Lincoln Hikes Dividend by 60% - Analyst Blog

November 11 2011 - 7:15AM

Zacks

Despite basking in a modest

third quarter, yesterday, the board of Lincoln

National Corp. (LNC) has announced a significant 60%

increase in its quarterly dividend to 8 cents per share from the

previous pay

out of 5 cents. The hiked dividend will be paid on February 1, 2012

to shareholders of record as on January 10, 2012.

This marks the second

dividend hike since 2007. In November last year, Lincoln had raised

its quarterly dividend from 1 cent to 5 cents per share. The

company’s restructuring initiatives taken up last year have paid

off well. The current hike also reflects Lincoln’s capital and

liquidity strength.

With a quarterly operating

return on equity (ROE) of 13.4% at the end of third quarter 2011,

up from 9.4% at the end of the prior-year quarter, Lincoln has

strengthened its balance sheet and cash position. This is primarily

attributable to improved consolidated deposits and net inflows that

also drove the book value per share.

The upsides have also

helped Lincoln deploy excess capital efficiently. Earlier, during

the fourth quarter of 2010, the company had announced its objective

of buying back common equity shares worth approximately $125

million, over the following 15 months. However, Lincoln has

successfully repurchased 14.2 million shares for a total cost of

$300 million, until the third quarter of 2011.

Earnings

Review

Lincoln’s third quarter operating

earnings of $1.00 per share came in modestly ahead of the Zacks

Consensus Estimate of 93 cents and 63 cents recorded in the

prior-year quarter. Meanwhile, operating net income surged 53.9%

year over year to $317.3 million.

Besides, the Zacks Consensus

Estimate for the fourth quarter is currently pegged at 97 cents,

expected to increase about 19% over the year-ago period. Over the

last 30 days, 4 of the 15 analyst firms have raised their

estimates, while 7 downward revisions were witnessed. For 2011,

earnings are projected to jump about 32% to $4.14 per share over

2010.

On Thursday, the shares of Lincoln

closed at $19.54, up 4.3%, on the New York Stock Exchange. At this

price and the hiked dividend, Lincoln’s dividend yield stands at

0.41%, up from the previous yield of 0.26%. However, this dividend

yield is significantly lower than Prudential Financial

Inc.'s (PRU) 2.66% and MetLife Inc.’s

(MET) 2.10%, the two major insurance giants.

Besides, the quantitative Zacks

rank for Lincoln currently stands at #3, indicating a short-term

Hold rating. The long term stance also remains Neutral.

Industry Moves

Most of the other insurers in the

industry have been efficiently deploying capital through dividends

and share repurchases. Last month, Aflac Inc.

(AFL) also announced a 10% hike in its quarterly cash dividend to

33 cents from 30 cents per share.

Earlier this week, Allstate

Corp. (ALL) announced a new share repurchase program worth

$1.0 billion, while Prudential also raised its annual

dividend by 26% to $1.45 from $1.15 per share. Earlier this month,

Amerisafe Inc. (AMSF) extended its share buy back

program to $25 million.

AFLAC INC (AFL): Free Stock Analysis Report

ALLSTATE CORP (ALL): Free Stock Analysis Report

AMERISAFE INC (AMSF): Free Stock Analysis Report

LINCOLN NATL-IN (LNC): Free Stock Analysis Report

METLIFE INC (MET): Free Stock Analysis Report

PRUDENTIAL FINL (PRU): Free Stock Analysis Report

Zacks Investment Research

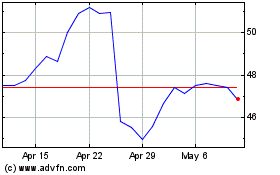

AMERISAFE (NASDAQ:AMSF)

Historical Stock Chart

From Apr 2024 to May 2024

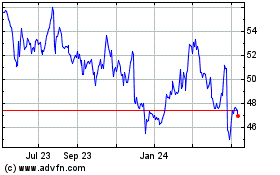

AMERISAFE (NASDAQ:AMSF)

Historical Stock Chart

From May 2023 to May 2024