0001640428false00016404282024-05-062024-05-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): May 06, 2024 |

EverQuote, Inc.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-38549 |

26-3101161 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

210 Broadway |

|

Cambridge, Massachusetts |

|

02139 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (855) 522-3444 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Class A Common Stock, $0.001 par value per share |

|

EVER |

|

The Nasdaq Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 6, 2024, EverQuote, Inc. (the “Company”) issued a press release reporting financial results for the fiscal quarter ended March 31, 2024. The full text of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information contained in Item 2.02 in this Current Report on Form 8-K (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 7.01 Regulation FD Disclosure.

On May 6, 2024, the Company posted an investor presentation to its website (www.everquote.com). A copy of the investor presentation is furnished as Exhibit 99.2 to this Current Report on Form 8-K.

The information contained in Item 7.01 in this Current Report on Form 8-K (including Exhibit 99.2) shall not be deemed to be “filed” for purposes of Section 18 of the Exchange Act or otherwise subject to the liability of that section, and shall not be incorporated by reference into any registration statement or other document filed under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

EVERQUOTE, INC. |

|

|

|

|

Date: |

May 6, 2024 |

By: |

/s/ Julia Brncic |

|

|

|

Julia Brncic

Secretary and General Counsel |

Exhibit 99.1

EverQuote Announces First Quarter 2024 Financial Results

•First Quarter Revenue of $91.1 million

•First Quarter Variable Marketing Margin of $30.8 million

•First Quarter Record GAAP Net Income of $1.9 million and Adjusted EBITDA of $7.6 million

CAMBRIDGE, Mass., May. 6, 2024 (GLOBE NEWSWIRE) -- EverQuote, Inc. (Nasdaq: EVER), a leading online insurance marketplace, today announced financial results for the first quarter ended March 31, 2024.

“We had a strong start to 2024, delivering first quarter results that exceeded the high end of our guidance range for revenue, Variable Marketing Margin, or VMM, and Adjusted EBITDA,” said Jayme Mendal, CEO of EverQuote. “We believe we are in the early stages of what will be a multi-year auto carrier recovery as insurers have continued to selectively reactivate marketing campaigns, increase budgets, and expand their state footprints in our marketplace. I want to thank the EverQuote team for the incredible tenacity they have demonstrated and continue to demonstrate through the recent hard market cycle and our customers for their continued partnership.”

“In the first quarter, we achieved record levels of net income, Adjusted EBITDA and operating cash flow, as we started to realize the benefits of actions taken in 2023 to realign the business,” said Joseph Sanborn, CFO of EverQuote. “We achieved our previously articulated goal of restoring consistent positive quarterly cash flow from operations and have returned to our pre-downturn Adjusted EBITDA margins. Looking ahead, as we gain increasing confidence in the auto insurance industry recovery, we will continue to invest responsibly in our platform and business to position the company for growth and success.”

First Quarter 2024 Highlights:

(Unless otherwise noted, all comparisons are relative to the first quarter of 2023. EverQuote exited the health insurance vertical at the end of the second quarter of 2023. Revenue in our health insurance vertical was $8.7 million in the first quarter of 2023.)

•Total revenue of $91.1 million, a decrease of 17%.

•Automotive insurance vertical revenue of $77.5 million, a decrease of 14%.

•Home and renters insurance vertical revenue of $12.7 million, up 34%.

•VMM of $30.8 million, representing 34% of total revenue, compared to 33%.

•GAAP net income improved to $1.9 million, compared to a GAAP net loss of $2.5 million.

•Adjusted EBITDA increased to $7.6 million, compared to Adjusted EBITDA of $5.4 million.

•Cash flow from operations of $10.4 million, compared to a negative cash flow from operations of ($1.2 million).

•Ended the quarter with $48.6 million in cash and cash equivalents, an increase of 28% from $38.0 million at the end of the fourth quarter of 2023.

Second Quarter 2024 Outlook:

•Revenue of $100.0 - $105.0 million.

•Variable Marketing Margin of $31.0 - $33.0 million.

•Adjusted EBITDA of $7.0 - $9.0 million.

