Check Point® Software Technologies Ltd. (NASDAQ: CHKP), the

worldwide leader in securing the Internet, today announced record

financial results for the third quarter ended September 30, 2009.

"I am proud of our ability to execute and deliver all-time

record results across key metrics for the quarter. Our revenues

came in at the high-end of our projections, with 17 percent growth,

while non-GAAP earnings per share were $0.52, representing 19%

growth, and exceeded our projections. This is particularly

encouraging given the state of the economy and the weakness of the

US dollar," said Gil Shwed, Chairman and Chief Executive Officer at

Check Point. "Operationally, we performed well across all regions,

with Asia Pacific having a particularly good quarter. We also

continued to realize further synergies from our recent acquisition,

which helped us to achieve these results and deliver non-GAAP

operating margin of 55%."

Financial Highlights for the Third Quarter of

2009

- Total Revenues: $233.6 million, an

increase of 17 percent compared to $199.7 million in the third

quarter of 2008.

- GAAP Operating Income: $105.5 million, an

increase of 17 percent compared to $90.4 million in the third

quarter of 2008. The GAAP operating income in the third quarter of

2009 included amortization of intangible assets in the amount of

$5.4 million related to the Nokia security business

acquisition.

- Non-GAAP(1) operating income: $127.5

million, an increase of 20 percent compared to $106.2 million in

the third quarter of 2008. Non-GAAP operating margin was 55

percent, compared to 53 percent in the third quarter of 2008, and

52 percent during the second quarter of 2009.

- GAAP Net Income and Earnings per Diluted

Share: GAAP net income was $91.5 million, an increase of 14

percent compared to $80.1 million in the third quarter of 2008.

GAAP earnings per diluted share were $0.43, an increase of 17

percent compared to $0.37 in the third quarter of 2008. GAAP net

income in the third quarter of 2009 included amortization of

intangible assets in the amount of $5.4 million (which represented

$0.03 in GAAP earnings per diluted share) related to the Nokia

security business acquisition. Net of taxes, these charges totaled

$5.1 million ($0.02 per diluted share).

- Non-GAAP(1) Net Income and Earnings per

Diluted Share: Non-GAAP net income was $109.5 million, an

increase of 16 percent compared to $94.2 million in the third

quarter of 2008, and non-GAAP EPS was $0.52, an increase of 19

percent compared to $0.44 in the third quarter of 2008.

- Deferred Revenues: As of September 30,

2009, we had deferred revenue of $360.1 million, an increase of 32

percent compared to $272.9 as of September 30, 2008.

- Cash Flow: Cash flow from operations was

$126.1 million, an increase of 10 percent compared to $115.1

million in the third quarter of 2008. We had $1,736.2 million in

cash and investments as of September 30, 2009.

- Share Repurchase Program: During the

third quarter of 2009, we repurchased 1.8 million shares at a total

cost of $50 million.

(1)For information regarding the non-GAAP financial measures

discussed in this release, please see "Use of Non-GAAP Financial

Information" and "Reconciliation of Non-GAAP to GAAP Financial

Information."

Mr. Shwed concluded, "We continued to realize good traction from

our latest product introductions, including the new SMART-1

management appliances, the high-end Power-1 11000 series and

low-end UTM-1 130 appliances. Our Software Blade Architecture

experienced excellent adoption by our customers as they continue to

recognize the benefits of a secure, flexible and easily managed

security platform."

Conference Call and Webcast Information

Check Point will host a conference call with the investment

community on October 22, 2009 at 8:30 AM ET/5:30 AM PT. To listen

to the live webcast, please visit Check Point's website at

http://www.checkpoint.com/ir. A replay of the conference call will

be available through October 29, 2009 at the company's website

http://www.checkpoint.com/ir or by telephone at +1 201.612.7415,

passcode # 335046, account # 215.

About Check Point Software Technologies

Ltd. Check Point Software Technologies Ltd.

(www.checkpoint.com), a worldwide leader in securing the Internet,

is the only vendor to delivers Total Security for networks, data

and endpoints, unified under a single management framework. Check

Point provides customers uncompromised protection against all types

of threats, reduces security complexity and lowers total cost of

ownership. Check Point first pioneered the industry with FireWall-1

and its patented stateful inspection technology. Today, Check Point

continues to innovate with the development of the Software Blade

architecture. The dynamic Software Blade architecture delivers

secure, flexible and simple solutions that can be fully customized

to meet the exact security needs of any organization or

environment. Check Point customers include tens of thousands of

businesses and organizations of all sizes, including all Fortune

100 companies. Check Point's award-winning ZoneAlarm solutions

protect millions of consumers from hackers, spyware and identity

theft.

