November 4, 2019 TCF Financial Corporation Investor Presentation - November 2019

Cautionary Statements for the Purposes of Safe Harbor Provisions of the Securities Litigation Reform Act Any statements contained in this presentation regarding the outlook for the Corporation's businesses and their respective markets, such as projections of future performance, targets, guidance, statements of the Corporation's plans and objectives, forecasts of market trends and other matters are forward-looking statements based on the Corporation's assumptions and beliefs. Such statements may be identified by such words or phrases as "will likely result," "are expected to," "will continue," "outlook," "will benefit," "is anticipated," "estimate," "project," "management believes" or similar expressions. These forward-looking statements are subject to certain risks and uncertainties that could cause actual results to differ materially from those discussed in such statements, and no assurance can be given that the results in any forward-looking statement will be achieved. For these statements, TCF claims the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. Any forward-looking statement speaks only as of the date on which it is made, and we disclaim any obligation to subsequently revise any forward-looking statement to reflect events or circumstances after such date or to reflect the occurrence of anticipated or unanticipated events. This presentation also contains forward-looking statements regarding TCF’s outlook or expectations with respect to the merger and integration with Chemical Financial Corporation (“Chemical”). Examples of forward-looking statements include, but are not limited to, statements regarding outlook and expectations with respect to strategic and financial benefits of the merger, including the expected impact of the transaction on TCF’s future financial performance (including anticipated accretion to earnings per share, the tangible book value earn-back period and other operating and return metrics), the expected costs to be incurred in connection with the merger, and operational aspects of post-merger integration. Certain factors could cause the Corporation's future results to differ materially from those expressed or implied in any forward-looking statements contained herein. These factors include the factors discussed in Part I, Item 1A of the Corporation’s Annual Report on Form 10-K for the year ended December 31, 2018 under the heading "Risk Factors" or otherwise disclosed in documents filed or furnished by the Corporation with or to the SEC after the filing of such Annual Report on Form 10-K, the factors discussed below, and any other cautionary statements, written or oral, which may be made or referred to in connection with any such forward-looking statements. Since it is not possible to foresee all such factors, these factors should not be considered as complete or exhaustive: deterioration in general economic, political and banking industry conditions; cyber-security breaches, hacking, denial of service, security breaches, loss or theft of information, or other cyber-attacks that disrupt TCF’s business operations or damage its reputation; fluctuation in interest rates that result in decreases in the value of assets or a mismatch between yields earned on TCF's interest-earning assets and the rates paid on its deposits and borrowings; lack of access to liquidity; inability to grow deposits, increase earnings and revenue, manage operating expenses, or pay and receive dividends; adverse effects related to competition from traditional competitors, non-bank providers of financial services and new technologies; soundness of other financial institutions and other counterparty risk, including the risk of default, operational disruptions, security breaches, or diminished availability of counterparties who satisfy our credit quality requirements; adverse developments affecting TCF's branches, including supermarket branches; risks related to developing new products, markets or lines of business; adverse changes in monetary, fiscal or tax policies; heightened consumer protection, supervisory or regulatory practices or requirements; deficiencies in TCF's compliance programs or risk mitigation frameworks; the effect of any negative publicity or reputational damage; technological or operational difficulties; failure to keep pace with technological change, including with respect to customer demands or system upgrades; risks related to TCF's loan sales activity; dependence on accurate and complete information from customers and counterparties; the failure to attract and retain key employees; inability to successfully execute on TCF's growth strategy through acquisitions or expanding existing business relationships; changes in accounting standards or interpretations of existing standards; adverse federal, state or foreign tax assessments; litigation or government enforcement actions; ineffective internal controls; and the effects of man-made and natural disasters, any of which may negatively affect our operations and/or our customers. 2

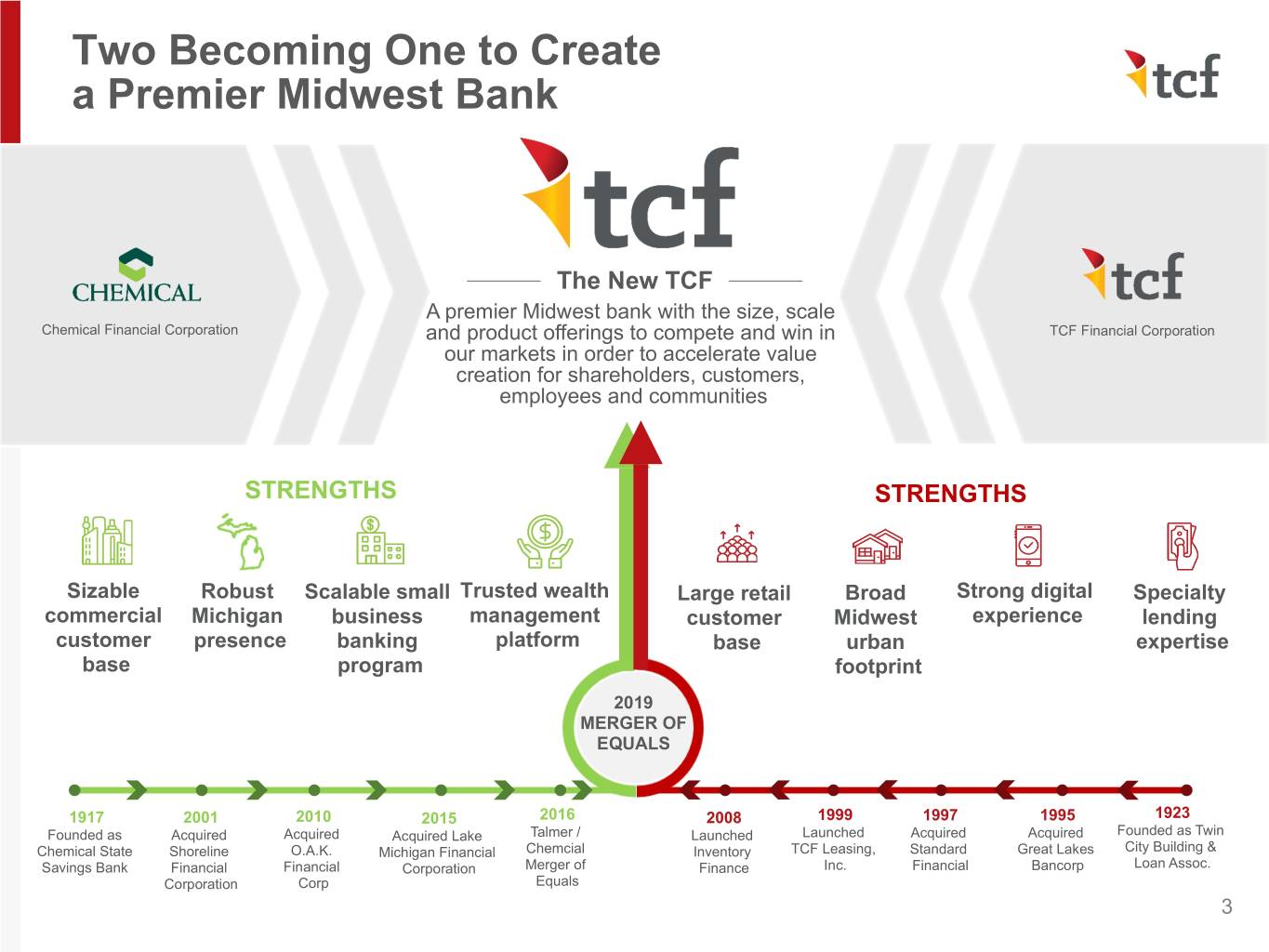

Two Becoming One to Create a Premier Midwest Bank The New TCF A premier Midwest bank with the size, scale Chemical Financial Corporation and product offerings to compete and win in TCF Financial Corporation our markets in order to accelerate value creation for shareholders, customers, employees and communities STRENGTHS STRENGTHS Sizable Robust Scalable small Trusted wealth Large retail Broad Strong digital Specialty commercial Michigan business management customer Midwest experience lending customer presence banking platform base urban expertise base program footprint 2019 MERGER OF EQUALS 1917 2001 2010 2015 2016 2008 1999 1997 1995 1923 Founded as Acquired Acquired Acquired Lake Talmer / Launched Launched Acquired Acquired Founded as Twin Chemical State Shoreline O.A.K. Michigan Financial Chemcial Inventory TCF Leasing, Standard Great Lakes City Building & Savings Bank Financial Financial Corporation Merger of Finance Inc. Financial Bancorp Loan Assoc. Corporation Corp Equals 3

