers currently in late-stage development. Visit us at www.evolus.com, and follow us on LinkedIn, Twitter, Instagram or Facebook.

1 Within this press release, “profitability” is defined as achieving positive non-GAAP operating income.

2 Represents cumulative statistics from the launch of Jeuveau® in May 2019 through March 31, 2024.

3 Represents cumulative statistics from the launch of Evolus Rewards in May 2020 through March 31, 2024.

Use of Non-GAAP Financial Measures

Evolus’ financial results are prepared in accordance with accounting principles generally accepted in the United States of America (“GAAP”). This press release and the reconciliation tables included in the financial schedules below include adjusted gross profit, adjusted gross profit margin, non-GAAP operating expenses and non-GAAP (loss) from operations. Adjusted gross profit is calculated as gross profit excluding amortization of an intangible asset. Adjusted gross profit margin is defined as adjusted gross profit as a percentage of total net revenues. Non-GAAP operating expenses and non-GAAP (loss) from operations exclude (i) product cost of sales, in the case of non-GAAP operating expenses only, (ii) the revaluation of contingent royalty obligations, (iii) stock-based compensation expense, and (iv) depreciation and amortization. Management believes that adjusted gross profit and adjusted gross profit margin are important measures for investors because management uses adjusted gross profit margin as a key performance indicator to evaluate the profitability of sales without giving effect to costs that are not core to our cost of sales, such as the amortization of an intangible asset. Management believes that non-GAAP operating expenses and non-GAAP (loss) from operations are useful in helping to identify the company’s core operating performance and enables management to consistently analyze the period-to-period financial performance of the core business operations. Management also believes that non-GAAP operating expenses and non-GAAP (loss) from operations will enable investors to assess the company in the same way that management has historically assessed the company’s operating expenses against comparable companies with conventional accounting methodologies. The company’s definitions of adjusted gross profit, adjusted gross profit margin, non-GAAP operating expenses and non-GAAP (loss) from operations have limitations as analytical tools and may differ from other companies reporting similarly named measures. Non-GAAP measures should not be considered measures of financial performance under GAAP, and the items excluded from such non-GAAP measures should not be considered in isolation or as alternatives to financial statement data presented in the financial statements as an indicator of financial performance or liquidity. Non-GAAP measures should be considered in addition to results prepared in accordance with GAAP but should not be considered a substitute for or superior to GAAP results.

For a reconciliation of our historical adjusted gross profit, adjusted gross profit margin, non-GAAP operating expenses and non-GAAP (loss) from operations presented herein to gross profit, gross profit margin, GAAP operating expenses and GAAP loss from operations, the most directly comparable GAAP financial measures, please see “Reconciliation of Gross Profit Margin to Adjusted Gross Profit Margin,” “Reconciliation of GAAP Operating Expenses to Non-GAAP Operating Expenses” and “Reconciliation of GAAP (Loss) from Operations to Non-GAAP (Loss) from Operations” in the financial schedules below. In addition, this press release includes information regarding the company’s expected adjusted gross profit margin and non-GAAP operating expenses for full year 2024 and the company’s expected non-GAAP operating income (loss) for the fourth quarter of 2024 and full year 2025. Evolus has not provided a reconciliation of such forward-looking non-GAAP adjusted gross profit margin, non-GAAP operating expenses or non-GAAP operating (loss) because a reconciliation of such measures to forward-looking GAAP gross profit margin, GAAP operating expenses and GAAP loss from operations, respectively, the most directly comparable GAAP financial measures, is not available without unreasonable efforts. This is due to the inherent difficulty of forecasting the timing or amount of various

reconciling items that would impact the forward-looking outlook for these non-GAAP financial measures that have not yet occurred and/or cannot be reasonably predicted. Such unavailable information could have a significant impact on Evolus’ GAAP financial results.

Forward-Looking Statements

This press release contains forward-looking statements as defined under the Private Securities Litigation Reform Act of 1995 that involve risks and uncertainties, including statements about future events, our business, financial condition, results of operations and prospects, our industry and the regulatory environment in which we operate. Any statements contained herein that are not statements of historical or current facts are forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “plan,” “potential,” “predict,” “project,” “should,” “will,” “would” or the negative of those terms, or other comparable terms intended to identify statements about the future. The company’s forward-looking statements include, but are not limited to, statements related to anticipated product launches; market conditions and consumer demand; timing of regulatory submissions and approvals; expansions into new markets; the company’s long-term revenue outlook and its financial outlook for 2024 and, in the case of non-GAAP operating income, 2025; and the company’s cash position and expectations for reaching profitability1 and funding the company’s operations.

