0001362468falseLas VegasNV00013624682024-05-072024-05-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

_____________________________________________

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): May 7, 2024

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Allegiant Travel Company | | | | |

| | (Exact name of registrant as specified in its charter) | | |

| | | | | | | | | | |

| Nevada | | 001-33166 | | 20-4745737 | |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (I.R.S. Employer Identification No.) | |

| | | | | | | | | | |

| | 1201 North Town Center Drive | | | | |

| | Las Vegas, NV | | 89144 | | |

| | (Address of principal executive offices) | | (Zip Code) | | |

Registrant’s telephone number, including area code: (702) 851-7300

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | N/A | | | | |

| (Former name or former address, if changed since last report.) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

Common stock, par value $0.001 | | ALGT | | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as in Rule 405 of the Securities Act of 1933 (Section 17 CFR §230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (Section 17 CFR §240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 2 Financial Information

Item 2.02 Results of Operations and Financial Condition.

On May 7, 2024, Allegiant Travel Company (the “Company”) issued the press release attached as Exhibit 99.1 to this Form 8-K concerning our results of operations for the quarter ended March 31, 2024.

This information is being furnished under Item 2.02 of Form 8-K. This report and Exhibit 99.1 are deemed to be furnished and are not considered “filed” with the Securities and Exchange Commission. As such, this information shall not be incorporated by reference into any of our reports or other filings made with the Securities and Exchange Commission.

Non-GAAP Financial Measures: The press release contains non-GAAP financial measures as such term is defined in Regulation G under the rules of the Securities and Exchange Commission. While the Company believes these financial measures are useful in evaluating the Company’s performance, this information should be considered to be supplemental in nature and not as a substitute for or superior to the related financial information prepared in accordance with GAAP. Further, these non-GAAP financial measures may differ from similarly titled measures presented by other companies.

Forward-Looking Statements: Under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, statements in the press release that are not historical facts are forward-looking statements. These forward-looking statements are only estimates or predictions based on our management's beliefs and assumptions and on information currently available to our management. Forward-looking statements include our statements regarding future airline and Sunseeker Resort operations, revenue, expenses and earnings, ASM growth, expected capital expenditures, the cost of fuel, the timing of aircraft acquisitions and retirements, the number of contracted aircraft to be placed in service in the future, our ability to consummate announced aircraft transactions, as well as other information concerning future results of operations, business strategies, financing plans, competitive position, industry environment, and potential growth opportunities. Forward-looking statements include all statements that are not historical facts and can be identified by the use of forward-looking terminology such as the words "believe," "expect," “guidance,” "anticipate," "intend," "plan," "estimate," “project”, “hope” or similar expressions.

Forward-looking statements involve risks, uncertainties and assumptions. Actual results may differ materially from those expressed in the forward-looking statements. Important risk factors that could cause our results to differ materially from those expressed in the forward-looking statements generally may be found in our periodic reports filed with the Securities and Exchange Commission at www.sec.gov. These risk factors include, without limitation, the impact of regulatory reviews of Boeing on its aircraft delivery schedule, an accident involving, or problems with, our aircraft, public perception of our safety, our reliance on our automated systems, our reliance on Boeing and other third parties to deliver aircraft under contract to us on a timely basis, risk of breach of security of personal data, volatility of fuel costs, labor issues and costs, the ability to obtain regulatory approvals as needed , the effect of economic conditions on leisure travel, debt covenants and balances, the impact of government regulations on the airline industry, the ability to finance aircraft to be acquired, the ability to obtain necessary government approvals to implement the announced alliance with Viva Aerobus and to otherwise prepare to offer international service from our markets, terrorist attacks, risks inherent to airlines, our competitive environment, our reliance on third parties who provide facilities or services to us, the impact of the possible loss of key personnel, economic and other conditions in markets in which we operate, the ability to successfully operate Sunseeker Resort, increases in maintenance costs and availability of outside maintenance contractors to perform needed work on our aircraft on a timely basis and at acceptable rates, cyclical and seasonal fluctuations in our operating results and the perceived acceptability of our environmental, social and governance efforts.

Any forward-looking statements are based on information available to us today and we undertake no obligation to update publicly any forward-looking statements, whether as a result of future events, new information or otherwise.

Section 9 Financial Statements and Exhibits

Item 9.01 Financial Statements and Exhibits.

a.Not applicable.

b.Not applicable.

c.Not applicable.

d.Exhibits

| | | | | |

| Exhibit No. | Description of Document |

| |

| |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, Allegiant Travel Company has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| Date: May 7, 2024 | ALLEGIANT TRAVEL COMPANY | |

| | | | |

| | | |

| | | | |

| By: | /s/ Robert J. Neal | |

| Name: | Robert J. Neal | |

| | Title: | Senior Vice President and Chief Financial Officer | |

EXHIBIT INDEX

| | | | | |

| Exhibit No. | Description of Document |

| |

| |

ALLEGIANT TRAVEL COMPANY

FIRST QUARTER 2024 FINANCIAL RESULTS

First quarter 2024 GAAP diluted loss per share of $(0.07)

First quarter 2024 diluted earnings per share, excluding special charges of $0.57(1)(4)(5)

First quarter 2024 airline only diluted earnings per share, excluding special charges of $1.08(1)(4)(6)

LAS VEGAS. May 7, 2024 — Allegiant Travel Company (NASDAQ: ALGT) today reported the following financial results for the first quarter 2024, as well as comparisons to the prior year:

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Consolidated | Three Months Ended March 31, | | Percent Change | | | | |

| (unaudited) (in millions, except per share amounts) | 2024 | | 2023 | | | | YoY | | | | | | | | |

| Total operating revenue | $ | 656.4 | | | $ | 649.7 | | | | | 1.0 | % | | | | | | | | |

| Total operating expense | 641.0 | | | 554.9 | | | | | 15.5 | % | | | | | | | | |

| Operating income | 15.4 | | | 94.8 | | | | | (83.8) | % | | | | | | | | |

| | | | | | | | | | | | | | | |

| Income (loss) before income taxes | (1.3) | | | 74.4 | | | | | NM | | | | | | | | |

| | | | | | | | | | | | | | | |

| Net income (loss) | (0.9) | | | 56.1 | | | | | NM | | | | | | | | |

| | | | | | | | | | | | | | | |

| Diluted earnings (loss) per share | (0.07) | | | 3.09 | | | | | NM | | | | | | | | |

