Filed

Pursuant to Rule 424(b)(5)

Registration

No. 333-267116

Prospectus

Supplement

(to

Prospectus Dated November 22, 2022)

$3,000,000

worth of Ordinary Shares and Warrants

Bon

Natural Life Limited

Pursuant

to this prospectus supplement and the accompanying prospectus, Bon Natural Life Limited is offering directly to the public up to $3,000,000

worth of ordinary shares of the Company, par value $0.0001 per share (the “Ordinary Shares”) in three (3) tranches at the

subscription price as defined below. Ordinary shares issued in the first tranche will be issued on the first trading day that occurs

after 15 calendar days from the filing date of the Company’s Listing of Additional Shares Notification Form with Nasdaq. The second

tranche of Ordinary Shares will be issued on the 11th trading day from the closing date of the first tranche. Ordinary shares issued

in the third tranche will be issued on the 11th trading day from the closing date of the second tranche.

The Ordinary Shares will be priced at the

lower of (a) $1.00 per share or (b) 80% of the market closing price for the Company’s Ordinary Shares as reported by the Nasdaq

Capital Market on the trading day immediately preceding the closing date for the initial tranche. The subscription price for the first

closing date shall remain fixed and will be the subscription price for all the remaining closing dates thereafter.

Together with each Ordinary Share subscribed

for, we will issue one (1) warrant to purchase one (1) Ordinary Share at an exercise price equal to 120% of the subscription price,

exercisable for a period of thirty-six (36) months following the closing date. We currently expect the initial public offering

price will be $1.00 per share and warrants exercisable at $1.20 per share, resulting in 3,000,000 Ordinary Shares and 2,500,000 Ordinary

Shares issuable upon exercise of warrants.

For

a more detailed description of the Ordinary Shares and warrants offered hereby, see the sections entitled “Description of Share

Capital and Warrants” beginning on page S-47 and “Description of Share Capital” starting on page S-47 of the accompanying

prospectus. There is no established public trading market for the warrants, and we do not expect a market to develop. We do not intend

to apply to list the warrants on any securities exchange.

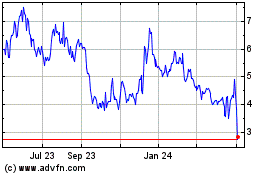

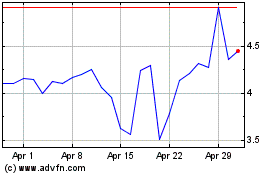

Our

Ordinary Shares are listed on the Nasdaq Capital Market, or “Nasdaq,” under the symbol “BON.” On March 28, 2023,

the last reported sale price of our Ordinary Shares on Nasdaq was $1.48 per share. The aggregate market value of our outstanding Ordinary

Shares held by non-affiliates, or public float, as of March 28, 2023, was approximately $10,728,114 which was calculated based on Ordinary

Shares held by non-affiliates and the price of $1.48 per share, which was the closing price of our Ordinary Shares on Nasdaq on March

28, 2023.

Investing

in our Ordinary Shares involves a high degree of risk. Before making an investment decision, please read the information under the heading

“Risk Factors” beginning on page S-18 of this prospectus supplement and risk factors set forth in our most recent

annual report on Form 20-F, in other reports incorporated herein by reference, and in an applicable prospectus supplement under the heading

“Risk Factors.” Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved

the issuance of these securities or passed upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus.

Any representation to the contrary is a criminal offense.

Investors

in our Ordinary Shares are not purchasing equity securities in our subsidiaries that have substantive business operations in China but

instead are purchasing equity securities of a Cayman Islands holding company, Bon Natural Life Limited. We are a Cayman Islands holding

company that conducts all of our operations and operates our business in China through our PRC subsidiaries. Such structure involves

unique risks to investors in our ordinary shares. References in this Prospectus to “Bon Natural Life,” “the Company,”

“we,” “us,” “our company” or “our” are to Bon Natural Life Limited a Cayman Islands corporation,

together with its subsidiaries collectively. Please see “Commonly Defined Terms” for naming conventions regarding our subsidiary

companies. Although we control our PRC operating subsidiaries through our Hong Kong and PRC subsidiaries, investors in this offering

may never hold equity interests directly in our operating entities. In addition, Bon Natural Life Limited, the Cayman Islands company

selling securities in this offering, does not hold equity interests in the PRC operating subsidiaries discussed herein. Instead, Bon

Natural Life owns a Hong Kong subsidiary, which in turn owns two PRC subsidiaries, which in turn own the operating PRC companies discussed

in this Prospectus. Please refer to the organizational chart on page 1 of this Prospectus.

We

originally carried out our business through a variable interest entity structure. Effective November 1, 2021, we terminated the original

VIE contractual agreements and completed the reorganization of our corporate structure and all of our operations are currently conducted

in China through our wholly-owned subsidiaries.

We

do not currently engage in any businesses where foreign investment is restricted under Chinese law, as the Company and its subsidiaries

do not participate in any sector or industry that is “restricted” or “prohibited” from foreign investment under

the “Negative List” published by China’s National Development and Reform Commission and the Ministry of Commerce. The

most recent version of the PRC’s Negative List, The Special Administrative Measures (Negative List) for Foreign Investment Access

(2021 Edition) or the Negative List 2021, lists 31 industries in which foreign investment is restricted or prohibited. Our

business activities, which are focused on the production of fragrance compounds, health supplements, and bioactive food ingredients,

are not included within the industries and fields listed in the Negative List 2021. For a fuller explanation of China’s

“Negative List,” please see our Annual Report on Form 20-F filed February 10, 2023, 2022 at page 45 under “Regulations

Relating to Foreign Investment in China – Foreign investment law.”

Because

all of our business operations are conducted in China though our wholly-owned subsidiaries, the Chinese government may intervene or influence

the operation of our PRC operating entities and may exercise significant oversight and discretion over the conduct of our business and

may intervene in or influence our operations at any time, which could result in a material change in our operations and/or the value

of our ordinary shares. Please see, the Risk Factors beginning on page S-18 of this Prospectus, including “Risk Factor

– If the Chinese government chooses to exert more oversight and control over offerings that are conducted overseas and/or foreign

investment in China-based issuers, such action could significantly limit or completely hinder our ability to offer or continue to offer

securities to investors and cause the value of such securities to significantly decline or be worthless;” “Risk Factor –

If the Chinese government were to impose new requirements for approval from the PRC Authorities to issue our ordinary shares to foreign

investors or list on a foreign exchange, such action could significantly limit or completely hinder our ability to offer or continue

to offer securities to investors and cause the value of such securities to significantly decline or be worthless;” and “Risk

Factor – Because all of our operations are in China, our business is subject to the complex and rapidly evolving laws and regulations

there. The Chinese government may exercise significant oversight and discretion over the conduct of our business and may intervene in

or influence our operations at any time, which could result in a material change in our operations and/or the value of our ordinary shares.”

Recent

statements by the Chinese government have indicated an intent to exert more oversight and control over offerings that are conducted overseas

and/or foreign investments in China-based issuers. Any future action or control by the Chinese government over offerings conducted overseas

and/or foreign investment in China-based issuers could significantly limit or completely hinder our ability to offer or continue to offer

securities to investors and could cause the value of such securities to significantly decline or be worthless.

