For Immediate Release

Chicago, IL – February 22, 2012 – Zacks.com announces the list

of stocks featured in the Analyst Blog. Every day the Zacks Equity

Research analysts discuss the latest news and events impacting

stocks and the financial markets. Stocks recently featured in the

blog include Equinix

Inc. (EQIX), AT&T

Inc. (T), Verizon Inc. (VZ),

Qualcomm Inc. (QCOM) and Apple

Inc. (AAPL).

Get the most recent insight from Zacks Equity Research with the

free Profit from the Pros newsletter:

http://at.zacks.com/?id=5513

Here are highlights from Tuesday’s Analyst

Blog:

Equinix Adds Capacity in U.S.

Leading data center solutions provider Equinix

Inc. (EQIX) announced its intention to set up a new

232,000 square foot customer floor space International Business

Exchange (IBX) data center (DC11) in Washington, D.C.

The first phase of the IBX, which is scheduled to start

operation by 2013, will cost $88.0 million. With a total work area

of 42,800 square feet, the first phase of DC11 will accommodate

1,200 cabinets. The subsequent phases will allow the setting up of

an additional 1,800 cabinets.

Apart from scheduling a new data center, Equinix also announced

plans to proceed with the second phase of another local data center

(DC10). Development costs are estimated to be $21.0 million, with

the extension expected to be operational by March 2012.

The expansion was expedited upon sensing the high demand for

Equinix’s colocation platform in the region. Washington, D.C.

serves as the eastern hub of Internet traffic exchange in the U.S.,

and is therefore an important business area for Equinix. Increasing

data exchange through Internet calls for the development of more

data centers in the region. Now, with the tenth operating IBX and

the eleventh one underway, it will be easier for Equinix to meet

the growing business needs.

Equinix boasts a presence across various geographical regions

and is increasingly becoming popular among major players in the

tech industry. The company’s worldwide presence has resulted in

high network density with a vertically focused approach, which will

continue to support demand growth.

During the last quarter (fourth quarter 2011), the company

witnessed substantial year-over-year revenue growth of 25.0% on

solid geographical contributions partially offset by foreign

exchange headwinds. The U.S. was the strongest of all the regions,

with relatively strong growth.

In the Americas, the average monthly recurring revenue (MRR) per

cabinet increased to $2,133 from $2,110 in the third quarter of

2011. In the Asia-Pacific, MRR per cabinet was $1,863, relatively

flat with $1,868 in the previous quarter. In Europe, cabinet

pricing decreased slightly to $1,199 from $1,210, on account of

foreign exchange weakness.

We believe that the favorable pricing trend in the U.S. coupled

with the planned expansion will boost revenue growth in the

upcoming quarters. Apart from the U.S., Equinix is planning to

capture share in the emerging markets. The company is now targeting

China, India, Japan and Australia for further expansion.

We are also optimistic about the company’s recurring revenue

model and future expansion plans. Despite all the positives,

competitive threats from the likes of AT&T

Inc. (T) and Verizon

Inc. (VZ) raise our apprehension. European exposure

and industry consolidation are also causes for concern.

Equinix has a Zacks #3 Rank, implying a short-term Hold

rating.

Earnings Scorecard: Qualcomm

Qualcomm Inc. (QCOM) reported record

first-quarter fiscal 2012 financial results, where both the

earnings per share (EPS) and revenues exceeded the Zacks Consensus

Estimates. The out performance was primarily attributable to the

surge in demand for high-end 3G smartphones and tablets.

The company’s Snapdragon platform and product diversification

strategy induced management to significantly raise the company’s

outlook for the second quarter of fiscal 2012 and beyond.

First Quarter Highlights

On a GAAP basis, quarterly net income was $1,401 million or 81

cents per share compared with $1,170 million or 71 cents per share

in the year-ago quarter. However, adjusted (excluding special

items) EPS in the reported quarter came in at 85 cents, surpassing

the Zacks Consensus Estimate of 81 cents.

Total revenue of $4,681 million in the quarter was up 40% year

over year, and surpassed the Zacks Consensus Estimate of $4,569

million. During the first quarter of fiscal 2012, Qualcomm shipped

approximately 156 million CDMA-based MSM chipsets, up 32% year over

year and 23% sequentially.

Gross margin was 62.5% compared with 68.9% in the year-ago

quarter. Quarterly operating margin was 33.1% compared with 37.3%

in the prior-year quarter.

Agreements of Analysts

Of the eight analysts covering the stock in the last 7 days,

seven analysts revised the estimates upward for the second quarter

of fiscal 2012. Likewise, for the third quarter of 2012, all the

seven analysts covering the stock raised their EPS estimates.

Similarly, for fiscal 2012, all the seven analysts covering the

stock in the last 7 days raised the estimates. Likewise, for fiscal

2013, out of the eight analysts covering the stock, seven analysts

increased the estimates.

