Astec Industries, Inc. (Nasdaq: ASTE) announced today its financial

results for the first quarter ended March 31, 2024.

“Despite a difficult first quarter, we remain

optimistic for the year. We anticipate Materials Solutions softness

to be offset by a strong Infrastructure Solutions market. Declines

during the first quarter in the Materials Solutions segment were

primarily due to longer product conversion cycles from rental to

buy and finance capacity constraints attributable to the

challenging interest rate environment. Infrastructure Solutions

sales were affected by supply chain delays from a specific supplier

and are expected to ship during the second quarter.” said Jaco van

der Merwe, Chief Executive Officer. “We anticipate a continuation

of challenging conditions in our Materials Solutions segment in the

first half of the year, resulting in more conversions occurring

towards the end of the year. In our Infrastructure Solutions

segment, we continue to see strong demand for asphalt and concrete

plants and project activity at the federal, state and local levels

remains robust. As we navigate these near-term headwinds, we are

focused on maintaining efficient operations and performing for our

customers while deploying our long term strategy."

Mr. van der Merwe continued, "We see additional

opportunity ahead supported by the expansion of our collaboration

with dealers to develop best-in-class aftermarket practices in both

Infrastructure Solutions and Materials Solutions and the rollout of

new products in 2024, and we will remain focused on driving margin

enhancement and working capital improvements."

| |

|

|

|

|

|

| (in millions, except

per share and percentage data) |

1Q 2024 |

|

1Q 2023 |

|

Change |

|

Net sales |

$ |

309.2 |

|

|

$ |

347.9 |

|

|

(11.1) |

% |

|

Domestic sales |

|

243.2 |

|

|

|

281.3 |

|

|

(13.5) |

% |

|

International sales |

|

66.0 |

|

|

|

66.6 |

|

|

(0.9) |

% |

| Backlog |

|

559.8 |

|

|

|

800.2 |

|

|

(30.0) |

% |

|

Domestic backlog |

|

437.8 |

|

|

|

685.7 |

|

|

(36.2) |

% |

|

International backlog |

|

122.0 |

|

|

|

114.5 |

|

|

6.6 |

% |

| Income from operations |

|

6.3 |

|

|

|

17.6 |

|

|

(64.2) |

% |

|

Operating margin |

|

2.0 |

% |

|

|

5.1 |

% |

|

(310) |

bps |

| Effective tax rate |

|

29.8 |

% |

|

|

26.7 |

% |

|

310 |

bps |

| Net income attributable to

controlling interest |

|

3.4 |

|

|

|

12.1 |

|

|

71.9 |

% |

| Diluted EPS |

|

0.15 |

|

|

|

0.53 |

|

|

71.7 |

% |

| |

|

|

|

|

|

|

Adjusted (Non-GAAP) |

|

|

|

|

|

|

Adjusted income from operations |

|

12.0 |

|

|

|

28.5 |

|

|

(57.9) |

% |

|

Adjusted operating margin |

|

3.9 |

% |

|

|

8.2 |

% |

|

(430) |

bps |

| Adjusted effective tax

rate |

|

26.0 |

% |

|

|

25.2 |

% |

|

80 |

bps |

| Adjusted net income

attributable to controlling interest |

|

7.8 |

|

|

|

20.5 |

|

|

(62.0) |

% |

| Adjusted EPS |

|

0.34 |

|

|

|

0.90 |

|

|

(62.2) |

% |

| Adjusted EBITDA |

|

18.9 |

|

|

|

35.2 |

|

|

(46.3) |

% |

|

Adjusted EBITDA margin |

|

6.1 |

% |

|

|

10.1 |

% |

|

(400) |

bps |

|

|

|

|

|

|

|

|

|

|

|

|

All comparisons are made to the prior year first

quarter:

- Net sales decreased primarily due

to fewer conversions in the Materials Solutions group, attributable

to the challenging interest rate environment and finance capacity

constraints coupled with specific supply chain delays for our

Infrastructure Solutions group. We expect market conditions to

improve as we move through 2024, supported by continued strong

demand for asphalt and concrete plants.

- Our backlog remains healthy and

continues to stabilize, supported by improvement in parts backlog

efficiency.

