Cadence Design Systems, Inc. (NASDAQ: CDNS) today announced results

for the third quarter of 2008. The Company also announced today

that the Audit Committee of its Board of Directors, in conjunction

with special counsel, has completed its previously announced

investigation of the recognition of revenue related to customer

contracts, the results of which are set forth below.

Third Quarter 2008 Results

Cadence reported third quarter 2008 revenue of $232 million,

compared to revenue of $401 million reported for the same period in

2007. On a GAAP basis, Cadence recognized a net loss of $169

million, or $(0.67) per share on a diluted basis, in the third

quarter of 2008, compared to net income of $73 million, or $0.24

per share on a diluted basis in the same period in 2007.

In addition to using GAAP results in evaluating Cadence's

business, management believes it is useful to measure results using

a non-GAAP measure of net income or net loss, which excludes, as

applicable, amortization of intangible assets, stock-based

compensation expense, in-process research and development charges,

certain termination and legal costs, costs related to Cadence's

withdrawn proposal to acquire Mentor Graphics Corporation and

losses on the sale of Mentor Graphics Corporation shares,

integration and acquisition-related costs, gains or losses and

expenses or credits related to non-qualified deferred compensation

plan assets, executive severance payments, restructuring charges

and credits, losses on extinguishment of debt, equity in losses

(income) from investments and write-down of investments. Non-GAAP

net income or net loss is adjusted by the amount of additional

taxes or tax benefit that the company would accrue if it used

non-GAAP results instead of GAAP results to calculate the company's

tax liability. See "GAAP to non-GAAP Reconciliation" below for

further information on the non-GAAP measure.

Using this non-GAAP measure, net loss in the third quarter of

2008 was $23 million, or $(0.09) per share on a diluted basis, as

compared to net income of $97 million, or $0.33 per share on a

diluted basis, in the same period in 2007.

"Over the past two months, the Interim Office of the Chief

Executive has been working closely with the management team, and

taking aggressive steps to better position the company today and in

the future. We remain focused on leveraging the company's many

strengths, including our market leadership position, our

innovative, cutting-edge technology and our long-standing customer

relationships. We believe strongly that Cadence's highly ratable

business model and improved cost structure form a solid foundation

for enhanced operating and financial performance and long-term

growth," said Lip-Bu Tan, Interim Vice Chairman of the Board of

Directors and member of the Interim Office of the Chief

Executive.

"We are focused on delivering compelling and innovative

technology to our customers. As part of this, in November, we

restructured our R&D organization into two teams, each led by

an experienced industry veteran and supported by some of the best

and brightest minds in our field. We expect the new R&D team

structure will deliver greater product synergy and tighter

integration as we leverage our leadership positions to grow our

business. We are also pleased with the quality and breadth of our

technology portfolio, which provides our customers with an

attractive consolidation option as they seek to optimize their own

productivity and efficiency," said Charlie Huang, Senior Vice

President and member and chief of staff of the Interim Office of

the Chief Executive.

"As we continue to manage through the global economic downturn,

we are pleased that our transition to the new ratable mix is on

track. During the quarter, we implemented a significant cost

reduction program to refocus the company, improve our operational

execution and financial performance and bring our expense base and

operating structure in-line with our outlook," added Kevin S.

Palatnik, Senior Vice President and Chief Financial Officer and

member of the Interim Office of the Chief Executive. "We remain

focused on improving efficiency and productivity, while continuing

to invest in areas that enhance our competitive position and

growth."

Results of Accounting Investigation

As announced on October 22, 2008, Cadence will be restating its

quarterly financial statements for the periods ending March 29,

2008 and June 28, 2008. Cadence will adjust $24.8 million of

product revenue recognized in the first quarter of 2008 and $12.0

million of product revenue recognized in the second quarter of

2008. This revenue will be instead realized over the term of the

relevant arrangement. The results of the Audit Committee's

investigation into the restatement issues are summarized below.

During the first quarter of 2008, Cadence executed a term

license arrangement with a customer and, during the third quarter

of 2008, Cadence executed a subscription license arrangement with

the same customer. As part of its regular quarterly review process

for the third quarter, Cadence identified certain factors that,

when evaluated together, indicated that the software arrangements

executed with this customer both in the first quarter and in the

third quarter were negotiated in contemplation of one another.

Accordingly, Cadence determined that the term license arrangement

executed during the first quarter and the subscription license

arrangement executed during the third quarter collectively

represented a multiple element arrangement. Because the

subscription arrangement provides the customer with the right to

use unspecified additional software products that become

commercially available during the term of the arrangement, Cadence

determined that the revenue relating to this multiple element

arrangement should be recognized during the term of the

arrangement, beginning in the fourth quarter of 2008.

Consistent with good corporate governance practices, the Audit

Committee of Cadence's Board of Directors, with the assistance of

special counsel and other advisors, conducted an investigation of

the events that led to the restatement of the Company's financial

results. Upon completion of the investigation, the Audit Committee

concluded that the circumstances that led to the restatement were

not the result of illegal conduct on the part of any of Cadence's

directors, officers, or other employees. However, as a result of

the investigation, the Company has identified a material weakness

relating to the insufficient design and ineffective operation of

certain internal controls over the recognition of revenue from term

license agreements. The Company has taken and will continue to take

actions to remediate the deficiencies identified as promptly as

practicable.

As part of the remediation efforts that Cadence has begun

implementing in response to the identified material weakness,

Cadence reexamined a transaction that occurred during the second

quarter of 2008 in which it concurrently cancelled a subscription

arrangement and executed both a term license arrangement and

hardware arrangement with a customer. Specifically, Cadence

determined that, despite the cancellation of the subscription

arrangement, the customer did not intend to substantively cancel

its right to access future new technology because at the time the

subscription license was cancelled the customer intended to

re-establish its right to access future new technology at a later

time. Accordingly, Cadence has determined that $12.0 million of

revenue originally recognized in the second quarter of 2008

relating to the term license and hardware arrangement should be

recognized ratably over the term of the arrangement, consistent

with the way in which revenue was recognized on the cancelled

subscription arrangement.