Recently,

the PRC government initiated a series of regulatory actions and made a number of public statements on the regulation of business operations

in China with little advance notice, including cracking down on illegal activities in the securities market, enhancing supervision over

China-based companies listed overseas using a variable interest entity structure, adopting new measures to extend the scope of cybersecurity

reviews, and expanding efforts in anti-monopoly enforcement. Specifically, the Measures for Cybersecurity Review (2021 version) which

was promulgated by the Cyberspace Administration of China, or the CAC on December 28, 2021, and became effective on February 15, 2022,

iterates that any “online platform operators” controlling personal information of more than one million users which seeks

to list in a foreign stock exchange should also be subject to cybersecurity review. We cannot assure you that we will not be deemed as

the “online platform operators” as mentioned above, even though we do not operate any online platforms. We do not believe

that we are directly subject to these regulatory actions or statements, as we do not have a variable interest entity structure and our

business does not involve the collection of user data, implicate cybersecurity, or involve any other type of restricted industry. We

believe that, as of the date of this prospectus, the Company and its subsidiaries, (1) are not required to obtain permissions or approvals

from any PRC authorities to operate or issue our Ordinary Shares to foreign investors; and (2) are not subject to permission requirements

from the China Securities Regulatory Commission (the “CSRC”), the Cyberspace Administration of China (the “CAC”)

or any other entity that is required to approve of our operations. However, given the current PRC regulatory environment, it is uncertain

when and whether we or our PRC subsidiaries, will be required to obtain permission from the PRC government to list on U.S. exchanges

in the future, and even when such permission is obtained, whether it will be denied or rescinded. Because these statements and regulatory

actions are new, however, it is highly uncertain how soon legislative or administrative regulation making bodies in China will respond

to them, or what existing or new laws or regulations or detailed implementation rules and interpretations will be modified or promulgated,

if any, or the potential impact such modified or new laws and regulations will have on our daily business operations or our ability to

accept foreign investments and continue to be listed on an U.S. exchange. If it is determined in the future that the approval of the

CSRC, the CAC or any other regulatory authority is required for this offering, the offering will be delayed until we have obtained the

relevant approvals. There is also the possibility that we may not be able to obtain or maintain such approval or that we inadvertently

concluded that such approval was not required. If the approval was required while we inadvertently concluded that such approval was not

required or if applicable laws and regulations or the interpretation of such were modified to require us to obtain the CSRC approval

in the future, we may face sanctions by the CSRC, the CAC or other PRC regulatory agencies. These regulatory agencies may impose fines

and penalties on our operations in China, limit our ability to pay dividends outside of China, limit our operations in China, delay or

restrict the repatriation of the proceeds from this offering into China or take other actions that could have a material adverse effect

on our business, financial condition, results of operations and prospects, as well as the trading price of our securities. The CSRC,

the CAC, or other PRC regulatory agencies also may take actions requiring us, or making it advisable for us, to halt this offering before

settlement and delivery of our ordinary shares.

Consequently,

if you engage in market trading or other activities in anticipation of and prior to the settlement and delivery of the ordinary shares

we are offering, you would be doing so at the risk that the settlement and delivery may not occur. Any uncertainties or negative publicity

regarding such approval requirements could have a material adverse effect on our ability to complete this offering or any follow-on offering

of our securities or the market for and market price of our ordinary shares.

On

December 24, 2021, China Securities Regulatory Commission, or the CSRC issued the Administrative Provisions of the State Council Regarding

the Overseas Issuance and Listing of Securities by Domestic Enterprises (the “Draft Administrative Provisions”) and the Measures

for the Overseas Issuance of Securities and Listing Record-Filings by Domestic Enterprises (Draft for Comments) (the “Draft Filing

Measures”, collectively with the Draft Administrative Provisions, the “Draft Rules Regarding Overseas Listings”), which

were published for comments only with the comment period expired on January 23, 2022. The Draft Rules Regarding Overseas Listing lay

out the filing regulation arrangement for both direct and indirect overseas listing, and clarify the determination criteria for indirect

overseas listing in overseas market. Among other things, if a domestic enterprise intends to indirectly offer and list securities in

an overseas market, the record-filing obligation is with a major operating entity incorporated in the PRC and such filing obligation

shall be completed within three working days after the overseas listing application is submitted. The Draft Rules Regarding Overseas

Listings, if enacted, may subject us to additional compliance requirements in the future, and we cannot assure you that we will be able

to get the clearance of filing procedures under the Draft Rules Regarding Overseas List on a timely basis, or at all. Any failure of

us to fully comply with new regulatory requirements may significantly limit or completely hinder our ability to offer or continue to

offer our ordinary shares, cause significant disruption to our business operations, and severely damage our reputation, which would materially

and adversely affect our financial condition and results of operations and cause our ordinary shares to significantly decline in value

or become worthless. Please see “Risk Factor — If the Chinese government were to impose new requirements for approval

from the PRC Authorities to issue our ordinary shares to foreign investors or list on a foreign exchange, such action could significantly

limit or completely hinder our ability to offer or continue to offer securities to investors and cause the value of such securities to

significantly decline or be worthless.”

On

February 17, 2023, the CSRC promulgated the Trial Administrative Measures of Overseas Securities Offering and Listing by Domestic Companies

(the “Trial Administrative Measures”), which will take effect on March 31, 2023. The Trial Administrative Measures further

stipulate the rules and requirements for overseas offerings and listings conducted by PRC domestic companies. After the Trial Administrative

Measures take effect, we will be required to go through the filing procedure to satisfy the filing requirements. See “Risk Factor

- Upon the effectiveness of the Trial Administrative measures, we will be subject to the Trial Administrative Measures, as the Company

has: (i) 50% or more of the issuer’s operating revenue, total profit, total assets or net assets as documented in its audited consolidated

financial statements for the most recent accounting year is accounted for by PRC domestic companies; and (ii) the main parts of the issuer’s

business activities are conducted in mainland China, or its main places of business are located in mainland China, or the senior managers

in charge of its business operation and management are mostly Chinese citizens or domiciled in mainland China; and we cannot assure you

that we will be able to complete such process on time or at all.”

Pursuant

to the Holding Foreign Companies Accountable Act (“HFCAA”), the Public Company Accounting Oversight Board (the “PCAOB”)

issued a Determination Report on December 16, 2021 which found that the PCAOB is unable to inspect or investigate completely registered

public accounting firms headquartered in: (1) mainland China of the People’s Republic of China because of a position taken by one

or more authorities in mainland China; and (2) Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position

taken by one or more authorities in Hong Kong. In addition the PCAOB’s report identified the specific registered public accounting

firms which are subject to these determinations. The HFCAA does not currently directly affect us, as the registered public accounting

firm whose audit opinion is incorporated herein by reference, Friedman, LLP, is not headquartered in mainland China or Hong Kong

and was not identified in this report as a firm subject to the PCAOB’s determination. In addition, our current retained

audit firm, YCM CPA, Inc., is also not headquartered in mainland China or Hong Kong and was not identified in this report

as a firm subject to the PCAOB’s determination. Notwithstanding the foregoing, if the PCAOB is not able to fully conduct inspections

of our auditor’s work papers in China, you may be deprived of the benefits of such inspection which could result in limitation

or restriction to our access to the U.S. capital markets and trading of our securities may be prohibited under the HFCAA. Under the HFCAA,

our securities may be prohibited from trading on the Nasdaq or other U.S. stock exchanges if our auditor is not inspected by the PCAOB

for three consecutive years, and this ultimately could result in our Ordinary Shares being delisted. Furthermore, on June 22, 2021, the

U.S. Senate passed the Accelerating Holding Foreign Companies Accountable Act (“AHFCAA”), which was signed into law on December

29, 2022, amending the HFCAA and requiring the SEC to prohibit an issuer’s securities from trading on any U.S. stock exchanges

if its auditor is not subject to PCAOB inspections for two consecutive years instead of three. See Risk Factor –“Although

the audit report included in this prospectus was issued by U.S. auditors who are currently inspected by the PCAOB, if it is later determined

that the PCAOB is unable to inspect or investigate our auditor completely, investors would be deprived of the benefits of such inspection

and our ordinary shares may be delisted or prohibited from trading.”