- Operating margin decreased 310

basis points due to a slight decrease in gross margin and increased

selling, general and administrative expenses mainly associated with

personnel-related costs partially offset by lower exhibit costs

associated with the ConExpo industry trade show held in 2023.

- The adjusted earnings income tax

expense for the three months ended March 31, 2024 was $2.7 million,

reflecting a 26.0% effective tax rate. This compared to the prior

three-month period adjusted earnings tax expense of $6.9 million,

reflecting a 25.2% effective tax rate.

- The Company reached another

milestone in our Oracle transformation to drive sustainable

profitability. On April 1, 2024, we went live in two additional

manufacturing sites, as well as with a transportation management

system.

- Adjusted net income and Adjusted

EPS exclude $4.4 million and $0.19, respectively, of incremental

costs, net of tax, primarily driven by our transformation program

initiatives to optimize our Company for long-term value

creation.

- Federal highway and pavement

contract awards increased 11% year-over-year in February 2024, as

funding for the Federal Highway Bill continues to be deployed.

Total state budgets are up 12% year-over-year in fiscal year 2024

following an 11% increase in fiscal year 2023.

- The 2024 World of Asphalt/Agg 1

trade show had record attendance with a 38% increase over the

previous record set in 2022. The Astec booth was exceptionally busy

and interest in our equipment and digital solutions was high.

Segments Results

Our two reportable segments are comprised of

sites based upon the nature of the products or services produced,

the type of customer for the products, the similarity of economic

characteristics, the manner in which management reviews results and

the nature of the production process, among other considerations.

Based on a review of these factors, our Australia and LatAm sites,

which were previously reported in the Infrastructure Solutions

segment have moved to the Materials Solutions segment and Astec

Digital, which was previously included in the Corporate and Other

category has moved to the Infrastructure Solutions segment, each

beginning January 1, 2024. Prior periods have been revised to

reflect the changes for the segment composition for

comparability.

Infrastructure Solutions - Road

building equipment, asphalt and concrete plants, thermal storage

solutions and related aftermarket parts.

- Net sales of $202.2 million

decreased 6.2% as lower equipment sales, service and equipment

installation revenue were partially offset by increased parts

sales.

- Segment Operating Adjusted EBITDA

of $25.6 million compared to $28.5 million for the same period in

the prior year primarily due to a component delay with a specific

supplier as well as manufacturing inefficiencies. Segment Operating

Adjusted EBITDA margin of 12.7% decreased 50 basis points.

Materials Solutions -

Processing equipment to crush, screen and convey aggregates and

related aftermarket parts.

- Net sales of $107.0 million decreased by 19.1% primarily due to

lower equipment sales attributable to finance capacity constraints

with contractors and dealers resulting in fewer product

conversions.

- Segment Operating Adjusted EBITDA

of $5.3 million decreased 63.7%. The decrease between periods

primarily resulted from lower net sales, manufacturing

inefficiencies and higher inventory-related costs incurred during

the period.

- Segment Operating Adjusted EBITDA

margin of 5.0% decreased 600 basis points.

Balance Sheet, Cash Flow and

Liquidity

- Our total liquidity was $170.5

million, consisting of $55.3 million of cash and cash equivalents

available for operating purposes and $115.2 million available for

additional borrowings under our revolving credit facility.

- Net cash used by operating

activities for the quarter ended March 31, 2024 was $47.0 million

to support the timing of collections of trade receivables and

inventory purchases.

- Net cash consumed by investing

activities for the three months ended March 31, 2024 was $5.9

million as compared to providing net cash of $11.8 million during

the three months ended March 31, 2023. The change was primarily due

to the cash inflows from the sale of the Tacoma facility for $19.9

million in the first quarter of 2023. Capital expenditures

decreased $2.2 million during the three months ended March 31, 2024

as compared to the same period in 2023.

- Net cash provided by financing

activities for the three months ended March 31, 2024 was $48.4

million as opposed to a net cash use of $16.2 million during the

three months ended March 31, 2023, primarily due to increased

borrowings net of repayments of $63.6 million.

First Quarter Capital

Allocation

- Capital expenditure investments to

increase capacity and improve efficiency were $5.8 million.

- Dividend payment of $0.13 per

share.

