Total year-over-year sales growth of 3.7% to

$186.3 million

Comparable sales growth of 3.1%; Gross

margin at 38.7%

Balance sheet continues to have ample

liquidity and no debt

Company reiterates Fiscal 2024 EBITDA

Outlook

Citi Trends, Inc. (NASDAQ: CTRN), a leading specialty value

retailer of apparel, accessories and home trends for way less spend

primarily for African American and multicultural families in the

United States, today reported results for the first quarter ended

May 4, 2024.

Financial Highlights – First Quarter

2024

- Total sales of $186.3 million increased 3.7% vs. Q1 2023;

comparable store sales, calculated on a shifted 13-week to 13-week

basis, increased 3.1% compared to Q1 2023

- Gross margin of 38.7% vs. 36.7% as reported and 37.0% as

adjusted* in Q1 2023

- Operating loss of $7.0 million, or $5.6 million as adjusted*,

compared to an operating loss of $9.5 million or $7.9 million as

adjusted* in Q1 2023

- Adjusted EBITDA* loss of $0.8 million compared to an adjusted*

loss of $3.2 million in Q1 2023

- Net loss per share was ($0.42), or ($0.32) as adjusted*,

compared to ($0.81), or ($0.66) as adjusted* in Q1 2023

- Closed 3 stores and remodeled 20 stores to end the quarter with

599 locations; remodeled an additional 15 stores Q2 2024 to date,

resulting in 21% of the fleet in CTx format

- Cash of $58.2 million at quarter-end, with no debt and no

borrowings under a $75 million credit facility

- Exited Q1 2024 with an inventory increase of 4% vs. Q1

2023

Interim Chief Executive Officer

Comments

Ken Seipel, Interim Chief Executive Officer, commented, “The

board is encouraged with our first quarter performance in which we

registered an improvement in topline trend, delivering a comparable

sales increase of 3.1%. The quarter was further highlighted by

gross margin expansion of 160 basis points compared to last year.

The improvements in topline and gross margin were helped by our

rebuild of inventories in targeted product categories. We also

benefitted from our store teams’ delivering in-store experiences

and bringing to life our Citi Trends’ value proposition for the

entire family.”

Mr. Seipel continued, “Our balance sheet has ample liquidity and

no debt because of our financial disciplines, which in turn allows

us the flexibility to fund business opportunities with acceptable

rates of returns. We are mindful of the challenging economic

environment for the lower income consumer, however, we will execute

the business initiatives within our control that will position us

to achieve our EBITDA target for the year. We are focused on

driving profitable sales, sharpening our product assortment

decisions, streamlining costs, optimizing our supply chain,

improving inventory returns and leveraging benefits from recent

technology investments. I would like to thank our entire

organization for their dedication to executing our initiatives and

serving our customers every day.”

Mr. Seipel concluded, “As announced on May 31, 2024, David

Makuen has stepped down from his role as CEO. On behalf of the

Board of Directors and the entire Citi Trends Team, I would like to

thank David for his hard work and leadership these past four years.

David shaped and built our strong purpose driven Citi Trends

culture while leading the company through some of the most

challenging consumer environments in recent history. Our best

wishes to David!”

Capital Return Program

Update

In the first quarter of fiscal 2024, the Company did not

repurchase any shares of its common stock. At the end of Q1 2024,

$50.0 million remained available under the Company’s share

repurchase program.

Fiscal 2024 Outlook

The Company’s updated fiscal 2024 outlook is as follows:

- Expecting full year comparable store sales growth of low to

mid-single digits, a range slightly below our previous outlook

- Full year gross margin to expand by approximately 75 to 100

basis points, consistent with previous outlook

- SG&A dollars expected to increase by approximately 1.5% to

2.5%, slightly better than previous outlook from streamlined costs

in a variety of areas

- Full year EBITDA* planned to be in the range of $4 million to

$10 million, unchanged from previous outlook

- The Company continues to plan to open up to 5 new stores,

remodel approximately 40 stores and close 10 to 15 underperforming

stores as part of its ongoing fleet optimization; expecting to end

fiscal 2024 with approximately 595 stores

- Full year capital expenditures are still expected to be

approximately $20 million

Investor Conference Call and

Webcast

Citi Trends will host a conference call today at 9:00 a.m. ET.

The live broadcast of Citi Trends' conference call will be

available online at the Company's website, cititrends.com, under

the Investor Relations section, beginning today at 9:00 a.m. ET.