Lip-Bu Tan, Interim Vice Chairman and member of the Interim

Office of the Chief Executive, said, "Cadence is committed to

accurate and transparent financial reporting. The Audit Committee

of our Board of Directors conducted a thorough investigation and we

are pleased to put this matter behind us and focus our efforts on

executing our business strategy."

The effect of the restatement on certain line items in Cadence's

financial statements for the quarter ended March 29, 2008, the

quarter ended June 28, 2008 and the six months ended June 28, 2008

is as set forth in the chart below. The effects set forth below

take into account the $24.8 million and $12.0 million of revenue

respectively discussed above, product revenue of $8.4 million

recognized in the second quarter of 2008 that should have been

recognized in the first quarter of 2008, as previously disclosed in

Cadence's Form 10-Q for the period ended June 28, 2008, other

immaterial adjustments to costs and expenses and the tax effect of

the restatement adjustments.

Quarter Ended Quarter Ended Six Months Ended

March 29, 2008 June 28, 2008 June 28, 2008

------------------ ------------------ ------------------

As As As

Previously As Previously As Previously As

Reported Restated Reported Restated Reported Restated

-------- -------- -------- -------- -------- --------

(In thousands, except per share data)

Total revenue $287,189 $270,750 $329,478 $308,041 $616,667 $578,791

Total costs

and expenses $314,192 $314,192 $310,092 $307,485 $624,284 $621,677

Income (loss)

from

operations $(27,003) $(43,442) $ 19,386 $ 556 $ (7,617) $(42,886)

Provision

(benefit) for

income taxes $ (5,488) $(11,451) $ 9,760 $ 12,720 $ 4,272 $ 1,269

Net income

(loss) $(18,747) $(29,223) $ 4,996 $(16,794) $(13,751) $(46,017)

Diluted net

income (loss)

per share $ (0.07) $ (0.11) $ 0.02 $ (0.07) $ (0.05) $ (0.18)

A reconciliation of Cadence's previously reported and restated

Statements of Operations for the quarter ended March 29, 2008, the

quarter ended June 28, 2008 and the six months ended June 28, 2008

is included with this release.

Cadence is preparing its third quarter Form 10-Q, together with

amended Form 10-Qs for the first and second quarter of 2008, and

expects to file all three reports no later than December 12,

2008.

The following statements are based on current expectations.

These statements are forward looking, and actual results may differ

materially.

Business Outlook

For the fourth quarter of 2008, the company expects total

revenue in the range of $215 million to $225 million. Fourth

quarter GAAP net loss per diluted share is expected to be in the

range of $(0.29) to $(0.27). Net loss per diluted share using the

non-GAAP measure defined below is expected to be in the range of

$(0.06) to $(0.04).

For the full year 2008, the company expects total revenue in the

range of $1.025 billion to $1.035 billion. On a GAAP basis, net

loss per diluted share for fiscal 2008 is expected to be in the

range of $(1.13) to $(1.11). Using the non-GAAP measure defined

below, net loss per diluted share for fiscal 2008 is expected to be

in the range of $(0.06) to $(0.04).

A schedule showing a reconciliation of the business outlook from

GAAP net loss and diluted net loss per share to the non-GAAP net

loss and diluted net loss per share is included with this

release.

Audio Webcast Scheduled

Lip-Bu Tan, Cadence's Interim Vice Chairman and member of the

Interim Office of the Chief Executive, Charlie Huang, Cadence's

Senior Vice President and member and chief of staff of the Interim

Office of the Chief Executive, and Kevin S. Palatnik, Cadence's

Senior Vice President and Chief Financial Officer and member of the

Interim Office of the Chief Executive, will host a third quarter

2008 financial results audio webcast today, December 10, 2008, at 2

p.m. (Pacific) / 5 p.m. (Eastern). Attendees are asked to register

at the Web site at least 10 minutes prior to the scheduled webcast.

An archive of the webcast will be available starting December 10,

2008 at 5 p.m. (Pacific) and ending December 17, 2008 at 5 p.m.

(Pacific). Webcast access is available at

www.cadence.com/company/investor_relations.

About Cadence

Cadence enables global electronic-design innovation and plays an

essential role in the creation of today's integrated circuits and

electronics. Customers use Cadence� software and hardware,

methodologies, and services to design and verify advanced

semiconductors, consumer electronics, networking and

telecommunications equipment, and computer systems. The company is

headquartered in San Jose, Calif., with sales offices, design

centers, and research facilities around the world to serve the

global electronics industry. More information about Cadence and its

products and services is available at www.cadence.com.

Cadence is a registered trademark and the Cadence logo is a

trademark of Cadence Design Systems, Inc. All other trademarks are

the property of their respective owners.

The statements contained above regarding the company's third

quarter 2008 results, and the results of the accounting

investigation, as well as the comments in the Business Outlook

section and the statements by Lip-Bu Tan, Charlie Huang and Kevin

Palatnik include forward-looking statements based on current

expectations or beliefs, as well as a number of preliminary

assumptions about future events that are subject to factors and

uncertainties that could cause actual results to differ materially

from those described in the forward-looking statements. Readers are

cautioned not to put undue reliance on these forward-looking

statements, which are not a guarantee of future performance and are

subject to a number of risks, uncertainties and other factors, many

of which are outside Cadence's control, including but not limited

to: (i) Cadence's ability to compete successfully in the electronic

design automation product and the commercial electronic design and

methodology services industries; (ii) Cadence's ability to

successfully complete and realize the expected benefits of the

previously announced restructuring without significant unexpected

costs or delays; (iii) the mix of products and services sold and

the timing of significant orders for its products, and its shift to

a ratable license structure, which may result in changes in the mix

of license types; (iv) change in customer demands, including the

possibility that Cadence's previously announced restructuring and

management changes could result in delays in customers' purchases

of products and services; (v) economic and industry conditions in

regions in which Cadence does business; (vi) fluctuations in rates

of exchange between the U.S. dollar and the currencies of other

countries in which Cadence does business; (vii) capital expenditure

requirements, legislative or regulatory requirements, interest

rates and Cadence's ability to access capital and debt markets;

(viii) the acquisition of other companies or technologies or the

failure to successfully integrate and operate these companies or

technologies Cadence acquires; (ix) the effects of the previously

announced restructuring and management changes on Cadence's

business, including its strategic and customer relationships,

ability to retain key employees and stock prices; (x) the outcome

of the previously announced accounting investigation conducted by

the Audit Committee and Cadence's ability to timely remediate the

material weakness; (xi) the effects of any litigation or other

proceedings to which Cadence is or may become a party; and (xii)

the effect of any goodwill impairment analyses Cadence may perform

in the future.

