Electronic Arts Inc. (NASDAQ:EA) today announced preliminary

financial results for its first fiscal quarter ended June 30,

2022.

“EA delivered strong results in Q1 with our growing player

network deeply engaged in new games and live services,” said CEO

Andrew Wilson. “Our expanding EA SPORTS portfolio and owned IP

franchises continue to power resilience and longevity in our

business. Our teams remain focused on what they do best – making

amazing experiences that inspire new generations to play, watch,

create, compete and connect.”

“Our FIFA franchise and the successful launch of F1 drove our

net bookings outperformance, delivering another quarter ahead of

expectations,” said CFO Chris Suh. “Looking ahead, our focus on

execution and disciplined investment across our broad portfolio of

games and live services will fuel our long-term growth.”

Selected Operating Highlights and

Metrics

- Net bookings1 for the trailing twelve months was $7.478

billion, up 22% year-over-year.

- Live services and other net bookings for the trailing twelve

months were up 20% year-over-year and represent 73% of total net

bookings.

- The EA player network grew to nearly 600 million active

accounts at quarter end.

- FIFA Ultimate Team™ engagement during the quarter was up nearly

40% year-over-year in weekly and daily average players.

- In Q1, FIFA Mobile delivered the highest net bookings quarter

in history, with record high DAUs, up 10% from last quarter.

Selected Financial Highlights and

Metrics

- Net cash (used in)/provided by operating activities was $(78)

million for the quarter and $1.964 billion for the trailing twelve

months.

- EA repurchased 2.5 million shares for $320 million during the

quarter, bringing the total for the trailing twelve months to 9.7

million shares for $1.295 billion.

- EA paid a cash dividend of $0.19 per share during the quarter,

for a total of $53 million.

Dividend

EA has declared a quarterly cash dividend of $0.19 per share of

the Company’s common stock. The dividend is payable on September

21, 2022 to shareholders of record as of the close of business on

August 31, 2022.

Quarterly Financial

Highlights

Three Months Ended June 30,

2022

2021

(in $ millions, except per share amounts) Full game

341

322

Live services and other

1,426

1,229

Total net revenue

1,767

1,551

Net income

311

204

Diluted earnings per share

1.11

0.71

Operating cash flow

(78

)

(143

)

Value of shares repurchased

320

325

Number of shares repurchased

2.5

2.3

The following GAAP-based financial data2 and tax rate of 19% was

used internally by company management to adjust its GAAP results in

order to assess EA’s operating results:

Three Months Ended June 30, 2022 GAAP-Based Financial

Data (in $ millions)

Statement of

Operations

Acquisition-

related

expenses

Change in

deferred net

revenue

(online-

enabled

games)

Stock-based

compensation

Total net revenue

1,767

-

(468

)

-

Cost of revenue

314

(30

)

-

(2

)

Gross profit

1,453

30

(468

)

2

Total operating expenses

1,012

(39

)

-

(123

)

Operating income

441

69

(468

)

125

Interest and other income (expense), net

(5

)

-

-

-

Income before provision for income taxes

436

69

(468

)

125

Number of shares used in computation: Diluted

281

Trailing Twelve Months Financial

Highlights

Twelve Months Ended June 30,

2022

2021

(in $ millions) Full game

2,012

1,576

Live services and other

5,195

4,145

Total net revenue

7,207

5,721

Net income

896

676

Operating cash flow

1,964

1,413

Value of shares repurchased

1,295

976

Number of shares repurchased

9.7

7.2

The following GAAP-based financial data2 was used internally by

company management to adjust its GAAP results in order to assess

EA’s operating results. During fiscal 2022, management used a tax

rate of 18% and in fiscal 2023 a tax rate of 19%.