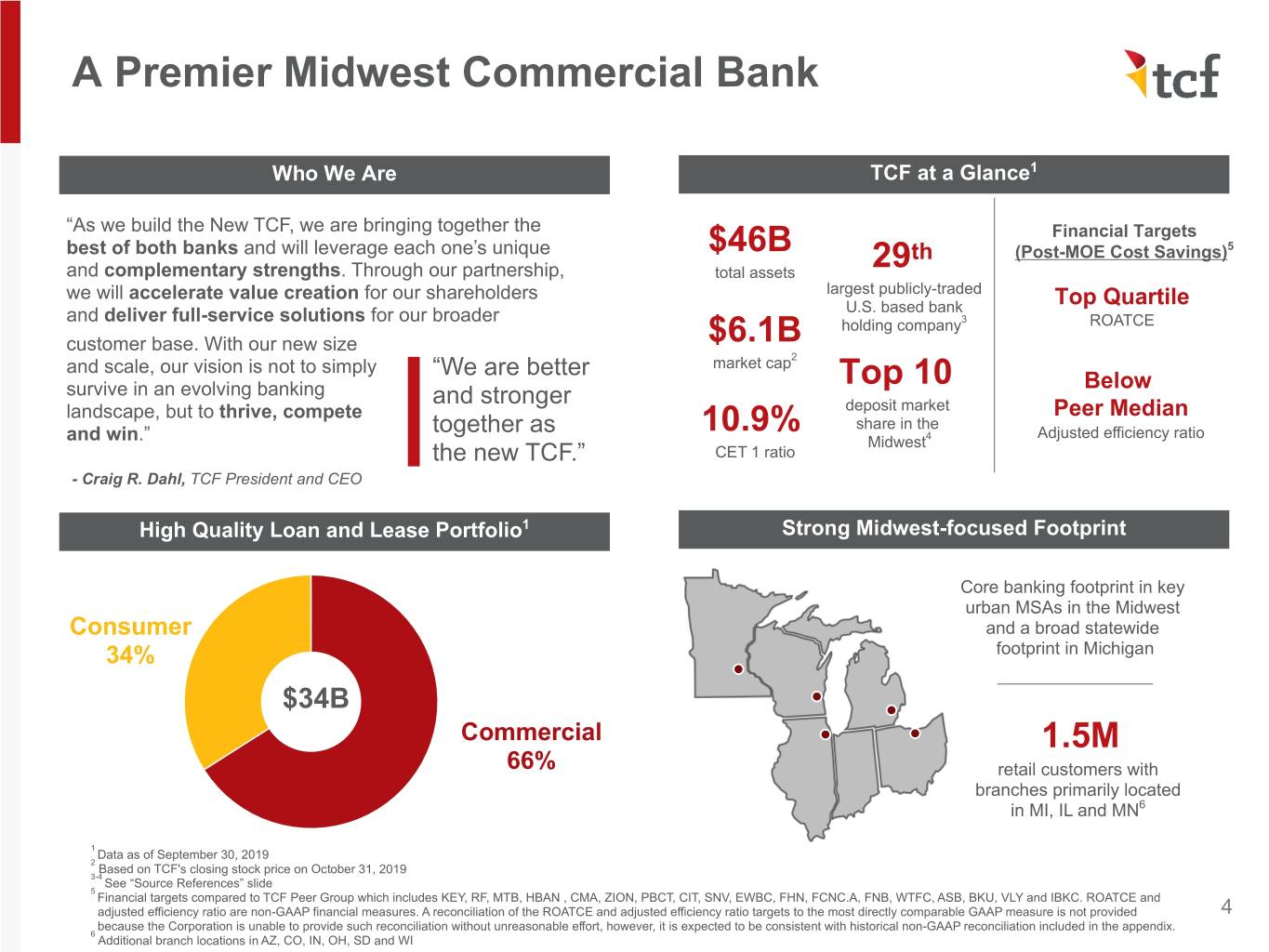

A Premier Midwest Commercial Bank Who We Are TCF at a Glance1 “As we build the New TCF, we are bringing together the Financial Targets best of both banks and will leverage each one’s unique $46B 5 th (Post-MOE Cost Savings) and complementary strengths. Through our partnership, total assets 29 we will accelerate value creation for our shareholders largest publicly-traded U.S. based bank Top Quartile and deliver full-service solutions for our broader 3 holding company ROATCE customer base. With our new size $6.1B 2 and scale, our vision is not to simply “We are better market cap Top 10 Below survive in an evolving banking and stronger landscape, but to thrive, compete deposit market Peer Median share in the together as 10.9% Adjusted efficiency ratio and win.” Midwest4 the new TCF.” CET 1 ratio - Craig R. Dahl, TCF President and CEO High Quality Loan and Lease Portfolio1 Strong Midwest-focused Footprint Core banking footprint in key urban MSAs in the Midwest Consumer and a broad statewide 34% footprint in Michigan $34B Commercial 1.5M 66% retail customers with branches primarily located in MI, IL and MN6 1 Data as of September 30, 2019 2 Based on TCF's closing stock price on October 31, 2019 3-4 See “Source References” slide 5 Financial targets compared to TCF Peer Group which includes KEY, RF, MTB, HBAN , CMA, ZION, PBCT, CIT, SNV, EWBC, FHN, FCNC.A, FNB, WTFC, ASB, BKU, VLY and IBKC. ROATCE and adjusted efficiency ratio are non-GAAP financial measures. A reconciliation of the ROATCE and adjusted efficiency ratio targets to the most directly comparable GAAP measure is not provided 4 because the Corporation is unable to provide such reconciliation without unreasonable effort, however, it is expected to be consistent with historical non-GAAP reconciliation included in the appendix. 6 Additional branch locations in AZ, CO, IN, OH, SD and WI

Experienced Management Team • Seasoned management team with deep banking expertise, Large Bank including large bank experience Experience • Executive and senior leadership team represents a broad cross-section of experience across leading Midwest and other national banking institutions • Experienced in organically growing & operating businesses: ◦ Capital Solutions built $5B business organically Entrepreneurial ◦ Inventory Finance built $3B business organically Backgrounds ◦ Commercial Banking Expansion in Detroit, Grand Rapids and Cleveland Lift out of key commercial leaders in market and growth of commercial portfolios. • Strong bench strength of talent as a result of bringing together the best of both organizations Ability to • Size and scale of the current platform supports continued Recruit Talent recruitment of top banking talent across Midwest markets • Opportunity to add bankers from larger regional banks who can lead a build-out/expansion of a market or product vertical 5

A Full-scale Product Offering Across Commercial and Consumer Client Base 6

2020 Strategic Priorities Focus on driving improved return on average tangible common equity and efficiency through key strategic priorities Deliver on Merger Cost Savings Drive organizational efficiencies by executing on $180 million of merger-related cost savings; unique opportunity for TCF to drive relative growth in earnings vs. peers over the next 12-18 months Continue to Grow Organically & Leverage the Best of Both Banks Build on the positive momentum generated by Legacy TCF and Chemical by leveraging complementary products in adjacent markets to drive future growth Maintain Strong Risk and Credit Culture Apply scalable risk management framework across the larger organization to maintain credit, liquidity and capital discipline Execute & Complete Integration Program Integrate systems, branding and culture as One TCF and provide a consistent customer experience by the fourth quarter of 2020 7

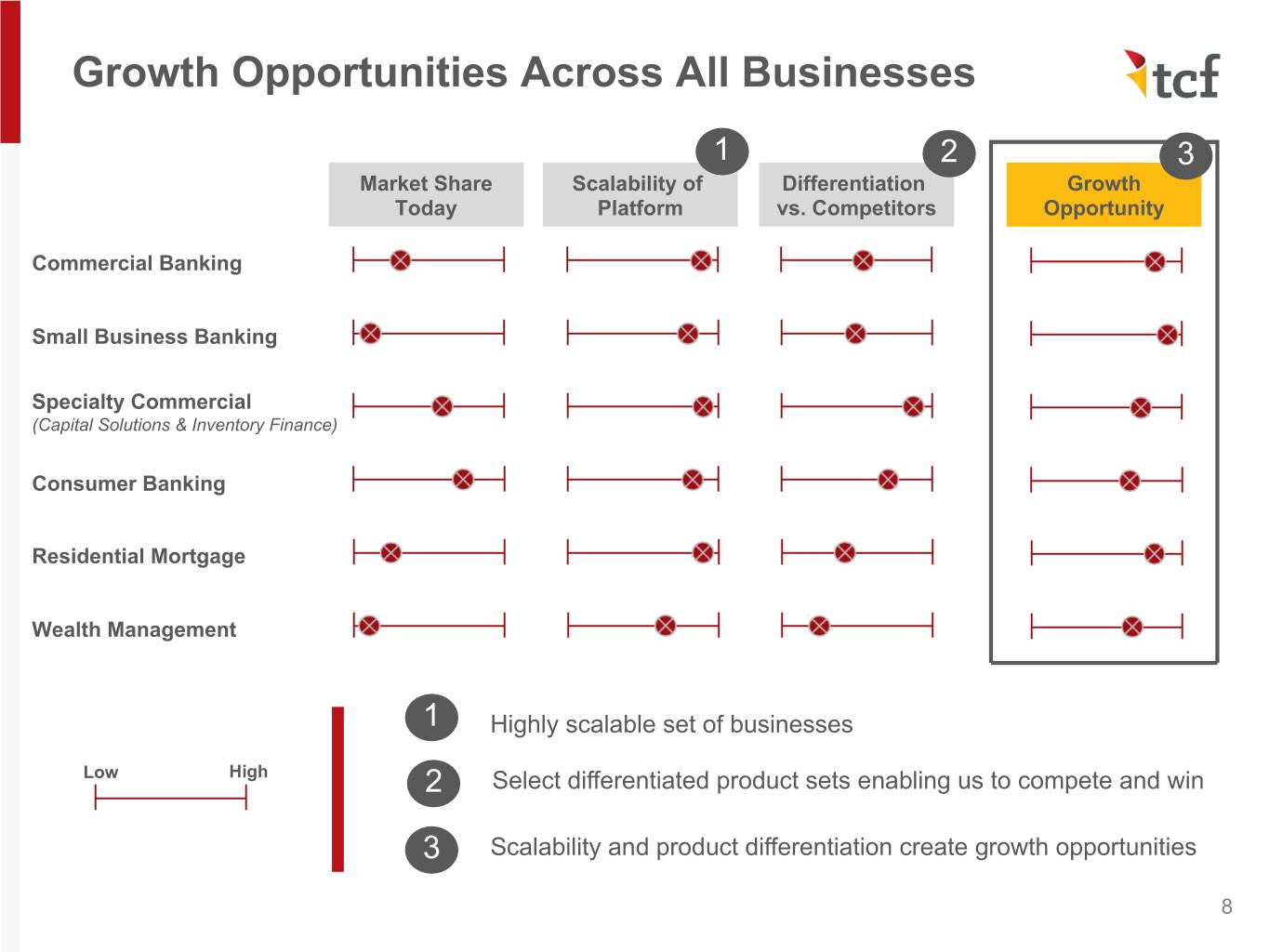

Growth Opportunities Across All Businesses 1 2 3 Market Share Scalability of Differentiation Growth Today Platform vs. Competitors Opportunity Commercial Banking Small Business Banking Specialty Commercial (Capital Solutions & Inventory Finance) Consumer Banking Residential Mortgage Wealth Management 1 Highly scalable set of businesses Low High 2 Select differentiated product sets enabling us to compete and win 3 Scalability and product differentiation create growth opportunities 8