The

structure of cash flows within our organization, and the applicable regulations, are as follows:

1.

Our equity structure is a direct holding structure, that is, the overseas entity listed in the U.S., Bon Natural Life, directly controls

Xi’an CMIT and Xi’an Youpincui (the “WFOEs”) and other domestic operating entities through the Hong Kong company,

Tea Essence. See “Corporate History and Structure” above for additional details.

2.

After foreign investors’ funds enter Bon Natural Life at the close of this Offering, the funds can be directly transferred to Tea

Essence, and then transferred to operating subsidiaries through the WFOEs in compliance with the applicable PRC laws and regulations.

If

we determine to distribute dividends, we will rely on payments made from WFOEs and other PRC subsidiaries, and the distribution of such

payments to the Hong Kong company, Tea Essense, as dividends from the WFOEs in accordance with the laws and regulations of the PRC, and

then Tea Essence will transfer the dividends to Bon Natural Life, and the dividends will be distributed from Bon Natural Life to all

shareholders respectively in proportion to the shares they hold, regardless of whether the shareholders are U.S. investors or investors

in other countries or regions.

3.

As of the date of this prospectus, net proceeds of approximately $9 million from our initial public offering (“IPO”) and

net proceeds of approximately $1 million from the exercise of the over-allotment option were transferred from our company to the PRC

subsidiaries in June and July 2021, respectively, as intercompany loans. Please see “Parent Company Statements of Cash Flows”

in Note 21 (Condensed Financial Information of the Parent Company) to the audited financial statements included in our Annual Report

on Form 20-F filed with the SEC on February 10, 2023. The inter-company transfers are reflected on the line labelled “Cash lent

to subsidiaries and VIE,” In the reporting periods presented in this Prospectus, no dividends or distributions of a subsidiary

has been made to us. For the foreseeable future, we intend to use earnings for research and development, to develop new products and

to expand its production capacity. As a result, we do not expect to pay any cash dividends.

4.

Our PRC subsidiaries’ ability to distribute dividends is based upon their distributable earnings. Current PRC regulations permit

our PRC subsidiaries to pay dividends to their respective shareholders only out of their accumulated profits, if any, determined in accordance

with PRC accounting standards and regulations. In addition, each of our PRC subsidiaries is required to set aside at least 10% of its

after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of each of their registered capitals.

These reserves are not distributable as cash dividends.

To

address persistent capital outflows and the RMB’s depreciation against the U.S. dollar in the fourth quarter of 2016, the People’s

Bank of China and the State Administration of Foreign Exchange, or SAFE, have implemented a series of capital control measures in the

subsequent months, including stricter vetting procedures for China-based companies to remit foreign currency for overseas acquisitions,

dividend payments and shareholder loan repayments. The PRC government may continue to strengthen its capital controls and our PRC subsidiaries’

dividends and other distributions may be subject to tightened scrutiny in the future. The PRC government also imposes controls on the

conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. Therefore, we may experience difficulties

in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from our profits,

if any. Furthermore, if our PRC subsidiaries incur debt on their own in the future, the instruments governing the debt may restrict their

ability to pay dividends or make other payments.

In

addition, the Enterprise Income Tax Law and its implementation rules provide that a withholding tax at a rate of 10% will be applicable

to dividends payable by Chinese companies to non-PRC-resident enterprises unless reduced under treaties or arrangements between the PRC

central government and the governments of other countries or regions where the non-PRC resident enterprises are tax resident. Pursuant

to the tax agreement between Mainland China and the Hong Kong Special Administrative Region, the withholding tax rate in respect to the

payment of dividends by a PRC enterprise to a Hong Kong enterprise may be reduced to 5% from a standard rate of 10% upon the satisfaction

of certain requirements. However, if the relevant tax authorities determine that our transactions or arrangements are for the primary

purpose of enjoying a favorable tax treatment, the relevant tax authorities may adjust the favorable withholding tax in the future. Accordingly,

there is no assurance that the reduced 5% withholding rate will apply to dividends received by our Hong Kong subsidiary from our PRC

subsidiaries. This withholding tax will reduce the amount of dividends we may receive from our PRC subsidiaries. We have not yet made

any application for such favorable tax treatment as of the date of this prospectus supplement and there is no assurance that the reduced

5% will apply to dividends received by our Hong Kong subsidiary from our PRC subsidiary. See “Risk Factors — We may rely

on dividends and other distributions on equity paid by our PRC subsidiary to fund any cash and financing requirements we may have, and

any limitation on the ability of our PRC subsidiary to make payments to us could have a material and adverse effect on our ability to

conduct our business.”

The

date of this prospectus supplement is March 30, 2023.

TABLE

OF CONTENTS

PROSPECTUS

SUPPLEMENT

PROSPECTUS

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement is part of a registration statement on Form F-3 that we filed with the United States Securities and Exchange Commission

(the “SEC”) using a “shelf” registration process. Under this shelf registration process, should the selling stockholders

choose to do so, they may, over time, offer and sell the shares described in this prospectus in one or more offerings or resales. This

prospectus provides a general description of the shares. Each time any of the selling stockholders offer and sell any of the shares described

herein, the selling stockholders may provide a prospectus supplement that will contain specific information about the terms of that offering.

Any prospectus supplement may also add to, update or change the information contained in this prospectus. If there is any inconsistency

between the information in this prospectus and any applicable prospectus supplement, you should rely on the information in the applicable

prospectus supplement. Please carefully read this prospectus, any applicable prospectus supplement and any free-writing prospectus together

with the information contained in the documents we refer to under the headings “Where You Can Find More Information” and

“Information Incorporated by Reference.”

We have not authorized anyone to provide any information

or to make any representations other than those contained or incorporated by reference in this prospectus or any applicable prospectus

supplement prepared by or on behalf of us or to which we have referred you. We take no responsibility for, and can provide no assurance

as to the reliability of, any other information that others may give you. You should not assume that the information in this prospectus

or any applicable prospectus supplement to this prospectus is accurate as of any date other than the date on its respective cover page,

or that any information we have incorporated by reference is accurate as of any date other than the date of the documents incorporated

by reference. Our business, financial condition, results of operations and prospects may have changed since those dates. This prospectus

incorporates by reference, and any applicable prospectus supplement or free writing prospectus may contain and incorporate by reference,

market data and industry statistics and forecasts that are based on independent industry publications and other publicly available information.

Although we believe these sources are reliable, we do not guarantee the accuracy or completeness of this information and we have not

independently verified this information. In addition, the market and industry data and forecasts that may be included or incorporated

by reference in this prospectus, any applicable prospectus supplement or any applicable free writing prospectus may involve estimates,

assumptions and other risks and uncertainties and are subject to change based on various factors, including those discussed under the

heading “Risk Factors” below, any applicable prospectus supplement and any applicable free writing prospectus, and under

similar headings in other documents that are incorporated by reference into this prospectus. Accordingly, investors should not place

undue reliance on this information.