Twelve Months Ended June 30, 2022 GAAP-Based Financial

Data (in $ millions)

Statement of

Operations

Acquisition-

related

expenses

Change in

deferred net

revenue

(online-

enabled

games)

Stock-based

compensation

Total net revenue

7,207

-

271

-

Cost of revenue

1,858

(141

)

-

(7

)

Gross profit

5,349

141

271

7

Total operating expenses

4,101

(182

)

-

(521

)

Operating income

1,248

323

271

528

Interest and other income (expense), net

(39

)

-

-

-

Income before provision for income taxes

1,209

323

271

528

Operating Metric

The following is a calculation of our total net bookings1 for

the periods presented:

Three Months Ended Twelve Months Ended June

30, June 30,

2022

2021

2022

2021

(in $ millions) Total net revenue

1,767

1,551

7,207

5,721

Change in deferred net revenue (online-enabled games)

(468

)

(215

)

271

415

Net bookings

1,299

1,336

7,478

6,136

Business Outlook as of August 2,

2022

Fiscal Year 2023 Expectations – Ending March 31, 2023

Financial metrics:

- Net revenue is expected to be approximately $7.600 to $7.800

billion.

- Change in deferred net revenue (online-enabled games) is

expected to be approximately $300 million.

- Net income is expected to be approximately $793 to $815

million.

- Diluted earnings per share is expected to be approximately

$2.79 to $2.87.

- Operating cash flow is expected to be approximately $1.600 to

$1.650 billion.

- The Company estimates a share count of 284 million for purposes

of calculating fiscal year 2023 diluted earnings per share.

Operational metric:

- Net bookings1 is expected to be approximately $7.900 to $8.100

billion.

In addition, the following outlook for GAAP-based financial

data2 and updated long-term tax rate of 19% are used internally by

EA to adjust our GAAP expectations to assess EA’s operating results

and plan for future periods:

Twelve Months Ending March 31,

2023

GAAP-Based Financial

Data

GAAP

Guidance

Range

Acquisition-

related

expenses

Change in

deferred net

revenue (online-

enabled games)

Stock-based

compensation

(in $ millions) Total net revenue

7,600 to 7,800

-

300

-

Cost of revenue

2,020 to 2,065

(110

)

-

(5

)

Operating expense

4,200 to 4,315

(140

)

-

(595

)

Income before provision for income taxes

1,321 to 1,358

250

300

600

Net income

793 to 815

Number of shares used in computation: Diluted shares

284

* The mid-point of the range has been used for purposes of

presenting the reconciling items.

Second Quarter Fiscal Year 2023 Expectations – Ending

September 30, 2022

Financial metrics:

- Net revenue is expected to be approximately $1.850 to $1.900

billion.

- Change in deferred net revenue (online-enabled games) is

expected to be approximately $(125) million.

- Net income is expected to be approximately $220 to $242

million.

- Diluted earnings per share is expected to be approximately

$0.78 to $0.86.

- The Company estimates a share count of 281 million for purposes

of calculating second quarter fiscal 2023 diluted earnings per

share.

Operational metric:

- Net bookings1 is expected to be approximately $1.725 to $1.775

billion.

In addition, the following outlook for GAAP-based financial

data2 and updated long-term tax rate of 19% are used internally by

EA to adjust our GAAP expectations to assess EA’s operating results

and plan for future periods:

Three Months Ending September 30, 2022 GAAP-Based

Financial Data*

GAAP

Guidance

Range

Acquisition-

related

expenses

Change in

deferred net

revenue (online-

enabled games)

Stock-based

compensation

(in $ millions) Total net revenue

1,850 to 1,900

-

(125

)

-

Cost of revenue

467 to 480

(30

)

-

(2

)

Operating expense

1,036 to 1,041

(40

)

-

(148

)

Income before provision for income taxes

338 to 373

70

(125

)

150

Net income

220 to 242

Number of shares used in computation: Diluted shares

281

* The mid-point of the range has been used for purposes of

presenting the reconciling items.

Conference Call and Supporting

Documents

Electronic Arts will host a conference call on August 2, 2022 at

2:00 pm PT (5:00 pm ET) to review its results for the first quarter

ended June 30, 2022 and its outlook for the future. During the

course of the call, Electronic Arts may disclose material

developments affecting its business and/or financial performance.