Most analysts raised the EPS estimate on the back of increased

penetration of 3G-based smartphones into the huge Chinese market.

Moreover, the growing popularity of new Snapdragon S4 processors

has made the analyst more bullish on the stock.

Currently, the Zacks Consensus EPS Estimate for the second

quarter of fiscal 2012 is pegged at 85 cents. The projected annual

growth is 9.74%. Similarly, for the third quarter of fiscal 2012,

the Zacks Consensus EPS Estimate of 78 cents indicates an annual

gain of 24.04%.

Magnitude of Estimate Revisions

During the last 7 days, the current Zacks Consensus Estimates

for the second and third quarter of 2012 remained in line with the

previous estimates of 85 cents and 78 cents, respectively.

Likewise, for fiscal 2012 and 2013, the current Zacks Consensus

Estimates were in line with the prior estimates of $3.35 and $3.78,

respectively.

Earning Surprises

With respect to earnings surprises, the company’s consistent

track record of beating the estimates in the last four quarters is

expected to persist in the coming quarters. In the last quarter,

Qualcomm outpaced the Zacks estimate by a whopping 6 cents or

7.59%.

No surprises are expected for the ongoing and the third quarter

of fiscal 2012. EPS growth potential for fiscal 2012 is also at

breakeven. However, in fiscal 2013, there is an upside potential of

1.32%.

Our Recommendation

We believe Qualcomm’s record-high earnings; strong balance

sheet, huge product pipelines and better market segmentation by

introducing chipsets for mid-tier and upper-tier smartphones and

tablets segment will act as positive catalysts in the long run.

Moreover, Qualcomm chipsets are recently being used in most

CDMA-based iPhone 4S from Apple

Inc. (AAPL) will further bolster the company’s

top-line growth in the forthcoming quarters.

We maintain our long-term Outperform recommendation on Qualcomm.

Currently, Qualcomm has a Zacks #1 Rank, implying a short-term

Strong Buy rating on the stock.

Want more from Zacks Equity Research? Subscribe to the free

Profit from the Pros newsletter: http://at.zacks.com/?id=5515.

About Zacks Equity Research

Zacks Equity Research provides the best of quantitative and

qualitative analysis to help investors know what stocks to buy and

which to sell for the long-term.

Continuous coverage is provided for a universe of 1,150 publicly

traded stocks. Our analysts are organized by industry which gives

them keen insights to developments that affect company profits and

stock performance. Recommendations and target prices are six-month

time horizons.

Zacks "Profit from the Pros" e-mail newsletter provides

highlights of the latest analysis from Zacks Equity Research.

Subscribe to this free newsletter today:

http://at.zacks.com/?id=5517

About Zacks

Zacks.com is a property of Zacks Investment Research, Inc.,

which was formed in 1978 by Leon Zacks. As a PhD from MIT Len knew

he could find patterns in stock market data that would lead to

superior investment results. Amongst his many accomplishments was

the formation of his proprietary stock picking system; the Zacks

Rank, which continues to outperform the market by nearly a 3 to 1

margin. The best way to unlock the profitable stock recommendations

and market insights of Zacks Investment Research is through our

free daily email newsletter; Profit from the Pros. In short, it's

your steady flow of Profitable ideas GUARANTEED to be worth your

time! Register for your free subscription to Profit from the Pros

at http://at.zacks.com/?id=5518.

Visit http://www.zacks.com/performance for information about the

performance numbers displayed in this press release.

Follow us on Twitter: http://twitter.com/zacksresearch

Join us on Facebook:

http://www.facebook.com/home.php#/pages/Zacks-Investment-Research/57553657748?ref=ts

Disclaimer: Past performance does not guarantee future results.

Investors should always research companies and securities before

making any investments. Nothing herein should be construed as an

offer or solicitation to buy or sell any security.

Media Contact

Zacks Investment Research

800-767-3771 ext. 9339

support@zacks.com

http://www.zacks.com

APPLE INC (AAPL): Free Stock Analysis Report

EQUINIX INC (EQIX): Free Stock Analysis Report

QUALCOMM INC (QCOM): Free Stock Analysis Report

AT&T INC (T): Free Stock Analysis Report

VERIZON COMM (VZ): Free Stock Analysis Report

To read this article on Zacks.com click here.

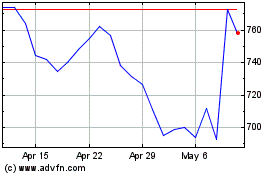

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From Apr 2024 to May 2024

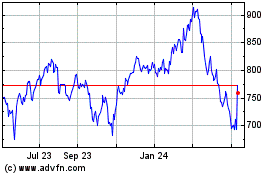

Equinix (NASDAQ:EQIX)

Historical Stock Chart

From May 2023 to May 2024