For a detailed discussion of these and other cautionary

statements, please refer to the company's filings with the

Securities and Exchange Commission. These include the company's

Annual Report on Form 10-K for the year ended December 29, 2007 and

the company's future filings.

GAAP to non-GAAP Reconciliation

Cadence management evaluates and makes operating decisions using

various operating measures. These measures are generally based on

the revenues of its product, maintenance and services business

operations and certain costs of those operations, such as cost of

revenues, research and development, sales and marketing and general

and administrative expenses. One such measure is non-GAAP net

income or net loss, which is a non-GAAP financial measure under

Section 101 of Regulation G under the Securities Exchange Act of

1934, as amended, and is GAAP net income or net loss excluding, as

applicable, amortization of intangible assets, stock-based

compensation expense, in-process research and development charges,

certain termination and legal costs, costs related to Cadence's

withdrawn proposal to acquire Mentor Graphics Corporation and

losses on the sale of Mentor Graphics Corporation shares,

integration and acquisition-related costs, gains or losses and

expenses or credits related to non-qualified deferred compensation

plan assets, executive severance payments, restructuring charges

and credits, losses on extinguishment of debt, equity in losses

(income) from investments and write-down of investments. Intangible

assets consist primarily of purchased or licensed technology,

backlog, patents, trademarks, distribution rights, customer

contracts and related relationships and non-compete agreements.

Non-GAAP net income or net loss is adjusted by the amount of

additional taxes or tax benefit that the company would accrue if it

used non-GAAP results instead of GAAP results to calculate the

company's tax liability.

Cadence's management believes it is useful in measuring

Cadence's operations to exclude amortization of intangible assets,

in-process research and development charges and integration and

acquisition-related costs because these costs are primarily fixed

at the time of an acquisition and generally cannot be changed by

Cadence's management in the short term. In addition, Cadence's

management believes it is useful to exclude stock-based

compensation expense because it enhances investors' ability to

review Cadence's business from the same perspective as Cadence's

management, which believes that stock-based compensation expense is

not directly attributable to the underlying performance of the

company's business operations. Cadence's management also believes

that it is useful to exclude restructuring charges and credits.

During the fourth quarter of 2008, Cadence commenced a

restructuring program that it expects to complete in the second

half of fiscal 2009. Cadence's management believes that in

measuring the company's operations, it is useful to exclude any

such restructuring charges and credits because Cadence does not

undertake significant restructuring on a regular basis, and

exclusion of such charges permits consistent evaluations of

Cadence's performance before and after such actions are taken.

Cadence's management also believes it is useful to exclude

executive severance costs and certain termination and legal costs

as these costs do not occur frequently. Cadence's management

believes it is useful to exclude gains or losses and expenses or

credits related to the non-qualified deferred compensation plan

assets as these gains and expenses are not part of Cadence's direct

costs of operations, but reflect changes in the value of assets

held in the non-qualified deferred compensation plan. Finally,

Cadence's management believes it is useful to exclude the equity in

losses (income) from investments and write-down of investments, as

these items are not part of Cadence's direct cost of operations.

Rather, these are non-operating items that are included in other

income (expense) and are part of the company's investment

activities.

In the third quarter of 2008, Cadence's non-GAAP net loss also

excludes the impact of tax expense associated with Cadence's

repatriation of foreign earnings. Cadence's management believes it

is useful to exclude the tax expense associated with the

repatriation of foreign earnings as it resulted from an event which

is not expected to occur frequently.

In the third quarter of 2008, Cadence's non-GAAP net loss also

excludes costs related to Cadence's withdrawn proposal to acquire

Mentor Graphics Corporation and losses on the sale of Mentor

Graphics Corporation shares Cadence acquired as part of the

proposed acquisition. Cadence's management believes that in

measuring Cadence's operations it is useful to exclude the costs

and the losses associated with this proposed acquisition as these

items are not directly related to Cadence's operating performance

and resulted from events which are not expected to occur

frequently.

Cadence's management believes that non-GAAP net income or net

loss provides useful supplemental information to Cadence's

management and investors regarding the performance of the company's

business operations and facilitates comparisons to the company's

historical operating results. Cadence's management also uses this

information internally for forecasting and budgeting. Non-GAAP

financial measures should not be considered as a substitute for or

superior to measures of financial performance prepared in

accordance with GAAP. Investors and potential investors are

encouraged to review the reconciliation of non-GAAP financial

measures contained within this press release with their most

directly comparable GAAP financial results.

The following tables reconcile the specific items excluded from

GAAP net income or net loss and GAAP net income or net loss per

diluted share in the calculation of non-GAAP net income or net loss

and Non-GAAP net income or net loss per diluted share for the

periods shown below:

Net Income (Loss) Reconciliation Quarters Ended

----------------------------

September 27, September 29,

2008 2007

------------- -------------

(unaudited)

(in thousands)

Net income (loss) on a GAAP basis $ (169,066) $ 72,732

Amortization of acquired intangibles 10,754 12,003

Stock-based compensation expense 14,634 24,119

Non-qualified deferred compensation

expenses 188 2,876

Costs related to Cadence's withdrawn

proposal to acquire Mentor Graphics

Corporation 3,153 -

Restructuring and other charges (credits) 48,120 (7,066)