COMMONLY

USED DEFINED TERMS

Except

as otherwise indicated by the context and for the purposes of this prospectus supplement only, references in this prospectus supplement

to:

| |

● |

“Bon

Natural Life,” “the Company,” “we,” “us,” “our company” or “our”

are to Bon Natural Life Limited a Cayman Islands exempted company, its subsidiaries and its consolidated affiliated entities. |

| |

|

|

| |

● |

“China”

or the “PRC” are to the People’s Republic of China, including Hong Kong and Macau, and excluding, for the purposes

of this prospectus supplement only Taiwan. |

| |

|

|

| |

● |

“Operating

subsidiaries” or “PRC subsidiaries” are to Xi’an App-Chem Bio(Tech) Co., Ltd., a PRC company, and its subsidiary

entities incorporated in the PRC. |

| |

|

|

| |

● |

“Ordinary

shares” or “Shares” are to our ordinary shares, par value $0.0001 per share; |

| |

|

|

| |

● |

“RMB,”

“Renminbi” “Yuan,” or “¥” are to the legal currency of the People’s Republic of China; |

| |

|

|

| |

● |

“Tea

Essence” are to Tea Essence Limited, our direct wholly owned subsidiary incorporated in Hong Kong. |

| |

|

|

| |

● |

“US$,”

“U.S. dollars,” “$,” or “dollars” are to the legal currency of the United States; |

| |

|

|

| |

● |

“WFOEs”

is to Xi’an Cell and Molecule Information Technology Limited and Xi’an Youpincui

Biotechnology Co., Ltd.

|

| |

● |

“Xi’an

App-Chem” are to Xi’an App-Chem Bio(Tech) Co., Ltd., an entity incorporated in the PRC or, depending on the context,

Xi’an App-Chem Bio(Tech) Co., Ltd. and its subsidiaries |

| |

|

|

| |

● |

“Xi’an

CMIT” are to Xi’an Cell and Molecule Information Technology Limited, one of our Wholly Foreign-Owned Enterprises incorporated

in the PRC |

| |

|

|

| |

● |

“Xi’an

Youpincui” are to Xi’an Youpincui Biotechnology Co., Ltd., another of our Wholly Foreign-Owned Enterprises incorporated

in the PRC |

Our

reporting currency is the U.S. Dollar. The functional currency of Xi’an App-Chem and of our operating subsidiaries in the PRC is

the Renminbi. See “Prospectus Supplement Summary—Business Overview.”

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement contains forward-looking statements that involve risks and uncertainties. We use words such as anticipate, believe,

plan, expect, future, intend and similar expressions to identify such forward-looking statements. The actual results could differ materially

from our forward-looking statements. Our actual results are most likely to differ materially from those anticipated in these forward-looking

statements for many reasons, including the risks faced by us described under the caption “Risk Factors” and elsewhere in

this prospectus supplement. This prospectus supplement also contains certain data and information that we obtained from various government

and private publications. Statistical data in these publications also include projections based on a number of assumptions. The Chinese

nutritional and dietary supplements market may not grow at the rate projected by market data, or at all. Failure of this market to grow

at the projected rate may have a material and adverse effect on our business and the market price of our Ordinary Shares. In addition,

the rapidly changing nature of the nutritional and dietary supplements industry results in significant uncertainties for any projections

or estimates relating to the growth prospects or future condition of our market. Furthermore, if any one or more of the assumptions underlying

the market data are later found to be incorrect, actual results may differ from the projections based on these assumptions. You should

not place undue reliance on these forward-looking statements.

Readers

are urged to carefully review and consider the various disclosures made by us in this prospectus supplement, any subsequently filed prospectus

supplement and our other filings with the SEC. This prospectus, any subsequently filed prospectus supplement and our annual and current

reports attempt to advise interested parties of the risks and factors that may affect our business, financial condition and results of

operations and prospects. The forward-looking statements made in this prospectus supplement speak only as of the date hereof and we disclaim

any obligation, except as required by law, to provide updates, revisions or amendments to any forward-looking statements to reflect changes

in our expectations or future events.

Prospectus

supplement Summary

History

and Development of the Company

We

commenced our natural products and ingredients business through Xi’an App-Chem Bio(Tech) Co., Ltd. (“Xi’an App-Chem”),

a corporation formed in the People’s Republic of China in April of 2006. On April 23, 2006, Xi’an App-Chem received its Business

License (Registration No.: 6101012116403) from the Xi’an Administration for Industry and Commerce.

On

December 11, 2019, Bon Natural Life Limited was incorporated under the laws of the Cayman Islands as our offshore holding company to

facilitate financing and offshore listing. Bon Natural Life Limited subsequently established a Wholly Foreign-Owned Enterprise (“WOFE”)

in PRC China, Xi’an CMIT Information and Technology Co., Ltd. (“Xi’an CMIT”). Xi’an CMIT is wholly owned

by our direct subsidiary in Hong Kong, Tea Essence.

Initial

Public Offering

On

June 28, 2021, the Company closed its initial public offering (“IPO”) of 2,200,000 ordinary shares, par value US$0.0001 per

share at a public offering price of $5.00 per share, and the Company’s ordinary shares started to trade on the Nasdaq Capital Market

under the ticker symbol “BON” since June 24, 2021. On July 2, 2021, the underwriters exercised its over-allotment option

to purchase an additional 330,000 shares, par value US$0.0001 per share at the price of $5.00 per share. Gross proceeds of the Company’s

IPO, including the proceeds from the sale of the over-allotment shares, totaled $12.65 million,

before deducting underwriting discounts and other related expenses, resulting in net proceeds of approximately $11.3 million.

The

following diagram illustrates our corporate structure as of the date of this prospectus supplement:

We

are a company incorporated under the laws of the Cayman Islands, we conduct substantially all of our operations in China, and substantially

all of our assets are located in China. In addition, all our senior executive officers reside within China for a significant portion

of the time and most are PRC nationals. As a result, it may be difficult for our shareholders to effect service of process upon us or

those persons inside China. In addition, China does not have treaties providing for the reciprocal recognition and enforcement of judgments

of courts with the Cayman Islands and many other countries and regions. Therefore, recognition and enforcement in China of judgments

of a court in any of these non-PRC jurisdictions in relation to any matter not subject to a binding arbitration provision may be difficult

or impossible. Shareholder claims that are common in the United States, including securities law class actions and fraud claims, generally

are difficult to pursue as a matter of law or practicality in China. Please see “Risk Factor — You may experience difficulties

in effecting service of legal process, enforcing foreign judgments or bringing actions in China against us or our management named in

the prospectus based on foreign laws.” In addition, Cayman Islands companies may not have standing to initiate a shareholder

derivative action in a federal court of the United States. There is no statutory recognition in the Cayman Islands of judgments obtained

in the United States, although the courts of the Cayman Islands will in certain circumstances recognize and enforce a non-penal judgment

of a foreign court of competent jurisdiction without retrial on the merits.

The

structure of cash flows within our organization, and the applicable regulations, are as follows:

| |

1. |

Our

equity structure is a direct holding structure, that is, the overseas entity listed in the U.S., Bon Natural Life, directly controls

Xi’an CMIT and Xi’an Youpincui (the “WFOEs”) and other domestic operating entities through the Hong Kong

company, Tea Essence. See “Corporate History and Structure” above for additional details. |

| |

|

|

| |

2. |

Within

our direct holding structure, the cross-border transfer of funds within our corporate group is legal and compliant with the laws

and regulations of the PRC. After foreign investors’ funds enter Bon Natural Life following an offering of securities, the

funds can be directly transferred to Tea Essence, and then transferred to subordinate operating entities through the WFOEs. |

| |

|

|

| |

|

If

we distribute dividends, we will transfer the dividends to Tea Essence in accordance with the laws and regulations of the PRC, and

then Tea Essence will transfer the dividends to Bon Natural Life, and the dividends will be distributed from Bon Natural Life to

all shareholders respectively in proportion to the shares they hold, regardless of whether the shareholders are U.S. investors or

investors in other countries or regions. |

| |

|

|

| |

3. |

As

of the date of this prospectus supplement, net proceeds of approximately $9 million from our initial public offering (“IPO”)

and net proceeds of approximately $1 million from the exercise of the over-allotment option were transferred from our company to

the PRC subsidiaries in June and July 2021, respectively, as intercompany loans. Please see “Parent Company Statements of Cash

Flows” in Note 21 (Condensed Financial Information of the Parent Company) to the audited financial statements included in our

Annual Report on Form 20-F filed with the SEC on February 10, 2023. The inter-company transfers are reflected on the line labelled