With respect to the Company’s expectations under “Second Quarter 2024 Outlook” above, the Company has not reconciled the non-GAAP measure Adjusted EBITDA to the GAAP measure net income (loss) in this press release because the Company does not provide guidance for stock-based compensation expense, depreciation and amortization expense, restructuring and other charges, acquisition-related costs, interest income, and income taxes on a consistent basis as the Company is unable to quantify these amounts without unreasonable efforts, which would be required to include a reconciliation of Adjusted EBITDA to GAAP net income (loss). In addition, the Company believes such a reconciliation would imply a degree of precision that could be confusing or misleading to investors.

Conference Call and Webcast Information

EverQuote will host a conference call and live webcast to discuss its first quarter 2024 financial results at 4:30 p.m. Eastern Time today, May 6, 2024. To access the conference call, dial Toll Free: +1 (800) 715-9871 for the US, or +1 (646) 307-196 for international callers, and provide conference ID 4210704. The live webcast and replay will be available on the Investors section of the Company’s website at https://investors.everquote.com.

Safe Harbor Statement

This press release contains forward-looking statements, within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact contained in this press release, including statements regarding our future results of operations and financial position, business strategy and plans, and objectives of management for future operations, are forward-looking statements. These statements involve known and unknown risks, uncertainties, and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “should,” “expects,” “might,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential,” “seek,” “would” or “continue,” or the negative of these terms or other similar expressions. The forward-looking statements in this press release are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition, liquidity and results of operations. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. These forward-looking statements speak only as of the date of this press release and are subject to a number of risks, uncertainties and assumptions described in our annual report on Form 10-K, our quarterly reports on Form 10-Q and our current reports on Form 8-K as filed with the Securities and Exchange Commission (“SEC”) from time to time. Additional information will also be set forth in the Company's quarterly report on Form 10-Q for the fiscal quarter ended March 31, 2024, which will be filed with the SEC. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. While we may elect to update these forward-looking statements at some point in the future, whether as a result of any new information, future events, or otherwise, we have no current intention of doing so except to the extent required by applicable law. Some of the key factors that could cause actual results to differ include: (1) our dependence on revenue from the property and casualty insurance industries, and specifically automotive insurance, and exposure to risks related to those industries; (2) our dependence on our relationships with insurance providers with no long-term minimum financial commitments; (3) our reliance on a small number of insurance providers for a significant portion of our revenue; (4) our dependence on third-party media sources for a significant portion of visitors to our websites and marketplace; (5) our ability to attract consumers searching for insurance to our websites and marketplace through Internet search engines, display

advertising, social media, content-based online advertising and other online sources; (6) any limitations restricting our ability to market to users or collect and use data derived from user activities; (7) risks related to cybersecurity incidents or other network disruptions; (8) risks related to the use of artificial intelligence; (9) our ability to develop new and enhanced products and services to attract and retain consumers and insurance providers, and to successfully monetize them; (10) the impact of competition in our industry and innovation by our competitors; (11) our ability to hire and retain necessary qualified employees to expand our operations; (12) our ability to stay abreast of and comply with new or modified laws and regulations that currently apply or become applicable to our business, including with respect to the insurance industry, telemarketing restrictions and data privacy requirements; (13) our ability to protect our intellectual property rights and maintain and build our brand; (14) our future financial performance, including our expectations regarding our revenue, cost of revenue, variable marketing margin, operating expenses, cash flows and ability to achieve, and maintain, future profitability; (15) our ability to properly collect, process, store, share, disclose and use consumer information and other data; and (16) the future trading prices of our Class A common stock.

About EverQuote

EverQuote operates a leading online insurance marketplace, connecting consumers with insurance providers. Our vision is to become the largest online source of insurance policies by using data, technology, and knowledgeable advisors to make insurance simpler, more affordable and personalized.

For more information, visit everquote.com and follow on LinkedIn https://www.linkedin.com/company/everquote/.

Investor Relations Contact

Brinlea Johnson

The Blueshirt Group

(415) 489-2193

EVERQUOTE, INC.

