Second Quarter Highlights: DERIDDER, La., Aug. 6

/PRNewswire-FirstCall/ -- AMERISAFE, Inc. (NASDAQ:AMSF), a

specialty writer of high hazard workers' compensation insurance,

today announced results for the second quarter ended June 30, 2008.

Net income in the second quarter was $12.8 million compared to net

income of $11.4 million in the 2007 second quarter, an increase of

12.9%. Pre-tax income for the second quarter of 2008 included $2.8

million of favorable prior year loss development and income of

$991,000 from a previously announced reinsurance commutation.

Pre-tax income for the second quarter of 2007 had no prior year

loss development, but included income of $2.7 million from the

commutation of several reinsurance contracts. Net investment income

was $7.4 million for both the second quarter of 2008 and the second

quarter of 2007. The Company's return on average equity for the

2008 second quarter was 20.6% compared to 22.8% for the same period

in 2007. Gross premiums written in the second quarter of 2008 were

$86.0 million, a decrease of 8.8%, compared to $94.3 million in the

second quarter of 2007. The decrease was the result of reduced

state-mandated loss costs, increased competition, as well as

decreased audit premium from lower work activity. Second quarter

revenues totaled $79.8 million, a decrease of 5.8%, compared to

revenues of $84.7 million in the prior year period. Net income for

the first half of 2008 was $24.8 million compared to $19.8 million

for the first half of 2007, an increase of 25.1%. First half 2008

pre-tax income included $4.5 million of favorable prior year loss

development and income of $991,000 from reinsurance commutations.

Pre-tax net income for the first half of 2007 had no prior year

loss development, but included income of $2.7 million from

reinsurance commutations. Net investment income increased to $15.2

million for the six months ended June 30, 2008, from $14.4 million

for the same period in 2007, an increase of 6.0%. The Company's

return on average equity was 20.3% for both the first half of 2008

and the first half of 2007. For the six months ended June 30, 2008,

gross premiums written totaled $167.0 million, a 9.6% decrease from

gross premiums written of $184.8 million for the same period in

2007. Revenues for the first half of 2008 totaled $162.1 million, a

3.3% decrease from revenues of $167.7 million for the first six

months of 2007. In the second quarter of 2008, diluted earnings per

share allocable to common shareholders were $0.63 compared to $0.56

in the same period of 2007. Weighted average diluted shares

outstanding for the second quarter of 2008 totaled 19,091,675

shares compared to 19,109,452 shares in the second quarter of 2007.

In the first six months of 2008, diluted earnings per share

allocable to common shareholders were $1.22 compared to $0.98 in

the same period of 2007. Weighted average diluted shares

outstanding for the first half of 2008 totaled 19,060,673 shares

compared to 19,055,149 shares in the first half of 2007. The net

combined ratio for the second quarter of 2008 was 85.4% compared to

88.4% for the same period in 2007. Loss and loss adjustment

expenses for the second quarter of 2008 were $47.3 million, or

65.6% of net premiums earned, compared to $53.2 million, or 69.0%

of net premiums earned, for the same period in 2007. Total

underwriting expenses for the second quarter of 2008 were $14.1

million, or 19.6% of net premiums earned, compared to $14.8

million, or 19.2% of net premiums earned, for the second quarter

2007. The net combined ratio for the first half of 2008 was 86.3%

compared to 90.4% for the same period in 2007. Loss and loss

adjustment expenses for the first six months of 2008 were $97.2

million, or 66.4% of net premiums earned, compared to $105.7

million, or 69.1% of net premiums earned, for the same period in

2007. Total underwriting expenses for the first half of 2008 were

$28.7 million, or 19.6% of net premiums earned, compared to $32.0

million, or 20.9% of net premiums earned, for the first half of

2007. Commenting on these results, Allen Bradley, AMERISAFE's

Chairman, President and Chief Executive Officer, stated, "We are

pleased to report these excellent second quarter results. We

generated a solid year-over-year improvement in our combined ratio

and a strong return on equity. We believe that our commitment to

pricing discipline, stringent risk selection, intensive safety

services, personalized claims adjudication and effective expense

management is the foundation upon which these financial results are

built and we are not inclined to compromise our commitment." 2008

Outlook For the full year 2008, AMERISAFE reaffirms its previously

issued guidance. The Company currently expects to produce a

combined ratio of 94% or lower and a return on average equity of

15% or greater. AMERISAFE calculates return on average equity by

dividing net income by the average of shareholders' equity plus

redeemable preferred stock. Conference Call Information AMERISAFE

has scheduled a conference call for August 7, 2008, at 11:00 a.m.

