How High Can Bitcoin Go Before A Top? Analyst Chimes In

May 29 2024 - 6:00PM

NEWSBTC

An analyst has explained how the Bitcoin rally could still have

room to run before hitting a top based on the data of this

indicator. Bitcoin Macro Oscillator Isn’t At Historical Top Zone

Yet In a new post on X, analyst Willy Woo has discussed the recent

trend developing in the Bitcoin Macro Oscillator (BMO). This

indicator combines four different metrics to provide an oscillating

value around the zero mark. The indicators in question are the

market Value to Realized Value (MVRV) ratio, Volume-Weighted

Average Price (VWAP) ratio, Cumulative Value-Days Destroyed (CVDD)

ratio, and Sharpe ratio. Related Reading: Is Mt. Gox A Worry For

Bitcoin? Crypto Analyst Weighs In The chart below shows how the

oscillator based on these metrics has fluctuated in value over the

past few Bitcoin cycles. From the graph, it’s visible that tops in

the cryptocurrency’s price have historically coincided with the

metric reaching relatively high levels. More particularly, the 2013

and 2021 tops occurred when the indicator breached the 1.8 level,

while the 2017 peak occurred when the oscillator hit 2.4. So far,

in the current rally, the oscillator has achieved a peak value of

1.2. This high coincided with the asset’s all-time high (ATH)

price, which continues to be the top of the run thus far. When

considering the historical precedent, though, this value doesn’t

seem to be high enough for the top to have been cyclical. As the

coin’s price has consolidated since this high, the oscillator has

cooled off, now hitting just 0.69. Thus, the asset has gained more

distance from the zone where tops have occurred in the past. “This

2.5 months of consolidation under bullish demand has been very good

for Bitcoin; it means the price has more room to run before topping

out,” notes Woo. The analyst suggests that BTC could now have 2 to

3 levels of the BMO to climb before reaching the macro top. Woo has

also pointed out a potential positive sign brewing for Bitcoin

regarding its net capital flows. Below is a chart showing this

metric’s trend over the last few years. As displayed in the graph,

net capital flows into Bitcoin were quite high during the surge

toward the price ATH, but money stopped flowing in as the asset

fell into sideways movement. Related Reading: Ethereum Deposits At

4-Month High: Whales Preparing For Selloff? During May, though, the

net flows have finally reversed the trend, as they have been on the

rise once more. This fresh demand can naturally be bullish for the

cryptocurrency’s value. BTC Price Bitcoin surged above the $70,500

level earlier, but the coin has since slumped back down, trading

around $67,800. Featured image from Dall-E, woocharts.com, chart

from TradingView.com

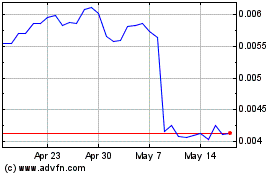

Four (COIN:FOURRUSD)

Historical Stock Chart

From May 2024 to Jun 2024

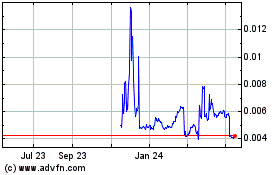

Four (COIN:FOURRUSD)

Historical Stock Chart

From Jun 2023 to Jun 2024