The online replay will follow shortly after the call and will be

available for replay for one year.

The live conference call can also be accessed by dialing (877)

407-0779. A replay of the conference call will be available until

June 11, 2024, by dialing (844) 512-2921 and entering the passcode,

13746167.

During the conference call, the Company may discuss and answer

questions concerning business and financial developments and trends

that have occurred after quarter-end. The Company’s responses to

questions, as well as other matters discussed during the call, may

contain or constitute information that has not been disclosed

previously.

*Non-GAAP Financial

Measures

The historical non-GAAP financial measures discussed herein are

reconciled to their corresponding GAAP measures at the end of this

press release. The Company is unable to provide a full

reconciliation of the forward-looking non-GAAP financial measure

used in 2024 guidance without unreasonable effort because it is not

possible to predict certain of its adjustment items with a

reasonable degree of certainty. This information is dependent upon

future events and may be outside of the Company’s control and its

unavailability could have a significant impact on its financial

results.

About Citi Trends

Citi Trends, Inc. is a leading specialty value retailer of

apparel, accessories and home trends for way less spend primarily

for African American and multicultural families in the United

States. The Company operates 599 stores located in 33 states. For

more information, visit cititrends.com or your local store.

Forward-Looking

Statements

All statements other than historical facts contained in this

news release, including statements regarding the Company’s future

financial results and position, business policy and plans,

objectives and expectations of management for future operations and

capital allocation expectations, are forward-looking statements

that are subject to material risks and uncertainties. The words

"believe," "may," "could," "plans," "estimate," “expects,”

"continue," "anticipate," "intend," "expect," “upcoming,” “trend”

and similar expressions, as they relate to the Company, are

intended to identify forward-looking statements, although not all

forward-looking statements contain such language. Statements with

respect to earnings, sales or new store guidance are

forward-looking statements. Investors are cautioned that any such

forward-looking statements are subject to the finalization of the

Company’s quarter-end financial and accounting procedures, are not

guarantees of future performance or results, and are inherently

subject to risks and uncertainties, some of which cannot be

predicted or quantified. Actual results or developments may differ

materially from those included in the forward-looking statements as

a result of various factors which are discussed in our Annual

Reports and Quarterly Reports on Forms 10-K and 10-Q, respectively,

and any amendments thereto, filed with the Securities and Exchange

Commission. These risks and uncertainties include, but are not

limited to, uncertainties relating to general economic conditions,

including inflation, energy and fuel costs, unemployment levels,

and any deterioration whether caused by acts of war, terrorism,

political or social unrest (including any resulting store closures,

damage or loss of inventory); or other factors; changes in market

interest rates and market levels of wages; impacts of natural

disasters such as hurricanes; uncertainty and economic impact of

pandemics, epidemics or other public health emergencies such as the

ongoing COVID-19 pandemic; transportation and distribution delays

or interruptions; changes in freight rates; the Company’s ability

to attract and retain workers; the Company’s ability to negotiate

effectively the cost and purchase of merchandise inventory risks

due to shifts in market demand; the Company’s ability to gauge

fashion trends and changing consumer preferences; consumer

confidence and changes in consumer spending patterns; competition

within the industry; competition in our markets; the duration and

extent of any economic stimulus programs; changes in product mix;

interruptions in suppliers’ businesses; the impact of the cyber

disruption we identified on January 14, 2023, including legal,

reputational, financial and contractual risks resulting from the

disruption, and other risks related to cybersecurity, data privacy

and intellectual property; temporary changes in demand due to

weather patterns; seasonality of the Company’s business; changes in

market interest rates and market level wages; the results of

pending or threatened litigation; delays associated with building,

remodeling, opening and operating new stores; and delays associated

with building, and opening or expanding new or existing

distribution centers. Any forward-looking statements by the

Company, with respect to guidance, the repurchase of shares

pursuant to a share repurchase program, or otherwise, are intended

to speak only as of the date such statements are made. Except as

required by applicable law, including the securities laws of the

United States and the rules and regulations of the Securities and

Exchange Commission, the Company does not undertake to publicly

update any forward-looking statements in this news release or with

respect to matters described herein, whether as a result of any new

information, future events or otherwise.

