ADP Buys Asparity - Analyst Blog

September 16 2011 - 6:30AM

Zacks

Automatic Data Processing

Inc. (ADP) recently announced the

acquisition of privately held Asparity Decision Solutions. However,

financial terms of the transaction were not disclosed.

Durham, North Carolina-based

Asparity offers solutions for both employees and employers.

Asparity’s employee benefits decision support tool known as

PlanSmartChoice is currently used by more than 100,000 federal

employees, who participated in the Federal Employees Health

Benefits (FEHB) program in 2011.

Asparity boasts an enviable

clientele, including FORTUNE 1,000 companies and public-sector

employers. The company offers advanced software and technologies,

which help employers to design effective benefit strategies for

employees.

The recent health care reforms and

complex regulations related to the Patient Protection and

Affordable Care Act (PPACA) has complicated the benefit

administration of many companies. Employees are also facing

increasing difficulties in selecting the appropriate benefit plan

for themselves and their families that could maximize their

take-home salary and simultaneously reduce the cost-burden on their

employers.

We believe that the acquisition

will expand ADP’s benefits administration service offerings going

forward. ADP will be able to use Asparity’s decision support tools

and expertise in analyzing and understanding employee health care

preferences, which will in turn help the company to deliver better

solutions to its customers.

The acquisition will also broaden

the scope of ADP’s recently launched Strategic Advisory Services

group, which is expected to provide clients direct input and

analysis of the constantly changing benefits administration

process.

Our Take

ADP’s growth in recent years has

been significantly driven by accretive acquisitions. ADP made

several acquisitions in fiscal 2011, including MasterTax, Cobalt

and AdvancedMD. ADP spent approximately $776 million in new

acquisitions in 2011. The company reported a year-over-year upside

of 11.0% in revenue to $9.88 billion in fiscal 2011, driven by a

4.7% growth from the acquired businesses.

We believe the new acquisition will

drive top-line growth going forward. Moreover, we believe this

acquisition will help ADP to counter significant competition from

Paychex Inc. (PAYX) and

Insperity Inc. (NSP) going

forward.

However, a gloomy macro outlook in

North America and Europe keeps us on the sidelines for the time

being.

We maintain a Neutral rating over

the long term (6-12 months). Currently, Automatic Data Processing

has a Zacks #3 Rank, which implies a Hold rating on a short-term

basis.

AUTOMATIC DATA (ADP): Free Stock Analysis Report

INSPERITY INC (NSP): Free Stock Analysis Report

PAYCHEX INC (PAYX): Free Stock Analysis Report

Zacks Investment Research

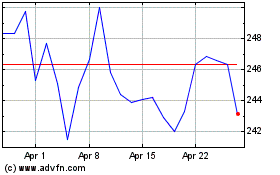

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Jul 2024 to Aug 2024

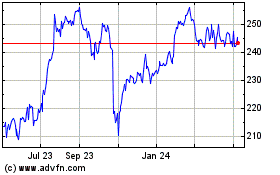

Automatic Data Processing (NASDAQ:ADP)

Historical Stock Chart

From Aug 2023 to Aug 2024