Total revenue of $127.6 million

Subscription Portion of Annual Recurring

Revenue (ARR) of $219 million with Growth Accelerating to 149%

Total ARR of $427 million with Growth

Accelerating to 48%

Subscription Bookings Mix of 86% in the first

quarter; Reaches Bookings Mix Target for Subscription

Transition

Full Year ARR Guidance Range Increased to $535

million to $541 million

CyberArk (NASDAQ: CYBR), the global leader in Identity Security,

today announced strong financial results for the first quarter

ended March 31, 2022.

“We had an excellent start to 2022 and our business continued to

accelerate,” said Udi Mokady, CyberArk Chairman and CEO. “Great

execution, robust demand and strong industry tailwinds resulted in

subscription ARR reaching $219 million with growth accelerating to

nearly 150 percent and total ARR reaching $427 million with growth

accelerating to 48 percent year-over-year. Driven by continued

strong demand for our Identity Security platform, our subscription

bookings mix reached 86 percent in the first quarter, beating our

guidance framework and passing our transition target for

subscription bookings mix of 85 percent in just five quarters from

the start of the transition. Digital transformation, the adoption

of Zero Trust and attacker innovation contributed to our momentum

and another great bookings quarter with our growth rate further

accelerating off an incredible fourth quarter of 2021. A key

contributor to our bookings growth was a particularly strong

quarter for new business with nearly 250 new logos, a record for a

first quarter. With our momentum from 2021 continuing in the first

quarter, we are confidently raising our full year guidance for ARR.

We are well positioned to deliver against a multi-year durable

growth opportunity, which we believe will increase shareholder

value.”

Financial Summary for the First Quarter Ended March 31,

2022

- Subscription revenue was $51.9 million in the first quarter of

2022, an increase of 110 percent from $24.7 million in the first

quarter of 2021.

- Maintenance and professional services revenue was $65.1 million

in the first quarter of 2022, compared to $61.3 million in the

first quarter of 2021.

- Perpetual license revenue was $10.6 million in the first

quarter of 2022, compared to $26.7 million in the first quarter of

2021.

- Total revenue was $127.6 million in the first quarter of 2022,

up 13 percent from $112.8 million in the first quarter of

2021.

- GAAP operating loss was $(41.1) million and non-GAAP operating

loss was $(11.8) million in the first quarter of 2022.

- GAAP net loss was $(37.8) million, or $(0.94) per basic and

diluted share, in the first quarter of 2022. Non-GAAP net loss was

$(11.9) million, or $(0.30) per basic and diluted share, in the

first quarter of 2022.

Balance Sheet and Net Cash Provided by Operating

Activities

- As of March 31, 2022, CyberArk had $1.2 billion in cash, cash

equivalents, marketable securities, and short-term deposits.

- During the first quarter of 2022, the Company generated $25.0

million in net cash provided by operating activities.

- As of March 31, 2022, total deferred revenue was $345.2

million, a 33 percent increase from $259.7 million at March 31,

2021.

Key Business Highlights

- Annual Recurring Revenue (ARR) was $427 million, with growth

accelerating to 48 percent from $288 million at March 31, 2021.

- The subscription portion of ARR was $219 million, 51 percent of

total ARR at March 31, 2022. This represents an increase of 149

percent from $88 million, or 31 percent of total ARR at March 31,

2021.

- The Maintenance portion of ARR was $208 million at March 31,

2022, compared to $201 million at March 31, 2021.

- Recurring revenue was $106.9 million, an increase of 40 percent

from $76.3 million for the first quarter of 2021.

- 86 percent of total license bookings were related to

subscription bookings, compared with approximately 51 percent in

the first quarter of 2021.

- Added a strong number of new logos in the quarter, signing

nearly 250 customers during the first quarter of 2022.

Business Outlook

Based on information available as of May 12, 2022, CyberArk is

issuing guidance for the second quarter and full year 2022 as

indicated below.