STATEMENTS OF OPERATIONS

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

|

|

(in thousands except per share) |

|

Revenue |

|

$ |

91,065 |

|

|

$ |

109,220 |

|

Cost and operating expenses(1): |

|

|

|

|

|

|

|

|

Cost of revenue |

|

|

5,041 |

|

|

|

5,770 |

|

Sales and marketing |

|

|

70,784 |

|

|

|

90,237 |

|

Research and development |

|

|

6,844 |

|

|

|

7,927 |

|

General and administrative |

|

|

6,630 |

|

|

|

7,830 |

|

Acquisition-related costs |

|

|

— |

|

|

|

(113 |

) |

Total cost and operating expenses |

|

|

89,299 |

|

|

|

111,651 |

|

Income (loss) from operations |

|

|

1,766 |

|

|

|

(2,431 |

) |

Other income (expense): |

|

|

|

|

|

|

|

|

Interest income |

|

|

386 |

|

|

|

187 |

|

Other income, net |

|

|

41 |

|

|

|

1 |

|

Total other income, net |

|

|

427 |

|

|

|

188 |

|

Income (loss) before income taxes |

|

|

2,193 |

|

|

|

(2,243 |

) |

Income tax expense |

|

|

(286 |

) |

|

|

(286 |

) |

Net income (loss) |

|

$ |

1,907 |

|

|

$ |

(2,529 |

) |

Net income (loss) per share: |

|

|

|

|

|

|

|

|

Basic |

|

$ |

0.06 |

|

|

$ |

(0.08 |

) |

Diluted |

|

$ |

0.05 |

|

|

$ |

(0.08 |

) |

Weighted average common shares outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

|

34,387 |

|

|

|

32,892 |

|

Diluted |

|

|

35,608 |

|

|

|

32,892 |

|

|

|

|

|

|

|

|

|

|

(1) Amounts include stock-based compensation expense, as follows: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

|

|

(in thousands) |

|

Cost of revenue |

|

$ |

36 |

|

|

$ |

54 |

|

Sales and marketing |

|

|

1,594 |

|

|

|

2,273 |

|

Research and development |

|

|

1,312 |

|

|

|

2,374 |

|

General and administrative |

|

|

1,576 |

|

|

|

1,808 |

|

|

|

$ |

4,518 |

|

|

$ |

6,509 |

|

EVERQUOTE, INC.

BALANCE SHEET DATA

|

|

|

|

|

|

|

|

|

|

|

March 31, |

|

|

December 31, |

|

|

|

2024 |

|

|

2023 |

|

|

|

(in thousands) |

|

Cash and cash equivalents |

|

$ |

48,620 |

|

|

$ |

37,956 |

|

Working capital |

|

|

48,624 |

|

|

|

39,293 |

|

Total assets |

|

|

135,401 |

|

|

|

110,925 |

|

Total liabilities |

|

|

47,078 |

|

|

|

30,018 |

|

Total stockholders' equity |

|

|

88,323 |

|

|

|

80,907 |

|

EVERQUOTE, INC.

STATEMENTS OF CASH FLOWS

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

|

|

(in thousands) |

|

Cash flows from operating activities: |

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

1,907 |

|

|

$ |

(2,529 |

) |

Adjustments to reconcile net income (loss) to net cash provided by (used in) operating activities: |