Write-off of acquired in-process

technology - 2,678

Integration and acquisition-related

costs 234 301

Equity in losses from investments,

write-down of investments, gains and

losses on non-qualified deferred

compensation plan assets -- recorded in

Other income (expense), net 2,798 444

Loss on sale of Mentor Graphics

Corporation shares 9,379 -

Income tax related to repatriation of

foreign earnings 71,047 -

Income tax effect of non-GAAP adjustments (14,037) (10,722)

------------- -------------

Net income (loss) on a non-GAAP basis $ (22,796) $ 97,365

============= =============

Diluted Net Income (Loss) per Share

Reconciliation Quarters Ended

----------------------------

September 27, September 29,

2008 2007

------------- -------------

(unaudited)

(in thousands, except per share data)

Diluted net income (loss) per share on

a GAAP basis $ (0.67) $ 0.24

Amortization of acquired intangibles 0.04 0.04

Stock-based compensation expense 0.06 0.08

Non-qualified deferred compensation

expenses - 0.01

Costs related to Cadence's withdrawn

proposal to acquire Mentor Graphics

Corporation 0.01 -

Restructuring and other charges (credits) 0.19 (0.02)

Write-off of acquired in-process

technology - 0.01

Integration and acquisition-related

costs - -

Equity in losses from investments,

write-down of investments, gains and

losses on non-qualified deferred

compensation plan assets -- recorded in

Other income (expense), net 0.01 -

Loss on sale of Mentor Graphics

Corporation shares 0.04 -

Income tax related to repatriation of

foreign earnings 0.28 -

Income tax effect of non-GAAP adjustments (0.05) (0.03)

------------- -------------

Diluted net income (loss) per share on a

non-GAAP basis $ (0.09) $ 0.33

============= =============

Shares used in calculation of diluted net

income (loss) per share -- GAAP (A) 252,915 299,506

Shares used in calculation of diluted net

income (loss) per share -- non-GAAP (A) 252,915 299,506

(A) Shares used in the calculation of GAAP net income (loss) per share are

expected to be the same as shares used in the calculation of non-GAAP

net income (loss) per share, except when the company reports a GAAP

net loss and non-GAAP net income, or GAAP net income and a non-GAAP

net loss.

Investors are encouraged to look at the GAAP results as the best

measure of financial performance. For example, amortization of

intangibles or in-process technology are important to consider

because they may represent initial expenditures that under GAAP are

reported across future fiscal periods. Likewise, stock-based

compensation expense is an obligation of the company that should be

considered. Restructuring charges can be triggered by acquisitions

or product adjustments, as well as overall company performance

within a given business environment. Losses on extinguishment of

debt can be incurred on remaining convertible notes. All of these

metrics are important to financial performance generally.

Although Cadence's management finds the non-GAAP measure useful

in evaluating the performance of Cadence's business, reliance on

this measure is limited because items excluded from such measures

often have a material effect on Cadence's earnings and earnings per

share calculated in accordance with GAAP. Therefore, Cadence's

management typically uses the non-GAAP earnings and earnings per

share measures, in conjunction with the GAAP earnings and earnings

per share measures, to address these limitations.

Cadence's management believes that presenting the non-GAAP

measure of earnings and earnings per share provides investors with

an additional tool for evaluating the performance of the company's

business, which Cadence's management uses in its own evaluation of

performance, and an additional baseline for assessing the future

earnings potential of the company. While the GAAP results are more

complete, Cadence's management prefers to allow investors to have

this supplemental measure since it may provide additional insights

into the company's financial results.

Cadence expects that its corporate representatives will meet

privately during the quarter with investors, the media, investment

analysts and others. At these meetings, Cadence may reiterate the

business outlook published in this press release. At the same time,

Cadence will keep this press release, including the business

outlook, publicly available on its Web site.

Prior to the start of the Quiet Period (described below), the

public may continue to rely on the business outlook contained

herein as still being Cadence's current expectations on matters

covered unless Cadence publishes a notice stating otherwise.

Beginning December 19, 2008, Cadence will observe a Quiet Period

during which the business outlook as provided in this press release

and the company's most recent Annual Report on Form 10-K and

Quarterly Report on Form 10-Q no longer constitute the company's

current expectations. During the Quiet Period, the business outlook

in these documents should be considered to be historical, speaking

as of prior to the Quiet Period only and not subject to any update

by the company. During the Quiet Period, Cadence's representatives

will not comment on Cadence's business outlook, financial results

or expectations. The Quiet Period will extend until the day when

Cadence's Fourth Quarter and Fiscal Year 2008 Earnings Release is

published, which is currently scheduled for February 4, 2009.

Cadence Design Systems, Inc.

Condensed Consolidated Balance Sheets

September 27, 2008 and December 29, 2007

(In thousands)

(Unaudited)

September 27, December 29,

2008 2007

------------- -------------

Current Assets:

Cash and cash equivalents $ 551,753 $ 1,062,920

Short-term investments 6,068 15,193

Receivables, net of allowances of $3,355 and

$2,895, respectively 278,458 326,211

Inventories 25,545 31,003

Prepaid expenses and other 84,112 94,236

------------- -------------

Total current assets 945,936 1,529,563

Property, plant and equipment, net of

accumulated depreciation of $636,305 and

$624,680, respectively 359,196 339,463

Goodwill 1,315,217 1,310,211

Acquired intangibles, net 101,409 127,072

Installment contract receivables 170,503 238,010

Other assets 356,527 326,831

------------- -------------

Total Assets $ 3,248,788 $ 3,871,150

============= =============

Current Liabilities:

Convertible notes $ - $ 230,385

Accounts payable and accrued liabilities 259,062 289,934

Current portion of deferred revenue 245,901 265,168

------------- -------------

Total current liabilities 504,963 785,487

------------- -------------

Long-Term Liabilities:

Long-term portion of deferred revenue 124,703 136,655

Convertible notes 500,178 500,000

Other long-term liabilities 413,993 368,942

------------- -------------

Total long-term liabilities 1,038,874 1,005,597

------------- -------------

Stockholders' Equity 1,704,951 2,080,066

------------- -------------

Total Liabilities and Stockholders' Equity $ 3,248,788 $ 3,871,150

============= =============

Cadence Design Systems, Inc.