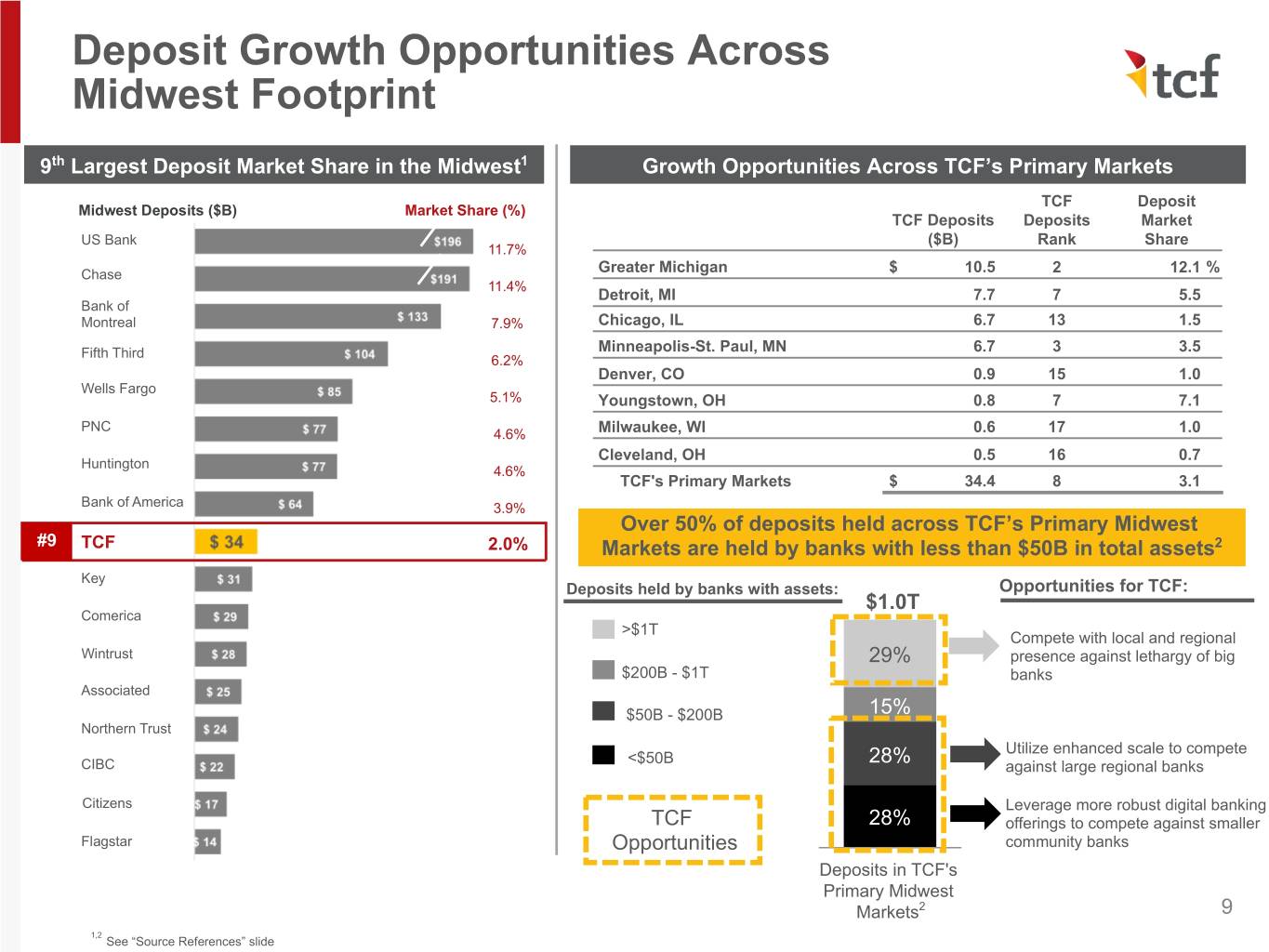

Deposit Growth Opportunities Across Midwest Footprint 9th Largest Deposit Market Share in the Midwest1 Growth Opportunities Across TCF’s Primary Markets TCF Deposit Midwest Deposits ($B) Market Share (%) TCF Deposits Deposits Market US Bank ($B) Rank Share 11.7% Chase Greater Michigan $ 10.5 2 12.1 % 11.4% Detroit, MI 7.7 7 5.5 Bank of Montreal 7.9% Chicago, IL 6.7 13 1.5 Fifth Third Minneapolis-St. Paul, MN 6.7 3 3.5 6.2% Denver, CO 0.9 15 1.0 Wells Fargo 5.1% Youngstown, OH 0.8 7 7.1 PNC 4.6% Milwaukee, WI 0.6 17 1.0 Cleveland, OH 0.5 16 0.7 Huntington 4.6% TCF's Primary Markets $ 34.4 8 3.1 Bank of America 3.9% Over 50% of deposits held across TCF’s Primary Midwest #9 TCF 2.0% Markets are held by banks with less than $50B in total assets2 Key Deposits held by banks with assets: Opportunities for TCF: $1.0T Comerica >$1T Compete with local and regional Wintrust 29% presence against lethargy of big $200B - $1T banks Associated $50B - $200B 15% Northern Trust Utilize enhanced scale to compete <$50B 28% CIBC against large regional banks Citizens Leverage more robust digital banking TCF 28% offerings to compete against smaller Flagstar Opportunities community banks Deposits in TCF's Primary Midwest Markets2 9 1,2 See “Source References” slide