Sunseeker special charges, net of recoveries (4) | (1.8) | | | (1.6) | | | | | NM | | | | | | | | |

Airline special charges (4) | 14.9 | | | — | | | | | NM | | | | | | | | |

Net income, excluding special charges net of recoveries(1)(3)(5) | 10.4 | | | 55.3 | | | | | (81.2) | % | | | | | | | | |

Diluted earnings per share excluding special charges net of recoveries(1)(3)(5) | 0.57 | | | 3.04 | | | | | (81.3) | % | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Airline only | Three Months Ended March 31, | | Percent Change(2) | | | | |

| (unaudited) (in millions, except per share amounts) | 2024 | | 2023 | | | | YoY | | | | | | | | |

Airline operating revenue | $ | 632.5 | | | $ | 649.7 | | | | | (2.6) | % | | | | | | | | |

Airline operating expense | 608.3 | | | 552.1 | | | | | 10.2 | % | | | | | | | | |

Airline operating income | 24.2 | | | 97.6 | | | | | (75.2) | % | | | | | | | | |

Airline income before income taxes | 12.5 | | | 78.9 | | | | | (84.2) | % | | | | | | | | |

Airline net income (1)(3) | 11.4 | | | 59.9 | | | | | (81.0) | % | | | | | | | | |

Airline special charges (4) | 14.9 | | | — | | | | | NM | | | | | | | | |

Airline net income, excluding special charges (1)(3)(6) | 19.8 | | | 59.9 | | | | | (66.9) | % | | | | | | | | |

Airline operating margin, excluding special charges (1)(6) | 6.2 | % | | 15.0 | % | | | | (8.8) | | | | | | | | | |

Airline diluted earnings per share, excluding special charges (1)(3)(6) | 1.08 | | | 3.30 | | | | | (67.3) | % | | | | | | | | |

(1)Denotes a non-GAAP financial measure. Refer to the Non-GAAP Presentation section within this document for further information and for calculation of per share figures.

(2)Except Airline operating margin, excluding special charges, which is percentage point change.

(3)Refer to the Non-GAAP Presentation section within this document for the income tax effect of non-GAAP adjustments.

(4)In 2024 and 2023, we recognized as special charges the full amount of estimated property damage to Sunseeker Resort due to weather and other insured events less the amount of recognized insurance recoveries through the end of the applicable period. In first quarter 2024, we also recognized aircraft accelerated depreciation as special charges related to our revised fleet plan. We sometimes refer to these amounts as “specials” in this earnings release.

(5)Adjusted to exclude the impacts of property damage to Sunseeker Resort, net of recoveries, and aircraft accelerated depreciation charges resulting from our revised fleet plan.

(6)Adjusted to exclude aircraft accelerated depreciation charges recognized as special charges related to our revised fleet plan.

NM Not meaningful

* Note that amounts may not recalculate due to rounding

“We finished the quarter with diluted earnings per share, excluding special charges, of 57 cents,” stated Maurice J. Gallagher, Jr., chairman and CEO of Allegiant Travel Company. “The peak demand environment remained strong throughout the quarter, with TRASM representing the second best first quarter TRASM in company history. Demand trends are holding into the second quarter, and although we expect TRASM to be down from the highs of 2023, we anticipate second quarter TRASM will again be among the best second quarters in company history – particularly impressive given expected growth during the peak month of June of roughly six percent, year-over-year.

“The first quarter marked the first full quarter of operations at Sunseeker Resort. Hats off to the team led by Micah Richins and Jason Shkorupa. The final product is truly amazing and unique to that part of Florida. It will take time to build to financial maturity. We are still in the early stages, but our marketing efforts are now in full swing. Encouragingly, food and beverage surpassed our initial expectations and accounted for nearly half of total Sunseeker revenue during the first quarter. I am excited to see the potential of this property unfold in the coming years.”

“I am happy to report another quarter of near industry-leading operational results,” stated Gregory Anderson, president of Allegiant Travel Company. “The team’s efforts yielded a controllable completion of 99.7 percent. Over the past 18 months we have prioritized operational integrity, and I could not be prouder of Team Allegiant as we continue to achieve record high net promoter scores from our customers.

"While I am pleased with our operational and customer service performance, our first quarter adjusted airline-only operating margin of roughly six percent is disappointing. These lower margins were largely driven by temporary headwinds such as Boeing’s inability to meet its delivery schedule, delayed pricing functionality due to the integration of Navitaire, our new reservations and revenue system, and lower aircraft utilization in our peak demand periods – we are fixing all three of these items. Excluding these headwinds and on a more normalized basis, our adjusted airline operating margin for the first quarter would have been approximately 13 percent.

“On the labor front, I am pleased to announce our flight attendants overwhelmingly voted to ratify their tentative agreement. This new contract will not only provide well-deserved pay increases, but also comes with several quality-of-life improvements. Our pilot contract remains in federal mediation. The Teamsters that represent our pilots appointed a new negotiating team, and I am encouraged by the improved collaboration and progress now being made at the table – getting a deal complete remains a top priority.

“2024 is a transitional year for the company. We expect to have all of our labor agreements finalized. We have a clear path to increasing utilization and improving productivity amongst our work groups. We expect to integrate the MAX aircraft into our fleet in the coming months. We are well on our way to unlocking the full power of our Navitaire reservation system and providing strong opportunities to further increase our ancillary revenues. Achieving these items will return us to our industry leading margins as our airline is one of the best proven models in the business.”