Listeners may access the conference call live through the following

dial-in number (888) 330-2446 (domestic) or (240) 789-2732

(international), using the conference code 5939891 or via webcast

at EA’s IR Website at http://ir.ea.com.

EA has posted a slide presentation with a financial model of

EA’s historical results and guidance on EA’s IR Website. EA will

also post the prepared remarks and a transcript from the conference

call on EA’s IR Website.

A dial-in replay of the conference call will be available until

August 16, 2022 at (800) 770-2030 (domestic) or (647) 362-9199

(international) using pin code 5939891. An audio webcast replay of

the conference call will be available for one year on EA’s IR

Website.

Forward-Looking Statements

Some statements set forth in this release, including the

information relating to EA’s expectations under the heading

“Business Outlook as of August 2, 2022” and other information

regarding EA's fiscal 2023 expectations contain forward-looking

statements that are subject to change. Statements including words

such as “anticipate,” “believe,” “expect,” “intend,” “estimate,”

“plan,” “predict,” “seek,” “goal,” “will,” “may,” “likely,”

“should,” “could” (and the negative of any of these terms),

“future” and similar expressions also identify forward-looking

statements. These forward-looking statements are not guarantees of

future performance and reflect management’s current expectations.

Our actual results could differ materially from those discussed in

the forward-looking statements.

Some of the factors which could cause the Company’s results to

differ materially from its expectations include the following:

sales of the Company’s products and services; the Company’s ability

to develop and support digital products and services, including

managing online security and privacy; outages of our products,

services and technological infrastructure; the Company’s ability to

manage expenses; the competition in the interactive entertainment

industry; governmental regulations; the effectiveness of the

Company’s sales and marketing programs; timely development and

release of the Company’s products and services; the Company’s

ability to realize the anticipated benefits of, and integrate,

acquisitions; the consumer demand for, and the availability of an

adequate supply of console hardware units; the Company’s ability to

predict consumer preferences among competing platforms; the

Company’s ability to develop and implement new technology; foreign

currency exchange rate fluctuations; economic and geopolitical

conditions; changes in our tax rates or tax laws; and other factors

described in Part I, Item 1A of Electronic Arts’ latest Annual

Report on Form 10-K under the heading “Risk Factors”, as well as in

other documents we have filed with the Securities and Exchange

Commission.

These forward-looking statements are current as of August 2,

2022. Electronic Arts assumes no obligation to revise or update any

forward-looking statement for any reason, except as required by

law. In addition, the preliminary financial results set forth in

this release are estimates based on information currently available

to Electronic Arts.

While Electronic Arts believes these estimates are meaningful,

they could differ from the actual amounts that Electronic Arts

ultimately reports in its Quarterly Report on Form 10-Q for the

fiscal quarter ended June 30, 2022. Electronic Arts assumes no

obligation and does not intend to update these estimates prior to

filing its Form 10-Q for the fiscal quarter ended June 30,

2022.

About Electronic Arts

Electronic Arts (NASDAQ:EA) is a global leader in digital

interactive entertainment. The Company develops and delivers games,

content and online services for Internet-connected consoles, mobile

devices and personal computers.

In fiscal year 2022, EA posted GAAP net revenue of approximately

$7 billion. Headquartered in Redwood City, California, EA is

recognized for a portfolio of critically acclaimed, high-quality

brands such as EA SPORTS™ FIFA, Battlefield™, Apex Legends™, The

Sims™, Madden NFL, Need for Speed™, Titanfall™, Plants vs. Zombies™

and F1®. More information about EA is available at

www.ea.com/news.

EA SPORTS, Battlefield, Need for Speed, Apex Legends, The Sims,

Titanfall and Plants vs. Zombies are trademarks of Electronic Arts

Inc. STAR WARS © & TM 2015 Lucasfilm Ltd. All rights reserved.

John Madden, NFL, FIFA and F1 are the property of their respective

owners and used with permission.

1 Net bookings is defined as the net amount of products and

services sold digitally or sold-in physically in the period. Net

bookings is calculated by adding total net revenue to the change in

deferred net revenue for online-enabled games. 2 For more

information about the nature of the GAAP-based financial data,

please refer to EA’s Form 10-K for the fiscal year ended March 31,

2022.