Investor Conference Call and

Webcast

Astec will conduct a conference call and live

webcast today, May 1, 2024, at 8:30 A.M. Eastern Time, to

review its first quarter financial results as well as current

business conditions.

To access the call, dial (888) 440-4118 on

Wednesday, May 1, 2024 at least 10 minutes prior to the

scheduled time for the call. International callers should dial

(646) 960-0833.

You may also access a live webcast of the call at:

https://events.q4inc.com/attendee/470717703

You will need to give your name and company

affiliation and reference Astec. An archived webcast will be

available for ninety days at www.astecindustries.com.

A replay of the call can be accessed until May

15, 2024 by dialing (800) 770-2030, or (609) 800-9909 for

international callers, Conference ID# 8741406. A transcript of the

conference call will be made available under the Investor Relations

section of the Astec Industries, Inc. website within 5 business

days after the call.

About Astec

Astec, (www.astecindustries.com), is a

manufacturer of specialized equipment for asphalt road building,

aggregate processing and concrete production. Astec's

manufacturing operations are divided into two primary business

segments: Infrastructure Solutions that includes road building,

asphalt and concrete plants, thermal and storage solutions; and

Materials Solutions that include our aggregate processing

equipment. Astec also operates a line of controls and automation

products designed to deliver enhanced productivity through improved

equipment performance.

Safe Harbor Statements under the Private

Securities Litigation Reform Act of 1995

This News Release contains forward-looking

statements within the meaning of the Securities Act of 1933, as

amended, the Securities Exchange Act of 1934, as amended, and the

Private Securities Litigation Reform Act of 1995. Such statements

relate to, among other things, income, earnings, cash flows,

changes in operations, operating improvements, businesses in which

we operate and the United States and global economies. Statements

in this News Release that are not historical are hereby identified

as "forward-looking statements" and may be indicated by words or

phrases such as "anticipates," "supports," "plans," "projects,"

"expects," "believes," "should," "would," "could," "forecast,"

"management is of the opinion," use of the future tense and similar

words or phrases. These forward-looking statements are based

largely on management's expectations, which are subject to a number

of known and unknown risks, uncertainties and other factors

discussed and described in our most recent Annual Report on Form

10-K, including those risks described in Part I, Item 1A. Risk

Factors thereof, and in other reports filed

subsequently by us with the Securities and Exchange Commission,

which may cause actual results, financial or otherwise, to be

materially different from those anticipated, expressed or implied

by the forward-looking statements. All forward-looking statements

included in this document are based on information available to us

on the date hereof, and we assume no obligation to update any such

forward-looking statements to reflect future events or

circumstances, except as required by law.

Non-GAAP Financial Measures

In an effort to provide investors with

additional information regarding the Company's results, the Company

refers to various U.S. GAAP (U.S. generally accepted accounting

principles) and non-GAAP financial measures which management

believes provides useful information to investors. These non-GAAP

financial measures have no standardized meaning prescribed by U.S.

GAAP and therefore may not be comparable to the calculation of

similar measures for other companies. Management of the Company

does not intend these items to be considered in isolation or as a

substitute for the related GAAP measures. Nonetheless, this

non-GAAP information can be useful in understanding the Company's

operating results and the performance of its core business.

Management of the Company uses both GAAP and non-GAAP financial

measures to establish internal budgets and targets and to evaluate

the Company's financial performance against such budgets and

targets. A reconciliation of these non-GAAP measures to the most

directly comparable GAAP measure is included in this News

Release.

For Additional Information

Contact: Steve Anderson Senior Vice President of

Administration and Investor RelationsPhone: (423)

899-5898 E-mail: sanderson@astecindustries.com

Certain reclassifications have been made to the

prior period financial information included in this News Release to

conform to the presentation used in the financial statements for

the three months ended March 31, 2024.