Second Quarter 2022:

- Total revenue is expected to be in the range of $135.0 million

and $141.0 million.

- Non-GAAP operating loss is expected to be in the range of

$(14.5) million to $(9.5) million.

- Non-GAAP net loss per share is expected to be in the range of

$(0.37) to $(0.25) per basic and diluted share.

- Assumes 40.6 million weighted average basic and diluted

shares.

Full Year 2022:

- Total revenue is expected to be in the range of $583.5 million

to $598.5 million.

- Non-GAAP operating loss is expected to be in the range of

$(33.5) million to $(20.5) million.

- Non-GAAP net loss per share is expected to be in the range of

$(0.92) to $(0.60) per basic and diluted share.

- Assumes 40.7 million weighted average basic and diluted

shares.

- ARR as of December 31, 2022 is expected to be in the range of

$535.0 million to $541.0 million, representing growth of 36 percent

to 38 percent from December 31, 2021.

Conference Call Information

In conjunction with this announcement, CyberArk will host a

conference call on Thursday, May 12, 2022 at 8:00 a.m. Eastern Time

(ET) to discuss the Company’s first quarter financial results and

its business outlook. To access this call, dial +1 (833) 968-2251

(U.S.) or +1 (778) 560-2670 (international). The conference ID is

8455417. Additionally, a live webcast of the conference call will

be available via the “Investor Relations” section of the company’s

website at www.cyberark.com.

Following the conference call, a replay will be available for

one week at +1 (800) 585-8367 (U.S.) or +1 (416) 621-4642

(international). The replay pass code is 8455417. An archived

webcast of the conference call will also be available in the

“Investor Relations” section of the company’s website at

www.cyberark.com.

About CyberArk

CyberArk (NASDAQ: CYBR) is the global leader in Identity

Security. Centered on privileged access management, CyberArk

provides the most comprehensive security offering for any identity

– human or machine – across business applications, distributed

workforces, hybrid cloud workloads and throughout the DevOps

lifecycle. The world’s leading organizations trust CyberArk to help

secure their most critical assets. To learn more about CyberArk,

visit https://www.cyberark.com, read the CyberArk blogs or follow

on Twitter via @CyberArk, LinkedIn or Facebook.

Copyright © 2022 CyberArk Software. All Rights Reserved. All

other brand names, product names, or trademarks belong to their

respective holders.

Key Performance Indicators and Non-GAAP Financial

Measures

Annual Recurring Revenue (ARR)

- Annual Recurring Revenue (ARR) is defined as the annualized

value of active SaaS, subscription or term-based license and

maintenance contracts related to perpetual licenses in effect at

the end of the reported period.

Subscription Portion of Annual Recurring Revenue

- Subscription portion of ARR is defined as the annualized value

of active SaaS and subscription or term-based license contracts in

effect at the end of the reported period. The subscription portion

of ARR excludes maintenance contracts related to perpetual

licenses.

Maintenance Portion of Annual Recurring Revenue

- Maintenance portion of ARR is defined as the annualized value

of active maintenance contracts related to perpetual licenses. The

Maintenance portion of ARR excludes SaaS and subscription or

term-based license contracts in effect at the end of the reported

period.

Recurring Revenue

- Recurring Revenue is defined as revenue derived from SaaS and

subscription or term-based license contracts, and maintenance

contracts related to perpetual licenses during the reported

period.

Non-GAAP Financial Measures

CyberArk believes that the use of non-GAAP gross profit,

non-GAAP operating expense, non-GAAP operating income (loss),

non-GAAP net income (loss) and free cash flow is helpful to our

investors. These financial measures are not measures of the

Company’s financial performance under U.S. GAAP and should not be

considered as alternatives to gross profit, operating loss, net

loss or net cash provided by operating activities or any other

performance measures derived in accordance with GAAP.