First Quarter 2024 Results and Highlights

•Total operating revenue of $656.4M, up 1.0 percent over the prior year

•Total fixed fee contracts revenue of $18.9M, up 33.6 percent year-over-year

•Operating income, excluding specials,(1)(2)(3) of $28.5M, yielding an adjusted operating margin of 4.3 percent

•Airline-only operating income, excluding specials,(1)(5) of $39.1M, yielding an airline-only adjusted operating margin of 6.2 percent

•Income before income tax, excluding specials,(1)(2)(3) of $11.8M, yielding an adjusted pre-tax margin of 1.8 percent

•Airline-only income before income tax, excluding specials,(1)(5) of $27.5M, yielding an adjusted pre-tax margin of 4.3 percent

•Consolidated EBITDA, excluding specials,(1)(2)(3) of $92.3M, yielding an adjusted EBITDA margin of 14.1 percent

•Airline-only EBITDA, excluding specials,(1) of $97.0M, an adjusted 15.3 percent margin

•Airline-only operating CASM, excluding fuel and special charges,(4) of 8.87 ¢, up 14.5 percent year-over-year

•Includes $20.4M in incremental cost related to accrual of pilot retention bonuses

•$34.7M in total cobrand credit card remuneration received from Bank of America, up 23.7 percent from the prior year

•Enrolled 540K new Allways Rewards members during the first quarter bringing total members to 17.9M

•In April, ratified a new five-year agreement with the Transport Workers Union of America, AFL-CIO Local 577, representing Allegiant's flight attendants

•Agreement includes immediate wage increases as well as certain quality-of-life improvements

•Ranked third on the American Customer Satisfaction Index for Airlines, moving up from spot seven in 2023

(1)Denotes a non-GAAP financial measure. Refer to the Non-GAAP Presentation section within this document for further information and for calculation of per share figures.

(2)In 2024 and 2023, we recognized as special charges the full amount of estimated property damage to Sunseeker Resort due to weather and other insured events less the amount of recognized insurance recoveries through the end of the applicable period. In first quarter 2024, we also recognized aircraft accelerated depreciation as special charges related to our revised fleet plan.

(3)Adjusted to exclude the impacts of property damage to Sunseeker Resort, net of recoveries, and aircraft accelerated depreciation charges resulting from our revised fleet plan.

(4)Adjusted to exclude aircraft accelerated depreciation recognized as special charges related to our revised fleet plan.

Balance Sheet, Cash and Liquidity

•Total available liquidity at March 31, 2024 was $1.1B, which included $853.7M in cash and investments, and $275.0M in undrawn revolving credit facilities

•$167.8M in cash from operations during the first quarter 2024

•Total debt at March 31, 2024 was $2.2B

•Net debt at March 31, 2024 was $1.4B

•Debt principal payments of $31.5M during the quarter

•Returned $11.0M in dividends during the quarter

•Scheduled payment of quarterly dividend in the amount of $0.60 per share on June 3, 2024 to shareholders of record on May 15, 2024

•Air traffic liability at March 31, 2024 was $432.6M

Airline Capital Expenditures

•First quarter capital expenditures of $122.2M, which included $82.6M for aircraft purchases and inductions, pre-delivery deposits, and other related costs, and $39.6M in other airline capital expenditures

•First quarter deferred heavy maintenance expenditures were $18.1M

Sunseeker Resort Charlotte Harbor

•Reported total operating revenues of $23.9M during its first quarter of operation

•First quarter occupancy was roughly 40 percent with an average daily rate of $330 per night

| | | | | | | | | | | |

| Guidance, subject to revision | | |

| | |

| Second quarter 2024 airline-only guidance | | | |

| | | |

| System ASMs - year over year change | | | ~(1.0%) |

| Scheduled service ASMs - year over year change | | | ~(1.0%) |

| | | |

| Fuel cost per gallon | | | $ | 2.90 | |

| Operating margin | | | 7.0% to 9.0% |

| Airline-only earnings per share, excluding special charges | | | $1.25 - $1.75 |

| | | |

| | | |

| Second quarter 2024 consolidated guidance | | | |

| | | |

| Consolidated earnings per share, excluding special charges | | | $0.50 - $1.00 |

| | | |

| Full-year 2024 airline-only guidance | | | |

| | | |

| System ASMs - year over year change | | | 2.0% to 4.0% |

| Scheduled service ASMs - year over year change | | | 2.0% to 4.0% |

| | | |

| Interest expense (millions) | | | $135 to $145 |

Capitalized interest (1) (millions) | | | ($40) to ($50) |

| Interest income (millions) | | | $35 to $45 |

| | | |

| Airline full-year CAPEX | | | |

Aircraft, engines, induction costs, and pre-delivery deposits(2) (millions) | | | $230 to $250 |

| Capitalized deferred heavy maintenance (millions) | | | $80 to $90 |

| Other airline capital expenditures (millions) | | | $160 to $170 |

| | | |

| Recurring principal payments (millions) | | | $135 to $145 |

| | | |

(1)Includes capitalized interest related to pre-delivery deposits on new aircraft.

(2)Excludes capitalized interest related to pre-delivery deposits on new aircraft. Estimated capital expenditures are based on management's best estimate around aircraft deliveries, which differs from contractual obligations.

| | | | | | | | | | | |

| Full-year 2024 Sunseeker guidance | | | |

| | | |

| EBITDA (millions) | | | ~(15) |

| Depreciation expense (millions) | | | ~$25 |

| Interest expense (millions) | | | ~$20 |

| | | |

| Occupancy rate | | | ~45% |

| Average daily rate | | | ~$320 |

Aircraft Fleet Plan by End of Period

| | | | | | | | | | |

| | | | |

| | | | |

| Aircraft - (seats per AC) | | | 2Q24 | YE24 |

| 737-8200 (190 seats) | | | — | | 6 | |

| | | | |

| A320 (177 seats) | | | 17 | | 11 | |

| A320 (180-186 seats) | | | 75 | | 75 | |

| A319 (156 seats) | | | 34 | | 34 | |

| Total | | | 126 | | 126 | |

The table above is provided based on the company’s current plans and is subject to change. The numbers exclude aircraft expected to be delivered during 2024 but will not be placed into revenue service until 2025.