| |

|

Astec Industries Inc. |

|

Condensed Consolidated Statements of

Operations |

|

(In millions, except shares in thousands and per share

amounts; unaudited) |

| |

| |

|

Three Months Ended March 31, |

| |

|

2024 |

|

2023 |

|

Net sales |

|

$ |

309.2 |

|

|

$ |

347.9 |

|

| Cost of sales |

|

|

232.3 |

|

|

|

258.7 |

|

| Gross profit |

|

|

76.9 |

|

|

|

89.2 |

|

| |

|

|

|

|

| Operating expenses: |

|

|

|

|

| Selling, general and

administrative expenses |

|

|

71.4 |

|

|

|

67.9 |

|

| Restructuring and other asset

(gains) charges, net |

|

|

(0.8 |

) |

|

|

3.7 |

|

|

Total operating expenses |

|

|

70.6 |

|

|

|

71.6 |

|

| Income from operations |

|

|

6.3 |

|

|

|

17.6 |

|

| |

|

|

|

|

| Other expenses, net: |

|

|

|

|

|

Interest expense |

|

|

(2.7 |

) |

|

|

(2.0 |

) |

|

Other income, net |

|

|

1.1 |

|

|

|

0.9 |

|

| Income before income

taxes |

|

|

4.7 |

|

|

|

16.5 |

|

| Income tax provision |

|

|

1.4 |

|

|

|

4.4 |

|

| Net income |

|

|

3.3 |

|

|

|

12.1 |

|

| Net loss attributable to

noncontrolling interest |

|

|

0.1 |

|

|

|

— |

|

| Net income attributable to

controlling interest |

|

$ |

3.4 |

|

|

$ |

12.1 |

|

| |

|

|

|

|

| Earnings per common share |

|

|

|

|

|

Basic |

|

$ |

0.15 |

|

|

$ |

0.53 |

|

|

Diluted |

|

|

0.15 |

|

|

|

0.53 |

|

| |

|

|

|

|

| Weighted average shares

outstanding |

|

|

|

|

|

Basic |

|

|

22,762 |

|

|

|

22,656 |

|

|

Diluted |

|

|

22,835 |

|

|

|

22,743 |

|

|

Astec Industries Inc. |

|

Segment Net Sales and Operating Adjusted

EBITDA |

|

(In millions, except percentage data;

unaudited) |

| |

| Segment net sales

are reported net of intersegment sales. |

| |

Three Months Ended March 31, |

| |

Infrastructure Solutions |

|

Materials Solutions |

|

Corporate and Other |

|

Total |

|

2024 Net sales |

$ |

202.2 |

|

|

|

$ |

107.0 |

|

|

|

$ |

— |

|

|

|

$ |

309.2 |

|

|

| 2023 Net sales |

|

215.5 |

|

|

|

|

132.2 |

|

|

|

|

0.2 |

|

|

|

|

347.9 |

|

|

| Change $ |

|

(13.3 |

) |

|

|

|

(25.2 |

) |

|

|

|

(0.2 |

) |

|

|

|

(38.7 |

) |

|

| Change % |

|

(6.2 |

) |

% |

|

|

(19.1 |

) |

% |

|

|

(100.0 |

) |

% |

|

|

(11.1 |

) |

% |

| |

|

|

|

|

|

|

|

| 2024 Segment Operating

Adjusted EBITDA |

|

25.6 |

|

|

|

|

5.3 |

|

|

|

|

(12.0 |

) |

|

|

|

18.9 |

|

|

| 2023 Segment Operating

Adjusted EBITDA |

|

28.5 |

|

|

|

|

14.6 |

|

|

|

|

(7.9 |

) |

|

|

|

35.2 |

|

|

| Change $ |

|

(2.9 |

) |

|

|

|

(9.3 |

) |

|

|

|

(4.1 |

) |

|

|

|

(16.3 |

) |

|

| Change % |

|

(10.2 |

) |

% |

|

|

(63.7 |

) |

% |

|

|

(51.9 |

) |

% |

|

|

(46.0 |

) |

% |

| |

|

|

|

|

|

|

|

| 2024 Segment Operating

Adjusted EBITDA Margin |

|

12.7 |

|

% |

|

|

5.0 |

|

% |

|

|

|

|

| 2023 Segment Operating

Adjusted EBITDA Margin |

|

13.2 |

|

% |

|

|

11.0 |

|

% |

|

|

|

|

| Change bps |

|

(50 |

) |

bps |

|

|

(600 |

) |

bps |

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

We present certain non-GAAP information that can

be useful in understanding our operating results and the

performance of our core business. We use both GAAP and non-GAAP

financial measures to establish internal budgets and targets and to

evaluate financial performance against such budgets and targets. We

exclude the costs and related tax effects, which are based on the

statutory tax rate applicable to each respective item, of the

following items as we do not believe they are indicative of our

core business operations:

- Transformation program -

Incremental costs related to the execution of our ongoing strategic

transformation initiatives which may include personnel costs,

third-party consultant costs, duplicative systems usage fees,

administrative costs, accelerated depreciation and amortization on

certain long-lived assets and other similar type charges.