|

|

|

|

|

|

|

|

Depreciation and amortization expense |

|

|

1,263 |

|

|

|

1,407 |

|

Stock-based compensation expense |

|

|

4,518 |

|

|

|

6,509 |

|

Change in fair value of contingent consideration liabilities |

|

|

— |

|

|

|

(113 |

) |

Provision for bad debt |

|

|

18 |

|

|

|

245 |

|

Unrealized foreign currency transaction (gains) losses |

|

|

(4 |

) |

|

|

9 |

|

Changes in operating assets and liabilities: |

|

|

|

|

|

|

|

|

Accounts receivable |

|

|

(17,123 |

) |

|

|

(9,827 |

) |

Prepaid expenses and other current assets |

|

|

972 |

|

|

|

1,709 |

|

Commissions receivable, current and non-current |

|

|

1,323 |

|

|

|

595 |

|

Operating lease right-of-use assets |

|

|

497 |

|

|

|

688 |

|

Other assets |

|

|

— |

|

|

|

36 |

|

Accounts payable |

|

|

15,868 |

|

|

|

4 |

|

Accrued expenses and other current liabilities |

|

|

1,870 |

|

|

|

852 |

|

Deferred revenue |

|

|

(2 |

) |

|

|

80 |

|

Operating lease liabilities |

|

|

(667 |

) |

|

|

(902 |

) |

Net cash provided by (used in) operating activities |

|

|

10,440 |

|

|

|

(1,237 |

) |

Cash flows from investing activities: |

|

|

|

|

|

|

|

|

Acquisition of property and equipment, including costs capitalized for development of internal-use software |

|

|

(770 |

) |

|

|

(1,007 |

) |

Net cash used in investing activities |

|

|

(770 |

) |

|

|

(1,007 |

) |

Cash flows from financing activities: |

|

|

|

|

|

|

|

|

Proceeds from exercise of stock options |

|

|

1,428 |

|

|

|

287 |

|

Tax withholding payments related to net share settlement |

|

|

(429 |

) |

|

|

(130 |

) |

Net cash provided by financing activities |

|

|

999 |

|

|

|

157 |

|

Effect of exchange rate changes on cash, cash equivalents and restricted cash |

|

|

(5 |

) |

|

|

5 |

|

Net increase (decrease) in cash, cash equivalents and restricted cash |

|

|

10,664 |

|

|

|

(2,082 |

) |

Cash, cash equivalents and restricted cash at beginning of period |

|

|

37,956 |

|

|

|

30,835 |

|

Cash, cash equivalents and restricted cash at end of period |

|

$ |

48,620 |

|

|

$ |

28,753 |

|

EVERQUOTE, INC.

FINANCIAL AND OPERATING METRICS

Revenue by vertical:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

Change |

|

|

|

2024 |

|

|

2023 |

|

|

% |

|

|

|

(in thousands) |

|

|

|

|

|

Automotive |

|

$ |

77,538 |

|

|

$ |

89,699 |

|

|

|

-13.6 |

% |

Home and Renters |

|

|

12,689 |

|

|

|

9,456 |

|

|

|

34.2 |

% |

Other |

|

|

838 |

|

|

|

10,065 |

|

|

|

-91.7 |

% |

Total Revenue |

|

$ |

91,065 |

|

|

$ |

109,220 |

|

|

|

-16.6 |

% |

Other financial and non-financial metrics:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

Change |

|

|

|

2024 |

|

|

2023 |

|

|

% |

|

|

|

(in thousands) |

|

|

|

|

|

Income (loss) from operations |

|

$ |

1,766 |

|

|

$ |

(2,431 |

) |

|

|

-172.6 |

% |

Net income (loss) |

|

$ |

1,907 |

|

|

$ |

(2,529 |

) |

|

|

-175.4 |

% |

Variable Marketing Margin |

|

$ |

30,818 |

|

|

$ |

35,593 |

|

|

|

-13.4 |

% |

Adjusted EBITDA(1) |

|

$ |

7,588 |

|

|

$ |

5,373 |

|

|

|

41.2 |

% |

|

|

(1) |

Adjusted EBITDA is a non-GAAP measure. Please see “EverQuote, Inc. Reconciliation of Non-GAAP Measures to GAAP” below for more information. |

To supplement the Company’s financial statements presented in accordance with GAAP and to provide investors with additional information regarding EverQuote’s financial results, the Company has presented Adjusted EBITDA as a non-GAAP financial measure. This non-GAAP financial measure is not based on any standardized methodology prescribed by GAAP and is not necessarily comparable to similarly titled measures presented by other companies.