The above plan is management's best estimate and differs from our contractual obligations.

Allegiant Travel Company will host a conference call with analysts at 12:30 p.m. ET Tuesday, May 7, 2024 to discuss its first quarter 2024 financial results. A live broadcast of the conference call will be available via the Company’s Investor Relations website homepage at http://ir.allegiantair.com. The webcast will also be archived in the “Events & Presentations” section of the website.

Allegiant Travel Company

Las Vegas-based Allegiant (NASDAQ: ALGT) is an integrated travel company with an airline at its heart, focused on connecting customers with the people, places and experiences that matter most. Since 1999, Allegiant Air has linked travelers in underserved cities to world-class vacation destinations with all-nonstop flights and industry-low average fares. Today, Allegiant serves communities across the nation, with base airfares less than half the cost of the average domestic round trip ticket. For more information, visit us at Allegiant.com. Media information, including photos, is available at http://gofly.us/iiFa303wrtF.

Media Inquiries: mediarelations@allegiantair.com

Investor Inquiries: ir@allegiantair.com

Under the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, statements in this press release that are not historical facts are forward-looking statements. These forward-looking statements are only estimates or predictions based on our management's beliefs and assumptions and on information currently available to our management. Forward-looking statements include our statements regarding future airline and Sunseeker Resort operations, revenue, expenses and earnings, available seat mile growth, expected capital expenditures, the cost of fuel, the timing of aircraft acquisitions and retirements, the number of contracted aircraft to be placed in service in the future, our ability to consummate announced aircraft transactions, as well as other information concerning future results of operations, business strategies, financing plans, industry environment and potential growth opportunities. Forward-looking statements include all statements that are not historical facts and can be identified by the use of forward-looking terminology such as the words "believe," "expect," “guidance,” "anticipate," "intend," "plan," "estimate", “project”, “hope” or similar expressions.

Forward-looking statements involve risks, uncertainties and assumptions. Actual results may differ materially from those expressed in the forward-looking statements. Important risk factors that could cause our results to differ materially from those expressed in the forward-looking statements generally may be found in our periodic reports filed with the Securities and Exchange Commission at www.sec.gov. These risk factors include, without limitation, the impact of regulatory reviews of Boeing on its aircraft delivery schedule, an accident involving, or problems with, our aircraft, public perception of our safety, our reliance on our automated systems, our reliance on Boeing and other third parties to deliver aircraft under contract to us on a timely basis, risk of breach of security of personal data, volatility of fuel costs, labor issues and costs, the ability to obtain regulatory approvals as needed , the effect of economic conditions on leisure travel, debt covenants and balances, the impact of government regulations on the airline industry, the ability to finance aircraft to be acquired, the ability to obtain necessary government approvals to implement the announced alliance with Viva Aerobus and to otherwise prepare to offer international service, terrorist attacks, risks inherent to airlines, our competitive environment, our reliance on third parties who provide facilities or services to us, the impact of the possible loss of key personnel, economic and other conditions in markets in which we operate, the ability to successfully operate Sunseeker Resort, increases in maintenance costs and availability of outside maintenance contractors to perform needed work on our aircraft on a timely basis and at acceptable rates, cyclical and seasonal fluctuations in our operating results, and the perceived acceptability of our environmental, social and governance efforts.

Any forward-looking statements are based on information available to us today and we undertake no obligation to update publicly any forward-looking statements, whether as a result of future events, new information or otherwise.

Detailed financial information follows:

Allegiant Travel Company

Consolidated Statements of Income

(in thousands, except per share amounts)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, | | Percent Change |

| | 2024 | | 2023 | | | | YoY | | |

| OPERATING REVENUES: | | | | | | | | | |

| Passenger | $ | 579,936 | | | $ | 609,277 | | | | | (4.8) | % | | |

| Third party products | 33,399 | | | 26,037 | | | | | 28.3 | | | |

| Fixed fee contracts | 18,861 | | | 14,117 | | | | | 33.6 | | | |

| Resort and other | 24,210 | | | 256 | | | | | NM | | |

| Total operating revenues | 656,406 | | | 649,687 | | | | | 1.0 | | | |

| OPERATING EXPENSES: | | | | | | | | | |

| Salaries and benefits | 213,327 | | | 159,623 | | | | | 33.6 | | | |

| Aircraft fuel | 170,087 | | | 189,546 | | | | | (10.3) | | | |

| Station operations | 66,468 | | | 61,520 | | | | | 8.0 | | | |

| Depreciation and amortization | 63,844 | | | 54,680 | | | | | 16.8 | | | |

| Sales and marketing | 30,419 | | | 26,928 | | | | | 13.0 | | | |

| Maintenance and repairs | 30,278 | | | 26,442 | | | | | 14.5 | | | |

| Aircraft lease rentals | 5,985 | | | 7,092 | | | | | (15.6) | | | |

| Other | 47,451 | | | 30,643 | | | | | 54.9 | | | |

| | | | | | | | | |

| Special charges, net of recoveries | 13,099 | | | (1,612) | | | | | NM | | |

| Total operating expenses | 640,958 | | | 554,862 | | | | | 15.5 | | | |

| OPERATING INCOME | 15,448 | | | 94,825 | | | | | (83.7) | | | |

| OTHER (INCOME) EXPENSES: | | | | | | | | | |

| Interest expense | 40,160 | | | 35,708 | | | | | 12.5 | | | |

| Capitalized interest | (11,185) | | | (5,180) | | | | | 115.9 | | | |

| Interest income | (12,241) | | | (10,128) | | | | | 20.9 | | | |

| | | | | | | | | |

| | | | | | | | | |

| Other, net | 51 | | | 7 | | | | | NM | | |

| Total other expenses | 16,785 | | | 20,407 | | | | | (17.7) | | | |

| INCOME (LOSS) BEFORE INCOME TAXES | (1,337) | | | 74,418 | | | | | NM | | |

| INCOME TAX PROVISION (BENEFIT) | (418) | | | 18,269 | | | | | NM | | |

| NET INCOME (LOSS) | $ | (919) | | | $ | 56,149 | | | | | NM | | |

| | | | | | | | | |

| | | | | | | | | |

| Earnings (loss) per share to common shareholders: | | | | | | | | | |

| Basic | ($0.07) | | | $3.09 | | | | | NM | | |

| Diluted | ($0.07) | | | $3.09 | | | | | NM | | |

Weighted average shares outstanding used in computing earnings per share attributable to common shareholders(1): | | | | | | | | | |