Eastern Time. To participate in the conference call dial

303-262-2138 at least 10 minutes before the call begins and ask for

the AMERISAFE conference call. A replay of the call will be

available approximately two hours after the live broadcast ends and

will be accessible through August 15, 2008. To access the replay,

dial 303-590-3000 and use the pass code 11116393#. Investors,

analysts and the general public will also have the opportunity to

listen to the conference call over the Internet by visiting

http://www.amerisafe.com/. To listen to the live call on the web,

please visit the website at least fifteen minutes before the call

begins to register, download and install any necessary audio

software. For those who cannot listen to the live webcast, an

archive will be available shortly after the call and will remain

available for approximately 60 days at http://www.amerisafe.com/.

About AMERISAFE AMERISAFE, Inc. is a specialty provider of workers'

compensation insurance focused on small to mid-sized employers

engaged in hazardous industries, principally construction,

trucking, logging, agriculture, oil and gas, maritime and sawmills.

AMERISAFE actively markets workers' compensation insurance in 30

states and the District of Columbia. The Company's financial

strength rating is "A-" (Excellent) by A.M. Best. Statements made

in this press release that are not historical facts, including

statements accompanied by words such as "will," "believe,"

"anticipate," "expect," "estimate," or similar words are

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995 regarding AMERISAFE's

plans and performance. These statements are based on management's

estimates, assumptions and projections as of the date of this

release and are not guarantees of future performance. Actual

results may differ materially from the results expressed or implied

in these statements as the results of risks, uncertainties and

other factors including, but not limited to, the factors set forth

in the Company's filings with the Securities and Exchange

Commission, including AMERISAFE's Annual Report on Form 10-K for

the year ended December 31, 2007. AMERISAFE cautions you not to

place undue reliance on the forward-looking statements contained in

this release. AMERISAFE does not undertake any obligation to

publicly update or revise any forward-looking statements to reflect

future events, information or circumstances that arise after the

date of this release. Contacts: Geoff Banta, EVP & CFO

AMERISAFE, Inc. 337-463-9052 Ken Dennard, Managing Partner Karen

Roan, Sr. VP DRG&E / 713-529-6600 - Tables to follow -

AMERISAFE, INC. AND SUBSIDIARIES Consolidated Statements of Income

(in thousands, except per share amounts) Three Months Ended Six

Months Ended June 30, June 30, 2008 2007 2008 2007 (unaudited)

Revenues: Gross premiums written $85,995 $94,290 $166,972 $184,775

Ceded premiums written (4,666) (4,887) (9,456) (9,860) Net premiums

written $81,329 $89,403 $157,516 $174,915 Net premiums earned

$72,143 $77,106 $146,443 $152,987 Net investment income 7,405 7,433

15,222 14,358 Net realized gains on investments 53 36 61 36 Fee and

other income 229 138 370 277 Total revenues 79,830 84,713 162,096

167,658 Expenses: Loss and loss adjustment expenses incurred 47,317

53,203 97,245 105,706 Underwriting and other operating costs 14,149

14,829 28,663 31,987 Interest expense 657 886 1,426 1,764

Policyholder dividends 122 166 438 687 Total expenses 62,245 69,084

127,772 140,144 Income before taxes 17,585 15,629 34,324 27,514

Income tax expense 4,758 4,267 9,574 7,734 Net income 12,827 11,362

24,750 19,780 Preferred dividends - - - - Net income available to

common shareholders $12,827 $11,362 $24,750 $19,780 AMERISAFE, INC.