The forward-looking statements included herein are based on our current expectations, assumptions, estimates and projections, which we believe to be reasonable, and are subject to risks and uncertainties that could cause actual results to differ materially from those expressed or implied by the forward-looking statements. These risks and uncertainties, all of which are difficult or impossible to predict accurately and many of which are beyond our control, include, but are not limited to uncertainties associated with our ability to comply with the terms and conditions in the Medytox Settlement Agreements, our ability to fund our future operations or obtain financing to fund our operations, unfavorable global economic conditions and the impact on consumer discretionary spending, uncertainties related to customer and consumer adoption of Jeuveau® and EvolysseTM, the efficiency and operability of our digital platform, competition and market dynamics, our ability to successfully launch and commercialize our products in new markets, including the EvolysseTM dermal filler product line in the U.S., our ability to maintain regulatory approvals of Jeuveau® or obtain regulatory approvals for new product candidates or indications, our reliance on Symatese to achieve regulatory approval for the EvolysseTM dermal filler product line in the U.S., and other risks described in our filings with the Securities and Exchange Commission, including in the section entitled “Risk Factors” in our Annual Report on Form 10-K Form and our Quarterly Report on Form 10-Q for the quarter ended March 31, 2024 expected to be filed with the Securities and Exchange Commission on or about May 7, 2024. These filings can be accessed online at www.sec.gov. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. Except as required by law, we undertake no obligation to update or revise any forward-looking statements to reflect new information, changed circumstances or unanticipated events. If we do update or revise one or more of these statements, investors and others should not conclude that we will make additional updates or corrections.

Jeuveau® and Nuceiva®, are registered trademarks and Evolysse™ is a trademark of Evolus, Inc.

Hi-Pure™ is a trademark of Daewoong Pharmaceutical Co, Ltd.

Estyme® is a trademark of Symatese Aesthetics S.A.S.

###

Investor Contact:

Nareg Sagherian

Vice President, Head of Global Investor Relations and Corporate Communications

Tel: 248-202-9267

Email: ir@evolus.com

Media Contact:

Email: media@evolus.com

Evolus, Inc.

Consolidated Statements of Operations and Comprehensive Loss

(Unaudited, in thousands, except loss per share data)

| | | | | | | | | | | | | | | |

| Three Months Ended

March 31, | | |

| 2024 | | 2023 | | | | |

| Revenue: | | | | | | | |

| Product revenue, net | $ | 58,964 | | | $ | 41,047 | | | | | |

| Service revenue | 369 | | | 674 | | | | | |

| Total net revenues | 59,333 | | | 41,721 | | | | | |

| | | | | | | |

| Operating expenses: | | | | | | | |

| Product cost of sales (excludes amortization of intangible assets) | 18,067 | | | 12,146 | | | | | |

| Selling, general and administrative | 45,123 | | | 37,384 | | | | | |

| Research and development | 2,078 | | | 1,381 | | | | | |

| | | | | | | |

| Revaluation of contingent royalty obligation payable to Evolus Founders | 1,578 | | | 1,648 | | | | | |

| Depreciation and amortization | 1,409 | | | 1,202 | | | | | |

| Total operating expenses | 68,255 | | | 53,761 | | | | | |

| Loss from operations | (8,922) | | | (12,040) | | | | | |

| Other income (expense): | | | | | | | |

| Interest income | 517 | | | 99 | | | | | |

| Interest expense | (4,702) | | | (2,789) | | | | | |

| Other income (expense), net | 45 | | | (38) | | | | | |

| Loss before income taxes: | (13,062) | | | (14,768) | | | | | |

| Income tax expense | 47 | | | 23 | | | | | |

| Net loss | $ | (13,109) | | | $ | (14,791) | | | | | |

| Other comprehensive loss: | | | | | | | |

| Unrealized loss, net of tax | (130) | | | (79) | | | | | |

| | | | | | | |

| Comprehensive loss | $ | (13,239) | | | $ | (14,870) | | | | | |

| Net loss per share, basic and diluted | $ | (0.22) | | | $ | (0.26) | | | | | |

| Weighted-average shares outstanding used to compute basic and diluted net loss per share | 58,797 | | | 56,476 | | | | | |

Evolus, Inc.

Summary of Consolidated Balance Sheet Data

(Unaudited, in thousands)

| | | | | | | | | | | |

| March 31, 2024 | | December 31, 2023 |

| Cash and cash equivalents | $ | 96,958 | | | $ | 62,838 | |

| Accounts receivable, net | 34,240 | | | 30,529 | |

| Inventories | 11,547 | | | 10,998 | |

| Prepaid expenses and other current assets | 7,520 | | | 5,580 | |

| Total current assets | 150,265 | | | 112,421 | |

| Noncurrent assets | 75,911 | | | 76,577 | |

| Total assets | $ | 226,176 | | | $ | 188,998 | |

| Accounts payable and accrued expenses | $ | 36,270 | | | $ | 38,084 | |

| Other current liabilities | 10,531 | | | 10,207 | |

| Total current liabilities | 46,801 | | | 48,291 | |

| Term loan, net of discount and issuance costs | 120,636 | | | 120,359 | |

| Other noncurrent liabilities | 40,296 | | | 41,037 | |

| Total liabilities | $ | 207,733 | | | $ | 209,687 | |

| Total stockholders’ equity (deficit) | $ | 18,443 | | | $ | (20,689) | |

Evolus, Inc.

