Ethereum’s Positive Funding Rates Push Price Near $4K—Are There Any Downsides?

November 12 2024 - 10:30PM

NEWSBTC

Ethereum has recently climbed to a major high above $3,400,

reigniting enthusiasm among market participants and signaling a

potential upward trend that may lead to a push above $4,000 toward

a new all-time high. This optimism has been met with major

speculation of ETH’s price from the crypto community and analysts,

who are observing key indicators within the market to assess the

asset’s trajectory. Related Reading: Ethereum Weekly Volume Hits

$60 Billion As ETH Aims For Yearly Highs Ethereum Rise and Market

Sentiment According to a report shared by a CryptoQuant analyst

known as ‘ShayanBTC,’ Ethereum’s recent price performance, up by

35% in the past week, has been accompanied by positive sentiment in

the futures market, providing a detailed look into potential

short-term fluctuations. Shayan pointed out that the funding rates

for Ethereum futures have remained positive, demonstrating strong

demand and bullish sentiment among investors. Notably, positive

funding rates typically indicate buyers are willing to pay a

premium to hold long positions, which signifies market confidence.

The analyst highlighted that this surge in positive sentiment was

especially evident when Ethereum surpassed the $3,000 mark,

reflecting a similar pattern observed during the March 2024 rally

that culminated in a yearly peak. This pattern now raises questions

about whether the current momentum can be sustained or if the

market is vulnerable to sudden reversals, just as it did following

a major rally earlier this year. What Is Expected While positive

funding rates are a favorable sign of market interest, they can

also indicate heightened risk when they become too elevated. Shayan

particularly noted: Although positive funding rates generally

signify healthy demand in a bullish market, elevated funding rates

can be a red flag. The analyst cautioned that high funding rates

may point to an “overheated” market, which could increase the

likelihood of a long liquidation cascade if the price faces

significant resistance or experiences even a modest correction.

Elevated rates suggest that traders may be over-leveraged, creating

conditions where a sharp pullback could trigger a wave of sell-offs

as leveraged positions are liquidated. The CryptoQuant analyst

further revealed that with Ethereum experiencing high funding rates

in the current market climate, investors may need to “exercise

caution and adopt strategies to mitigate potential risks.” Related

Reading: Ethereum Could Be Set To Explore New Highs As On-Chain

Metrics Light Up The analyst emphasized that with heightened

funding rates comes an increased chance of market volatility. Rapid

price movements could lead to liquidations, particularly if

profit-taking or minor corrections unsettle the market. Meanwhile,

Ethereum has breached the $3,400 price mark to trade as high as

$3,424 earlier today. However, at the time of writing, the asset

appears to have seen a slight correction with a current trading

price of $3,289, albeit still up by 2.2% in the past day. Featured

image created with DALL-E, Chart from TradingView

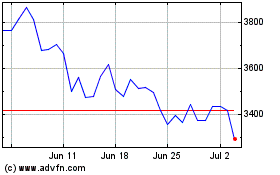

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

Ethereum (COIN:ETHUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024