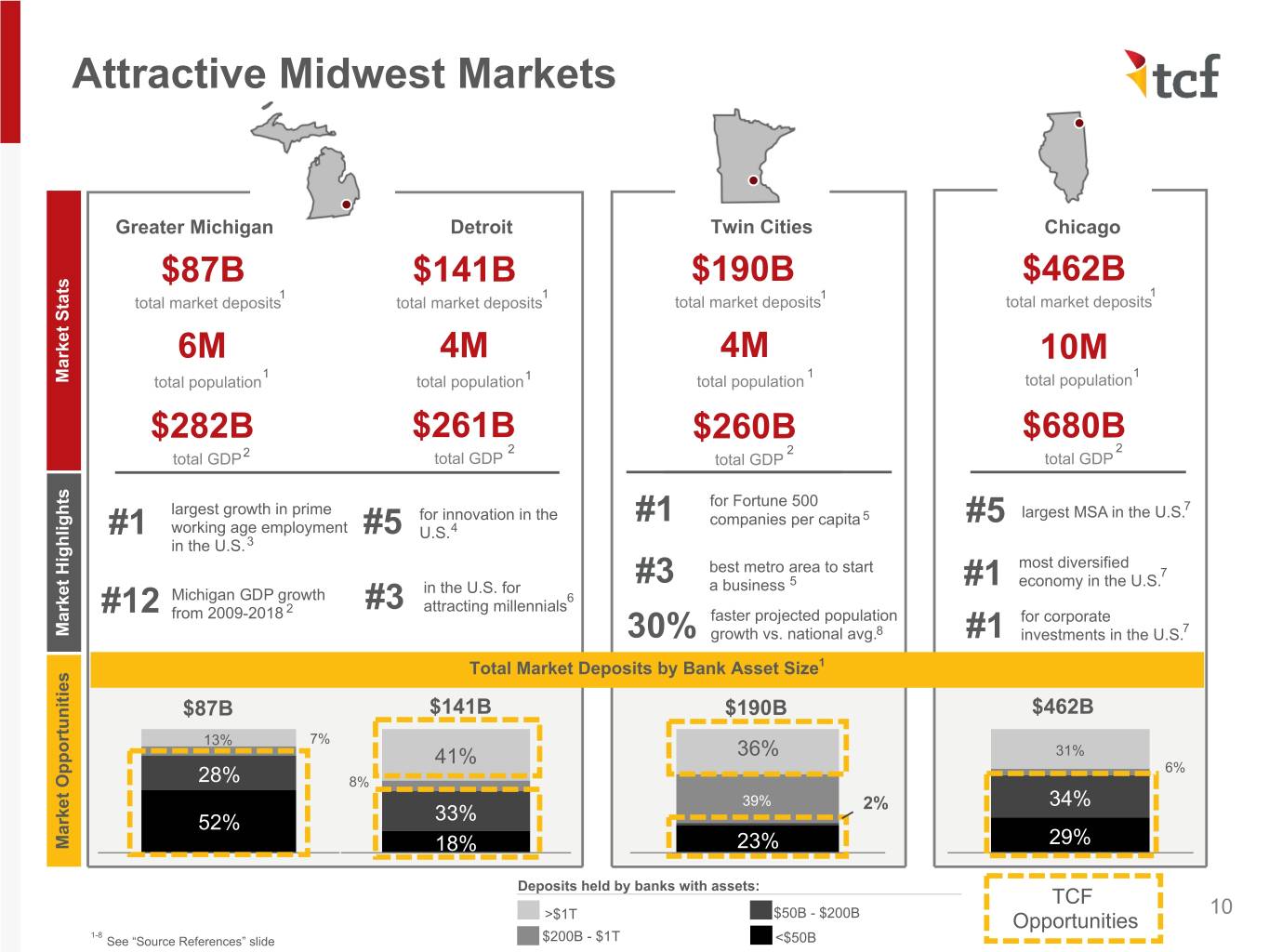

Attractive Midwest Markets Greater Michigan Detroit Twin Cities Chicago $87B $141B $190B $462B 1 1 1 1 total market deposits total market deposits total market deposits total market deposits 6M 4M 4M 10M 1 1 1 1 Market Stats total population total population total population total population $282B $261B $260B $680B 2 2 2 total GDP2 total GDP total GDP total GDP for Fortune 500 largest growth in prime 7 for innovation in the #1 companies per capita 5 #5 largest MSA in the U.S. #1 working age employment #5 U.S.4 in the U.S.3 most diversified best metro area to start 7 in the U.S. for #3 a business 5 #1 economy in the U.S. Michigan GDP growth 6 2 #3 attracting millennials #12 from 2009-2018 faster projected population for corporate 7 Market Highlights 30% growth vs. national avg.8 #1 investments in the U.S. Total Market Deposits by Bank Asset Size1 $87B $141B $190B $462B 13% 7% 41% 36% 31% 6% 28% 8% 39% 2% 34% 52% 33% 29% Market Opportunities 18% 23% Deposits held by banks with assets: TCF 10 >$1T $50B - $200B Opportunities 1-8 See “Source References” slide $200B - $1T <$50B

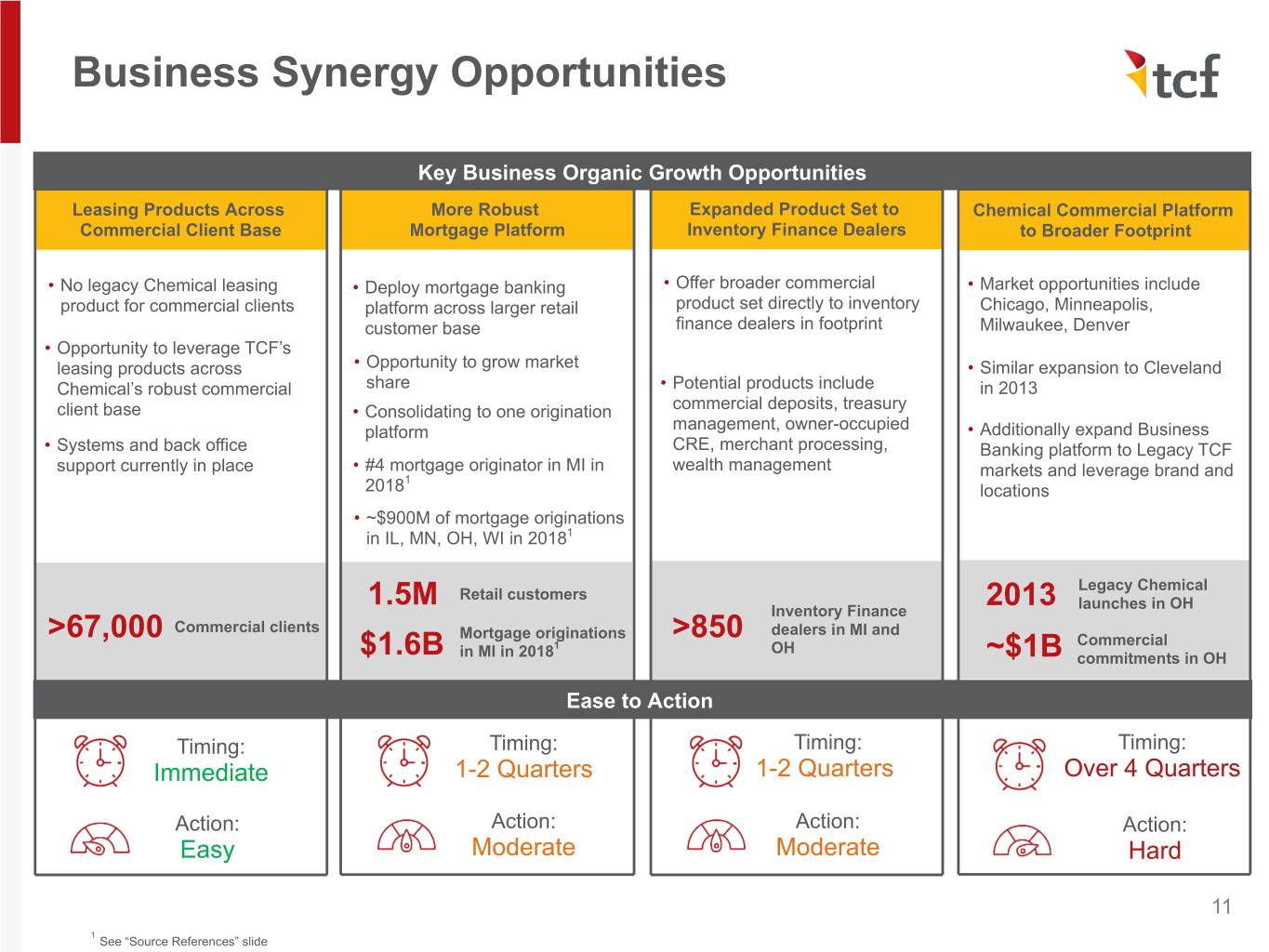

Business Synergy Opportunities Key Business Organic Growth Opportunities Leasing Products Across More Robust Expanded Product Set to Chemical Commercial Platform Commercial Client Base Mortgage Platform Inventory Finance Dealers to Broader Footprint • No legacy Chemical leasing • Deploy mortgage banking • Offer broader commercial • Market opportunities include product for commercial clients platform across larger retail product set directly to inventory Chicago, Minneapolis, customer base finance dealers in footprint Milwaukee, Denver • Opportunity to leverage TCF’s leasing products across • Opportunity to grow market • Similar expansion to Cleveland Chemical’s robust commercial share • Potential products include in 2013 client base • Consolidating to one origination commercial deposits, treasury platform management, owner-occupied • Additionally expand Business • Systems and back office CRE, merchant processing, Banking platform to Legacy TCF support currently in place • #4 mortgage originator in MI in wealth management markets and leverage brand and 1 2018 locations • ~$900M of mortgage originations in IL, MN, OH, WI in 20181 Legacy Chemical 1.5M Retail customers Inventory Finance 2013 launches in OH >67,000 Commercial clients Mortgage originations >850 dealers in MI and 1 OH Commercial $1.6B in MI in 2018 ~$1B commitments in OH Ease to Action Timing: Timing: Timing: Timing: Immediate 1-2 Quarters 1-2 Quarters Over 4 Quarters Action: Action: Action: Action: Easy Moderate Moderate Hard 11 1 See “Source References” slide

Well-diversified Loan and Lease Portfolio Loan portfolio comprised primarily of commercial-based portfolios (66% of total loans) with upside growth potential driven by multiple lending origination businesses Consumer installment Traditional Year-over-Year Loan and Lease Growth1 5% Commercial Consumer $15B Home $11B equity 11.3% 11% CRE 26% 9.5% Residential mortgage $1.1B 5.7% 5.3% 18% $34B $0.8B Traditional $0.1B $0.6B C&I Inventory 15% finance Capital Capital C&I 2 CRE Lease Consumer Specialty 10% Solutions 3 Solutions Financing (ex. Auto) Commercial leases loans 7% $8B 8% Traditional Commercial Consumer Specialty Commercial Traditional C&I and commercial real Residential mortgage, Capital Solutions provides loan and lease estate lending primarily within the home equity and consumer financing across the U.S. in select equipment footprint installment loans sectors based on management expertise Inventory Finance leverages exclusive manufacturer agreements to provide floorplan 1 Based on changes from combined TCF and Chemical reported financials financing across the U.S. and Canada 12 2 Includes traditional C&I, Capital Solutions loans and inventory finance 3 Excludes Legacy TCF auto finance balances of $2.3B at 3Q18 and $0.0B at 3Q19 (total combined loan and lease balances of $33.2B at 3Q18 and $33.5B at 3Q19)

Preferred Deposit Composition Focus on funding loan and lease growth through a well-diversified deposit mix with opportunities for organic growth in both commercial and consumer deposit offerings Deposit Growth ($ Billions) Well-diversified Deposit Mix by Type and Product YoY Deposit Growth of 4% / non-CD growth of 7% by type: by product: Noninterest-bearing Commercial CDs Checking $35.3 $33.9 24% 23% 38% $8.4 $35B $35B Money $8.7 CDs Market 12% 18% 62% Non-CDs Interest- 23% bearing Consumer Checking Savings 3Q19 Cost of Deposits: 0.94%2 $25.2 $26.9 Opportunities for Organic Growth Commercial Consumer Deposits Deposits 3Q18 3Q19 TCF/Chemical Combined1 • Opportunities to increase market • Opportunities to increase market share across all markets share across all markets $1.7B of combined non-CD • Leverage Chemical commercial • Leverage investments in Legacy deposit and treasury management TCF digital channels across the full growth, or 7%, YoY system and sales process deposit base 13 1 Combined TCF and Chemical reported financials 2 Annualized