| Basic | 17,664 | | | 17,766 | | | | | (0.6) | | | |

| Diluted | 17,664 | | | 17,769 | | | | | (0.6) | | | |

(1)The Company's unvested restricted stock awards are considered participating securities as they receive non-forfeitable rights to cash dividends at the same rate as common stock. The basic and diluted earnings per share calculations for the periods presented reflect the two-class method mandated by ASC Topic 260, "Earnings Per Share." The two-class method adjusts both the net income and the shares used in the calculation. Application of the two-class method did not have a significant impact on the basic and diluted earnings per share for the periods presented.

NM Not meaningful

Allegiant Travel Company

Operating Revenues and Expenses by Segment

(in thousands)

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended March 31, 2024 | | Three Months Ended March 31, 2023 |

| | Airline | | Sunseeker | | Consolidated | | Airline | | Sunseeker | | Consolidated |

| OPERATING REVENUES: | | | | | | | | | | | |

| Passenger | $ | 579,936 | | | $ | — | | | $ | 579,936 | | | $ | 609,277 | | | $ | — | | | $ | 609,277 | |

| Third party products | 33,399 | | | — | | | 33,399 | | | 26,037 | | | — | | | 26,037 | |

| Fixed fee contracts | 18,861 | | | — | | | 18,861 | | | 14,117 | | | — | | | 14,117 | |

| Resort and other | 323 | | | 23,887 | | | 24,210 | | | 251 | | | 5 | | | 256 | |

| Total operating revenues | 632,519 | | | 23,887 | | | 656,406 | | | 649,682 | | | 5 | | | 649,687 | |

| OPERATING EXPENSES: | | | | | | | | | | | |

| Salaries and benefits | 199,508 | | | 13,819 | | | 213,327 | | | 157,521 | | | 2,102 | | | 159,623 | |

| Aircraft fuel | 170,087 | | | — | | | 170,087 | | | 189,546 | | | — | | | 189,546 | |

| Station operations | 66,468 | | | — | | | 66,468 | | | 61,520 | | | — | | | 61,520 | |

| Depreciation and amortization | 57,868 | | | 5,976 | | | 63,844 | | | 54,622 | | | 58 | | | 54,680 | |

| Sales and marketing | 28,878 | | | 1,541 | | | 30,419 | | | 26,640 | | | 288 | | | 26,928 | |

| Maintenance and repairs | 30,278 | | | — | | | 30,278 | | | 26,442 | | | — | | | 26,442 | |

| Aircraft lease rentals | 5,985 | | | — | | | 5,985 | | | 7,092 | | | — | | | 7,092 | |

| Other | 34,315 | | | 13,136 | | | 47,451 | | | 28,711 | | | 1,932 | | | 30,643 | |

| Special charges, net of recoveries | 14,915 | | | (1,816) | | | 13,099 | | | 14 | | | (1,626) | | | (1,612) | |

| Total operating expenses | 608,302 | | | 32,656 | | | 640,958 | | | 552,108 | | | 2,754 | | | 554,862 | |

| OPERATING INCOME (LOSS) | 24,217 | | | (8,769) | | | 15,448 | | | 97,574 | | | (2,749) | | | 94,825 | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Allegiant Travel Company

Airline Operating Statistics

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | Percent Change(1) |

| 2024 | | 2023 | | | | YoY | | |

| AIRLINE OPERATING STATISTICS | | | | | | | | | |

| Total system statistics: | | | | | | | | | |

| Passengers | 4,104,860 | | | 4,148,453 | | | | | (1.1) | % | | |

| Available seat miles (ASMs) (thousands) | 4,771,971 | | | 4,677,622 | | | | | 2.0 | | | |

| | | | | | | | | |

| | | | | | | | | |

| Airline operating expense per ASM (CASM) (cents) | 12.75 | ¢ | | 11.80 | ¢ | | | | 8.1 | | | |

| Fuel expense per ASM (cents) | 3.56 | ¢ | | 4.05 | ¢ | | | | (12.1) | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| Airline operating CASM, excluding fuel (cents) | 9.18 | ¢ | | 7.75 | ¢ | | | | 18.5 | | | |

| Departures | 29,225 | | | 29,145 | | | | | 0.3 | | | |

| Block hours | 72,632 | | | 71,790 | | | | | 1.2 | | | |

| Average stage length (miles) | 919 | | | 908 | | | | | 1.2 | | | |

| Average number of operating aircraft during period | 125.8 | | | 122.7 | | | | | 2.5 | | | |

| Average block hours per aircraft per day | 6.3 | | | 6.5 | | | | | (3.1) | | | |

| Full-time equivalent employees at end of period | 5,951 | | | 5,318 | | | | | 11.9 | | | |

| Fuel gallons consumed (thousands) | 56,224 | | | 55,434 | | | | | 1.4 | | | |

| ASMs per gallon of fuel | 84.9 | | | 84.4 | | | | | 0.6 | | | |

| Average fuel cost per gallon | $ | 3.03 | | | $ | 3.42 | | | | | (11.4) | | | |

| Scheduled service statistics: | | | | | | | | | |

| Passengers | 4,069,519 | | | 4,122,196 | | | | | (1.3) | | | |

| Revenue passenger miles (RPMs) (thousands) | 3,883,810 | | | 3,925,362 | | | | | (1.1) | | | |

| Available seat miles (ASMs) (thousands) | 4,636,922 | | | 4,573,766 | | | | | 1.4 | | | |

| Load factor | 83.8 | % | | 85.8 | % | | | | (2.0) | | | |

| Departures | 28,177 | | | 28,273 | | | | | (0.3) | | | |

| Block hours | 70,365 | | | 70,009 | | | | | 0.5 | | | |

| Average seats per departure | 177.5 | | | 176.0 | | | | | 0.9 | | | |

Yield (cents) (2) | 7.86 | ¢ | | 8.29 | ¢ | | | | (5.2) | | | |

Total passenger revenue per ASM (TRASM) (cents)(3) | 13.23 | ¢ | | 13.89 | ¢ | | | | (4.8) | | | |