ELECTRONIC ARTS INC. AND

SUBSIDIARIES

Unaudited Condensed

Consolidated Statements of Operations

(in $ millions, except per

share data)

Three Months Ended

June 30,

2022

2021

Net revenue

1,767

1,551

Cost of revenue

314

315

Gross profit

1,453

1,236

Operating expenses:

Research and development

572

515

Marketing and sales

234

190

General and administrative

167

169

Amortization and impairment of

intangibles

39

40

Total operating expenses

1,012

914

Operating income

441

322

Interest and other income (expense),

net

(5

)

(14

)

Income before provision for income

taxes

436

308

Provision for income taxes

125

104

Net income

311

204

Earnings per share

Basic

1.11

0.71

Diluted

1.11

0.71

Number of shares used in

computation

Basic

279

286

Diluted

281

289

Results (in $ millions, except per share data)

The following table reports the variance of the actuals versus

our guidance provided on May 10, 2022 for the three months ended

June 30, 2022 plus a comparison to the actuals for the three months

ended June 30, 2021.

Three Months Ended June

30,

2022 Guidance

(Mid-Point)

2022

Actuals

2021

Actuals

Variance

Net revenue

Net revenue

1,700

67

1,767

1,551

GAAP-based financial data

Change in deferred net revenue

(online-enabled games)1

(475

)

7

(468

)

(215

)

Cost of revenue

Cost of revenue

315

(1

)

314

315

GAAP-based financial data

Acquisition-related expenses

(30

)

—

(30

)

(22

)

Stock-based compensation

(2

)

—

(2

)

(1

)

Operating expenses

Operating expenses

1,013

(1

)

1,012

914

GAAP-based financial data

Acquisition-related expenses

(40

)

1

(39

)

(40

)

Stock-based compensation

(123

)

—

(123

)

(124

)

Income before tax

Income before tax

356

80

436

308

GAAP-based financial data

Acquisition-related expenses

70

(1

)

69

62

Change in deferred net revenue

(online-enabled games)1

(475

)

7

(468

)

(215

)

Stock-based compensation

125

—

125

125

Tax rate used for management reporting

19

%

19

%

18

%

Earnings per share

Basic

0.81

0.30

1.11

0.71

Diluted

0.81

0.30

1.11

0.71

Number of shares used in

computation

Basic

281

(2

)

279

286

Diluted

283

(2

)

281

289

1The change in deferred net revenue (online-enabled games) in

the unaudited condensed consolidated statements of cash flows does

not necessarily equal the change in deferred net revenue

(online-enabled games) in the unaudited condensed consolidated

statements of operations primarily due to the impact of

unrecognized gains/losses on cash flow hedges.

ELECTRONIC ARTS INC. AND

SUBSIDIARIES

Unaudited Condensed

Consolidated Balance Sheets

(in $ millions)

June 30, 2022

March 31, 20222

ASSETS

Current assets:

Cash and cash equivalents

2,082

2,732

Short-term investments

334

330

Receivables, net

579

650

Other current assets

522

439

Total current assets

3,517

4,151

Property and equipment, net

545

550

Goodwill

5,382

5,387

Acquisition-related intangibles, net

893

962

Deferred income taxes, net

2,327

2,243

Other assets

528

507

TOTAL ASSETS

13,192

13,800

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

70

101

Accrued and other current liabilities

1,215

1,388

Deferred net revenue (online-enabled

games)

1,548

2,024

Total current liabilities

2,833

3,513

Senior notes, net

1,878

1,878

Income tax obligations

438

386

Deferred income taxes, net

1

1

Other liabilities

401

397

Total liabilities

5,551

6,175

Stockholders’ equity:

Common stock

3

3

Retained earnings

7,567

7,607

Accumulated other comprehensive income

71

15

Total stockholders’ equity

7,641

7,625

TOTAL LIABILITIES AND STOCKHOLDERS’

EQUITY

13,192

13,800

2Derived from audited consolidated financial statements.