“Cash lent to subsidiaries and VIE,” In the reporting periods presented in this prospectus supplement, no dividends or

distributions of a subsidiary have been made to us. For the foreseeable future, we intend to use earnings for research and development,

to develop new products and to expand its production capacity. As a result, we do not expect to pay any cash dividends. |

| |

|

|

| |

4. |

Our

PRC subsidiaries’ ability to distribute dividends is based upon their distributable earnings. Current PRC regulations permit

our PRC subsidiaries to pay dividends to their respective shareholders only out of their accumulated profits, if any, determined

in accordance with PRC accounting standards and regulations. In addition, each of our PRC subsidiaries is required to set aside at

least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such reserve reaches 50% of each of their

registered capitals. These reserves are not distributable as cash dividends. See “Regulations Relating to Dividend Distributions”

for more information. |

To

address persistent capital outflows and the RMB’s depreciation against the U.S. dollar in the fourth quarter of 2016, the People’s

Bank of China and the State Administration of Foreign Exchange, or SAFE, have implemented a series of capital control measures in the

subsequent months, including stricter vetting procedures for China-based companies to remit foreign currency for overseas acquisitions,

dividend payments and shareholder loan repayments. The PRC government may continue to strengthen its capital controls and our PRC subsidiaries’

dividends and other distributions may be subject to tightened scrutiny in the future. The PRC government also imposes controls on the

conversion of RMB into foreign currencies and the remittance of currencies out of the PRC. Therefore, we may experience difficulties

in completing the administrative procedures necessary to obtain and remit foreign currency for the payment of dividends from our profits,

if any. Furthermore, if our subsidiaries in the PRC incur debt on their own in the future, the instruments governing the debt may restrict

their ability to pay dividends or make other payments.

In

addition, the Enterprise Income Tax Law and its implementation rules provide that a withholding tax at a rate of 10% will be applicable

to dividends payable by Chinese companies to non-PRC-resident enterprises unless reduced under treaties or arrangements between the PRC

central government and the governments of other countries or regions where the non-PRC resident enterprises are tax resident. Pursuant

to the tax agreement between Mainland China and the Hong Kong Special Administrative Region, the withholding tax rate in respect to the

payment of dividends by a PRC enterprise to a Hong Kong enterprise may be reduced to 5% from a standard rate of 10%. However, if the

relevant tax authorities determine that our transactions or arrangements are for the primary purpose of enjoying a favorable tax treatment,

the relevant tax authorities may adjust the favorable withholding tax in the future. Accordingly, there is no assurance that the reduced

5% withholding rate will apply to dividends received by our Hong Kong subsidiary from our PRC subsidiaries. This withholding tax will

reduce the amount of dividends we may receive from our PRC subsidiaries.

Xi’an

App-Chem’s Operating Subsidiaries

The

table below provides a summary of Xi’an App-Chem’s operating subsidiaries (“Bon Operating Companies”) and their

primary business functions as of the date of this prospectus supplement:

| Name

of Entity | |

Date

of Incorporation | |

Place

of Incorporation | |

%

of Ownership | |

Principal

Activities |

| Bon Natural Life | |

December 11, 2019 | |

Cayman Islands | |

Parent, 100% | |

Investment holding |

| | |

| |

| |

| |

|

| Tea Essence | |

January

9, 2020 | |

Hong Kong | |

100% | |

Investment

holding |

| | |

| |

| |

| |

|

| Xi’an CMIT | |

April 9, 2020 | |

Xi.an City, PRC | |

100% | |

WFOE, Investment holding |

| | |

| |

| |

| |

|

| Xi’an Youpincui | |

September 8, 2021 | |

Xi.an City, PRC | |

100% | |

WFOE, Investment holding |

| | |

| |

| |

| |

|

| PRC Subsidiaries: |

| Xi’an App- Chem

Bio (Tech) | |

April 23, 2006 | |

Xi’an City, PRC | |

100% owned by WFOEs | |

General administration

and sales of the Company’s products to customers |

| Bon Operating

Companies (owned by Xi’an App-Chem) | |

| |

| |

|

| App-Chem Health | |

April 17, 2006 | |

Tongchuan City, PRC | |

100% owned by Xi’an

App-Chem | |

Registered owner of land

with an area of 12,904.5 square meters, no other business activities |

| App-Chem Ag-tech | |

April 19, 2013 | |

Dali County, PRC | |

100% owned by Xi’an

App-Chem | |

Product manufacturing |

| Xi’an YH | |

September 15, 2009 | |

Xi.an City, PRC | |

100% owned by Xi’an

App-Chem | |

Research and development

of product |

| App-Chem Guangzhou | |

April 27, 2018 | |

Guangzhou City, PRC | |

100% owned by Xi’an

App-Chem | |

Raw material purchase |

| Tongchuan DT | |

May 22, 2017 | |

Tongchuan City, PRC | |

100% owned by Xi’an

App-Chem | |

Product manufacturing |

| Xi’an DT | |

April 24, 2015 | |

Xi’an City, PRC | |

75% owned by Xi’an

App-Chem | |

Research and development

of product |

| Tianjin YHX | |

September 16, 2019 | |

Tianjin City, PRC | |

51% owned by Xi’an

App-Chem | |

Raw material purchase |

| Gansu BMK | |

March 11, 2020 | |

Jiuquan City, PRC | |

100% owned by Xi’an

App-Chem | |

Product manufacturing |

All

of our actual business operations are conducted through Xi’an App-Chem and its subsidiaries. Bon Natural Life Limited (the Cayman

Islands holding company offering securities through this Prospectus), its immediate Hong Kong subsidiary Tea Essence, and Tea Essence’s

subsidiaries Xi’an CMIT and Xi’an Youpincui, function solely as holding companies.

Recent

Developments

Close

of Private Offering

On

January 17, 2023, we closed a private offering of ordinary shares and warrants to purchase ordinary shares. A total of 2,750,000 ordinary

shares (the “Shares”) were issued to a total of five (5) investors (the “Investors”) at a subscription price

of $0.80 per share, for total subscription proceeds of $2,200,000. In addition, for each share subscribed for by the Investors, we issued

one (1) warrant to purchase one (1) ordinary share at an exercise price of $0.88 per share, exercisable for a period of thirty-six

(36) months (the “Warrants”). We have agreed to register the Investors’ re-sale of the Shares by way of a prospectus

supplement to our currently effective unallocated shelf registration statement on Form F-3, (SEC File No. 333-267116). The offer and

sale of the Shares and the Warrants was exempt under Rule 506 of Regulation D under the Securities Act of 1933 (the “Securities

Act”). We engaged in no general solicitation or advertising with regard to the offering and the offering was made solely to “Accredited

Investors” as defined in Rule 501 of Regulation D under the Securities Act.

Completion

of the Initial Public Offering (“IPO”)

On

June 28, 2021, the Company closed its initial public offering (“IPO”) of 2,200,000 ordinary shares, par value US$0.0001 per

share at a public offering price of $5.00 per share, and the Company’s ordinary shares started to trade on the Nasdaq Capital Market

under the ticker symbol “BON” since June 24, 2021. On July 2, 2021, the underwriters exercised its over-allotment option

to purchase an additional 330,000 shares, par value US$0.0001 per share at the price of $5.00 per share. Gross proceeds of the Company’s

IPO, including the proceeds from the sale of the over-allotment shares, totaled $12.65 million,

before deducting underwriting discounts and other related expenses, resulting in net proceeds of approximately $11.3 million.

Acquisition

of Land Use Right for Construction of a New Manufacturing Facility

On

May 10, 2021, we acquired a land use right of 8.2 acres at cost of $267,000, through a government organized auction bidding in Yumen

City, Gansu Province of China. We have the right to use this land for 50 years until to May 9, 2071. We plan to construct a new manufacturing

facility on this land. Total budget for construction of this new manufacturing plant (“Yumen Plant”) is around $5.6 million.