Technology Strategy that Brings Together the Best of Both Banks Bringing together the complementary IT investments of both banks will drive efficiencies, enhance the customer experience and position TCF for success Deepen Customer Offer Exceptional Relationships Through Innovation Customer Experiences • Enhance person-to-person interactions with • Deepen personalization capabilities digital integrations • Incorporate emerging customer experience trends • Expand technology offerings (AI, voice, location • Design based on customer behaviors, taking experiences, etc.) segmentation to the next level • Leverage digital identification verification to CORE • Remove friction points service customers differently BANKING PLATFORM Utilize Digital To Test New Products Omni-Channel Experiences And Services • Expand self-service capabilities • Launch with MVP mindset; integrate and learn • Grow digital product offerings across all lines of business • Digital only product offerings and markets • Increase cross channel awareness • Leverage additional Fin Tech partnerships CORE SYSTEM One, consolidated core platform Leverage prior investments in Leverage prior investments in core banking platform Streamlined to drive efficiencies customer-facing digital technology 14 Singular set of centralized data platform

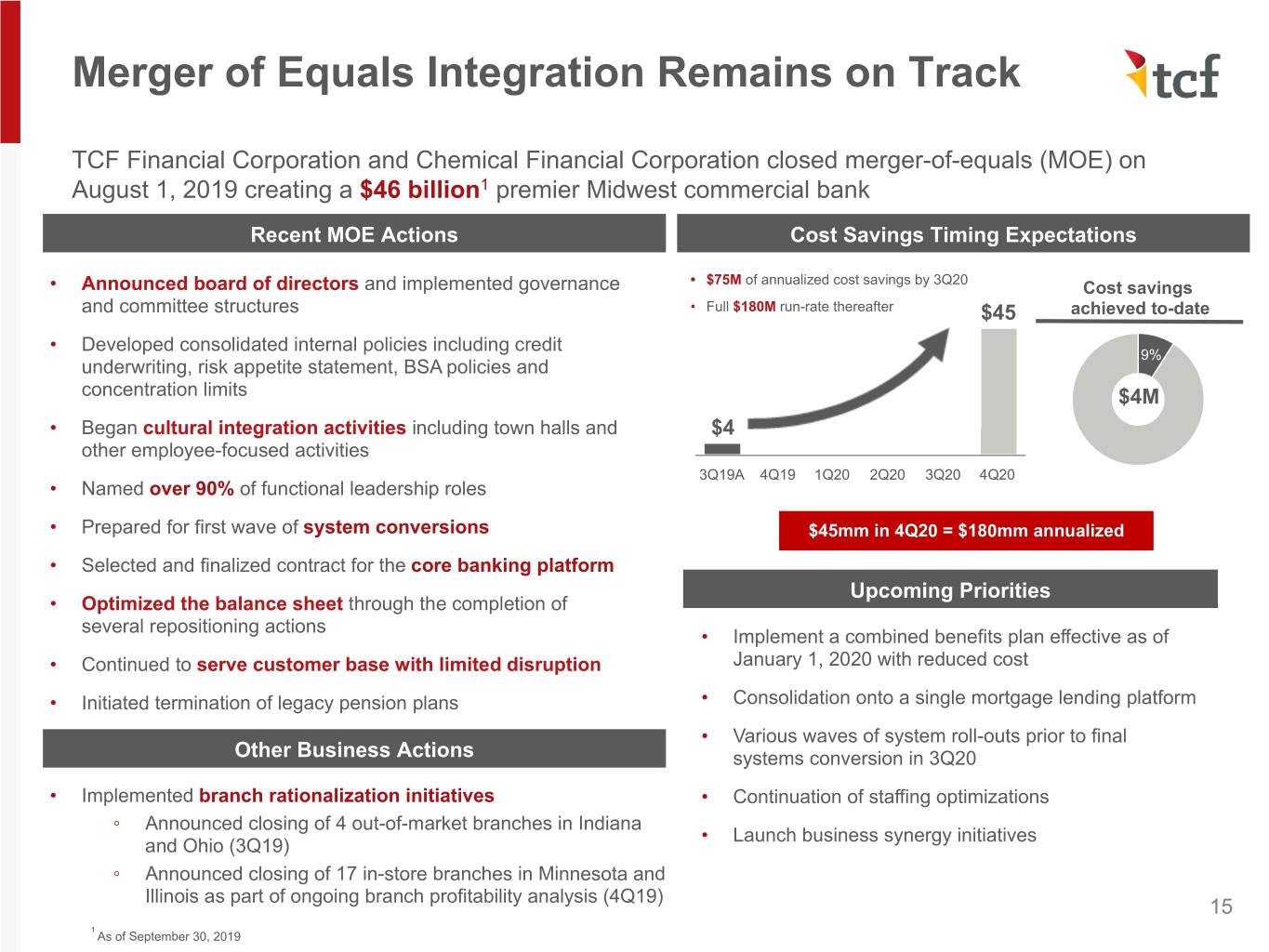

Merger of Equals Integration Remains on Track TCF Financial Corporation and Chemical Financial Corporation closed merger-of-equals (MOE) on August 1, 2019 creating a $46 billion1 premier Midwest commercial bank Recent MOE Actions Cost Savings Timing Expectations • Announced board of directors and implemented governance • $75M of annualized cost savings by 3Q20 Cost savings and committee structures • Full $180M run-rate thereafter $45 achieved to-date • Developed consolidated internal policies including credit 9% underwriting, risk appetite statement, BSA policies and concentration limits $4M • Began cultural integration activities including town halls and $4 other employee-focused activities 3Q19A 4Q19 1Q20 2Q20 3Q20 4Q20 • Named over 90% of functional leadership roles • Prepared for first wave of system conversions $45mm in 4Q20 = $180mm annualized • Selected and finalized contract for the core banking platform Upcoming Priorities • Optimized the balance sheet through the completion of several repositioning actions • Implement a combined benefits plan effective as of • Continued to serve customer base with limited disruption January 1, 2020 with reduced cost • Initiated termination of legacy pension plans • Consolidation onto a single mortgage lending platform • Various waves of system roll-outs prior to final Other Business Actions systems conversion in 3Q20 • Implemented branch rationalization initiatives • Continuation of staffing optimizations ◦ Announced closing of 4 out-of-market branches in Indiana • Launch business synergy initiatives and Ohio (3Q19) ◦ Announced closing of 17 in-store branches in Minnesota and Illinois as part of ongoing branch profitability analysis (4Q19) 15 1 As of September 30, 2019