ELECTRONIC ARTS INC. AND

SUBSIDIARIES

Unaudited Condensed

Consolidated Statements of Cash Flows

(in $ millions)

Three Months Ended June

30,

2022

2021

OPERATING ACTIVITIES

Net income

311

204

Adjustments to reconcile net income to net

cash used in operating activities:

Depreciation, amortization, accretion and

impairment

114

105

Stock-based compensation

125

125

Change in assets and liabilities

Receivables, net

70

12

Other assets

(15

)

(74

)

Accounts payable

(16

)

(19

)

Accrued and other liabilities

(105

)

(302

)

Deferred income taxes, net

(86

)

28

Deferred net revenue (online-enabled

games)

(476

)

(222

)

Net cash used in operating

activities

(78

)

(143

)

INVESTING ACTIVITIES

Capital expenditures

(59

)

(44

)

Proceeds from maturities and sales of

short-term investments

87

507

Purchase of short-term investments

(93

)

(285

)

Acquisitions, net of cash acquired

—

(1,989

)

Net cash used in investing

activities

(65

)

(1,811

)

FINANCING ACTIVITIES

Proceeds from issuance of common stock

1

—

Cash dividends paid

(53

)

(49

)

Cash paid to taxing authorities for shares

withheld from employees

(104

)

(105

)

Repurchase and retirement of common

stock

(320

)

(325

)

Net cash used in financing

activities

(476

)

(479

)

Effect of foreign exchange on cash and

cash equivalents

(31

)

11

Change in cash and cash

equivalents

(650

)

(2,422

)

Beginning cash and cash equivalents

2,732

5,260

Ending cash and cash

equivalents

2,082

2,838

ELECTRONIC ARTS INC. AND

SUBSIDIARIES

Unaudited Supplemental

Financial Information and Business Metrics

(in $ millions, except per

share data)

Q1

Q2

Q3

Q4

Q1

YOY %

FY22

FY22

FY22

FY22

FY23

Change

Net revenue

Net revenue

1,551

1,826

1,789

1,825

1,767

14

%

GAAP-based financial data

Change in deferred net revenue

(online-enabled games)1

(215

)

25

788

(74

)

(468

)

Gross profit

Gross profit

1,236

1,332

1,158

1,406

1,453

18

%

Gross profit (as a % of net revenue)

80

%

73

%

65

%

77

%

82

%

GAAP-based financial data

Acquisition-related expenses

22

22

44

45

30

Change in deferred net revenue

(online-enabled games)1

(215

)

25

788

(74

)

(468

)

Stock-based compensation

1

2

1

2

2

Operating income

Operating income

322

340

102

365

441

37

%

Operating income (as a % of net

revenue)

21

%

19

%

6

%

20

%

25

%

GAAP-based financial data

Acquisition-related expenses

62

52

105

97

69

Change in deferred net revenue

(online-enabled games)1

(215

)

25

788

(74

)

(468

)

Stock-based compensation

125

149

129

125

125

Net income

Net income

204

294

66

225

311

52

%

Net income (as a % of net revenue)

13

%

16

%

4

%

12

%

18

%

GAAP-based financial data

Acquisition-related expenses

62

52

105

97

69

Change in deferred net revenue

(online-enabled games)1

(215

)

25

788

(74

)

(468

)

Stock-based compensation

125

149

129

125

125

Tax rate used for management reporting

18

%

18

%

18

%

18

%

19

%

Diluted earnings per share

0.71

1.02

0.23

0.80

1.11

56

%

Number of shares used in

computation

Basic

286

285

283

281

279

Diluted

289

287

285

283

281

1The change in deferred net revenue (online-enabled games) in

the unaudited condensed consolidated statements of cash flows does

not necessarily equal the change in deferred net revenue

(online-enabled games) in the unaudited condensed consolidated

statements of operations primarily due to the impact of

unrecognized gains/losses on cash flow hedges.