- Non-GAAP gross profit is calculated as GAAP gross profit

excluding share-based compensation expense, and amortization of

intangible assets related to acquisitions.

- Non-GAAP operating expense is calculated as GAAP operating

expenses excluding share-based compensation expense, acquisition

related expenses and amortization of intangible assets related to

acquisitions.

- Non-GAAP operating income (loss) is calculated as GAAP

operating loss excluding share-based compensation expense,

acquisition related expenses and amortization of intangible assets

related to acquisitions.

- Non-GAAP net income (loss) is calculated as GAAP net loss

excluding share-based compensation expense, acquisition related

expenses, amortization of intangible assets related to

acquisitions, amortization of debt discount and issuance costs, and

the tax effect of non-GAAP adjustments.

- Free cash flow is calculated as net cash provided by operating

activities less purchase of property and equipment.

The Company believes that providing non-GAAP financial measures

that are adjusted by, as applicable, share-based compensation

expense, acquisition related expenses, amortization of intangible

assets related to acquisitions, non-cash interest expense related

to the amortization of debt discount and issuance cost, the tax

effect of the non-GAAP adjustments, and purchase of property and

equipment allows for more meaningful comparisons of its period to

period operating results. Share-based compensation expense has

been, and will continue to be for the foreseeable future, a

significant recurring expense in the Company’s business and an

important part of the compensation provided to its employees. Share

based compensation expense has varying available valuation

methodologies, subjective assumptions and a variety of equity

instruments that can impact a company’s non-cash expense. The

Company believes that expenses related to its acquisitions,

amortization of intangible assets related to acquisitions and

non-cash interest expense related to the amortization of debt

discount and issuance costs do not reflect the performance of its

core business and impact period-to-period comparability. The

Company believes free cash flow is a liquidity measure that, after

the purchase of property and equipment, provides useful information

about the amount of cash generated by the business.

Non-GAAP financial measures may not provide information that is

directly comparable to that provided by other companies in the

Company’s industry, as other companies in the industry may

calculate non-GAAP financial results differently, particularly

related to non-recurring, unusual items. In addition, there are

limitations in using non-GAAP financial measures as they exclude

expenses that may have a material impact on the Company’s reported

financial results. The presentation of non-GAAP financial

information is not meant to be considered in isolation or as a

substitute for the directly comparable financial measures prepared

in accordance with U.S. GAAP. CyberArk urges investors to review

the reconciliation of its non-GAAP financial measures to the

comparable U.S. GAAP financial measures included below, and not to

rely on any single financial measure to evaluate its business.

Guidance for non-GAAP financial measures excludes, as

applicable, share-based compensation expense, acquisition related

expenses, amortization of intangible assets related to

acquisitions, non-cash interest expense related to the amortization

of debt discount and issuance costs and the tax effect of the

non-GAAP adjustments. A reconciliation of the non-GAAP financial

measures guidance to the corresponding GAAP measures is not

available on a forward-looking basis due to the uncertainty

regarding, and the potential variability and significance of, the

amounts of share-based compensation expense, amortization of

intangible assets related to acquisitions, and the non-recurring

expenses that are excluded from the guidance. Accordingly, a

reconciliation of the non-GAAP financial measures guidance to the

corresponding GAAP measures for future periods is not available

without unreasonable effort.

Cautionary Language Concerning Forward-Looking

Statements

This release contains forward-looking statements, which express

the current beliefs and expectations of CyberArk’s (the “Company”)

management. In some cases, forward-looking statements may be

identified by terminology such as “believe,” “may,” “estimate,”

“continue,” “anticipate,” “intend,” “should,” “plan,” “expect,”