©2009 Check Point Software Technologies Ltd. All rights

reserved.

Use of Non-GAAP Financial Information In

addition to reporting financial results in accordance with

generally accepted accounting principles, or GAAP, Check Point uses

non-GAAP measures of net income, operating income and earnings per

share, which are adjustments from results based on GAAP to exclude

non-cash equity-based compensation charges, impairment of

marketable securities, amortization of acquired intangible assets,

restructuring-related charges and the related tax affects.

Management uses both GAAP and non-GAAP information in evaluating

and operating business internally and as such has determined that

it is important to provide this information to investors. Check

Point's management also believes the non-GAAP financial information

provided in this release is useful to investors' understanding and

assessment of Check Point's on-going core operations and prospects

for the future. The presentation of this non-GAAP financial

information is not intended to be considered in isolation or as a

substitute for results prepared in accordance with GAAP.

CHECK POINT SOFTWARE TECHNOLOGIES LTD.

CONDENSED CONSOLIDATED STATEMENT OF OPERATIONS

(In thousands, except per share amounts)

Three Months Ended Nine Months Ended

------------------------ ------------------------

September 30, September 30,

------------------------ ------------------------

2009 2008 2009 2008

----------- ----------- ----------- -----------

(unaudited) (unaudited) (unaudited) (unaudited)

Revenues:

Products and licenses $ 86,882 $ 81,925 $ 241,427 $ 244,277

Software updates,

maintenance and

services 146,759 117,795 410,867 346,646

----------- ----------- ----------- -----------

Total revenues 233,641 199,720 652,294 590,923

----------- ----------- ----------- -----------

Operating expenses:

Cost of products and

licenses 18,598 10,267 45,061 28,953

Cost of software

updates, maintenance

and services 10,033 6,941 26,637 20,792

Amortization of

technology 7,471 5,800 20,501 18,754

----------- ----------- ----------- -----------

Total cost of revenues 36,102 23,008 92,199 68,499

Research and

development 22,426 23,193 65,681 69,762

Selling and marketing 56,379 50,796 160,390 161,044

General and

administrative 13,190 12,294 40,487 38,865

Restructuring 67 - 9,101 -

----------- ----------- ----------- -----------

Total operating expenses 128,164 109,291 367,858 338,170

----------- ----------- ----------- -----------

Operating income 105,477 90,429 284,436 252,753

Financial income, net 7,825 10,039 24,368 30,351

Other than temporary

impairment on marketable

securities - (2,288) - (2,288)

----------- ----------- ----------- -----------

Income before income

taxes 113,302 98,180 308,804 280,816

Taxes on income 21,839 18,119 60,817 43,324

----------- ----------- ----------- -----------

Net income $ 91,463 $ 80,061 $ 247,987 $ 237,492

=========== =========== =========== ===========

Earnings per share

(basic) $ 0.44 $ 0.37 $ 1.18 $ 1.10

=========== =========== =========== ===========

Number of shares used in

computing earnings per

share (basic) 208,738 213,728 209,465 215,247

=========== =========== =========== ===========

Earnings per share

(diluted) $ 0.43 $ 0.37 $ 1.17 $ 1.09

=========== =========== =========== ===========

Number of shares used in

computing earnings per

share (diluted) 211,688 216,567 211,790 217,942

=========== =========== =========== ===========

CHECK POINT SOFTWARE TECHNOLOGIES LTD.

RECONCILIATION OF NON-GAAP TO GAAP FINANCIAL INFORMATION

(In thousands, except per share amounts)

Three Months Ended Nine Months Ended

------------------------ ------------------------

September 30, September 30,

------------------------ ------------------------

2009 2008 2009 2008

----------- ----------- ----------- -----------

(unaudited) (unaudited) (unaudited) (unaudited)

