Good News for U.S. Labor Market - Analyst Blog

January 05 2012 - 4:14AM

Zacks

Positive domestic data and the resumption of Europe-centric

negative headlines will be pushing stocks in opposite directions

today. France held an overall successful bond auction, though

yields inched up a bit. But Euro-zone worries are getting focused

on the region’s banks, which need to tap the capital markets to

spruce up their battered capital positions.

The Spanish government announced that the country’s banks need

to raise €50 billion in fresh capital, while Italy’s UniCredit was

forced to offer steep discounts in its bid to raise to €7.5 billion

in equity capital. Wednesday’s modestly positive stock market

finish despite no shortage of Euro-zone issues holds promise that

the market may be able to eke out further gains today on the

strength of reassuring domestic news flow.

The focus on the domestic front shifts to the labor market

today, where we saw two better-than-expected readings this morning

in the weekly Initial Jobless Claims and the December National

Employment Report from payroll processor, Automatic Data

Processing (ADP).

The ADP report came in significantly better than expected, with

325K jobs created in December, almost double the expected 175K

level. The prior month's tally was modestly revised downwards to

204K from the originally reported 206K level. The ADP report is

supposed to serve as a preview of the official monthly jobs numbers

from the Bureau of Labor Statistics (BLS) that comes out this

Friday.

Today's ADP report is way ahead of market expectations for

private-sector jobs in Friday's BLS report. If the ADP report is

any indication of things to come on the labor market front, then we

will likely get a blockbuster number on Friday. We have to keep in

mind, though, that ADP's track record in foretelling the BLS

numbers on a month-to-month basis is less than perfect. We will

have to wait till Friday to know the forecast accuracy of today's

report. Overall, though, this report is expected to cause

expectations for Friday's BLS report to go up.

The Jobless Claims data also came in better than expected, with

initial claims dropping by 15K in the last week of 2011 to 372K.

The prior-week’s tally was increased by 6K to 387K from 381K. The

four-week average dropped by 3.2K to 373.2K.

The continued drop in Jobless Claims in recent weeks and today’s

strong ADP provide unmistakable evidence of an improving U.S. labor

market. Naysayers will likely question the unusual strength in this

morning’s ADP reading, citing similar strength in this series in

December in the last two years. In fact, the December ADP readings

were the strongest monthly gains in 2009, 2010 and now in

2011.

That said, the ADP strength is not some isolated and outlier

data that is uncorroborated by other reports. The downtrend in the

weekly claims data aside, we saw similar strength in the employ

component of the December manufacturing ISM survey. And today’s

non-manufacturing ISM report, coming out a little later, is

expected to show a similar positive trend.

The bottom line is that the strong ADP reading may be due to

seasonal corporate bookkeeping. But it nevertheless reflects the

same developments that we are seeing in other economic reports as

well.

In corporate news, we have a negative earnings

pre-announcement from Tesoro (TSO), with the

independent refiner citing a weak margin environment in

California.

The Children’s Place (PLCE) also lowered

its outlook for the fourth quarter, with aggressive markdowns and

high apparel costs weighing on earnings. Seagate

Technology (STX) guided higher, while Eastman

Kodak (EK) appears to be readying itself for a bankruptcy

filing.

AUTOMATIC DATA (ADP): Free Stock Analysis Report

EASTMAN KODAK (EK): Free Stock Analysis Report

CHILDRENS PLACE (PLCE): Free Stock Analysis Report

SEAGATE TECH (STX): Free Stock Analysis Report

TESORO CORP (TSO): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

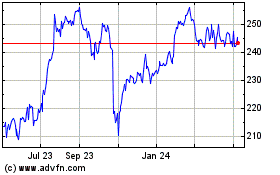

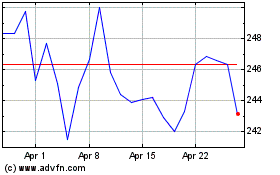

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Jun 2024 to Jul 2024

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Jul 2023 to Jul 2024