Condensed Consolidated Statements of Operations

For the Quarters and Nine Months Ended

September 27, 2008 and September 29, 2007

(In thousands, except per share amounts)

(Unaudited)

Quarters Ended Nine Months Ended

---------------------- ----------------------

Sept. 27, Sept. 29, Sept. 27, Sept. 29,

2008 2007 2008 2007

---------- ---------- ---------- ----------

Revenue:

Product $ 107,572 $ 273,799 $ 422,365 $ 775,496

Services 32,873 31,225 98,763 95,963

Maintenance 92,043 95,900 290,151 285,611

---------- ---------- ---------- ----------

Total revenue 232,488 400,924 811,279 1,157,070

---------- ---------- ---------- ----------

Costs and Expenses:

Cost of product 11,829 13,823 39,241 42,302

Cost of services 25,677 23,364 78,083 70,421

Cost of maintenance 13,910 15,217 42,889 45,635

Marketing and sales 91,075 97,163 274,016 297,924

Research and development 112,486 125,391 357,929 365,418

General and

administrative 32,937 40,747 105,608 123,166

Amortization of acquired

intangibles 5,626 4,739 17,206 13,661

Restructuring and other

charges (credits) 48,120 (7,066) 47,765 (9,584)

Write-off of acquired

in-process technology - 2,678 600 2,678

---------- ---------- ---------- ----------

Total costs and

expenses 341,660 316,056 963,337 951,621

---------- ---------- ---------- ----------

Income (loss) from

operations (109,172) 84,868 (152,058) 205,449

Interest expense (3,180) (2,849) (9,055) (9,373)

Other income (expense),

net (7,714) 14,201 (3,701) 47,938

---------- ---------- ---------- ----------

Income (loss)

before provision

for income taxes (120,066) 96,220 (164,814) 244,014

Provision for income

taxes 49,000 23,488 50,269 67,265

---------- ---------- ---------- ----------

Net income (loss) $ (169,066) $ 72,732 $ (215,083) $ 176,749

========== ========== ========== ==========

Basic net income (loss) per

share $ (0.67) $ 0.27 $ (0.84) $ 0.65

========== ========== ========== ==========

Diluted net income (loss)

per share $ (0.67) $ 0.24 $ (0.84) $ 0.60

========== ========== ========== ==========

Weighted average common

shares outstanding - basic 252,915 272,977 256,119 272,354

========== ========== ========== ==========

Weighted average common

shares outstanding -

diluted 252,915 299,506 256,119 297,783

========== ========== ========== ==========

Cadence Design Systems, Inc.

Condensed Consolidated Statements of Cash Flows

For the Nine Months Ended September 27, 2008 and September 29, 2007

(In thousands)

(Unaudited)

Nine Months Ended

---------------------------

September 27, September 29,

2008 2007

------------ ------------

Cash and Cash Equivalents at Beginning of

Period $ 1,062,920 $ 934,342

------------ ------------

Cash Flows from Operating Activities:

Net income (loss) (215,083) 176,749

Adjustments to reconcile net income (loss)

to net cash provided by operating

activities:

Depreciation and amortization 97,719 96,798

Stock-based compensation 57,678 78,828

Equity in loss from investments, net 823 2,504

(Gain) loss on investments, net 11,440 (16,608)

(Gain) loss on sale and leaseback of land

and buildings 350 (12,606)

Write-down of investment securities 10,666 2,550

Write-off of acquired in-process

technology 600 2,678

Non-cash restructuring and other charges

(credits) 222 (7,106)

Tax benefit of call options 7,034 7,036

Deferred income taxes (11,020) 4,848

Proceeds from the sale of receivables,

net 48,124 163,549

Provisions (recoveries) for losses

(gains) on trade accounts receivable and

sales returns 383 (975)

Other non-cash items (1,258) 8,525

Changes in operating assets and

liabilities, net of effect of acquired

businesses:

Receivables 21,489 9,053

Installment contract receivables 46,198 (273,301)

Inventories 5,486 (681)

Prepaid expenses and other (3,421) (23,229)

Other assets (1,849) (2,027)

Accounts payable and accrued

liabilities (41,582) (35,516)

Deferred revenue (32,243) 9,411

Other long-term liabilities 35,972 18,448

------------ ------------

Net cash provided by operating

activities 37,728 208,928

------------ ------------

Cash Flows from Investing Activities:

Proceeds from the sale of available-for-sale

securities 53,783 6,468

Purchases of available-for-sale securities (62,447) -

Proceeds from the sale of long-term

investments 3,250 6,323

Proceeds from the sale of property, plant

and equipment - 46,500

Purchases of property, plant and equipment (81,112) (57,405)

Purchases of software licenses (1,199) -

Investment in venture capital partnerships

and equity investments (4,053) (3,214)

Cash paid in business combinations and asset

acquisitions, net of cash acquired, and

acquisition of intangibles (20,621) (74,117)

------------ ------------

Net cash used for investing

activities (112,399) (75,445)

------------ ------------

Cash Flows from Financing Activities:

Proceeds from receivable sale financing 17,970 -

Principal payments on term loan - (28,000)

Payment of convertible notes due 2023 (230,207) -

Tax benefit from employee stock transactions 427 20,727

Proceeds from issuance of common stock 48,116 249,006

Stock received for payment of employee taxes

on vesting of restricted stock (3,693) (11,735)

Purchases of treasury stock (273,950) (372,416)

Other - 8,558

------------ ------------

Net cash used for financing

activities (441,337) (133,860)

------------ ------------

Effect of exchange rate changes on cash and

cash equivalents 4,841 1,622

------------ ------------

Increase (decrease) in cash and cash

equivalents (511,167) 1,245

------------ ------------

Cash and Cash Equivalents at End of Period $ 551,753 $ 935,587

============ ============

Cadence Design Systems, Inc.