Transformation program initiatives include our multi-year phased

implementation of a standardized enterprise resource planning

system across the global organization and a lean manufacturing

initiative at one of our largest manufacturing sites that was

largely completed during 2023. These costs are included in "Cost of

sales" and "Selling, general and administrative expenses", as

appropriate, in the Consolidated Statements of Operations.

- Restructuring and other related

charges - Charges related to restructuring activities which

primarily include personnel termination actions and reorganization

efforts to simplify and consolidate our operations. These

activities include the termination of our previous Chief Executive

Officer, the limited overhead restructuring action implemented in

February 2023 and ongoing litigation costs for our exited Enid

location. These costs are recorded in "Restructuring, impairment

and other asset charges, net" in the Consolidated Statements of

Operations.

- Asset impairment - Asset impairment

charges, to the extent that they are experienced, are recorded in

"Restructuring, impairment and other asset charges, net" in the

Consolidated Statements of Operations.

- Gain on sale of property and

equipment, net - Gains or losses recognized on the disposal of

property and equipment that are recorded in "Restructuring,

impairment and other asset charges, net" in the Consolidated

Statements of Operations. We may sell or dispose of assets in the

normal course of our business operations as they are no longer

needed or used.

A reconciliation of total Segment Operating

Adjusted EBITDA to the Company's "Net income attributable to

controlling interest" is as follows (in millions; unaudited):