“predict,” “potential” or the negative of these terms or other

similar expressions. Such statements involve a number of known and

unknown risks and uncertainties that could cause the Company’s

future results, levels of activity, performance or achievements to

differ materially from the results, levels of activity, performance

or achievements expressed or implied by such forward-looking

statements. Important factors that could cause or contribute to

such differences include risks relating to: changes to the drivers

of the Company’s growth and its ability to adapt its solutions to

IT security market demands; the transition of the Company’s

business to a subscription model that began in 2021 and its ability

to complete its transition goals in the time frame expected; the

Company’s sales cycles and multiple pricing and delivery models;

unanticipated product vulnerabilities or cybersecurity breaches of

the Company’s, or the Company’s customers’ or partners’ systems; an

increase in competition within the Privileged Access Management and

Identity Security markets; the Company’s ability to hire, train,

retain and motivate qualified personnel; the Company’s ability to

sell into existing and new customers and industry verticals; risks

related to compliance with privacy and data protection laws and

regulations; the Company’s history of incurring net losses and our

ability to achieve profitability in the future; the duration and

scope of the COVID-19 pandemic and its impact on global and

regional economies and the resulting effect on the demand for the

Company’s solutions and on its expected revenue growth rates and

costs; the Company’s ability to find, complete, fully integrate or

achieve the expected benefits of additional strategic acquisitions;

reliance on third-party cloud providers for the Company’s

operations and SaaS solutions; the Company’s ability to expand its

sales and marketing efforts and expand its channel partnerships

across existing and new geographies; risks related to sales made to

government entities; regulatory and geopolitical risks associated

with global sales and operations (including the current conflict

between Russia and Ukraine) and changes in regulatory requirements

or fluctuations in currency exchange rates; the ability of the

Company’s products to help customers achieve and maintain

compliance with government regulations or industry standards; risks

related to intellectual property claims or the Company’s ability to

protect its proprietary technology and intellectual property

rights; and other factors discussed under the heading “Risk

Factors” in the Company’s most recent annual report on Form 20-F

filed with the Securities and Exchange Commission. Forward-looking

statements in this release are made pursuant to the safe harbor

provisions contained in the U.S. Private Securities Litigation

Reform Act of 1995. These forward-looking statements are made only

as of the date hereof, and the Company undertakes no obligation to

update or revise the forward-looking statements, whether as a

result of new information, future events or otherwise.

CYBERARK SOFTWARE LTD. Consolidated Statements of

Operations U.S. dollars in thousands (except per share

data) (Unaudited) Three Months Ended

March 31,

2021

2022

Revenues: Subscription

$

24,727

$

51,950

Perpetual license

26,694

10,557

Maintenance and professional services

61,341

65,055

Total revenues

112,762

127,562

Cost of revenues: Subscription

5,210

9,197

Perpetual license

1,004

892

Maintenance and professional services

14,718

17,945

Total cost of revenues

20,932

28,034

Gross profit

91,830

99,528

Operating expenses: Research and development

29,737

43,443

Sales and marketing

61,440

77,433

General and administrative

15,999

19,736

Total operating expenses

107,176

140,612

Operating loss

(15,346)

(41,084)

Financial income (expense), net

(2,906)

1,056

Loss before taxes on income

(18,252)

(40,028)

Tax benefit

3,057

2,217

Net loss

$

(15,195)

$

(37,811)

Basic loss per ordinary share, net

$

(0.39)

$

(0.94)

Diluted loss per ordinary share, net

$

(0.39)

$

(0.94)

Shares used in computing net loss per ordinary shares, basic

39,175,052

40,169,333

Shares used in computing net loss per ordinary shares, diluted

39,175,052

40,169,333

CYBERARK SOFTWARE LTD.