The Company defines Adjusted EBITDA as net income (loss), excluding the impact of stock-based compensation expense; depreciation and amortization expense; restructuring and other charges; acquisition-related costs; interest income; and income taxes. The most directly comparable GAAP measure is net income (loss). The Company monitors and presents Adjusted EBITDA because it is a key measure used by management and the board of directors to understand and evaluate operating performance, to establish budgets and to develop operational goals for managing EverQuote’s business. In particular, the Company believes that excluding the impact of these items in calculating Adjusted EBITDA can provide a useful measure for period-to-period comparisons of EverQuote’s core operating performance.

The Company uses Adjusted EBITDA to evaluate EverQuote’s operating performance and trends and make planning decisions. The Company believes that this non-GAAP financial measure helps identify underlying trends in EverQuote’s business that could otherwise be masked by the effect of the items that the Company excludes in the calculations of Adjusted EBITDA. Accordingly, the Company believes that this financial measure provides useful information to investors and others in understanding and evaluating EverQuote’s operating results, enhancing the overall understanding of the Company’s past performance and future prospects.

The Company’s non-GAAP financial measures are not prepared in accordance with GAAP and should not be considered in isolation of, or as an alternative to, measures prepared in accordance with GAAP. There are a number of limitations related to the use of Adjusted EBITDA rather than net income (loss), which is the most directly comparable financial measure calculated and presented in accordance with GAAP. In addition, other companies may

use other measures to evaluate their performance, which could reduce the usefulness of the Company’s non-GAAP financial measures as tools for comparison.

The following table reconciles Adjusted EBITDA to net income (loss), the most directly comparable financial measure calculated and presented in accordance with GAAP.

EVERQUOTE, INC.