The construction of Yumen Project was initially expected to be completed by October 2022. Due to resurgence of the COVID-19 pandemic,

which resulted in the implementation of significant governmental measures, including lockdowns, closures, quarantines and travel bans,

the construction work is estimated to be completed in May 2023.

Newly

formed subsidiary

On

September 8, 2021, Xi’an Youpincui Biotechnology Co., Ltd (“Xi’an Youpincui”) was formed as a Wholly Foreign-Owned

Enterprise (“WFOE”) in the People’s Republic of China (“PRC”). Tea Essence Limited, our direct wholly owned

subsidiary incorporated in Hong Kong, owns 100% equity interest in Xi’an Youpincui.

Terminating

the VIE agreements for corporate restructuring

Due

to PRC legal restrictions on foreign ownership in companies that engage in online sales China, we originally carried out our business

through Xi’an App-Chem, a domestic PRC company holding a value-added telecommunications license, through a variable interest entity

structure, because foreign investment in the value-added telecommunication services industry in China is extensively regulated and subject

to numerous restrictions. However, our online sales have historically generated minimal revenues. On September 28, 2021, our Board of

Directors approved a restructuring of our corporate structure to terminate the original VIE contractual agreements, to convert Xi’an

App-Chem from a PRC domestic company into a Sino-foreign joint venture, and to transfer 100% of the ownership interests in Xi’an

App-Chem from its original shareholders to Xi’an CMIT and Xi’an Youpincui. On October 21, 2021, Xi’an Ap-Chem’s

original shareholders signed the share transfer agreement to transfer their 100% ownership interest in Xi-an App-Chem to Xi’an

CMIT and Xi’an Youpincui. On October 22, 2021, Xi-an App-Chem completed its business license registration with PRC government and

became a Sino-foreign joint venture.

Effective

November 1, 2021, we completed the reorganization of our corporate structure in the PRC and are the indirect sole shareholder of Xi’an

App-Chem. Xi’an App-Chem is wholly-owned by two WOFEs Xi’an CMIT and Xi’an Youpincui. Each of the WOFEs are in turn

wholly-owned by Tea Essence, our direct wholly-owned subsidiary in Hong Kong. Xi’an App-Chem’s financial results are consolidated

into our consolidated financial statements in accordance with U.S. GAAP because we have control over that entity by way of 100% share

ownership through Tea Essence, and in turn, Xi’an CMIT and Xi’an Youpincui. The termination of the VIE agreements as described

above does not adversely affect our business, financial condition, and results of operations because we, together with our wholly owned

subsidiaries, are effectively controlled by the same shareholders before and after the restructuring. The restructuring is therefore

considered to be a recapitalization of entities under common control. Following the corporate restructuring, the value-added telecommunication

license held by Xi’an App-Chem has been revoked and we’re investigating other feasible ways to explore online sales business.

COVID-19

Impact

Our

business operations have been affected and may continue to be affected by the ongoing COVID-19 pandemic. Although we resumed our operations

since early March 2020 and the impact of COVID-19 on our operating results and financial performance for fiscal year 2020, 2021 and 2022

were temporary, a resurgence could negatively affect the execution of customer contracts, the collection of customer payments, or disrupt

our supply chain, and the continued uncertainties associated with COVID 19 may cause our revenue and cash flows to underperform in the

next 12 months from the date of issuance of our 2022 consolidated financial statements. The extent of the future impact of the COVID-19

pandemic on our business and results of operations is still uncertain.

Business

Overview

Xi’an

App-Chem’s business focuses on the manufacturing of personal care ingredients, such as plant extracted fragrance compounds to perfume

and fragrance manufacturers, natural health supplements such as powder drinks and bioactive food ingredient products mostly used as food

additives and nutritional supplements by its customers. Xi’an App-Chem is devoted to providing high quality and competitive prices

and a stable supply of products and services for the functional food, personal care, natural medicine and other industries. It provides

these products and services for third party customers, as well as for its own proprietary brands. With “nourish life with natural

essence” as the business concept, and “becoming an innovator (leader) of natural functional ingredients and an integrated

supplier of great health industry” as the goal, after more than 16 years of efforts, Xi’an App-Chem has formed four technology

platforms respectively for natural product large-scale separation, natural product safety improvement, natural product activity enhancement,

and natural product function compounding. Its products have not been approved as effective in treating or preventing any health conditions

and/or diseases by a regulatory agency in the PRC.

We

were co-founded by a team of top-level executives from China’s domestic natural products industry, together with experts returned

from overseas. For the past 10 years, we have focused on the core needs of the natural products industry, emphasizing technological innovation

and supply chain integration. We are devoted to providing a stable supply of high-quality products and services at competitive prices

for the functional food, personal care, cosmetic and pharmaceutical industries. “Nourish life with natural essence” is our

business concept, and “Becoming an innovative leader of natural functional ingredients and an integrated supplier for the health

industry” is our goal. We have formed four technology platforms as follows:

| |

1. |

Commercial

scale natural ingredient extraction and separation platform built with technologies such as continuous dynamic extraction and molecular

distillation and membrane separation (“Technical Platform 1”); |

| |

2. |

Natural

extraction safety improvement and assurance platform designed with technology to remove heavy metal, pesticide, and other harmful

residues (“Technical Platform 2”); |

| |

|

|

| |

3. |

Platform

of bioactive ingredient of natural extract enhancement built with technology seeking to increase human absorption rate of naturally

extracted ingredients by increasing their water solubility and utilizing drug delivery system (“Technical Platform 3”);

and |

| |

|

|

| |

4. |

Natural

extract formulation technology platform based on steady state technology with focus on formulation of natural anti-oxidant and functional

oligosaccharide to achieve stable output, high purity and absorption rate (“Technical Platform 4”). |

The

four technical platforms are utilized throughout the production process of our products with applications illustrated as follows:

Technical

Platform 1. Commercial scale natural ingredient extraction and separation platform:

| |

● |

Clary

Sage concrete is produced by continuous countercurrent extraction, from clary sage; |

| |

● |

Sclareol

is produced by molecular distillation separation from clary Sage concrete; |

| |

● |

Stachyose

is produced by biological enzymatic hydrolysis-membrane method efficient and continuous separation from stachys affinis; and |

| |

● |

Apple

polyphenol is produced with high-efficiency membrane separation from apples. |

Technical

Platform 2. Natural extraction safety improvement and assurance platform:

| |

● |

Solvent

residues are removed in the process of producing ambroxide and Sclareolides with purity in order to maintain aroma

when used in fragrance products; |

| |

● |

Carbendazim

and other pesticide residues are removed in the process of producing apple polyphenols to parts per billion (“PPB”)

level in accordance to applicable food safety regulations; and |

| |

● |

Heavy

metals and other metal ions are removed in producing stachyose and the ash content is as low as 0.01%, for product safety

purpose, while improving product quality and flavor. |

Technical

Platform 3. Bioactive ingredient of natural extract enhancement

| |

● |

Mainly

used in dietary supplement products currently in early commercial development stage with applications of technology such as water

solubility enhancement and drug delivery system to seek higher absorption rate by human and to yield with more active ingredients. |

Technical

Platform 4. Natural extract formulation technology platform

| |

● |

Mainly

used in dietary supplement products currently in early commercial development stage with applications of technology such as molecule

steady state technology and anti-oxidants to seek consistent product quality and extended shelf life. |

With

the combination and application of the above technology platforms, we seek to produce products with high quality assurance.