As of December 10, 2008

Impact of Non-GAAP Adjustments on Forward Looking Diluted Net Loss

Per Share

(Unaudited)

Quarter Ended Year Ended

January 3, 2009 January 3, 2009

----------------- -----------------

Forecast Forecast

----------------- -----------------

Diluted net loss per share on a

GAAP basis $(0.29) to $(0.27) $(1.13) to $(1.11)

Amortization of acquired

intangibles 0.04 0.17

Stock-based compensation

expense 0.11 0.34

Non-qualified deferred

compensation expenses

(credits) - (0.01)

Costs related to Cadence's

withdrawn proposal to acquire

Mentor Graphics Corporation - 0.01

Restructuring and other

charges 0.07 0.25

Write-off of acquired

in-process technology - -

Integration and

acquisition-related costs - -

Equity in losses from

investments, write-down of

investments, gains and losses

on non-qualified deferred

compensation plan assets - 0.06

Loss on sale of Mentor

Graphics Corporation shares - 0.04

Foreign currency charge

related to liquidation of

subsidiary 0.04 0.04

Income tax related to

repatriation of foreign

earnings - 0.28

Income tax effect of non-GAAP

adjustments (0.03) (0.11)

----------------- -----------------

Diluted net loss per share on a

non-GAAP basis $(0.06) to $(0.04) $(0.06) to $(0.04)

================= =================

Cadence Design Systems, Inc.

As of December 10, 2008

Impact of Non-GAAP Adjustments on Forward Looking Net Loss

(Unaudited)

Quarter Ended Year Ended

January 3, 2009 January 3, 2009

----------------- -----------------

($ in Millions) Forecast Forecast

----------------- -----------------

Net loss on a GAAP basis $ (74) to $ (68) $ (289) to $ (283)

Amortization of acquired

intangibles 10 44

Stock-based compensation

expense 28 86

Non-qualified deferred

compensation expenses

(credits) - (3)

Costs related to Cadence's

withdrawn proposal to acquire

Mentor Graphics Corporation - 3

Restructuring and other

charges 17 65

Write-off of acquired

in-process technology - 1

Integration and

acquisition-related costs - 1

Equity in losses from

investments, write-down of

investments, gains and losses

on non-qualified deferred

compensation plan assets - 16

Loss on sale of Mentor

Graphics Corporation shares - 9

Foreign currency charge

related to liquidation of

subsidiary 10 10

Income tax related to

repatriation of foreign

earnings - 71

Income tax effect of non-GAAP

adjustments (7) (29)

----------------- -----------------

Net loss on a non-GAAP basis $ (16) to $ (10) $ (15) to $ (9)

================= =================

Cadence Design Systems, Inc.

(Unaudited)

Revenue Mix by Geography (% of Total Revenue)

2006 2007

======================== ========================

GEOGRAPHY Q1 Q2 Q3 Q4 Year Q1 Q2 Q3 Q4 Year

=== === === === ==== === === === === ====

Americas 51% 48% 54% 60% 54% 48% 52% 41% 50% 49%

Europe 19% 18% 22% 19% 19% 15% 17% 25% 17% 18%

Japan 21% 24% 13% 10% 17% 27% 14% 22% 22% 21%

Asia 9% 10% 11% 11% 10% 10% 17% 12% 11% 12%

Total 100% 100% 100% 100% 100% 100% 100% 100% 100% 100%

2008

=========================

GEOGRAPHY Q1 Q2 Q3

======== ======== =====

(Restated)(Restated)

Americas 43% 48% 43%

Europe 24% 21% 23%

Japan 21% 19% 20%

Asia 12% 12% 14%

Total 100% 100% 100%

Revenue Mix by Product Group (% of Total Revenue)

2006 2007

======================== ========================

PRODUCT GROUP Q1 Q2 Q3 Q4 Year Q1 Q2 Q3 Q4 Year

=== === === === ==== === === === === ====

Functional

Verification 26% 22% 24% 23% 24% 24% 24% 20% 26% 24%

Digital IC Design 20% 26% 19% 26% 24% 26% 29% 27% 27% 27%

Custom IC Design 27% 27% 30% 26% 27% 24% 24% 32% 25% 27%

Design for

Manufacturing 8% 8% 8% 6% 7% 7% 7% 6% 6% 6%

System Interconnect 9% 8% 10% 11% 9% 10% 8% 7% 9% 8%

Services & Other 10% 9% 9% 8% 9% 9% 8% 8% 7% 8%

Total 100% 100% 100% 100% 100% 100% 100% 100% 100% 100%

2008

=========================

PRODUCT GROUP Q1 Q2 Q3

======== ======== =====

(Restated)(Restated)

Functional

Verification 22% 25% 22%

Digital IC Design 24% 24% 20%

Custom IC Design 26% 23% 26%

Design for

Manufacturing 5% 7% 7%

System Interconnect 11% 10% 11%

Services & Other 12% 11% 14%

Total 100% 100% 100%

Note: Product Group total revenue includes Product + Maintenance

Cadence Design Systems, Inc.

Impact of Restatement Adjustments on Previously Reported Condensed

Consolidated Statements of Operations

For the Quarter Ended March 29, 2008 and the

Quarter and Six Months Ended June 28, 2008

(In thousands, except per share amounts)

(Unaudited)

Quarter Quarter Six Months

Ended Ended Ended

March 29, June 28, June 28,

2008 2008 2008

---------- ---------- ----------

Total revenue as previously reported $ 287,189 $ 329,478 $ 616,667

Restatement adjustments (A),(B),(C) (16,439) (21,437) (37,876)

---------- ---------- ----------

Total revenue as restated $ 270,750 $ 308,041 $ 578,791

========== ========== ==========

Total costs and expenses as previously

reported $ 314,192 $ 310,092 $ 624,284

Restatement adjustments (B),(D) - (2,607) (2,607)

---------- ---------- ----------

Total costs and expenses as restated $ 314,192 $ 307,485 $ 621,677

========== ========== ==========

Provision (benefit) for income taxes as

previously reported $ (5,488) $ 9,760 $ 4,272

Restatement adjustments (E) (5,963) 2,960 (3,003)

---------- ---------- ----------

Provision (benefit) for income taxes as

restated $ (11,451) $ 12,720 $ 1,269

========== ========== ==========

Net income (loss) as previously

reported $ (18,747) $ 4,996 $ (13,751)