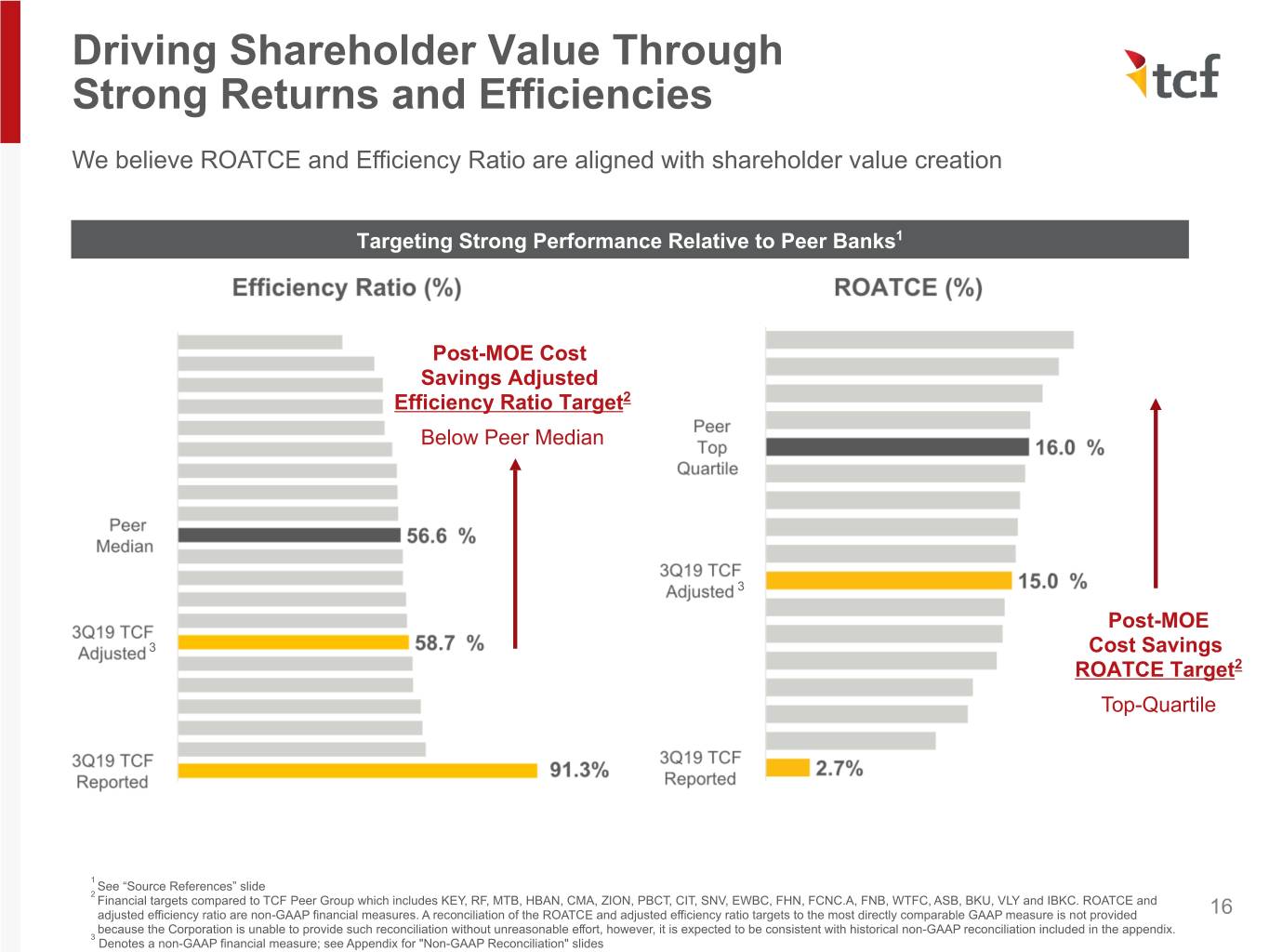

Driving Shareholder Value Through Strong Returns and Efficiencies We believe ROATCE and Efficiency Ratio are aligned with shareholder value creation Targeting Strong Performance Relative to Peer Banks1 Post-MOE Cost Savings Adjusted Efficiency Ratio Target2 Below Peer Median 3 Post-MOE 3 Cost Savings ROATCE Target2 Top-Quartile 1 See “Source References” slide 2 Financial targets compared to TCF Peer Group which includes KEY, RF, MTB, HBAN, CMA, ZION, PBCT, CIT, SNV, EWBC, FHN, FCNC.A, FNB, WTFC, ASB, BKU, VLY and IBKC. ROATCE and adjusted efficiency ratio are non-GAAP financial measures. A reconciliation of the ROATCE and adjusted efficiency ratio targets to the most directly comparable GAAP measure is not provided 16 because the Corporation is unable to provide such reconciliation without unreasonable effort, however, it is expected to be consistent with historical non-GAAP reconciliation included in the appendix. 3 Denotes a non-GAAP financial measure; see Appendix for "Non-GAAP Reconciliation" slides

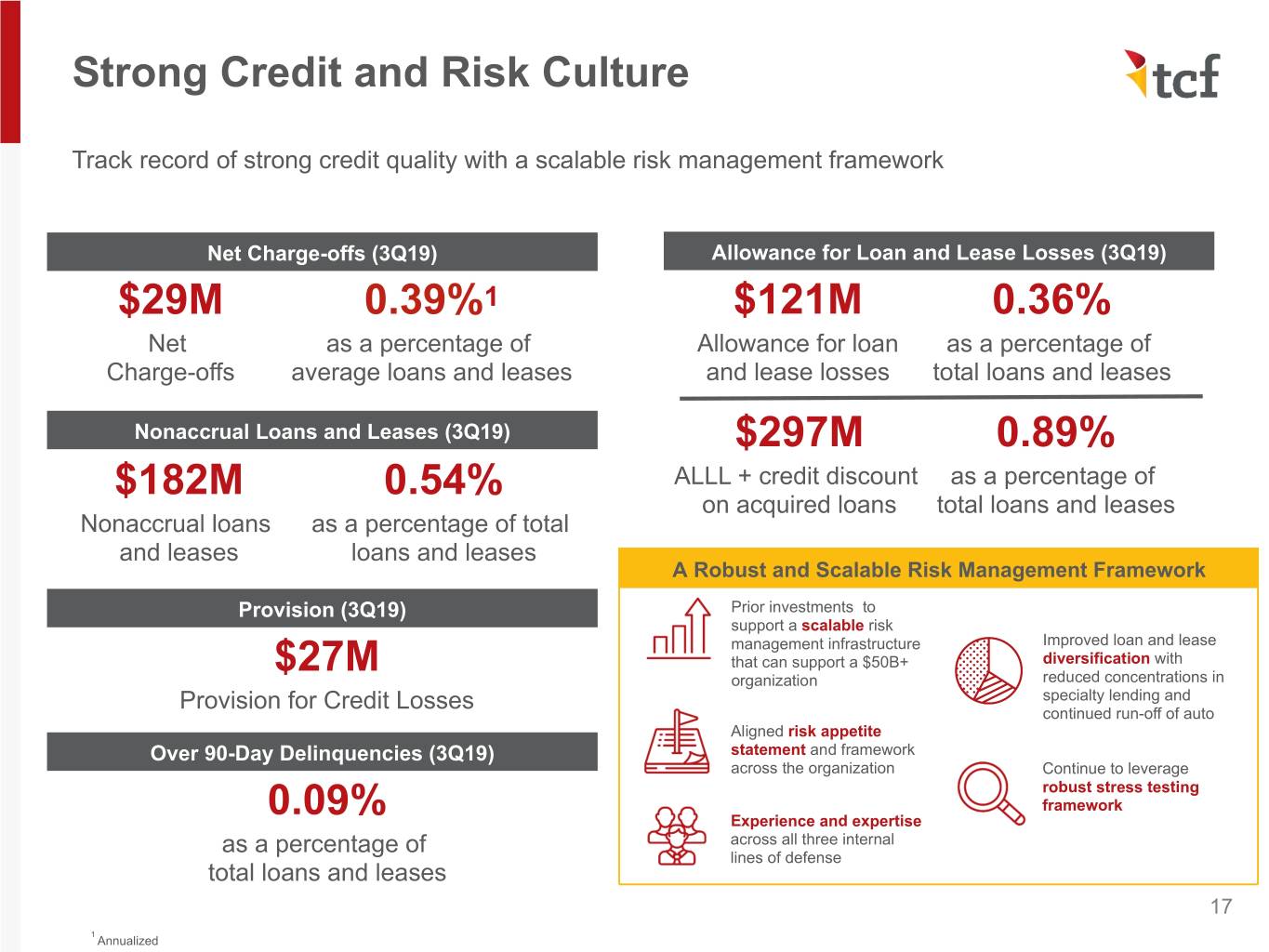

Strong Credit and Risk Culture Track record of strong credit quality with a scalable risk management framework Net Charge-offs (3Q19) Allowance for Loan and Lease Losses (3Q19) $29M 0.39%1 $121M 0.36% Net as a percentage of Allowance for loan as a percentage of Charge-offs average loans and leases and lease losses total loans and leases Nonaccrual Loans and Leases (3Q19) $297M 0.89% $182M 0.54% ALLL + credit discount as a percentage of on acquired loans total loans and leases Nonaccrual loans as a percentage of total and leases loans and leases A Robust and Scalable Risk Management Framework Provision (3Q19) Prior investments to support a scalable risk management infrastructure Improved loan and lease $27M that can support a $50B+ diversification with organization reduced concentrations in Provision for Credit Losses specialty lending and continued run-off of auto Aligned risk appetite Over 90-Day Delinquencies (3Q19) statement and framework across the organization Continue to leverage robust stress testing framework 0.09% Experience and expertise as a percentage of across all three internal lines of defense total loans and leases 17 1 Annualized