Consolidated Balance

Sheets

U.S. dollars in

thousands

(Unaudited)

December 31, March 31,

2021

2022

ASSETS CURRENT ASSETS: Cash and cash equivalents

$

356,850

$

347,852

Short-term bank deposits

369,645

353,063

Marketable securities

199,933

259,748

Trade receivables

113,211

76,372

Prepaid expenses and other current assets

22,225

25,072

Total current assets

1,061,864

1,062,107

LONG-TERM ASSETS: Marketable securities

300,662

262,314

Property and equipment, net

20,183

19,409

Intangible assets, net

17,866

23,153

Goodwill

123,717

135,526

Other long-term assets

121,743

149,623

Deferred tax asset

47,167

59,481

Total long-term assets

631,338

649,506

TOTAL ASSETS

$

1,693,202

$

1,711,613

LIABILITIES AND SHAREHOLDERS' EQUITY CURRENT

LIABILITIES: Trade payables

$

10,076

$

11,232

Employees and payroll accruals

75,442

53,028

Accrued expenses and other current liabilities

23,576

26,913

Deferred revenues

230,908

254,613

Total current liabilities

340,002

345,786

LONG-TERM LIABILITIES: Convertible senior notes, net

520,094

567,108

Deferred revenues

86,367

90,595

Other long-term liabilities

20,227

38,442

Total long-term liabilities

626,688

696,145

TOTAL LIABILITIES

966,690

1,041,931

SHAREHOLDERS' EQUITY: Ordinary shares of NIS 0.01 par value

104

105

Additional paid-in capital

588,937

551,299

Accumulated other comprehensive income (loss)

397

(7,588)

Retained earnings

137,074

125,866

Total shareholders' equity

726,512

669,682

TOTAL LIABILITIES AND SHAREHOLDERS’ EQUITY

$

1,693,202

$

1,711,613

CYBERARK SOFTWARE LTD.

Consolidated Statements of

Cash Flows

U.S. dollars in

thousands

(Unaudited)

Three Months Ended March 31,

2021

2022

Cash flows from operating activities: Net loss

$

(15,195)

$

(37,811)

Adjustments to reconcile net loss to net cash provided by operating

activities: Depreciation and amortization

3,370

3,884

Amortization of premium and accretion of discount on marketable

securities, net

1,789

1,877

Share-based compensation

19,297

27,278

Deferred income taxes, net

(5,121)

(4,238)

Decrease in trade receivables

26,412

36,839

Amortization of debt discount and issuance costs

4,390

744

Decrease (increase) in prepaid expenses, other current and

long-term assets and others

444

(8,675)

Increase (decrease) in trade payables

(1,783)

1,298

Increase in short-term and long-term deferred revenues

17,174

27,933

Decrease in employees and payroll accruals

(12,312)

(21,588)

Decrease in accrued expenses and other current and long-term

liabilities

(4,490)

(2,557)

Net cash provided by operating activities

33,975

24,984

Cash flows from investing activities: Proceeds from

(investment in) short and long term deposits, net

(1,313)

16,026

Investment in marketable securities and other

(77,158)

(104,477)

Proceeds from sales and maturities of marketable securities

55,978

69,905

Purchase of property and equipment

(2,665)

(2,013)

Payments for business acquisitions, net of cash acquired

-

(12,987)

Net cash used in investing activities

(25,158)

(33,546)

Cash flows from financing activities: Proceeds from

(payment of) withholding tax related to employee stock plans

1,411

(620)

Proceeds from exercise of stock options

4,961

1,100

Net cash provided by financing activities

6,372

480

Increase (decrease) in cash, cash equivalents and restricted

cash

15,189

(8,082)

Effect of exchange rate differences on cash and cash

equivalents

-

(916)

Cash, cash equivalents and restricted cash at the beginning

of the period

500,044

356,850

Cash, cash equivalents and restricted cash at the end of the

period

$

515,233

$

347,852

CYBERARK SOFTWARE LTD. Reconciliation of GAAP Measures to

Non-GAAP Measures U.S. dollars in thousands (except per

share data) (Unaudited) Reconciliation of Net

cash provided by operating activities to Free cash flow:

Three Months Ended March 31,

2021

2022

Net cash provided by operating activities

$

33,975

$

24,984

Less: Purchase of property and equipment

(2,665)