RECONCILIATION OF NON-GAAP MEASURES TO GAAP

|

|

|

|

|

|

|

|

|

|

|

Three Months Ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

|

|

(in thousands) |

|

Net income (loss) |

|

$ |

1,907 |

|

|

$ |

(2,529 |

) |

Stock-based compensation |

|

|

4,518 |

|

|

|

6,509 |

|

Depreciation and amortization |

|

|

1,263 |

|

|

|

1,407 |

|

Acquisition-related costs |

|

|

— |

|

|

|

(113 |

) |

Interest income |

|

|

(386 |

) |

|

|

(187 |

) |

Income tax expense |

|

|

286 |

|

|

|

286 |

|

Adjusted EBITDA |

|

$ |

7,588 |

|

|

$ |

5,373 |

|

Investor Presentation�May 2024 Exhibit 99.2

Disclaimer This presentation contains forward-looking statements, within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact contained in this presentation, including statements regarding our future results of operations and financial position, business strategy and plans, and objectives of management for future operations, are forward-looking statements. These statements involve known and unknown risks, uncertainties, and other important factors that may cause our actual results, performance or achievements to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “should,” “expects,” “might,” “plans,” “anticipates,” “could,” “intends,” “target,” “projects,” “contemplates,” “believes,” “estimates,” “predicts,” “potential,” “seek,” “would” or “continue,” or the negative of these terms or other similar expressions. The forward-looking statements in this presentation are only predictions. We have based these forward-looking statements largely on our current expectations and projections about future events and financial trends that we believe may affect our business, financial condition liquidity and results of operations. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that the future results, levels of activity, performance or events and circumstances reflected in the forward-looking statements will be achieved or occur. These forward-looking statements speak only as of the date of this presentation and are subject to a number of risks, uncertainties and assumptions described in our annual report on Form 10-K, our quarterly reports on Form 10-Q and our current reports on Form 8-K as filed with the Securities and Exchange Commission (“SEC”) from time to time. Additional information will also be set forth in the Company’s quarterly report on Form 10-Q for the fiscal quarter ended March 31, 2024, which will be filed with the SEC. Because forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified, you should not rely on these forward-looking statements as predictions of future events. The events and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially from those projected in the forward-looking statements. While we may elect to update these forward-looking statements at some point in the future, whether as a result of any new information, future events, or otherwise, we have no current intention of doing so except to the extent required by applicable law. Some of the key factors that could cause actual results to differ include: (1) our dependence on revenue from the property and casualty insurance industries, and specifically automotive insurance, and exposure to risks related to those industries; (2) our dependence on our relationships with insurance providers with no long-term minimum financial commitments; (3) our reliance on a small number of insurance providers for a significant portion of our revenue; (4) our dependence on third-party media sources for a significant portion of visitors to our websites and marketplace; (5) our ability to attract consumers searching for insurance to our websites and marketplace through Internet search engines, display advertising, social media, content-based online advertising and other online sources; (6) any limitations restricting our ability to market to users or collect and use data derived from user activities; (7) risks related to cybersecurity incidents or other network disruptions; (8) risks related to the use of artificial intelligence; (9) our ability to develop new and enhanced products and services to attract and retain consumers and insurance providers, and to successfully monetize them; (10) the impact of competition in our industry and innovation by our competitors; (11) our ability to hire and retain necessary qualified employees to expand our operations; (12) our ability to stay abreast of and comply with new or modified laws and regulations that currently apply or become applicable to our business, including with respect to the insurance industry, telemarketing restrictions and data privacy requirements; (13) our ability to protect our intellectual property rights and maintain and build our brand; (14) our future financial performance, including our expectations regarding our revenue, cost of revenue, variable marketing margin, operating expenses, cash flows and ability to achieve, and maintain, future profitability; (15) our ability to properly collect, process, store, share, disclose and use consumer information and other data; and (16) the future trading prices of our Class A common stock. The Company’s presentation also contains estimates, projections, & other information concerning the Company’s industry, the Company’s business & the markets for certain of the Company’s products & services, including data regarding the estimated size of those markets. The information concerning our industry contained in this presentation is based on our general knowledge of and expectations concerning the industry. The Company’s market position, market share and industry market size are based on estimates using our internal data and estimates, data from various industry analyses, our internal research and adjustments and assumptions that we believe to be reasonable. Information that is based on estimates, forecasts, projections, market research, or similar methodologies is inherently subject to uncertainties & actual events or circumstances may differ materially from events & circumstances reflected in this information. Unless otherwise expressly stated, the Company obtained this industry, business, market & other data from reports, research surveys, studies & similar data prepared by market research firms & other third parties, from industry, general publications, & from government data & similar sources. We have not independently verified data from these sources and cannot guarantee their accuracy or completeness. The Company presents Adjusted EBITDA as a non-GAAP measure, which is not a substitute for or superior to, other measures of financial performance prepared in accordance with U.S. GAAP. A reconciliation to the most directly comparable GAAP measures is included in the Appendix to these slides.

Our vision��Become the largest online source of insurance policies by using data, technology and knowledgeable advisors to make insurance simpler, more affordable and personalized.

Extensive distribution channels with Carriers and Local Agent Network3 Asset-Light model, with strong operating leverage, well positioned as the auto insurance market recovers Key Investment Highlights Insurance Marketplace Leader Massive Market Opportunity Proprietary Tech and Data Extensive Distribution Attractive Business Model Leading Property and Casualty1 (”P&C”) online insurance marketplace providing compelling benefits for consumers and insurance providers $100b+ in annual P&C insurance distribution and advertising spend in the early phases of shifting online provides multi-year tailwind2 Proprietary platforms improving the way insurance providers attract and connect with consumers shopping for insurance Includes auto, home, renters and other related insurance products Source: S&P Global Market Intelligence as of 2021 Also referred to as 3rd party agent network

Company Overview One of the insurance industry’s largest online customer acquisition and distribution platforms Highly scalable, proprietary data platform leveraging 3.0b+ consumer data points amassed over a decade1 "Hybrid Marketplace” with extensive distribution: ~75 carriers and ~6,000 3rd party local agents Diversified distribution model serving consumers and providers across multiple P&C insurance markets Founded in 2011 with headquarters in Cambridge, MA; IPO in summer 2018 Company Snapshot Compelling Value Proposition Providers: efficiently acquire consumers Large volume of high intent consumers Higher ROI from target-based consumer attributes Opportunity to acquire consumer referrals Source: estimated using Company data through 2023 Consumers: saving time and money Single destination for P&C insurance needs Personalized shopping experience Provide multiple quotes, fitting the consumer’s needs