Average fare - scheduled service(4) | $ | 74.98 | | | $ | 78.93 | | | | | (5.0) | | | |

Average fare - air-related charges(4) | $ | 67.52 | | | $ | 68.87 | | | | | (2.0) | | | |

| Average fare - third party products | $ | 8.21 | | | $ | 6.32 | | | | | 29.9 | | | |

| Average fare - total | $ | 150.71 | | | $ | 154.12 | | | | | (2.2) | | | |

| Average stage length (miles) | 926 | | | 915 | | | | | 1.2 | | | |

| Fuel gallons consumed (thousands) | 54,566 | | | 54,145 | | | | | 0.8 | | | |

| Average fuel cost per gallon | $ | 3.01 | | | $ | 3.42 | | | | | (12.0) | | | |

| Percent of sales through website during period | 96.5 | % | | 95.6 | % | | | | 0.9 | | | |

| Other data: | | | | | | | | | |

| Rental car days sold | 357,944 | | | 354,426 | | | | | 1.0 | | | |

| Hotel room nights sold | 61,294 | | | 68,939 | | | | | (11.1) | | | |

(1)Except load factor and percent of sales through website, which is percentage point change.

(2)Defined as scheduled service revenue divided by revenue passenger miles.

(3)Various components of this measurement do not have a direct correlation to ASMs. These figures are provided on a per ASM basis to facilitate comparison with airlines reporting revenues on a per ASM basis.

(4)Reflects division of passenger revenue between scheduled service and air-related charges in Company's booking path.

Summary Balance Sheet

| | | | | | | | | | | | | | | | | |

Unaudited (millions) | March 31, 2024

(unaudited) | | December 31, 2023 | | Percent Change |

| Unrestricted cash and investments | | | | | |

| Cash and cash equivalents | $ | 193.4 | | | $ | 143.3 | | | 35.0 | % |

| Short-term investments | 616.5 | | | 671.4 | | | (8.2) | |

| Long-term investments | 43.8 | | | 56.0 | | | (21.8) | |

| Total unrestricted cash and investments | 853.7 | | | 870.7 | | | (2.0) | |

| Debt | | | | | |

| Current maturities of long-term debt and finance lease obligations, net of related costs | 459.2 | | | 439.9 | | | 4.4 | |

| Long-term debt and finance lease obligations, net of current maturities and related costs | 1,789.6 | | | 1,819.7 | | | (1.7) | |

| Total debt | 2,248.8 | | | 2,259.6 | | | (0.5) | |

| Debt, net of unrestricted cash and investments | 1,395.1 | | | 1,388.9 | | | 0.4 | |

| Total Allegiant Travel Company shareholders’ equity | 1,322.2 | | | 1,328.6 | | | (0.5) | |

EPS Calculation

The following table sets forth the computation of net income per share, on a basic and diluted basis, for the periods indicated (share count and dollar amounts other than per-share amounts in table are in thousands):

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| Basic: | | | | | | | |

| Net income (loss) | $ | (919) | | | $ | 56,149 | | | | | |

| Less income allocated to participating securities | (354) | | | (1,254) | | | | | |

| Net income (loss) attributable to common stock | $ | (1,273) | | | $ | 54,895 | | | | | |

| Earnings (loss) per share, basic | $ | (0.07) | | | $ | 3.09 | | | | | |

| Weighted-average shares outstanding | 17,664 | | | 17,766 | | | | | |

| Diluted: | | | | | | | |

| Net income (loss) | $ | (919) | | | $ | 56,149 | | | | | |

| Less income allocated to participating securities | (354) | | | (1,254) | | | | | |

| Net income (loss) attributable to common stock | $ | (1,273) | | | $ | 54,895 | | | | | |

| Earnings (loss) per share, diluted | $ | (0.07) | | | $ | 3.09 | | | | | |

Weighted-average shares outstanding (1) | 17,664 | | | 17,766 | | | | | |

| Dilutive effect of restricted stock | — | | | 104 | | | | | |

| Adjusted weighted-average shares outstanding under treasury stock method | 17,664 | | | 17,870 | | | | | |

| Participating securities excluded under two-class method | — | | | (101) | | | | | |

| Adjusted weighted-average shares outstanding under two-class method | 17,664 | | | 17,769 | | | | | |

(1)Dilutive effect of common stock equivalents excluded from the diluted per share calculation is not material.

Appendix A

Non-GAAP Presentation

Three Months Ended March 31, 2024

(Unaudited)

Airline operating expense, airline income before income taxes, airline net income, and airline diluted earnings per share all eliminate the effects of non-airline activity as such activity is not reflective of airline operating performance. We also present these airline-only metrics excluding special charges related to aircraft accelerated depreciation on early retirement of certain airframes. Management believes the exclusion of these special charges enhances comparability of financial information between periods. Airline earnings before interest, taxes, depreciation and amortization ("Airline EBITDA") eliminates the effects of non-airline operating activity and other items. As such, all of these are non-GAAP financial measures. We believe the presentation of these measures is relevant and useful for investors because it allows them to better gauge the performance of the airline and to compare our results to other airlines.

We also present both operating expense and CASM excluding aircraft fuel expense as fuel price volatility impacts the comparability of year over year financial performance. We believe the adjustment for fuel expense allows investors to better understand our non-fuel costs and related performance.

