ADP Reaches India - Analyst Blog

January 17 2012 - 5:15AM

Zacks

Automatic Data Processing Inc. (ADP) recently

marked its entry into the lucrative Indian market with the

acquisition of Ma Foi Consulting Solutions Ltd, an Indian human

resource and payroll management company. The acquired company was

previously a part of Ma Foi Randstad, an Indian subsidiary of

RANDSTAND HOLDINGS. Though the financial details of the deal were

not disclosed, ADP stated that it will incorporate Ma Foi’s 200

associates.

ADP will now manage Ma Foi’s extensive Indian clientele,

including both domestic and multinational companies. The

acquisition is a strategic fit for the company as it will

facilitate further expansion in developing markets. Through this

acquisition, ADP will gain access to the growing market of human

resource business process outsourcing (HR BPO) in India.

Incidentally, Ma Foi and ADP have enjoyed a healthy business

relationship since 2009 for the marketing and operations of ADP

Streamline, ADP’s multi-country payroll and human resource

service.

ADP’s growth in recent years has been largely attributable to

accretive acquisitions, for which it has spent approximately $776

million in 2011 itself. The company reported a year-over-year

increase of 11.0% in total revenue to $9.88 billion in fiscal 2011,

driven by a 4.7% growth from the acquired businesses.

Recently, ADP acquired The RightThing, a leading recruitment

process outsourcing (RPO) provider. The acquisition is expected to

expand ADP's human resources business process outsourcing portfolio

and complement the existing applicant tracking and talent

management solutions, thereby boosting ADP’s customer base and

top-line growth going forward.

Moreover, the acquisition of privately held WALLACE is expected

to further boost ADP’s tax credit solutions portfolio and expand

its customer base going forward.

We believe that the back-to-back acquisitions will drive

top-line growth for fiscal 2012 and beyond. The new acquisitions

are expected to diversify ADP’s revenue growth base, which in turn

will help the company to outperform the market, in our view.

However, increasing competition from Paychex

Inc. (PAYX) and Insperity Inc. (NSP) and

a gloomy macro outlook in North America and Europe are the major

headwinds in the near term. Additionally, higher unemployment rates

and low interest rates remain concerns for the company’s payroll

processing business.

We maintain our Neutral recommendation on the stock over the

long term (6-12 months). Currently, Automatic Data Processing has a

Zacks #4 Rank, which implies a Sell rating on a short-term

basis.

AUTOMATIC DATA (ADP): Free Stock Analysis Report

INSPERITY INC (NSP): Free Stock Analysis Report

PAYCHEX INC (PAYX): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

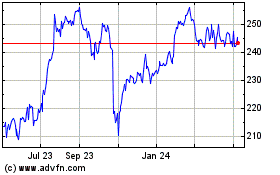

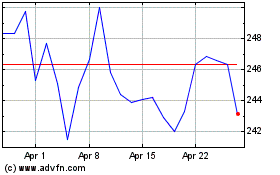

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Jul 2023 to Jul 2024