GAAP operating income $ 105,477 $ 90,429 $ 284,436 $ 252,753

Stock-based

compensation (1) 7,695 6,857 22,769 24,313

Amortization of

intangible assets (2) 14,301 8,893 36,647 28,090

Restructuring (3) 67 - 9,101 -

----------- ----------- ----------- -----------

Non-GAAP operating

income $ 127,540 $ 106,179 $ 352,953 $ 305,156

=========== =========== =========== ===========

GAAP net income $ 91,463 $ 80,061 $ 247,987 $ 237,492

Stock-based

compensation (1) 7,695 6,857 22,769 24,313

Amortization of

intangible assets (2) 14,301 8,893 36,647 28,090

Restructuring (3) 67 - 9,101 -

Other than temporary

impairment * (4) - 2,288 - 2,288

Taxes on stock-based

compensation,

amortization of

intangible assets and

other than temporary

impairment (5) (4,040) (3,849) (10,662) (11,867)

----------- ----------- ----------- -----------

Non-GAAP net income $ 109,486 $ 94,250 $ 305,842 $ 280,316

=========== =========== =========== ===========

GAAP Earnings per share

(diluted) $ 0.43 $ 0.37 $ 1.17 $ 1.09

Stock-based

compensation (1) 0.04 0.04 0.11 0.11

Amortization of

intangible assets (2) 0.07 0.04 0.17 0.13

Restructuring (3) - - 0.04 -

Other than temporary

impairment * (4) - 0.01 - 0.01

Taxes on stock-based

compensation,

amortization of

intangible assets and

other than temporary

impairment (5) (0.02) (0.02) (0.05) (0.05)

----------- ----------- ----------- -----------

Non-GAAP Earnings per

share (diluted) $ 0.52 $ 0.44 $ 1.44 $ 1.29

=========== =========== =========== ===========

Number of shares used

in computing Non-GAAP

earnings per share

(diluted) 211,688 216,567 211,790 217,942

=========== =========== =========== ===========

(1) Stock-based

compensation:

Cost of products

and licenses $ 14 $ 15 $ 35 $ 42

Cost of software

updates,

maintenance

and services 236 133 536 510

Research and

development 1,998 1,364 4,771 3,665

Selling and

marketing 1,769 1,696 4,485 5,862

General and

administrative 3,678 3,649 12,942 14,234

----------- ----------- ----------- -----------

7,695 6,857 22,769 24,313

----------- ----------- ----------- -----------

(2) Amortization of

intangible assets:

Cost of products

and licenses 7,471 5,800 20,501 18,754

Selling and

marketing 6,830 3,093 16,146 9,336

----------- ----------- ----------- -----------

14,301 8,893 36,647 28,090

----------- ----------- ----------- -----------

(3) Restructuring 67 - 9,101 -

----------- ----------- ----------- -----------

(4) Other than

temporary impairment*

Financial income, net - 2,288 - 2,288

----------- ----------- ----------- -----------

(5) Taxes on stock-based

compensation,

amortization of

intangible assets and

other than temporary

impairment (4,040) (3,849) (10,662) (11,867)

----------- ----------- ----------- -----------

Total, net $ 18,023 $ 14,189 $ 57,855 $ 42,824

=========== =========== =========== ===========

* Relates to impairment of Lehman Brothers bonds.

CHECK POINT SOFTWARE TECHNOLOGIES LTD.

CONDENSED CONSOLIDATED BALANCE SHEET DATA

(In thousands)

ASSETS

September 30, December 31,

2009 2008

------------- -------------

(unaudited) (unaudited)

Current assets:

Cash and cash equivalents $ 608,221 $ 543,190

Short-term deposit - 26,302

Marketable securities 348,898 344,895

Trade receivables, net 191,156 251,771

Other current assets 34,477 28,372

------------- -------------

Total current assets 1,182,752 1,194,530

------------- -------------

Long-term assets:

Marketable securities 779,045 529,445

Property, plant and equipment, net 39,956 40,248

Severance pay fund 6,315 5,817

Deferred income taxes, net 16,926 19,003

Intangible assets, net 123,448 123,151

Goodwill 708,458 664,602

Other assets 21,167 16,820

------------- -------------

Total long-term assets 1,695,315 1,399,086

------------- -------------

Total assets $ 2,878,067 $ 2,593,616

============= =============

LIABILITIES AND

SHAREHOLDERS' EQUITY

Current liabilities:

Deferred revenues $ 322,764 $ 289,998

Trade payables and other accrued liabilities 145,191 112,556

------------- -------------

Total current liabilities 467,955 402,554

------------- -------------

Long-term deferred revenues 37,361 40,799

Income tax accrual 121,138 101,230

Deferred tax liability, net 15,127 22,225

Accrued severance pay 11,125 10,943

------------- -------------

Total liabilities 652,706 577,751

------------- -------------

Shareholders' equity:

Share capital 774 774

Additional paid-in capital 512,200 503,408

Treasury shares at cost (1,173,239) (1,105,250)

Accumulated other comprehensive income

(loss) 16,895 (4,673)

Retained earnings 2,868,731 2,621,606

------------- -------------

Total shareholders' equity 2,225,361 2,015,865

------------- -------------

Total liabilities and shareholders' equity $ 2,878,067 $ 2,593,616

============= =============

Total cash and cash equivalents, deposits

and marketable securities $ 1,736,164 $ 1,443,832

============= =============

CHECK POINT SOFTWARE TECHNOLOGIES LTD.