We present consolidated operating income (loss), EBITDA, and diluted earnings (loss) per share excluding Sunseeker special charges, net of recoveries, and airline special charges, to exclude the impact of losses and insurance recoveries incurred primarily as the result of hurricanes and other insured events at Sunseeker and to exclude aircraft accelerated depreciation on early retirements of certain airframes. Management believes these measures enhance comparability of financial information between periods.

Consolidated EBITDA, Consolidated EBITDA excluding special charges, and Airline EBITDA excluding special charges, as presented in this press release, are supplemental measures of our performance that are not required by, or presented in accordance with, accounting principles generally accepted in the United States (“GAAP”). These are not measurements of our financial performance under GAAP and should not be considered in isolation or as an alternative to net income or any other performance measures derived in accordance with GAAP or as an alternative to cash flows from operating activities as a measure of our liquidity.

We define “EBITDA” as earnings before interest, taxes, depreciation and amortization. We also adjust EBITDA within this release to exclude non-airline activity and special charges. We caution investors that amounts presented in accordance with this definition may not be comparable to similar measures disclosed by other issuers, because not all issuers and analysts calculate EBITDA in the same manner.

We use EBITDA and Airline EBITDA to evaluate our operating performance and liquidity, and these are among the primary measures used by management for planning and forecasting of future periods. We believe these presentations of EBITDA are relevant and useful for investors because they allow investors to view results in a manner similar to the method used by management and make it easier to compare our results with other companies that have different financing and capital structures. EBITDA has important limitations as an analytical tool. These limitations include the following:

•EBITDA does not reflect our capital expenditures, future requirements for capital expenditures or contractual commitments to purchase capital equipment;

•EBITDA does not reflect interest expense or the cash requirements necessary to service principal or interest payments on our debt;

•although depreciation and amortization are non-cash charges, the assets that we currently depreciate and amortize will likely have to be replaced in the future, and EBITDA does not reflect the cash required to fund such replacements; and

•other companies in our industry may calculate EBITDA differently than we do, limiting its usefulness as a comparative measure.

Presented below is a quantitative reconciliation of these adjusted numbers to the most directly comparable GAAP financial performance measure.

The SEC has adopted rules (Regulation G) regulating the use of non-GAAP financial measures. Because of our use of non-GAAP financial measures in this press release to supplement our consolidated financial statements presented on a GAAP basis, Regulation G requires us to include in this press release a presentation of the most directly comparable GAAP measure, which is operating revenue, operating expenses, operating income, income (loss) before income taxes, net income (loss), and net income (loss) per share and a reconciliation of the non-GAAP measures to the most comparable GAAP measure. Our utilization of non-GAAP measurements is not meant to be considered in isolation or as a substitute for operating expenses, income (loss) before income taxes, net income (loss), earnings (loss) per share, or other measures of financial performance prepared in accordance with GAAP. Our use of these non-GAAP measures may not be comparable to similarly titled measures employed by other companies in the airline and travel industry. The reconciliation of each of these measures to the most comparable GAAP measure for the periods is indicated below.

Reconciliation of Non-GAAP Financial Measures

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| Reconciliation of net income and earnings per share excluding special charges net of recoveries (millions except share and per share amounts) | | | | | | | |

| Net income (loss) as reported (GAAP) | $ | (0.9) | | | $ | 56.1 | | | | | |

Special charges(2) | 13.1 | | | (1.6) | | | | | |

| Income tax effect of adjustments | (1.8) | | | 0.8 | | | | | |

Net income excluding special charges net of recoveries(1)(3) | 10.4 | | | 55.3 | | | | | |

| Net income allocated to participating securities | (0.4) | | | (1.2) | | | | | |

Net income attributable to common stock excluding special charges net of recoveries(1)(3) | 10.0 | | | 54.1 | | | | | |

| | | | | | | |

| Diluted shares used for computation (GAAP) (thousands) | 17,664 | | | 17,769 | | | | | |

| Diluted shares used for computation - excluding special charges net of recoveries (thousands) | 17,669 | | | 17,769 | | | | | |

| | | | | | | |

| Diluted earnings (loss) per share as reported (GAAP) | $ | (0.07) | | | $ | 3.09 | | | | | |

Diluted earnings per share excluding special charges net of recoveries(1)(3) | $ | 0.57 | | | $ | 3.04 | | | | | |

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| Reconciliation of airline net income excluding special charges and airline earnings per share excluding special charges (millions except share and per share amounts) | | | | | | | |

| Net income (loss) as reported (GAAP) | $ | (0.9) | | | $ | 56.1 | | | | | |

| Non-airline loss before taxes | 13.9 | | | 4.4 | | | | | |

Airline special charges(2) | 14.9 | | | — | | | | | |

| Income tax effect of adjustments | (8.1) | | | (0.6) | | | | | |

Airline net income, excluding special charges(1)(4) | 19.8 | | | 59.9 | | | | | |

| | | | | | | |

| Airline net (income) allocated to participating securities excluding special charges | (0.7) | | | (1.3) | | | | | |

Airline net income attributable to common stock excluding special charges(1)(4) | 19.1 | | | 58.6 | | | | | |

| | | | | | | |

| Diluted shares used for computation (GAAP) (thousands) | 17,664 | | | 17,769 | | | | | |

| Diluted shares used for computation - airline only excluding special charges (thousands) | 17,669 | | | 17,769 | | | | | |

| | | | | | | |

| Diluted earnings (loss) per share as reported (GAAP) | $ | (0.07) | | | $ | 3.09 | | | | | |

Diluted airline earnings per share excluding special charges(1)(4) | $ | 1.08 | | | $ | 3.30 | | | | | |