In

addition, based on our technology for rehabilitation of the human microbiome, cell death regulation, and anti-aging product development,

we are able to provide products and services advantageous in terms of cost, safety, performance, function and other aspects for customers

in the food, personal care, cosmetics and pharmaceutical industries.

The

services provided to our customers include customized product development and formulation and after-sale and technical support. These

services are value-added provided to our customers to enhance customer loyalty and our competitiveness in the marketplace.

Product

Categories

Fragrance

compounds:

| |

● |

Clary

sage extract products (Sclareol, Sclareolide, Ambroxide, Clary Sage Oil, Clary Sage Concrete); |

| |

|

|

| |

● |

Lavender

essential oil; |

While

some perfumers may still use the expensive and hard-to-find substance ambergris, which is produced in the intestines of sperm whales,

the industry now increasingly uses a substance known as “ambroxide,” synthesized from the compound “sclareol”

found in clary sage plant. Ambroxide is used both as a fragrance and as a “fixative” for making scents linger longer in products.

Made by our proprietary microbial fermentation process and molecular distillation technology, our ambroxide products are produced with

higher purity and yield than industry average. Based on product testing reports, we have determined that our ambroxide products are produced

with 99.5% purity and above, while the industry average is approximately 99.0%. The yield of our ambroxide production is approximately

63%. Our management believes the industry average yield for ambroxide production to be approximately 40% to 43%.

Health

supplements (natural, functional active ingredients for powder drinks):

Based

on our accumulations in natural functional components separation, biological activity research, product application development, natural

product supply chain and other areas, we are able to provide a host of solutions for functional food (health products, nutrients, etc.),

functional personal care products (whitening, moisturizing, anti-acne, etc.), natural medicine and other needs, including formulation

development, ingredients supply, and product OEM. In addition, we have launched new over-the-counter products, including Bon Natural

Micro-eco Hair Repair Shampoo; Tianmei Jinghao Nutrition Powder. We are also in the development stage of more innovative products

using natural, functional ingredients intended for the precise regulation and control of the humane micro-biome. Examples include our

DuiJiuDangGe (JiuGe) and Gout Ease (Feng Qing Ping). Our products have not been approved as effective in treating

or preventing any health conditions and/or diseases by a regulatory agency in the PRC.

Bioactive

food ingredients:

| |

● |

Stachyose

(P60, P70, P80) |

| |

|

|

| |

● |

Milk

thistle extracts (various solvent Silymarin, Silybin, Water-soluble silymarin and silybin); |

| |

|

|

| |

● |

Apple

extracts (Apple polyphenol, Apple dietary fiber, Phloridzin, Phloretin) |

| |

|

|

| |

● |

Pomegranate

extract products (Ellagic acid, Punicalagin,Urolithin) |

Aside

from macronutrients such as carbohydrates, proteins, and fatty acids, the term “bioactive food ingredients” refers to natural

compounds, mainly from plant foods, with specific physiological functions. These include flavonoids, phenolic acids, organic sulfides,

terpenoids and carotenoids, coenzyme Q, γ-aminobutyric acid, melatonin, and L-carnitine and other biologically active ingredients

derived from animal food. These ingredients are believed to participate in the regulation of physiology and pathophysiology, such that

food containing these ingredients is believed to have specific functions in addition to basic nutrition.

Our

biologically active food ingredients and their main uses are as follows:

1.

Apple polyphenol: widely used in high-end personal care products such as weight loss, blood lipid reduction, anti-aging beauty, whitening,

anti-wrinkle and other high-end personal care products.

2.

Stachyose: Stachyose is a prebiotic, which can promote the proliferation of human intestinal probiotics. It is widely used in dairy products,

health drinks, personal care, health care products, ice cream, Chinese medicine, and other industries.

3.

Milk thistle extract: A flavonoid derived from the plant milk thistle. It is known to have (but has not been scientifically proven to

have) liver protection, anti-inflammatory, anti-tumor and blood pressure effects. It is used to seek to improve liver diseases caused

by alcohol and environmental toxins.

4.

Pomegranate extract: A plant-extracted polyphenol with potential effects of anti-oxidation, anti-aging, blood pressure lowering and whitening

effects, and can be used in food, medicine and cosmetics.

Xi’an

App-Chem’s Manufacturing Process

Xi’an

App-Chem’s health supplements (powder drinks) are made with naturally extracted active ingredients. For example, stachyose is a

single prebiotic, which seeks to accelerate proliferation of bacillus bifidus. Used together with other prebiotic bacteria, it helps

greatly in adjusting intestinal bacteria groups, relieving constipation and keeping intestines youthful and perpetually healthy. Xi’an

App-Chem’s quality control is throughout the entire production and starts souring from the farms with superior quality. The first

step is anti-degradation extraction with a special protective agent followed by continuous resin chromatographic separation and purification

to produce high purity stachyose.

Xi’an

App-Chem’s fragrance compound products are plant-based natural extracts widely used as fixatives in fragrance, detergent, health

supplements and tobacco flavoring. There are three different products being produced along our proprietary manufacturing process, Sclareol,

Sclareolide and Ambroxide. Our manufacturing process of clary sage products can be summarized as: i) continuous countercurrent extraction

to ensure faster, more efficient and higher yield than traditional extraction methods; ii) molecular distillation to improve evaporation

velocity, and liquid film distribution as well as to reduce heating time and degradation of thermo-sensitive materials; iii) biological

transformation with water as media, thus no chemical or heavy metal residues; followed by catalytic reduction; and iv) supramolecular

crystal reconstruction to produce our fine ambroxide for use in fragrance or detergent fixatives.

An

example of our bioactive food ingredients is apple polyphenols, which are major antioxidants extracted from apples and may contribute

to color, flavor, odor and oxidative stability. Therefore, apple polyphenols are widely used in various applications, including health

supplements, cosmetics, and food preservation. Our proprietary manufacturing process of apple polyphenols principally involves the following

steps: continuous anti-oxidant extraction, and continuous resin chromatographic separation and purification.

Intellectual

Property - Patents

As

a result of Xi’an App-Chem’s collection of academic and technological expertise, as of the date of this prospectus supplement,

it had 12 approved patents and 3 applying patents in China.

Key

Suppliers and Customers

Xi’an

App-Chem enjoys a broad network of raw materials suppliers and customers and distributors. Its relationships with its customers and suppliers

are based on standardized terms for the supply of specific products with a specific ingredient purity, referred to as content %. Payment

terms are a mixture of cash on delivery and a specifically-agreed maximum days payable outstanding

The

principal raw materials used for our production are various natural and plant-based extracts. For the years ended September 30, 2022,

four suppliers accounted for approximately 24.6%, 15.0%, 11.9% and 10.7% of the total purchases, respectively.

For the year ended September 30, 2021, two suppliers accounted for approximately 30.1% and 13.4% of the total purchases,

respectively. For the year ended September 30, 2020, two suppliers accounted for approximately 28.9% and 28.8% of

the total purchases, respectively. A change in suppliers, however, could cause a delay in manufacturing and a possible loss of sales,

which would adversely affect our business, financial position and results of operations.

We

sell our products primarily through direct distributors in the PRC and to some extent, the overseas customers in Europe. For the year

ended September 30, 2022, three customers accounted for 35.5%, 23.9% and 15.4% of the Company’s total

revenue, respectively. For the year ended September, 2021, two customers accounted for 35.5% and 26.1% of the Company’s

total revenue, respectively. For the year ended September 30, 2020, three customers accounted for 29.0%, 27.2% and 14.1% of

the Company’s total revenue, respectively.