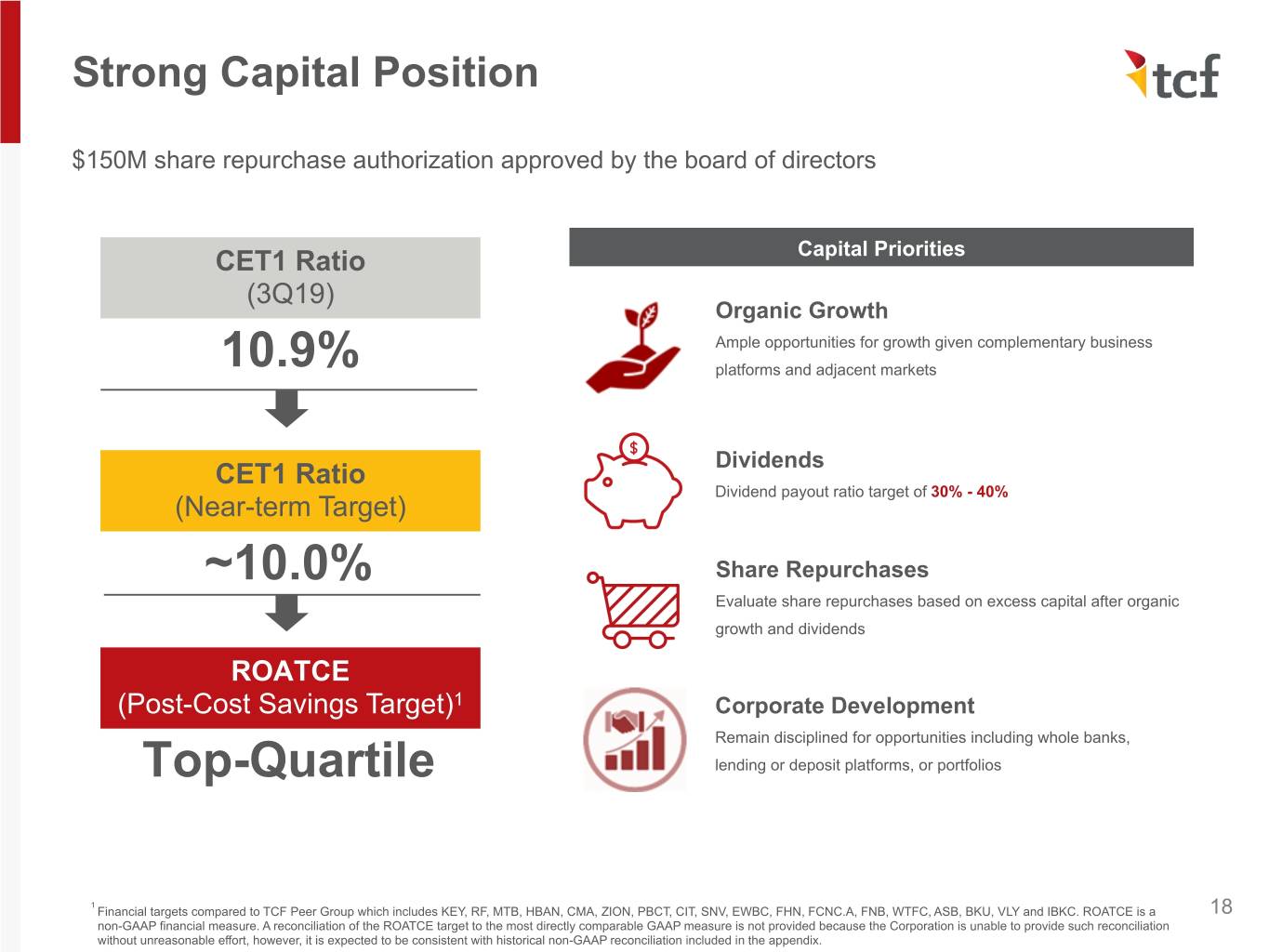

Strong Capital Position $150M share repurchase authorization approved by the board of directors CET1 Ratio Capital Priorities (3Q19) Organic Growth Ample opportunities for growth given complementary business 10.9% platforms and adjacent markets Dividends CET1 Ratio Dividend payout ratio target of 30% - 40% (Near-term Target) ~10.0% Share Repurchases Evaluate share repurchases based on excess capital after organic growth and dividends ROATCE (Post-Cost Savings Target)1 Corporate Development Remain disciplined for opportunities including whole banks, Top-Quartile lending or deposit platforms, or portfolios 1 Financial targets compared to TCF Peer Group which includes KEY, RF, MTB, HBAN, CMA, ZION, PBCT, CIT, SNV, EWBC, FHN, FCNC.A, FNB, WTFC, ASB, BKU, VLY and IBKC. ROATCE is a 18 non-GAAP financial measure. A reconciliation of the ROATCE target to the most directly comparable GAAP measure is not provided because the Corporation is unable to provide such reconciliation without unreasonable effort, however, it is expected to be consistent with historical non-GAAP reconciliation included in the appendix.

We Are One Company-wide employer brand cultural initiative that emphasizes the passion and collaboration of our team members to provide an exceptional customer experience Dejana Ewing Courtney Abela Andrew Hakala Donnell White Relationship Banker Corporate Marketing IT Manager Chief Diversity Officer Studying to become a Manager Trumpet Virtuoso Director of Strategic nurse Avid traveler Partnerships Avid golfer We celebrate the unique perspectives and background that combine us to make One TCF. We value: Community Culture Diverse teams 19

An Attractive Investment Opportunity A compelling shareholder value creation story, currently trading at a discount to peers, presents an attractive investment opportunity Accelerated Profitability Scale to Compete and Grow Targeting strong ROATCE and efficiency ratio Enhanced scale as a premier Midwest bank performance relative to peers with $180 million of provides opportunities for organic growth without merger-related cost savings serving as a unique building concentrations and ability to leverage catalyst for success given the current banking management’s track record of creating environment. shareholder value through M&A. Revenue Synergy Opportunities Strong Capital Position Ability to leverage the strengths of Maintaining a strong capital position while complementary businesses in adjacent executing on profitability targets allows for markets with limited overlap to provide new opportunistic deployment of capital via organic revenue synergy opportunities across the growth, dividends, share repurchases and organization. corporate development initiatives. 20

Appendix

Focused Digital Banking Strategy to Enhance the Customer Experience Digital offerings are competitive with larger institutions and are well ahead of smaller competitors... Face / Touch ID Lock & unlock Online account open Log in quickly using facial Instantly lock your Ability to open an recognition or fingerprint ID – no debit card if it’s lost account online in need to type a login ID and or stolen minutes password Quick glance Mobile deposit Apple Watch app Use one-click quick glance to Deposit mobile deposit Access your view your account balance checks to your account account via our and recent transactions without going to the convenient Apple bank Watch app ...and augmented by a robust branch network 500+ branches Instant-issue Image-enabled CRM and CX debit cards ATMs Programs 22

In Our Communities A Healthy A Foundation for Community Investing in Strong Approach to High Standards Building Community Community Ties Savings • $2.3 million to 650 TCF Bank replaces $20 million grant to Naming rights to TCF Comprehensive chartable partners in Cobo name on organizations and Bank Stadium and $8 financial education 2018 Detroit’s convention initiatives primarily million to Athlete’s programs for high center; this is more within southeast Village project school teens and • $500K in additional than just naming Michigan’s seven supports student adults team member-driven rights…this represents counties in areas programs philanthropy transformational including the arts, 200,000+ students Employee Matching change for the education, health and reached through the Gift Program matches community to break human services $1.4 million in TCF Financial from a divisive history Scholars Program 100% on gifts up to $5 million initial scholarships to (2013-2018) $10,000. We donated commitment to $35 Minnesota collegiate $1.3 million to million Detroit students over 14 765,000+ hours of charitable Strategic years learning promoted contributions in 2018 Neighborhood Fund to support economic development efforts in targeted areas 23

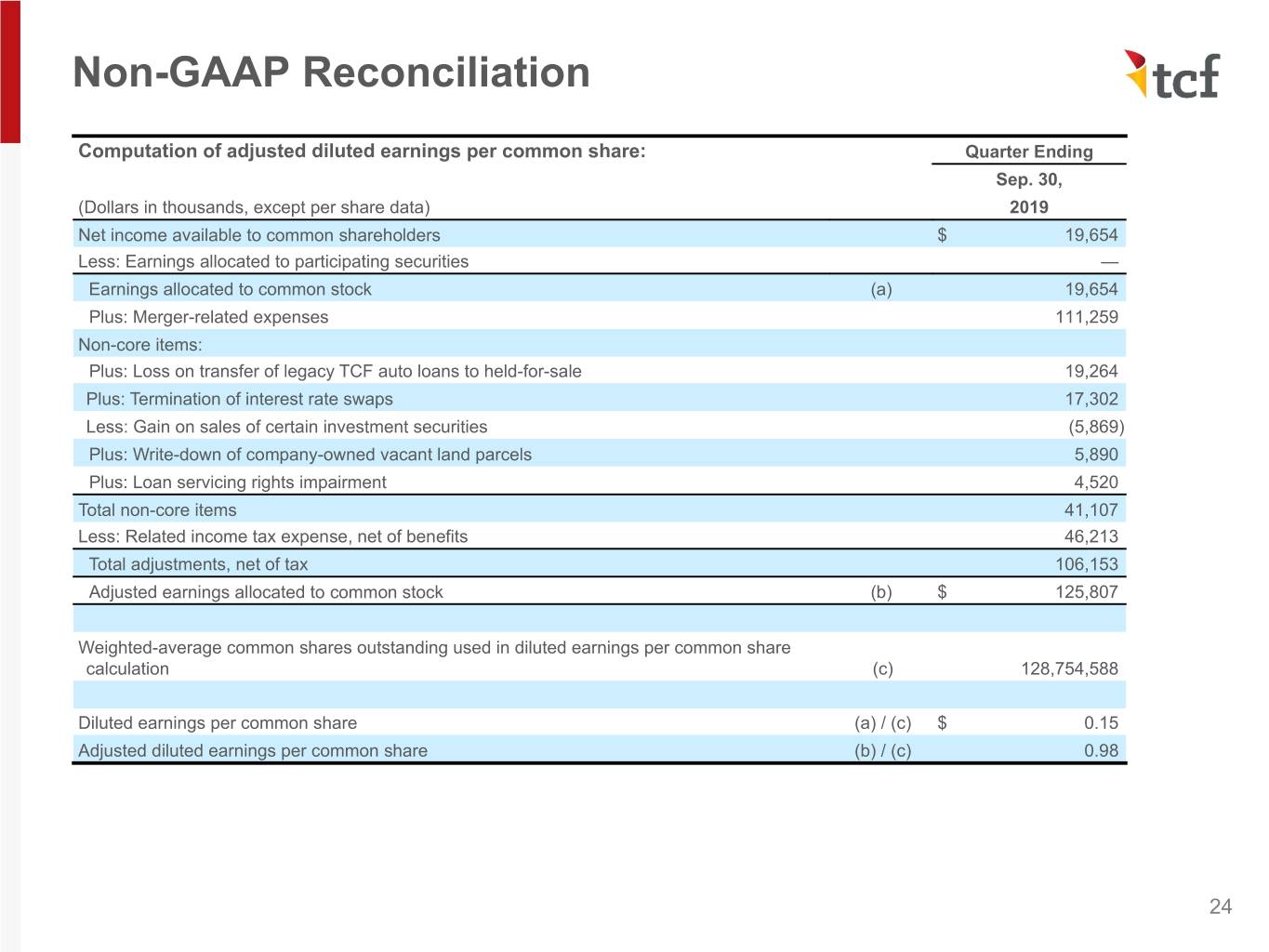

Non-GAAP Reconciliation Computation of adjusted diluted earnings per common share: Quarter Ending Sep. 30, (Dollars in thousands, except per share data) 2019 Net income available to common shareholders $ 19,654 Less: Earnings allocated to participating securities — Earnings allocated to common stock (a) 19,654 Plus: Merger-related expenses 111,259 Non-core items: Plus: Loss on transfer of legacy TCF auto loans to held-for-sale 19,264 Plus: Termination of interest rate swaps 17,302 Less: Gain on sales of certain investment securities (5,869) Plus: Write-down of company-owned vacant land parcels 5,890 Plus: Loan servicing rights impairment 4,520 Total non-core items 41,107 Less: Related income tax expense, net of benefits 46,213 Total adjustments, net of tax 106,153 Adjusted earnings allocated to common stock (b) $ 125,807 Weighted-average common shares outstanding used in diluted earnings per common share calculation (c) 128,754,588 Diluted earnings per common share (a) / (c) $ 0.15 Adjusted diluted earnings per common share (b) / (c) 0.98 24