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| Reconciliation of airline operating expense, operating income, and income before income taxes excluding special charges (millions) | | | | | | | |

| Operating expense as reported (GAAP) | $ | 641.0 | | | $ | 554.9 | | | | | |

| Non-airline operating expense | 32.7 | | | 2.8 | | | | | |

| Airline operating expense | 608.3 | | | 552.1 | | | | | |

Airline special charges(2) | 14.9 | | | — | | | | | |

Airline operating expense, excluding special charges(1)(4) | $ | 593.4 | | | $ | 552.1 | | | | | |

| | | | | | | |

| Operating income as reported (GAAP) | $ | 15.4 | | | $ | 94.8 | | | | | |

| Non-airline operating loss | 8.8 | | | 2.8 | | | | | |

Airline special charges(2) | 14.9 | | | — | | | | | |

Airline operating income, excluding special charges(1)(4) | $ | 39.1 | | | $ | 97.6 | | | | | |

Airline operating margin, excluding special charges(4) | 6.2 | % | | 15.0 | % | | | | |

| | | | | | | |

| Income (loss) before income taxes as reported (GAAP) | $ | (1.3) | | | $ | 74.4 | | | | | |

| | | | | | | |

| | | | | | | |

| Non-airline loss before income taxes | 13.9 | | | 4.4 | | | | | |

Airline special charges(2) | 14.9 | | | — | | | | | |

Airline income before income taxes, excluding special charges(1)(4) | $ | 27.5 | | | $ | 78.8 | | | | | |

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| Reconciliation of Airline net income (millions) | | | | | | | |

| Net income (loss) as reported (GAAP) | $ | (0.9) | | | $ | 56.1 | | | | | |

| Non-airline loss before taxes | 13.9 | | | 4.4 | | | | | |

| Income tax effect of adjustments | (1.6) | | | (0.6) | | | | | |

Airline net income(1) | $ | 11.4 | | | $ | 59.9 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| Reconciliation of operating income excluding special charges (millions) | | | | | | | |

| Operating income as reported (GAAP) | $ | 15.4 | | | $ | 94.8 | | | | | |

Sunseeker special charges, net of recoveries(2) | (1.8) | | | (1.6) | | | | | |

Airline special charges(2) | 14.9 | | | — | | | | | |

Operating income, excluding special charges(1)(3) | $ | 28.5 | | | $ | 93.2 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| Reconciliation of airline operating CASM excluding fuel and special charges (millions) | | | | | | | |

| Consolidated operating expense (GAAP) | $ | 641.0 | | | $ | 554.9 | | | | | |

| Less fuel expense | 170.1 | | | 189.5 | | | | | |

| Less non-airline operating expense | 32.7 | | | 2.8 | | | | | |

Less airline special charges(2) | 14.9 | | | — | | | | | |

Total airline operating expense less fuel and airline special charges(1)(4) | $ | 423.3 | | | $ | 362.6 | | | | | |

| | | | | | | |

| System available seat miles (millions) | 4,772.0 | | | 4,677.6 | | | | | |

| Cost per available seat mile (cents) | 13.43 | | | 11.86 | | | | | |

| Airline-only cost per available seat mile (cents) | 12.75 | | | 11.80 | | | | | |

Airline-only cost per available seat mile excluding fuel and airline special charges (cents)(4) | 8.87 | | | 7.75 | | | | | |

| | | | | | | | | | | | | | | |

| Three Months Ended March 31, | | |

| 2024 | | 2023 | | | | |

| Consolidated EBITDA and Consolidated EBITDA, excluding special charges(millions) | | | | | | | |

| Net income (loss) as reported (GAAP) | $ | (0.9) | | | $ | 56.1 | | | | | |

| Interest expense, net | 16.7 | | | 20.4 | | | | | |

| Income tax expense (benefit) | (0.4) | | | 18.3 | | | | | |

| Depreciation and amortization | 63.8 | | | 54.7 | | | | | |

| | | | | | | |

Consolidated EBITDA(1) | $ | 79.2 | | | $ | 149.5 | | | | | |

Special charges, net of recoveries(2) | 13.1 | | | (1.6) | | | | | |

Consolidated EBITDA, excluding special charges(1)(3) | $ | 92.3 | | | $ | 147.9 | | | | | |

| | | | | | | |

| Airline EBITDA, excluding special charges (millions) | | | | | | | |

| Income (loss) before taxes as reported (GAAP) | $ | (1.3) | | | $ | 74.4 | | | | | |

| Non-airline loss before taxes | 13.9 | | | 4.4 | | | | | |

Airline special charges(2) | 14.9 | | | — | | | | | |

Airline income before taxes, excluding special charges(1)(4) | $ | 27.5 | | | $ | 78.8 | | | | | |

| Airline interest expense, net | 11.6 | | | 18.8 | | | | | |

| Airline depreciation and amortization | 57.9 | | | 54.6 | | | | | |

Airline EBITDA, excluding special charges(1)(4) | $ | 97.0 | | | $ | 152.2 | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

| | | | | | | |

(1)Denotes non-GAAP figure.

(2)In 2024 and 2023, we recognized as special charges the full amount of estimated property damage to Sunseeker Resort due to weather and other insured events less the amount of recognized insurance recoveries through the end of the applicable period. Beginning in third quarter 2023, we also recognized aircraft accelerated depreciation as special charges related to our revised fleet plan.

(3)Adjusted to exclude the impacts of property damage to Sunseeker Resort, net of recoveries, and aircraft accelerated depreciation charges resulting from our revised fleet plan.

(4)Adjusted to exclude aircraft accelerated depreciation recognized as special charges related to our revised fleet plan.

* Note that amounts may not recalculate due to rounding

v3.24.1.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

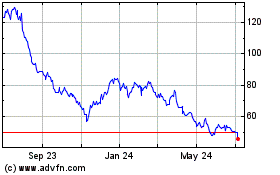

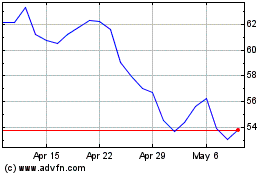

Allegiant Travel (NASDAQ:ALGT)

Historical Stock Chart

From Apr 2024 to May 2024

Allegiant Travel (NASDAQ:ALGT)

Historical Stock Chart

From May 2023 to May 2024