CITI TRENDS, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS (unaudited)

(in thousands, except per

share data)

First Quarter

2024

2023

2022

Net sales

$

186,289

$

179,688

$

208,215

Cost of sales (exclusive of depreciation shown separately

below)

(114,254

)

(113,659

)

(127,011

)

Selling, general and administrative expenses

(74,211

)

(70,807

)

(71,026

)

Depreciation

(4,793

)

(4,681

)

(5,445

)

Gain on sale-leaseback

-

-

34,920

(Loss) Income from operations

(6,969

)

(9,460

)

39,653

Interest income

849

1,023

-

Interest expense

(79

)

(75

)

(76

)

(Loss) income before income taxes

(6,199

)

(8,512

)

39,577

Income tax benefit (expense)

2,773

1,876

(9,374

)

Net (loss) income

$

(3,426

)

$

(6,635

)

$

30,203

Basic net (loss) income per common share

$

(0.42

)

$

(0.81

)

$

3.59

Diluted net (loss) income per common share

$

(0.42

)

$

(0.81

)

$

3.59

Weighted average number of shares outstanding Basic

8,253

8,182

8,407

Diluted

8,253

8,182

8,407

CITI TRENDS, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS (unaudited)

(in thousands)

May 4, 2024

April 29, 2023

Assets: Cash and cash equivalents

$

58,169

$

88,707

Inventory

119,014

114,322

Prepaid and other current assets

17,815

16,054

Property and equipment, net

53,352

57,383

Operating lease right of use assets

226,918

252,435

Other noncurrent assets

8,834

5,530

Total assets

$

484,102

$

534,430

Liabilities and Stockholders' Equity: Accounts payable

$

72,269

$

90,029

Accrued liabilities

24,437

23,473

Current operating lease liabilities

45,428

47,780

Other current liabilities

841

912

Noncurrent operating lease liabilities

184,463

209,594

Other noncurrent liabilities

1,831

2,680

Total liabilities

329,269

374,468

Total stockholders' equity

154,832

159,962

Total liabilities and stockholders' equity

$

484,101

$

534,430

RECONCILIATION OF NON-GAAP

FINANCIAL MEASURES (unaudited)

(in thousands, except per

share data)

The Company makes reference in this release to adjusted

gross margin, adjusted operating income, adjusted net income,

adjusted earnings per share and adjusted EBITDA. The Company

believes these supplemental measures reflect operating results that

are more indicative of the Company's ongoing operating performance

while improving comparability to prior and future periods, and as

such, may provide investors with an enhanced understanding of the

Company's past financial performance and prospects for the future.

This information is not intended to be considered in isolation or

as a substitute for net income or earnings per diluted share

prepared in accordance with generally accepted accounting

principles (GAAP).

First Quarter

May 4, 2024

April 29, 2023

Reconciliation of Adjusted Operating (Loss) Income Operating

loss

$

(6,969

)

$

(9,460

)

Cyber incident expenses

—

1,560

Other non-recurring expenses

1,380

—

Adjusted operating loss

$

(5,589

)

$

(7,900

)

First Quarter

May 4, 2024

April 29, 2023

Reconciliation of Adjusted Diluted EPS Diluted loss per

share

$

(0.42

)

$

(0.81

)

Cyber incident expenses

—

0.19

Other non-recurring expenses

0.17

—

Tax effect

(0.07

)

(0.04

)

Adjusted diluted loss per share

$

(0.32

)

$

(0.66

)

First Quarter

May 4, 2024

April 29, 2023

Reconciliation of Adjusted EBITDA Net loss

$

(3,426

)

$

(6,635

)

Interest income

(849

)

(1,023

)

Interest expense

79

75

Income tax benefit

(2,773

)

(1,876

)

Depreciation

4,793

4,681

Cyber incident expenses

—

1,560

Other non-recurring expenses

1,380

—

Adjusted EBITDA

$

(796

)

$

(3,218

)

First Quarter

May 4, 2024

April 29, 2023

Reconciliation of Adjusted Gross Margin Net sales

$

186,289

$

179,688

Cost of sales

(114,254

)

(113,659

)

Gross profit

$

72,035

$

66,029

Gross margin

38.7

%

36.7

%

Cyber incident expenses

$

-

$

513

Adjusted gross profit

$

72,035

$

66,542

Adjusted gross margin

38.7

%

37.0

%

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240604021473/en/

Tom Filandro ICR, Inc. CitiTrendsIR@icrinc.com

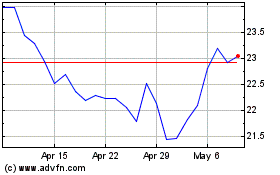

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Oct 2024 to Nov 2024

Citi Trends (NASDAQ:CTRN)

Historical Stock Chart

From Nov 2023 to Nov 2024