(2,013)

Free cash flow

$

31,310

$

22,971

GAAP net cash used in investing activities

(25,158)

(33,546)

GAAP net cash provided by financing activities

6,372

480

Reconciliation of Gross Profit to Non-GAAP Gross

Profit: Three Months Ended March 31,

2021

2022

Gross profit

$

91,830

$

99,528

Plus: Share-based compensation (1)

2,395

3,190

Amortization of share-based compensation capitalized in software

development costs (3)

47

88

Amortization of intangible assets (2)

1,278

1,278

Non-GAAP gross profit

$

95,550

$

104,084

Reconciliation of Operating Expenses to Non-GAAP

Operating Expenses: Three Months Ended March

31,

2021

2022

Operating expenses

$

107,176

$

140,612

Less: Share-based compensation (1)

16,902

24,088

Amortization of intangible assets (2)

174

152

Acquisition related expenses

-

478

Non-GAAP operating expenses

$

90,100

$

115,894

Reconciliation of Operating Loss to Non-GAAP Operating

Income (Loss): Three Months Ended March

31,

2021

2022

Operating loss

$

(15,346)

$

(41,084)

Plus: Share-based compensation (1)

19,297

27,278

Amortization of share-based compensation capitalized in software

development costs (3)

47

88

Amortization of intangible assets (2)

1,452

1,430

Acquisition related expenses

-

478

Non-GAAP operating income (loss)

$

5,450

$

(11,810)

Reconciliation of Net Loss to Non-GAAP Net Income

(Loss): Three Months Ended March 31,

2021

2022

Net loss

$

(15,195)

$

(37,811)

Plus: Share-based compensation (1)

19,297

27,278

Amortization of share-based compensation capitalized in software

development costs (3)

47

88

Amortization of intangible assets (2)

1,452

1,430

Acquisition related expenses

-

478

Amortization of debt discount and issuance costs

4,390

744

Taxes on income related to non-GAAP adjustments

(6,159)

(4,111)

Non-GAAP net income (loss)

$

3,832

$

(11,904)

Non-GAAP net income (loss) per share Basic

$

0.10

$

(0.30)

Diluted

$

0.09

$

(0.30)

Weighted average number of shares Basic

39,175,052

40,169,333

Diluted

40,491,989

40,169,333

(1) Share-based Compensation : Three Months

Ended March 31,

2021

2022

Cost of revenues - Subscription

$

254

$

376

Cost of revenues - Perpetual license

54

30

Cost of revenues - Maintenance and Professional services

2,087

2,784

Research and development

4,350

6,050

Sales and marketing

7,498

11,400

General and administrative

5,054

6,638

Total share-based compensation

$

19,297

$

27,278

(2) Amortization of intangible assets : Three

Months Ended March 31,

2021

2022

Cost of revenues - Subscription

$

1,089

$

1,208

Cost of revenues - Perpetual license

189

70

Sales and marketing

174

152

Total amortization of intangible assets

$

1,452

$

1,430

(3) Classified as Cost of revenues - Subscription.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220512005233/en/

Investor Contact: Erica Smith CyberArk Phone: +1

617-558-2132 ir@cyberark.com

Media Contact: Liz Campbell CyberArk Phone:

+1-617-558-2191 press@cyberark.com

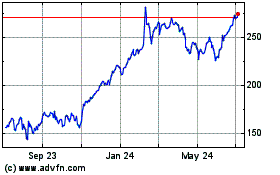

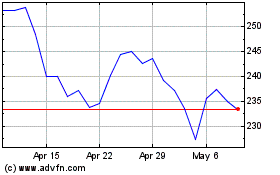

CyberArk Software (NASDAQ:CYBR)

Historical Stock Chart

From Oct 2024 to Nov 2024

CyberArk Software (NASDAQ:CYBR)

Historical Stock Chart

From Nov 2023 to Nov 2024