ELECTRONIC ARTS INC. AND

SUBSIDIARIES

Unaudited Supplemental

Financial Information and Business Metrics

(in $ millions)

Q1

Q2

Q3

Q4

Q1

YOY %

FY22

FY22

FY22

FY22

FY23

Change

QUARTERLY NET REVENUE

PRESENTATIONS

Net revenue by composition

Full game downloads

233

337

400

312

237

2

%

Packaged goods

89

280

216

126

104

17

%

Full game

322

617

616

438

341

6

%

Live services and other

1,229

1,209

1,173

1,387

1,426

16

%

Total net revenue

1,551

1,826

1,789

1,825

1,767

14

%

Full game

21

%

34

%

34

%

24

%

19

%

Live services and other

79

%

66

%

66

%

76

%

81

%

Total net revenue %

100

%

100

%

100

%

100

%

100

%

GAAP-based financial data

Full game downloads

(5

)

35

179

(103

)

(111

)

Packaged goods

(35

)

44

105

(68

)

(65

)

Full game

(40

)

79

284

(171

)

(176

)

Live services and other

(175

)

(54

)

504

97

(292

)

Total change in deferred net revenue

(online-enabled games) by composition1

(215

)

25

788

(74

)

(468

)

Net revenue by platform

Console

972

1,198

1,138

1,092

1,042

7

%

PC & Other

361

377

374

420

402

11

%

Mobile

218

251

277

313

323

48

%

Total net revenue

1,551

1,826

1,789

1,825

1,767

14

%

GAAP-based financial data

Console

(278

)

(29

)

608

(86

)

(405

)

PC & Other

9

26

137

3

(54

)

Mobile

54

28

43

9

(9

)

Total change in deferred net revenue

(online-enabled games) by platform1

(215

)

25

788

(74

)

(468

)

1The change in deferred net revenue (online-enabled games) in

the unaudited condensed consolidated statements of cash flows does

not necessarily equal the change in deferred net revenue

(online-enabled games) in the unaudited condensed consolidated

statements of operations primarily due to the impact of

unrecognized gains/losses on cash flow hedges.

ELECTRONIC ARTS INC. AND

SUBSIDIARIES

Unaudited Supplemental

Financial Information and Business Metrics

(in $ millions)

Q1

Q2

Q3

Q4

Q1

YOY %

FY22

FY22

FY22

FY22

FY23

Change

CASH FLOW DATA

Operating cash flow

(143

)

64

1,534

444

(78

)

45

%

Operating cash flow - TTM

1,413

1,416

1,826

1,899

1,964

39

%

Capital expenditures

44

43

48

53

59

34

%

Capital expenditures - TTM

130

148

166

188

203

56

%

Repurchase and retirement of common

stock

325

325

325

325

320

(2

%)

Cash dividends paid

49

48

48

48

53

8

%

DEPRECIATION

Depreciation expense

40

39

41

42

44

10

%

BALANCE SHEET DATA

Cash and cash equivalents

2,838

1,630

2,670

2,732

2,082

Short-term investments

881

342

346

330

334

Cash and cash equivalents, and short-term

investments

3,719

1,972

3,016

3,062

2,416

(35

%)

Receivables, net

557

1,031

965

650

579

4

%

STOCK-BASED COMPENSATION

Cost of revenue

1

2

1

2

2

Research and development

85

101

86

84

81

Marketing and sales

12

15

14

13

13

General and administrative

27

31

28

26

29

Total stock-based compensation

125

149

129

125

125

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220801005849/en/

For additional information, please contact: Chris Evenden Vice

President, Investor Relations 650-628-0255 cevenden@ea.com

Cat Channon Vice President, Global Communications + 41 22 316

1258 cchannon@ea.com

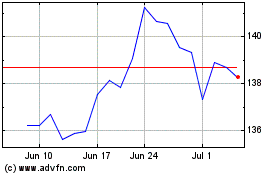

Electronic Arts (NASDAQ:EA)

Historical Stock Chart

From Oct 2024 to Nov 2024

Electronic Arts (NASDAQ:EA)

Historical Stock Chart

From Nov 2023 to Nov 2024