| |

|

Three Months Ended March 31, |

| |

|

2024 |

|

2023 |

|

Change $ |

|

Segment Operating Adjusted EBITDA |

|

$ |

18.9 |

|

|

$ |

35.2 |

|

|

$ |

(16.3 |

) |

| Adjustments: |

|

|

|

|

|

|

|

Transformation program |

|

|

(6.3 |

) |

|

|

(7.2 |

) |

|

|

0.9 |

|

|

Restructuring and other related charges |

|

|

(0.1 |

) |

|

|

(7.1 |

) |

|

|

7.0 |

|

|

Gain on sale of property and equipment, net |

|

|

0.9 |

|

|

|

3.4 |

|

|

|

(2.5 |

) |

| Interest expense, net |

|

|

(2.1 |

) |

|

|

(1.5 |

) |

|

|

(0.6 |

) |

| Depreciation and

amortization |

|

|

(6.5 |

) |

|

|

(6.3 |

) |

|

|

(0.2 |

) |

| Income tax provision |

|

|

(1.4 |

) |

|

|

(4.4 |

) |

|

|

3.0 |

|

| Net income attributable to

controlling interest |

|

$ |

3.4 |

|

|

$ |

12.1 |

|

|

$ |

(8.7 |

) |

|

Astec Industries Inc. |

|

Condensed Consolidated Balance Sheets |

|

(In millions; unaudited) |

| |

| |

March 31, 2024 |

|

December 31, 2023 |

| Assets |

|

|

|

| Current assets: |

|

|

|

|

Cash, cash equivalents and restricted cash |

$ |

58.1 |

|

$ |

63.2 |

|

Investments |

|

5.7 |

|

|

5.7 |

|

Trade receivables, contract assets and other receivables, net |

|

192.0 |

|

|

152.7 |

|

Inventories, net |

|

484.0 |

|

|

455.6 |

|

Other current assets, net |

|

39.0 |

|

|

42.3 |

|

Total current assets |

|

778.8 |

|

|

719.5 |

| Property, plant and equipment,

net |

|

185.0 |

|

|

187.6 |

| Other long-term assets |

|

159.2 |

|

|

152.2 |

| Total assets |

$ |

1,123.0 |

|

$ |

1,059.3 |

| |

|

|

|

| Liabilities |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

117.8 |

|

$ |

116.9 |

|

Customer deposits |

|

80.0 |

|

|

70.2 |

|

Other current liabilities |

|

112.6 |

|

|

111.9 |

|

Total current liabilities |

|

310.4 |

|

|

299.0 |

| Long-term debt |

|

125.0 |

|

|

72.0 |

| Other long-term

liabilities |

|

37.1 |

|

|

34.6 |

| Total equity |

|

650.5 |

|

|

653.7 |

| Total liabilities and

equity |

$ |

1,123.0 |

|

$ |

1,059.3 |

|

Astec Industries Inc. |

|

Condensed Consolidated Statements of Cash

Flows |

|

(In millions; unaudited) |

| |

| |

Three Months Ended March 31, |

| |

2024 |

|

2023 |

| Cash flows from

operating activities: |

|

|

|

|

Net income |

$ |

3.3 |

|

|

$ |

12.1 |

|

| Adjustments to reconcile net

income to net cash used in operating activities: |

|

|

|

|

Depreciation and amortization |

|

6.5 |

|

|

|

6.3 |

|

|

Provision for credit losses |

|

0.1 |

|

|

|

0.2 |

|

|

Provision for warranties |

|

4.2 |

|

|

|

3.9 |

|

|

Deferred compensation expense |

|

0.1 |

|

|

|

— |

|

|

Share-based compensation |

|

1.2 |

|

|

|

0.8 |

|

|

Deferred tax benefit |

|

(2.0 |

) |

|

|

(2.6 |

) |

|

Gain on disposition of property and equipment, net |

|

(0.9 |

) |

|

|

(3.4 |

) |

|

Amortization of debt issuance costs |

|

0.1 |

|

|

|

0.1 |

|

| Distributions to deferred

compensation programs' participants |

|

— |

|

|

|

(0.1 |

) |

| Change in operating assets and

liabilities: |

|

|

|

|

Purchase of trading securities, net |

|

(2.2 |

) |

|

|

(0.8 |

) |

|

Receivables and other contract assets |

|

(39.1 |

) |

|

|

(4.5 |

) |

|

Inventories |

|

(30.6 |

) |

|

|

(27.2 |

) |

|

Prepaid expenses |

|

0.6 |

|

|

|

2.5 |

|

|

Other assets |

|

(4.0 |

) |

|

|

(5.4 |

) |

|

Accounts payable |

|

2.5 |

|

|

|

3.5 |

|

|

Accrued loss reserves |

|

(0.3 |

) |

|

|

0.4 |

|

|

Accrued employee related liabilities |

|

(7.8 |

) |

|

|

(0.8 |

) |

|

Other accrued liabilities |

|

12.2 |

|

|

|

(5.9 |

) |

|

Accrued product warranty |

|

(4.5 |

) |

|

|

(3.4 |

) |

|

Customer deposits |

|

10.1 |

|

|

|

(1.9 |

) |

|

Income taxes payable/prepaid |

|

3.5 |

|

|

|

7.0 |

|

| Net cash used in operating

activities |

|

(47.0 |

) |

|

|

(19.2 |

) |

| Cash flows from

investing activities: |

|

|

|

|

Expenditures for property and equipment |

|

(5.8 |

) |

|

|

(8.0 |

) |

|

Proceeds from sale of property and equipment |

|

0.4 |

|

|

|

20.0 |

|

|

Purchase of investments |

|

(0.5 |

) |

|

|

(0.2 |

) |

| Net cash (used in) provided by

investing activities |

|

(5.9 |

) |

|

|

11.8 |

|

|

Astec Industries Inc. |

|

Condensed Consolidated Statements of Cash Flows

(Continued) |

|

(In millions; unaudited) |

| |

| |

Three Months Ended March 31, |

| |

2024 |

|

2023 |

| Cash flows from

financing activities: |

|

|

|

|

Payment of dividends |

|

(2.9 |

) |

|

|

(2.9 |

) |

|

Proceeds from borrowings on credit facilities and bank loans |

|

68.4 |

|

|

|

32.1 |

|

|

Repayments of borrowings on credit facilities and bank loans |

|

(16.7 |

) |

|

|

(44.0 |

) |

|

Withholding tax paid upon vesting of share-based compensation

awards |

|

(0.4 |

) |

|

|

(1.4 |

) |

| Net cash provided by (used in)