Summary of Consolidated Cash Flows

(Unaudited, in thousands)

| | | | | | | | | | | | | | |

| Three Months Ended March 31, | |

| 2024 | | 2023 | |

Net cash (used in) provided by: | | | | |

Operating activities | $ | (10,615) | | | $ | (20,587) | | * |

Investing activities | (797) | | | (511) | | |

Financing activities | 45,662 | | | (1,282) | | |

| Effect of exchange rates on cash | (130) | | | (79) | | |

| Change in cash and cash equivalents | 34,120 | | | (22,459) | | |

| Cash and cash equivalents, beginning of period | 62,838 | | | 53,922 | | |

| Cash and cash equivalents, end of period | $ | 96,958 | | | $ | 31,463 | | |

*Includes a settlement payment of $5.0 million to Allergan/Medytox in the three months ended March 31, 2023.

Evolus, Inc.

Reconciliation of Gross Profit Margin to Adjusted Gross Profit Margin

(Unaudited, in thousands)

| | | | | | | | | | | |

| Three Months Ended March 31, |

| 2024 | | 2023 |

| Total net revenues | $ | 59,333 | | | $ | 41,721 | |

| Cost of sales: | | | |

| Product cost of sales (excludes amortization of intangible assets) | 18,067 | | | 12,146 | |

| | | |

| Amortization of distribution right intangible asset | 763 | | | 739 | |

| Total cost of sales | 18,830 | | | 12,885 | |

| Gross profit | 40,503 | | | 28,836 | |

| Gross profit margin | 68.3 | % | | 69.1 | % |

| | | |

| Add: Amortization of distribution right intangible asset | 763 | | | 739 | |

| Adjusted gross profit | $ | 41,266 | | | $ | 29,575 | |

| Adjusted gross profit margin | 69.5 | % | | 70.9 | % |

Evolus, Inc.

Reconciliation of GAAP Operating Expenses to

Non-GAAP Operating Expenses

(Unaudited, in thousands) | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | Three Months Ended December 31, |

| 2024 | | 2023 | | 2023 |

| GAAP operating expense | $ | 68,255 | | | $ | 53,761 | | | $ | 69,634 | |

| Adjustments: | | | | | |

| Product cost of sales (excludes amortization of intangible assets) | 18,067 | | | 12,146 | | | 19,270 | |

| | | | | |

| Revaluation of contingent royalty obligation | 1,578 | | | 1,648 | | | (875) | |

| Stock-based compensation: | | | | | |

| Included in selling, general and administrative | 4,863 | | | 3,167 | | | 4,119 | |

| Included in research and development | 216 | | | 127 | | | 278 | |

| Depreciation and amortization | 1,409 | | | 1,202 | | | 1,373 | |

| Non-GAAP operating expense | $ | 42,122 | | | $ | 35,471 | | | $ | 45,469 | |

| | | | | |

| | | | | |

Evolus, Inc.

Reconciliation of GAAP (Loss) from Operations to

Non-GAAP (Loss) from Operations

(Unaudited, in thousands)

| | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | | | Three Months Ended December 31, |

| 2024 | | 2023 | | | | 2023 |

| GAAP (loss) from operations | $ | (8,922) | | | $ | (12,040) | | | | | $ | (8,635) | |

| Adjustments: | | | | | | | |

| | | | | | | |

| Revaluation of contingent royalty obligation | 1,578 | | | 1,648 | | | | | (875) | |

| Stock-based compensation: | | | | | | | |

| Included in selling, general and administrative | 4,863 | | | 3,167 | | | | | 4,119 | |

| Included in research and development | 216 | | | 127 | | | | | 278 | |

| Depreciation and amortization | 1,409 | | | 1,202 | | | | | 1,373 | |

| | | | | | | |

| Non-GAAP (loss) from operations | $ | (856) | | | $ | (5,896) | | | | | $ | (3,740) | |

v3.24.1.u1

Cover Page

|

May 07, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

May 07, 2024

|

| Entity Registrant Name |

EVOLUS, INC.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38381

|

| Entity Tax Identification Number |

46-1385614

|

| Entity Address, Address Line One |

520 Newport Center Drive, Suite 1200

|

| Entity Address, City or Town |

Newport Beach

|

| Entity Address, State or Province |

CA

|

| Entity Address, Postal Zip Code |

92660

|

| City Area Code |

949

|

| Local Phone Number |

284-4555

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $0.00001 per share

|

| Trading Symbol |

EOLS

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001570562

|

| Amendment Flag |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

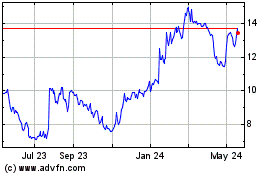

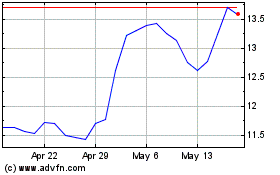

Evolus (NASDAQ:EOLS)

Historical Stock Chart

From Apr 2024 to May 2024

Evolus (NASDAQ:EOLS)

Historical Stock Chart

From May 2023 to May 2024