Large & Expanding TAM Growth Drivers U.S. Insurance Market: Distribution and Advertising Spend1 ~10% Estimated Digital Advertising Spend Growth3 Continued shift of consumer time spent online Continued shift of acquisition spend online Continued shift to digitization of insurance products and workflows Estimated share of P&C Digital Advertising Spend Market <5% Estimated share of P&C Distribution and Advertising Spend Market <1% Source: S&P Global Market Intelligence, Insider Intelligence, and Company’s own estimates. Includes commissions and advertising spend of individual insurance market including P&C, Life, and Health markets as of 2021 Market share based on EverQuote’s FY 2023 revenue, which was $288 million Estimated compound annual growth rate for 2023 to 2025 for all insurance verticals. Source: Insider Intelligence Highlights2 $6b P&C Digital Advertising Spend $100b P&C Distribution and Advertising Spend Market $171b U.S. Insurance Market Distribution and Advertising Spend

Distribution The Customer Journey Traffic Channels Provider Engagement Consumer Arrival Provider Matching Partnerships Performance Media Other1 SEM Clicks Calls Consumer Routing Customer Acquisition Performance Alignment Bidding Carriers Enterprise Distribution Agent Distribution Local Agent Network2 Other includes organic search, direct-to-site, partner exchange & other traffic sources In addition to the 3rd party agent network, EverQuote has a small 1st party agent presence Based on Company data & representative of the insurance provider partners on the platform as of December 31, 2023 Representative Carriers3

Proprietary Platforms Strengthen Competitive Moat Minimize Cost per Acquisition Omni-channel Automated Bidding Marketing Maximize Conversion Rates Consumer Personalized User Experiences Maximize Bind Performance Consumer Alignment Algorithms Distribution Maximize Value per Acquisition Enterprise & Agency Campaign Management B2B Highly integrated AI, machine learning and data assets to support growth of all verticals Source: estimated using Company data through 2023 3.0b+ Consumer Submitted Data Points Since Inception1

The State of the Auto Insurance Market Late Summer 2021 Auto Insurance Downturn Begins 2024 Auto Insurance Outlook Cost of claims rises rapidly due to higher used car values, increased cost to repair and overall accident severity Auto carriers are receiving rate increase approvals, allowing insurers to restore adequate profitability Carriers are unable to adjust and implement rates quickly due to regulatory process and policy renewal cycles Carriers face elevated claims and combined ratios; significantly reduce consumer acquisition spend Signs of improvement are shown in early 2024; timing for full auto recovery remains uncertain Cost of claims are stabilizing and loss pressures are showing signs of easing Early stages of auto recovery has begun as carriers reactivate marketing campaigns in our marketplace

2024 Strategic Focus Asset-Light Model Streamlining business around the most capital efficient parts of EVER’s operations; employee headcount down ~46% YoY1 Traffic Scale and Technology Drive greater value for carriers and agents by leveraging proprietary data, machine learning capabilities and expanding AI applications Positioned for Auto Recovery Expect to return to growth and drive significant Adjusted EBITDA expansion as auto insurance market recovers Exit of Health Vertical to focus on EVER’s core vertical markets of Auto and Home / Renters Focus on P&C Markets 613 employees as of 4/30/2023 to 330 employees as of 4/30/2024

Financial Overview Revenue ($m) Summary Auto carrier recovery is expected to drive a significant rebound to Revenue and VMM growth Adjusted EBITDA margin expected to return to pre-downturn levels as the auto insurance market recovers Note: Auto insurance market downturn began in the late summer of 2021 Note: Historical financials include health insurance vertical financials, which was exited on June 30, 2023. Note: The health insurance vertical revenue was: $29.7m in 2021, $38.7m in 2022, and $15.0m in 2023. Adjusted EBITDA ($m) Variable Marketing Margin ($m) Auto Downturn Begins in Late Summer 2021