financing activities |

|

48.4 |

|

|

|

(16.2 |

) |

| Effect of exchange rates on

cash |

|

(0.6 |

) |

|

|

0.1 |

|

| Decrease in cash, cash

equivalents and restricted cash |

|

(5.1 |

) |

|

|

(23.5 |

) |

| Cash, cash equivalents and

restricted cash, beginning of period |

|

63.2 |

|

|

|

66.0 |

|

| Cash, cash equivalents and

restricted cash, end of period |

$ |

58.1 |

|

|

$ |

42.5 |

|

|

Astec Industries Inc. |

|

GAAP vs Non-GAAP Adjusted EPS Reconciliations |

|

(In millions, except per share amounts;

unaudited) |

| |

| |

Three Months Ended March 31, |

|

|

2024 |

|

2023 |

|

Net income attributable to controlling interest |

$ |

3.4 |

|

|

$ |

12.1 |

|

| Adjustments: |

|

|

|

|

Transformation program |

|

6.5 |

|

|

|

7.2 |

|

|

Restructuring and other related charges |

|

0.1 |

|

|

|

7.1 |

|

|

Gain on sale of property and equipment, net |

|

(0.9 |

) |

|

|

(3.4 |

) |

|

Income tax impact of adjustments |

|

(1.3 |

) |

|

|

(2.5 |

) |

| Adjusted net income

attributable to controlling interest |

$ |

7.8 |

|

|

$ |

20.5 |

|

| |

|

|

|

| Diluted EPS |

$ |

0.15 |

|

|

$ |

0.53 |

|

| Adjustments: |

|

|

|

|

Transformation program(a) |

|

0.29 |

|

|

|

0.32 |

|

|

Restructuring and other related charges |

|

— |

|

|

|

0.31 |

|

|

Gain on sale of property and equipment, net |

|

(0.04 |

) |

|

|

(0.15 |

) |

|

Income tax impact of adjustments |

|

(0.06 |

) |

|

|

(0.11 |

) |

| Adjusted EPS |

$ |

0.34 |

|

|

$ |

0.90 |

|

|

(a) Calculation includes the impact of a rounding adjustment |

|

Astec Industries Inc. |

|

EBITDA and Adjusted EBITDA Reconciliations |

|

(In millions, except percentage data;

unaudited) |

| |

| |

Three Months Ended March 31, |

| |

2024 |

|

2023 |

|

Net sales |

$ |

309.2 |

|

|

$ |

347.9 |

|

| |

|

|

|

| Net income attributable to

controlling interest |

$ |

3.4 |

|

|

$ |

12.1 |

|

| Interest expense, net |

|

2.1 |

|

|

|

1.5 |

|

| Depreciation and

amortization |

|

6.5 |

|

|

|

6.3 |

|

| Income tax provision |

|

1.4 |

|

|

|

4.4 |

|

| EBITDA |

|

13.4 |

|

|

|

24.3 |

|

| EBITDA margin |

|

4.3 |

% |

|

|

7.0 |

% |

| |

|

|

|

| Adjustments: |

|

|

|

|

Transformation program |

|

6.3 |

|

|

|

7.2 |

|

|

Restructuring and other related charges |

|

0.1 |

|

|

|

7.1 |

|

|

Gain on sale of property and equipment, net |

|

(0.9 |

) |

|

|

(3.4 |

) |

| Adjusted EBITDA |

$ |

18.9 |

|

|

$ |

35.2 |

|

| Adjusted EBITDA margin |

|

6.1 |

% |

|

|

10.1 |

% |

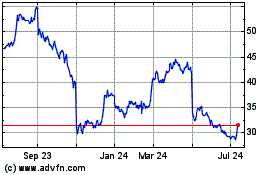

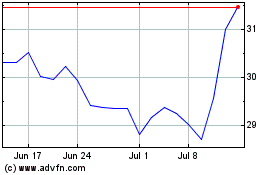

Astec Industries (NASDAQ:ASTE)

Historical Stock Chart

From Oct 2024 to Nov 2024

Astec Industries (NASDAQ:ASTE)

Historical Stock Chart

From Nov 2023 to Nov 2024