Non-GAAP Reconciliation Computation of adjusted return on average assets, common equity, average tangible common equity and average tangible common Quarter Ending equity: Sep. 30, (Dollars in thousands, except per share data) 2019 Adjsuted net income after tax expense: Income after tax expense (a) $ 24,978 Plus: Merger-related expenses 111,259 Plus: Non-core items 41,107 Less: Related income tax expense, net of tax benefits 46,213 Adjusted net income after tax expense for ROAA calculation (b) $ 131,131 Net income available to common shareholders (c) $ 19,654 Plus: Other intangibles amortization 4,544 Less: Related income tax expense 1,085 Net income available to common shareholders used in ROATCE calculation (d) $ 23,113 Adjusted net income available to common shareholders: Net income available to common shareholders $ 19,654 Plus: Merger-related expenses 111,259 Plus: Non-core items 41,107 Less: Related income tax expense, net of tax benefits 46,213 Net income available to common shareholders used in adjusted ROAA and ROACE calculation (e) 125,807 Plus: Other intangibles amortization 4,544 Less: Related income tax expense 1,085 Net income available to common shareholders used in adjusted ROATCE calculation (f) $ 129,266 Average balances: Average assets (g) $ 39,094,366 Total equity 4,683,129 Less: Non-controlling interest in subsidiaries 25,516 Total TCF Financial Corporation shareholders' equity 4,657,613 Less: Preferred stock 169,302 Average total common shareholders' equity used in ROACE calculation (h) 4,488,311 Less: Goodwill, net 890,155 Less: Other intangibles, net 142,925 Average tangible common shareholders' equity used in ROATCE calculation (i) $ 3,455,231 ROAA (a) / (g) 0.26 % Adjusted ROAA (b) / (g) 1.34 ROACE (c) / (h) 1.75 Adjusted ROACE (e) / (h) 11.21 ROATCE (d) / (i) 2.68 Adjusted ROATCE (f) / (i) 14.96 25

Non-GAAP Reconciliation Computation of adjusted efficiency ratio, core noninterest income and core noninterest expense: Quarter Ending Sep. 30, (Dollars in thousands, except per share data) 2019 Noninterest expense (a) $ 425,620 Less: Merger-related expenses 111,259 Less: Write-down of company-owned vacant land parcels 5,890 Adjusted noninterest expense $ 308,471 Less: Lease financing equipment depreciation 19,408 Less: Amortization of intangibles 4,544 Adjusted noninterest expense, efficiency ratio (b) $ 284,519 Net interest income $ 371,793 Noninterest income 94,258 Total revenue (c) $ 466,051 Noninterest income $ 94,258 Plus: Loss on transfer of legacy TCF auto loans to held-for-sale 19,264 Plus: Termination of interest rate swaps 17,302 Less: Gain on sales of certain investment securities (5,869) Plus: Loan servicing rights impairment 4,520 Adjusted noninterest income $ 129,475 Net interest income $ 371,793 Plus: Net interest income FTE adjustment 2,488 Adjusted net interest income $ 374,281 Less: Lease financing equipment depreciation 19,408 Adjusted total revenue, efficiency ratio (d) $ 484,348 Efficiency ratio (a) / (c) 91.32 % Adjusted efficiency ratio (b) / (d) 58.74 26

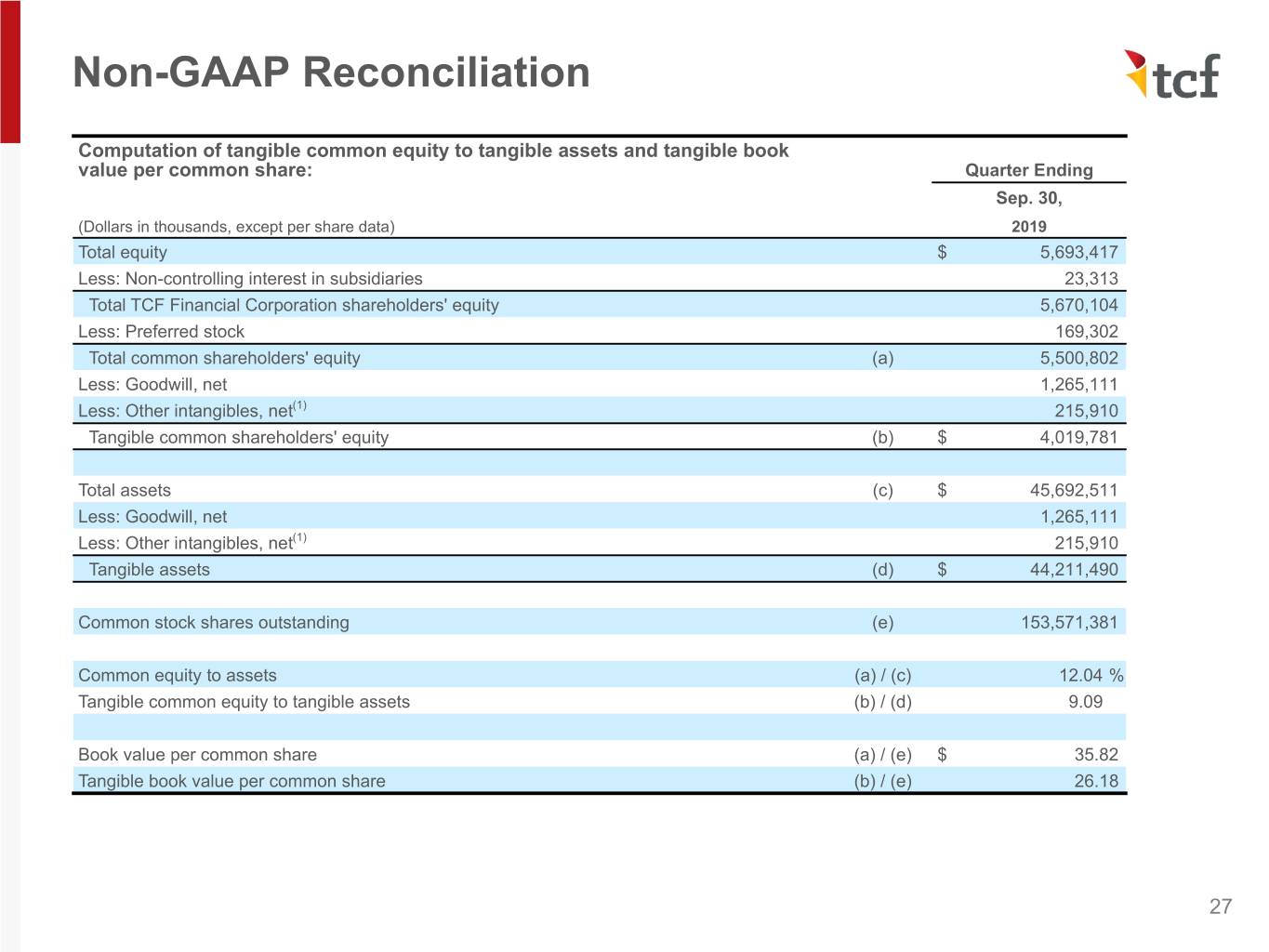

Non-GAAP Reconciliation Computation of tangible common equity to tangible assets and tangible book value per common share: Quarter Ending Sep. 30, (Dollars in thousands, except per share data) 2019 Total equity $ 5,693,417 Less: Non-controlling interest in subsidiaries 23,313 Total TCF Financial Corporation shareholders' equity 5,670,104 Less: Preferred stock 169,302 Total common shareholders' equity (a) 5,500,802 Less: Goodwill, net 1,265,111 Less: Other intangibles, net(1) 215,910 Tangible common shareholders' equity (b) $ 4,019,781 Total assets (c) $ 45,692,511 Less: Goodwill, net 1,265,111 Less: Other intangibles, net(1) 215,910 Tangible assets (d) $ 44,211,490 Common stock shares outstanding (e) 153,571,381 Common equity to assets (a) / (c) 12.04 % Tangible common equity to tangible assets (b) / (d) 9.09 Book value per common share (a) / (e) $ 35.82 Tangible book value per common share (b) / (e) 26.18 27

Source References Slide Source 3 S&P Global Market Intelligence (data as of September 30, 2019) 4 4 S&P Global Market Intelligence (deposit data as of June 30, 2019); Midwest region includes IL, IN, OH, MI, MN and WI) 1 S&P Global Market Intelligence (deposit data as of June 30, 2019); Midwest region includes IL, IN, OH, MI, MN and WI) 9 2 S&P Global Market Intelligence (deposit data as of June 30, 2019); TCF’s Primary Midwest Markets include Detroit, Greater Michigan, Minneapolis-St. Paul, Chicago, Youngstown, Milwaukee and Cleveland 1 S&P Global Market Intelligence (deposit data as of June 30, 2019) 2 Bureau of Economic Analysis 3 The Pew Charitable Trusts (2007-2017) 4 CNN Money 10 5 Minnesota Department of Employment and Economic Development 6 Michigan Economic Development Corporation 7 World Business Chicago 8 S&P Global Market Intelligence (2019-2024) 11 1 S&P Global Market Intelligence (2018 HMDA data) 16 1 S&P Global Market Intelligence (peer data as of 2Q19; TCF reported and adjusted data as of 3Q19) 28