Restatement adjustments (10,476) (21,790) (32,266)

---------- ---------- ----------

Net loss as restated $ (29,223) $ (16,794) $ (46,017)

========== ========== ==========

Basic net income (loss) per share as

previously reported $ (0.07) $ 0.02 $ (0.05)

Restatement adjustments (0.04) (0.09) (0.13)

---------- ---------- ----------

Basic net loss per share as restated $ (0.11) $ (0.07) $ (0.18)

========== ========== ==========

Diluted net income (loss) per share as

previously reported $ (0.07) $ 0.02 $ (0.05)

Restatement adjustments (0.04) (0.09) (0.13)

---------- ---------- ----------

Diluted net loss per share as restated $ (0.11) $ (0.07) $ (0.18)

========== ========== ==========

Notes:

(A) This restatement adjustment corrects revenue recognition for one

arrangement under which $24.8 million of Product revenue was recognized

during the first quarter of 2008 and $1.0 million of Maintenance

revenue was recognized during the second quarter of 2008, but should

be recognized during the term of the arrangement, beginning in the

fourth quarter of 2008.

(B) This restatement adjustment corrects revenue recognition for one

arrangement identified during Cadence's remediation efforts under which

$12.0 million of Product revenue was recognized during the second

quarter of 2008, but should be recognized during the term of the

arrangement, beginning in the third quarter of 2008. As a result of

reversing this $12.0 million of Product revenue that was previously

recognized, Cadence also decreased Cost of product by $0.1 million for

the second quarter of 2008.

(C) Because Cadence is restating its financial results for the first and

second quarters of 2008 for the revenue arrangements described in

Notes (A) and (B), Cadence has also recorded two other Product revenue

adjustments, in the aggregate amount of $8.4 million, that were

previously disclosed in Cadence's Quarterly Report on Form 10-Q for

the quarter ended June 28, 2008, initially filed with the SEC on

July 29, 2008. Cadence determined that Product revenue for these two

contracts totaling $8.4 million recognized during the second quarter

of 2008 should have been recognized during the first quarter of 2008.

(D) This restatement adjustment reduces Cost of product for a hardware

arrangement during the second quarter of 2008 by $2.5 million.

(E) This restatement adjustment represents the tax effect of the

restatement adjustments noted above.

Cadence Design Systems, Inc.

Impact of Restatement Adjustments on Previously Reported Condensed

Consolidated Statements of Operations

For the Quarter Ended March 29, 2008

(In thousands, except per share amounts)

(Unaudited)

Quarter Ended

March 29, 2008

------------------------------------------

As

Previously Restatement As

Reported Adjustments Restated

---------- ----------- ---------

Revenue

Product $ 156,193 $ (16,439) (A),(B) $ 139,754

Services 32,196 - 32,196

Maintenance 98,800 - 98,800

---------- ----------- ---------

Total revenue 287,189 (16,439) 270,750

---------- ----------- ---------

Costs and Expenses

Cost of product 12,001 - 12,001

Cost of services 25,193 - 25,193

Cost of maintenance 14,540 - 14,540

Marketing and sales 93,034 - 93,034

Research and development 125,356 - 125,356

General and administrative 37,708 - 37,708

Amortization of acquired

intangibles 5,760 - 5,760

Write-off of acquired

in-process technology 600 - 600

---------- ----------- ---------

Total costs and expenses 314,192 - 314,192

---------- ----------- ---------

Loss from operations (27,003) (16,439) (43,442)

Interest expense (2,995) - (2,995)

Other income, net 5,763 - 5,763

---------- ----------- ---------

Loss before benefit

for income taxes (24,235) (16,439) (40,674)

Benefit for income taxes (5,488) (5,963) (C) (11,451)

---------- ----------- ---------

Net loss $ (18,747) $ (10,476) $ (29,223)

========== =========== =========

Basic net loss per share $ (0.07) $ (0.11)

========== =========

Diluted net loss per share $ (0.07) $ (0.11)

========== =========

Weighted average common shares

outstanding - basic 262,825 262,825

========== =========

Weighted average common shares

outstanding - diluted 262,825 262,825

========== =========

Notes:

(A) This restatement adjustment corrects revenue recognition for one

arrangement under which $24.8 million of Product revenue was recognized

during the first quarter of 2008, but should be recognized during the

term of the arrangement, beginning in the fourth quarter of 2008.

(B) Because Cadence is restating its financial results for the first

quarter of 2008 for the revenue arrangement described in Note (A),

Cadence has also recorded two other Product revenue adjustments, in the

aggregate amount of $8.4 million, that were previously disclosed in

Cadence's Quarterly Report on Form 10-Q for the quarter ended June 28,

2008, initially filed with the SEC on July 29, 2008. Cadence determined

that Product revenue for these two contracts totaling $8.4 million

recognized during the second quarter of 2008 should have been

recognized during the first quarter of 2008.

(C) This restatement adjustment represents the tax effect of the

restatement adjustments noted above.

Cadence Design Systems, Inc.

Impact of Restatement Adjustments on Previously Reported Condensed

Consolidated Statements of Operations

For the Quarter Ended June 28, 2008

(In thousands, except per share amounts)

(Unaudited)

Quarter Ended

June 28, 2008

------------------------------------------

As

Previously Restatement As

Reported Adjustments Restated

---------- ----------- ---------

Revenue

Product $ 195,444 $(20,405) (A),(B),(C) $175,039

Services 33,694 - 33,694

Maintenance 100,340 (1,032) (A) 99,308

---------- -------- --------

Total revenue 329,478 (21,437) 308,041

---------- -------- --------

Costs and Expenses

Cost of product 18,018 (2,607) (B),(D) 15,411

Cost of services 27,213 - 27,213

Cost of maintenance 14,439 - 14,439

Marketing and sales 89,907 - 89,907

Research and development 120,087 - 120,087

General and administrative 34,963 - 34,963

Amortization of acquired

intangibles 5,820 - 5,820

Restructuring and other

charges (credits) (355) - (355)