SELECTED CONSOLIDATED CASH FLOW DATA

(In thousands)

Three Months Ended Nine Months Ended

------------------------ ------------------------

September 30, September 30,

------------------------ ------------------------

2009 2008 2009 2008

----------- ----------- ----------- -----------

(unaudited) (unaudited) (unaudited) (unaudited)

Cash flow from

operating activities:

Net income $ 91,463 $ 80,061 $ 247,987 $ 237,492

Adjustments to

reconcile net income

to net cash provided

by operating

activities:

Depreciation and

amortization of

property, plant and

equipment 2,190 2,257 7,226 6,548

Other than temporary

impairment - 2,288 - 2,288

Decrease (increase) in

trade and other

receivables, net (50) 1,770 85,050 38,638

Increase in deferred

revenues, trade

payables and other

accrued liabilities 15,494 20,836 24,769 25,380

Amortization of

intangible assets 14,301 8,893 36,647 28,090

Realized loss on

marketable securities - - 1,896 -

Stock-based

compensation 7,695 6,857 22,768 24,313

Excess tax benefit from

stock-based

compensation (2,474) (3,531) (6,988) (9,560)

Deferred income taxes,

net (2,487) (4,338) (8,729) (12,661)

----------- ----------- ----------- -----------

Net cash provided by

operating activities 126,132 115,093 410,626 340,528

----------- ----------- ----------- -----------

Cash flow from

investing activities:

Cash paid in

conjunction with the

acquisition of Protect

Data, net - - - (9,042)

Cash paid in

conjunction with the

acquisition of Nokia - - (57,540) -

Investment in property,

plant and equipment (1,043) (2,412) (3,644) (6,938)

----------- ----------- ----------- -----------

Net cash used in

investing activities (1,043) (2,412) (61,184) (15,980)

----------- ----------- ----------- -----------

Cash flow from

financing activities:

Proceeds from issuance

of shares upon

exercise of options 20,166 11,504 62,469 27,276

Purchase of treasury

shares (50,000) (49,825) (152,286) (172,825)

Excess tax benefit from

stock-based

compensation 2,474 3,531 6,988 9,560

----------- ----------- ----------- -----------

Net cash used in

financing activities (27,360) (34,790) (82,829) (135,989)

----------- ----------- ----------- -----------

Unrealized gain (loss)

on marketable

securities, net 8,255 (19,420) 25,719 (28,824)

----------- ----------- ----------- -----------

Increase in cash and

cash equivalents,

deposits and

marketable securities 105,984 58,471 292,332 159,735

Cash and cash

equivalents, deposits

and marketable

securities at the

beginning of the

period 1,630,180 1,342,773 1,443,832 1,241,509

----------- ----------- ----------- -----------

Cash and cash

equivalents, deposits

and marketable

securities at the end

of the period $ 1,736,164 $ 1,401,244 $ 1,736,164 $ 1,401,244

=========== =========== =========== ===========

INVESTOR CONTACT: Kip E. Meintzer Check Point Software

Technologies +1 650.628.2040 ir@us.checkpoint.com MEDIA CONTACT:

Greg Kunkel Check Point Software Technologies +1 650.628.2070

press@us.checkpoint.com

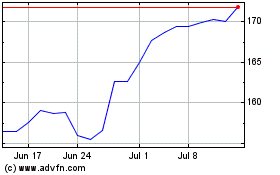

Check Point Software Tec... (NASDAQ:CHKP)

Historical Stock Chart

From Apr 2024 to May 2024

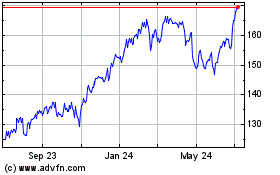

Check Point Software Tec... (NASDAQ:CHKP)

Historical Stock Chart

From May 2023 to May 2024