AND SUBSIDIARIES Consolidated Statements of Income (cont.) (in

thousands, except per share amounts) Three Months Ended Six Months

Ended June 30, June 30, 2008 2007 2008 2007 (unaudited) Basic EPS:

Net income available to common shareholders $12,827 $11,362 $24,750

$19,780 Portion allocable to common shareholders 94.0 % 94.0 % 94.0

% 94.0 % Net income allocable to common shareholders $12,057

$10,683 $23,265 $18,595 Basic weighted average common shares

18,809,250 18,779,248 18,803,805 18,744,818 Basic earnings per

share $0.64 $0.57 $1.24 $0.99 Diluted EPS: Net income allocable to

common shareholders $12,057 $10,683 $23,265 $18,595 Diluted

weighted average common shares: Weighted average common shares

18,809,250 18,779,248 18,803,805 18,744,818 Stock options 275,674

321,818 240,807 302,884 Restricted stock 6,751 8,386 16,061 7,447

Diluted weighted average common shares 19,091,675 19,109,452

19,060,673 19,055,149 Diluted earnings per common share $0.63 $0.56

$1.22 $0.98 AMERISAFE, INC. AND SUBSIDIARIES Consolidated Balance

Sheets (in thousands) June 30, December 31, 2008 2007 (unaudited)

Assets Investments $714,479 $711,745 Cash and cash equivalents

54,253 47,329 Amounts recoverable from reinsurers 69,500 76,915

Premiums receivable, net 173,369 152,150 Deferred income taxes

30,948 26,418 Deferred policy acquisition costs 20,781 18,414

Deferred charges 3,902 3,553 Other assets 38,065 25,329 $1,105,297

$1,061,853 Liabilities, redeemable preferred stock and

shareholders' equity Liabilities: Reserves for loss and loss

adjustment expenses $546,122 $537,403 Unearned premiums 149,475

138,402 Insurance-related assessments 44,639 42,234 Subordinated

debt securities 36,090 36,090 Other liabilities 74,129 74,154

Redeemable preferred stock 25,000 25,000 Total shareholders' equity

229,842 208,570 Total liabilities, redeemable preferred stock and

shareholders' equity $1,105,297 $1,061,853 AMERISAFE, INC. AND

SUBSIDIARIES Selected Insurance Ratios Three Months Ended Six

Months Ended June 30, June 30, 2008 2007 2008 2007 (unaudited)

Current accident year loss ratio (1) 69.5 % 69.0 % 69.5 % 69.1 %

Prior accident year loss ratio (2) (3.9)% 0.0 % (3.1)% 0.0 % Net

loss ratio 65.6 % 69.0 % 66.4% 69.1 % Net underwriting expense

ratio (3) 19.6 % 19.2 % 19.6 % 20.9 % Net dividend ratio (4) 0.2 %

0.2 % 0.3 % 0.4 % Net combined ratio (5) 85.4 % 88.4 % 86.3 % 90.4

% Return on average equity (6) 20.6 % 22.8 % 20.3 % 20.3 % (1) The

current accident year loss ratio is calculated by dividing loss and

loss adjustment expenses incurred for the current accident year by

the current year's net premiums earned. (2) The prior accident year

loss ratio is calculated by dividing the change in loss and loss

adjustment expenses incurred for prior accident years by the

current year's net premiums earned. (3) The net underwriting

expense ratio is calculated by dividing underwriting and certain

other operating costs by the current year's net premiums earned.

(4) The net dividend ratio is calculated by dividing policyholder

dividends by the current year's net premiums earned. (5) The net

combined ratio is the sum of the net loss ratio, the net

underwriting expense ratio and the net dividend ratio. (6) Return

on average equity is calculated by dividing the annualized net

income by the average shareholders' equity, including redeemable

preferred stock for the applicable period. DATASOURCE: AMERISAFE,

Inc. CONTACT: Geoff Banta, EVP & CFO of AMERISAFE, Inc.,

+1-337-463-9052; or Ken Dennard, Managing Partner, or Karen Roan,

Sr. VP, both of DRG&E, +1-713-529-6600, for AMERISAFE, Inc. Web

site: http://www.amerisafe.com/

Copyright

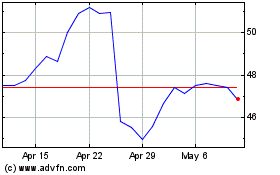

AMERISAFE (NASDAQ:AMSF)

Historical Stock Chart

From Sep 2024 to Oct 2024

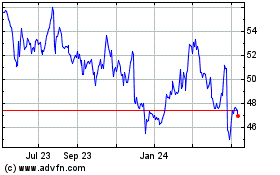

AMERISAFE (NASDAQ:AMSF)

Historical Stock Chart

From Oct 2023 to Oct 2024