Market

Focus — Raw Materials and Ingredients and Functional Health

Our

product sales are carried out by two teams within our sales department – Raw Materials and Ingredients and Functional Health. Its

Raw Material Ingredients Team sells natural active ingredients such as stachyose, apple polyphenol, Ambroxide, and others to customers

in the functional food and personal care industries, accounting for around 70% of the company’s total sales. The Functional Health

Team focuses on human micro-biome adjustment and control products, providing small and medium-sized customers in the Chinese domestic

Big Health industry with one-stop solutions from product design, research and development, and procurement to OEM in digestive health,

metabolic health, immune health and other fields. The Functional Health Team accounts for about 30% of the company’s overall business.

Xi’an App-Chem’s marketing efforts are focused in two areas – the international market and the domestic Chinese market.

The international market is dominated by raw materials and ingredients, while the domestic market is primarily focused on functional

health.

Our

raw materials and ingredients businesses are promoted through exhibitions, professional journals, academic conferences, and social platforms

(social broadcasting), with academic promotion of professional knowledge and general scientific knowledge being the main methods. Xi’an

App-Chem is committed to promoting and maintaining its brand image in the natural ingredients industry. Its brands and slogans, such

as App-Chem, App-Chem Stachyose for Healthy Digestion in China (“天美水苏糖,健康中国肠”),

App-Chem Cares Life (“天然至美呵护生命至美”). are well recognized

and widely praised in the industry. Xi’an App-Chem has established a strong and widely known reputation in the international natural

products industry, especially in the field of micro-biome health.

Our

functional health business focuses on adjustment and control of the micro-biome and focuses on immune health and digestion health as

the target market. Xi’an App-Chem promotes itself through exhibition, social platforms (stachyose social broadcasting), and Internet

promotions (Ning Xiang Tang Nutrition Powder, and Tianmei Jinghao Nutrition Powder). Through continuous efforts, Xi’an App-Chem

has established a sound reputation in the Great Health industry and has become a preferred supplier for several leading clients both

at home and abroad.

Leading

Competitors

Our main competitors are suppliers of functional

ingredients, nutrition food, and traditional Chinese medicine functional food in the Big Health industry. They are:

QHT-

a leading probiotics supplier in China

Quantum

Hi-Tech (China) Biotechnology Co., Ltd., publicly listed in 2010, is a national hi-tech enterprise committed to micro-ecology health.

As a leading enterprise in the micro-ecological health industry, Quantum Bio has brands like Oligo, and Sheng He Tang, and operates the

largest production site of oligosaccharide in China. QHT focuses on the field of probiotics with products like oligosaccharide and galactooligosaccharide,

which can regulate intestinal microecological balance in dual manner by stimulating beneficial bacteria and inhibiting harmful bacteria.

These products have been identified by the Public Nutrition and Development Center of the Macro Economy Institution of the National Development

and Reform Commission as advocacy products of nutrition and health, and emerging products with wide-ranging and promising applications.

In 2013, Forbes China included QHT in its Top 200 Listed Small- and Medium-sized Asian Enterprises. QHT and its logo are a well-known

trademark in China. As of March 2020, QHT’s total market value reached US $1 billion.

Chenguang

Biotech (CCGB)- a leading natural ingredients supplier in China

Chenguang

Biotech Group Co., Ltd., another publicly listed company, has twenty subsidiaries and is an export- and foreign-exchange-generation-oriented

enterprise which integrates intensive processing of agricultural products and extract of natural plants. It mainly develops and produces

natural colors, natural spice extracts and essential oils, natural nutrition and medicinal extracts, and protein oils. Among its products,

the production and sales volume of natural colors is the highest in China, and that of capsanthin the highest in the world. Its chili

extracts account for over 85% of total domestic output for that product. Its lutein, beet red and other varieties occupy a significant

share of world production. As of March 2020, the total market value of Chenguang Biotech Group Co., Ltd. reached ¥ 4.7 billion.

Tong

Ren Tang- a leading producer of traditional Chinese medicine and health products in China

Beijing

Tong Ren Tang (Group) Co., Ltd., a wholly state-owned company, is authorized by the municipal government to operate state-owned assets.

It was founded in 1669, with a history of 343 years. The group adheres to the development strategy of “taking modern traditional

Chinese medicine as the core, developing life and health industry, and becoming an internationally renowned modern traditional Chinese

medicine group”. It takes “growing, strengthening and expanding” as its policy, and takes innovation and technology

as its mission. Its sales revenue, profits, export earnings and the number of overseas terminals rank first in the industry in China.

Since 1997, Tong Ren Tang has maintained sustained and healthy development, with its economic indicators reaching double-digit growth

for 15 consecutive years, doubling every five years. As of 2011, the group has a total asset of ¥14 billion, a sales revenue of ¥16.3

billion, a profit of ¥1.316 billion, and foreign exchange earnings of $33.92 million. It has set up 64 pharmacies and 1 overseas

production and research base in 16 overseas countries and regions. Its products are sold to more than 40 overseas countries and regions.

At

the same time, Tong Ren Tang’s dual function of being both an economic entity and a cultural carrier has become increasingly apparent.

It has achieved fruitful results in brand maintenance and promotion, cultural innovation and inheritance. The “Tong Ren Tang traditional

Chinese medicine culture” has been approved as one of the first items to be included in the List of National Intangible Cultural

Heritage. It has signed a strategic cooperation framework agreement with the Confucius Institute Headquarters (Hanban) to jointly promote

Tong Ren Tang traditional Chinese medicine culture and has further strengthened the overseas dissemination of Tong Ren Tang Culture by

using the Confucius Institute platform. As of March 2020, Tong Ren Tang’s total market value reached ¥ 34.3 billion.

BY-HEALTH-

a leading supplier of nutrients by indirect selling in China

Founded

in October 1995, BY-HEALTH introduced dietary supplements into China’s indirect selling market systematically in 2002. It has since

grown rapidly into a leading brand and benchmark enterprise of dietary supplements in China. In August 2010, Yao Ming, the former international

basketball superstar, signed contract to become its brand ambassador. On December 15, 2010, BY-HEALTH was listed on the Growth Enterprise

Market (GEM) of Shenzhen Stock Exchange.

For

more than a decade, BY-HEALTH has been adhering to differentiated global quality strategy in three steps, namely, from global raw materials

procurement, to establishment of its global base for the sole purpose of supplying raw materials, and then to the establishment of a

global self-owned organic farm. So far, BY-HEALTH has sources of raw materials from 23 countries and regions worldwide. It has set up

5 exclusive raw materials bases in Brazil, Australia and other places. Now, its own organic farms are under planning. BY-HEALTH will

make unremitting efforts to select high-quality raw materials from all over the world, bringing together the essence of nutrition, and

building a “United Nations” of nutrients that selects the best from the better. As of March 2020, the total market value

of BY-HEALTH reached ¥ 27.2 billion.

Development

and Expansion Strategy

The

key components of our development and expansion strategy over the next two-to-three years are as follows:

Raw

Material and Ingredients

Using

our current projects as a foothold, we intend to expand our plants to increase productivity and enlarge our markets to ensure sustainable

growth. Over the next two to three years, our raw materials and ingredients business will be centered on the Great Health market and

focus on the core needs of the functional food and personal care industries. We view our current business in this area as foundation

from which we can expand our plants, increase our productivity, improve our technology and equipment, optimize our supply chain, and

broaden our sales channels to ensure a steady and sustainable growth. Management is committed to achieving a compound annual growth rate

in this business line of no less than 30%.

In

our functional health business, we intend a rapid expansion focused on the development and introduction of innovative new products. Over

the next two to three years, we will continue to place an intensive focus on human micro-biome health, and actively develop a series

of functional food and personal care products featuring strong and fasting-acting effects on the respiratory and gastrointestinal areas

of the human micro-biome. These products will be designed to take advantage of precise adjustment and regulation of the human micro-biome.

The quality raw materials produced by our own natural ingredients business will provide us a significant cost advantage in these efforts.

Our