---------- -------- --------

Total costs and expenses 310,092 (2,607) 307,485

---------- -------- --------

Income from operations 19,386 (18,830) 556

Interest expense (2,880) - (2,880)

Other expense, net (1,750) - (1,750)

---------- -------- --------

Income (loss) before

provision for income

taxes 14,756 (18,830) (4,074)

Provision for income taxes 9,760 2,960 (E) 12,720

---------- -------- --------

Net income (loss) $ 4,996 $(21,790) $(16,794)

========== ======== ========

Basic net income (loss) per

share $ 0.02 $ (0.07)

========== ========

Diluted net income (loss) per

share $ 0.02 $ (0.07)

========== ========

Weighted average common shares

outstanding - basic 252,629 252,629

========== ========

Weighted average common shares

outstanding - diluted 269,060 252,629

========== ========

Notes:

(A) This restatement adjustment corrects revenue recognition for one

arrangement under which $24.8 million of Product revenue was recognized

during the first quarter of 2008 and $1.0 million of Maintenance

revenue was recognized during the second quarter of 2008, but should

be recognized during the term of the arrangement, beginning in the

fourth quarter of 2008.

(B) This restatement adjustment corrects revenue recognition for one

arrangement identified during Cadence's remediation efforts under which

$12.0 million of Product revenue was recognized during the second

quarter of 2008, but should be recognized during the term of the

arrangement, beginning in the third quarter of 2008. As a result of

reversing this $12.0 million of Product revenue that was previously

recognized, Cadence also decreased Cost of product by $0.1 million for

the second quarter of 2008.

(C) Because Cadence is restating its financial results for the second

quarter of 2008 for the revenue arrangements described in Notes (A) and

(B), Cadence has also recorded two other Product revenue adjustments,

in the aggregate amount of $8.4 million, that were previously disclosed

in Cadence's Quarterly Report on Form 10-Q for the quarter ended June

28, 2008, initially filed with the SEC on July 29, 2008. Cadence

determined that Product revenue for these two contracts totaling $8.4

million recognized during the second quarter of 2008 should have been

recognized during first quarter of 2008.

(D) This restatement adjustment reduces Cost of product for a hardware

arrangement during the second quarter of 2008 by $2.5 million.

(E) This restatement adjustment represents the tax effect of the

restatement adjustments noted above.

Cadence Design Systems, Inc.

Impact of Restatement Adjustments on Previously Reported Condensed

Consolidated Statements of Operations

For the Six Months Ended June 28, 2008

(In thousands, except per share amounts)

(Unaudited)

Six Months Ended

June 28, 2008

------------------------------------------

As

Previously Restatement As

Reported Adjustments Restated

---------- ----------- ---------

Revenue

Product $ 351,637 $ (36,844) (A),(B) $ 314,793

Services 65,890 - 65,890

Maintenance 199,140 (1,032) (A) 198,108

---------- ----------- ---------

Total revenue 616,667 (37,876) 578,791

---------- ----------- ---------

Costs and Expenses

Cost of product 30,019 (2,607) (B),(C) 27,412

Cost of services 52,406 - 52,406

Cost of maintenance 28,979 - 28,979

Marketing and sales 182,941 - 182,941

Research and development 245,443 - 245,443

General and administrative 72,671 - 72,671

Amortization of acquired

intangibles 11,580 - 11,580

Restructuring and other

charges (credits) (355) - (355)

Write-off of acquired

in-process technology 600 - 600

---------- ----------- ---------

Total costs and expenses 624,284 (2,607) 621,677

---------- ----------- ---------

Loss from operations (7,617) (35,269) (42,886)

Interest expense (5,875) - (5,875)

Other income, net 4,013 - 4,013

---------- ----------- ---------

Loss before provision

for income taxes (9,479) (35,269) (44,748)

Provision for income taxes 4,272 (3,003) (D) 1,269

---------- ----------- ---------

Net loss $ (13,751) $ (32,266) $ (46,017)

========== =========== =========

Basic net loss per share $ (0.05) $ (0.18)

========== =========

Diluted net loss per share $ (0.05) $ (0.18)

========== =========

Weighted average common shares

outstanding - basic 257,724 257,724

========== =========

Weighted average common shares

outstanding - diluted 257,724 257,724

========== =========

Notes:

(A) This restatement adjustment corrects revenue recognition for one

arrangement under which $24.8 million of Product revenue and $1.0

million of Maintenance revenue was recognized during the six months

ended June 28, 2008, but should be recognized during the term of

the arrangement, beginning in the fourth quarter of 2008.

(B) This restatement adjustment corrects revenue recognition for one

arrangement identified during Cadence's remediation efforts under which

$12.0 million of Product revenue was recognized during the six months

ended June 28, 2008, but should be recognized during the term of

the arrangement, beginning in the third quarter of 2008. As a result

of reversing this $12.0 million of Product revenue that was previously

recognized, Cadence also decreased Cost of product by $0.1 million for

the six months ended June 28, 2008.

(C) This restatement adjustment reduces Cost of product for a hardware

arrangement during the six months ended June 28, 2008 by $2.5 million.

(D) This restatement adjustment represents the tax effect of the

restatement adjustments noted above.

For more information, please contact: Investors and Shareholders

Jennifer Jordan Cadence Design Systems, Inc. 408-944-7100

investor_relations@cadence.com Media and Industry Analysts Adolph

Hunter Cadence Design Systems, Inc. 408-914-6016

publicrelations@cadence.com

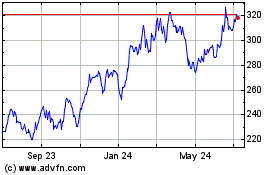

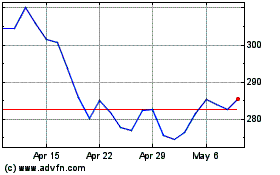

Cadence Design Systems (NASDAQ:CDNS)

Historical Stock Chart

From Oct 2024 to Nov 2024

Cadence Design Systems (NASDAQ:CDNS)

Historical Stock Chart

From Nov 2023 to Nov 2024