Revenues by Verticals Quarterly Revenue ($m) Summary Following our exit of the Health insurance vertical at the end of Q2 2023, revenue from our Other1 vertical significantly declined Starting in Q3 2023, EVER started reporting two main verticals - Auto and Home/Renters EVER’s Q1 2024 revenue totaled $91.1m, of which 99% was Auto and Home/Renters Auto Q1 2024 revenue increased 42% QoQ and declined 14% YoY Home/Renters Q1 2024 revenue increased 29% QoQ and 34% YoY $101.9 $88.3 $103.2 $109.2 $68.0 $55.0 EVER exits Health Insurance Vertical Total: Other consists of life, health and other insurance verticals. The health insurance vertical was exited on June 30, 2023. Note: Due to rounding within the individual revenue vertical amount, summation of verticals to total revenue may not agree. $55.7 $163.3 $248.8 $346.9 $418.5 $404.1 Total: $287.9 Annual Revenue ($m) $91.1

Multiple Levers to Drive Future Growth Attract �More Consumers Explore Acquisition Opportunities Increase�Provider Coverage �and Budget Deepen�Consumer and Provider Engagement Grow Core Verticals

NASDAQ: EVER

Appendix

Key Metrics Definitions Variable Marketing Margin We define variable marketing margin, or VMM, as revenue, as reported in our consolidated statements of operations and comprehensive income (loss), less advertising costs (a component of sales and marketing expense, as reported in our statements of operations and comprehensive income loss). We use VMM to measure the efficiency of individual advertising and consumer acquisition sources and to make trade-off decisions to manage our return on advertising. We do not use VMM as a measure of profitability. Adjusted EBITDA We define Adjusted EBITDA as net income (loss), adjusted to exclude: stock-based compensation expense, depreciation and amortization expense, restructuring and other charges, acquisition-related costs, legal settlement expense, one-time severance charges, interest income and the provision for (benefit from) income taxes. We monitor & present Adjusted EBITDA because it is a key measure used by our management & board of directors to understand & evaluate our operating performance, to establish budgets & to develop operational goals for managing our business.

Reconciliation of Adjusted EBITDA - 12 Months Ended 12 Months Ended December 31, 2023 December 31, 2022 December 31, 2021 December 31, 2020 December 31, 2019 December 31, 2018 Net Income (Loss) ($51,287) ($24,416) ($19,434) ($11,202) ($7,117) ($13,791) Stock-based compensation $22,808 $28,986 $30,020 $24,179 $12,721 $7,121 Depreciation & amortization $6,196 $5,848 $5,072 $3,350 $2,186 $1,341 Legal settlement - - - - $1,227 - Acquisition-related costs/earnout ($150) ($4,135) $1,065 $2,258 - - Restructuring and Other Charges $23,568 - 440 - - - Interest (income) expense, net ($1,251) ($349) ($37) (189) ($669) (121) Provision for (benefit from) income taxes $577 - ($2,510) - - - Adjusted EBITDA $461 $5,934 $14,616 $18,396 $8,348 ($5,450) ($ in Thousands)

Reconciliation of Adjusted EBITDA - 3 Months Ended 3 Months Ended March 31, 2024 December 31, 2023 September 30, 2023 June 30, 2023 March 31, 2023 Net Income (Loss) $1,907 ($6,348) ($29,217) ($13,193) ($2,529) Stock-based compensation $4,518 $4,813 $5,479 $6,007 $6,509 Depreciation & amortization $1,263 $1,075 $2,251 $1,463 $1,407 Legal settlement - - - - - Acquisition-related costs/earnout - - - ($37) ($113) Restructuring and Other Charges - ($21) $19,757 3,832 - Interest (income) expense, net ($386) ($382) ($411) ($271) ($187) Provision for (benefit from) income taxes $286 ($23) $236 $78 $286 Adjusted EBITDA $7,588 ($886) ($1,905) ($2,121) $5,373 ($ in Thousands)

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

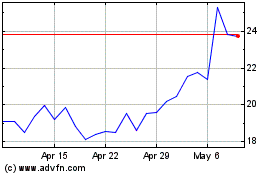

EverQuote (NASDAQ:EVER)

Historical Stock Chart

From Oct 2024 to Nov 2024

EverQuote (NASDAQ:EVER)

Historical Stock Chart

From Nov 2023 to Nov 2024