Free

Writing Prospectus

VanEck

Merk Gold Trust

2022-09-12

Bloomberg ETF IQ Interview

0001546652

Pursuant

to 433/164

333-238022

Speaker 1:

Joining our conversation, uh, right now to talk about one

of the things we, another thing we mentioned at the top, which is stagflation, is Axel Merk. He’s the CIO of Merk Investments, they have

more than a billion dollars of assets under management. And Axel, um, before we get to OUNZ , which is an-an ETF that we’re all pretty

excited about, I wanna talk about stagflation and the product that you’ve created to hedge against that. Explain it to us.

Axel Merk:

Sure. We launched the Merk Stagflation ETF in May as a diversifier.

Um, if you think about a stagflation environment, uh, first of all, if you look at the markets today, you’ll think it’s all Goldilocks.

Well, maybe it’s just short covering ahead of the CPI. Stagflation last time around lasted over a decade because the reaction of policymakers

tends to exacerbate the problem. And you want to have a diversified, ideally you want to invest in the CPI. You can’t do that. And so

when we do in the Stagflation ETF is, we invest, a big portion in TIPS, um, where you lock in real interest rates-

Speaker 3:

Mm-hmm.

Axel Merk:

... and then diversify with oil, gold and real estate. And

all these four components have historically done well in a stagflation environment, and, importantly, provided diversification, have a

low correlation while providing a risk profile that’s more bond-like, with a bit of a kick, then, uh, you’d get if you invested purely

into commodities, for example.

Speaker 3:

Well Axel, historically, TIPS for example have done well.

But if we look at the past year, year and a half, TIPS really have not kept up or provided that inflation hedge, as some might have hoped

that they would. And if I look at the Stagflation ETF, that’s ticker STGF, 73% of it or so is in ETFs-like exposure, so if it’s not working

now, when is that going to start working?

Axel Merk:

And with TIPS, you don’t buy inflation, you buy the real rates,

um, so to speak, right? You lock in the real rates. And as real rates have moved higher, that means you’ve lost money in the short-term.

The question is, is it sustainable for the Federal Reserve to keep real rates that high, and-and again, in that sense, it’s a diversifier.

The way I look at it is, um, the Fed’s “higher for longer” strategy will work until it doesn’t. If and when spreads blow out,

they have pretty much only one choice, in my view, is to revert again. And so the question of what point you want to start locking in

those higher real rates, whether the time is now, and uh, again, directly, the markets think everything is rosy today, um, and, uh, what

was it you-you rip the dip, or something like that (laughs).

Speaker 3:

Set sail on the ship, or... some ships.

Axel Merk:

Exactly. So, whether the...that’s the time now. And importantly,

right? We didn’t create this product just for-for a few months. Um, last time it lasted over a decade, from the late 60s to the early

70s, into the early 80s. And so, similarly the question is, will the sort of stagflation environment persist? Not identical to the 70s,

of course, but, will we get this-this sub-par growth and higher than normal inflation? And last time, even when Volcker, um quote-unquote

“beat inflation”, it still took several years for inflation to come down to the 2% mark.

Speaker 1:

Um, Axel, I looked at the holdings here, and I’m surprised

there’s no gold in here. Obviously, inflation is half of the word stagflation, and you have a gold ETF, you’re a gold guy. Uh, so curious

why it didn’t make it into the Stagflation ETF?

Axel Merk:

We do. O U N Z, our own gold ETF, is in there. We, um, we

reduced the-the management fees, so to speak, that’s passed to on that. So we do have gold in that. That is one of the components. But

gold, oil and real estate...we have a trend following methodology, um, and, the reason we have that, they-they tend to be weighed between

5% and 15%, uh, and the reason we have that, is, because the trend following methodology in those commodities work particularly well in

the stagflation environment.

Speaker 1:

It’s interesting, um, so the OUNZ ETF, which is your gold

ETF, uh, we’re so fascinated by it because you can take physical delivery of your gold. How does that work, it seems very complicated

for an ETF structure.

Axel Merk:

Well, we got a patent on the process when we came out with

it in 2014, we got over $600 million in assets right now, we’ve had several hundred ounces delivered this year, and what-the-there a few

things. First off, we have London bars. London, as most of these gold ETFs have, most investors never ever wanna hold a London bar as

a retail person, so we facilitate a swap into coins. We were able to facilitate deliveries and procure them, even during the height of

the-the pandemic-

Speaker 3:

Mm.

Axel Merk:

... and the London bars are always available, the coins

are only when needed. An important aspect is, you take delivery of what you already own. And what that means is, taking delivery is not

a taxable event. And that’s very different. There’s one other product that tries to do something remotely similar-

Speaker 3:

Right.

Axel Merk:

And, uh, taxes all over the place. And we-we are tax neutral in that

sense.

Speaker 1:

Can I just ask, a bar-a bar is 400 troy ounces, right? So

that would be a massive amount of shares. Are the coins smaller denomination?

Axel Merk:

One-one more... yes, uh, one ounce is the minimum delivery that we

request.

Speaker 1:

Okay.

Axel Merk:

Um, we, and actually, if you take about 10 to 20 ounces,

our fees are not more, not necessarily more than you do with a coin dealer. Uh, with one ounce it is, because we do have to-have to address

the fees that we have to pay for the shares-

Speaker 3:

Right.

Axel Merk:

... but-but-but it’s a, it’s a very straightforward process,

and, uh, usually it takes, uh, a-about a week or so, start to finish, when everybody’s organized. And the prospectus, of course we have

cautionary notes that it can take longer, but, uh, it’s a very smooth process, and, uh, and-and most people, by the way hold it long-term.

One of the things you might see is, um, we have steadily been gaining market share. And the reason is, that investors, in OUNZ, buy it

for the long-term. Very few people take delivery. But having that optionality is what makes OUNZ so attractive to investors.

Speaker 3:

Well Axel, to that last point, how many people are actually

taking physical delivery of gold right now? How does that compare to previous years, for example?

Axel Merk:

We have about one to two people a month taking delivery.

So it’s not huge, and, uh, that’s been reasonably consistent. It used to be, I guess, year two: one, now it’s 1-2, but, the assets and

the fund-outs were higher. So it’s not a huge amount, um, but it is steady, and we get smaller and larger requests. Some people just

take five ounces, some people take 50 ounces or more. Um, but again, they do convert them to-to coins. Um, we’ve had a London bar delivery,

but that was at the tail end. It was then swapped with another party, and so, retail investors do not want to have a London bar, that’s

good for executional trading-

Speaker 3:

(laughs)

Axel Merk:

... but not-not for, for retail investment.

Speaker 1:

Axel, thanks so much for joining us. Great having you on the program.

Axel Merk there, of Merk Investments. They run S-T-G-F, as well as O-U-N Zed.

***

The issuer has filed a registration statement with the SEC for

offering to which this communication relates. Before you invest, you should read the prospectus and other documents.

4

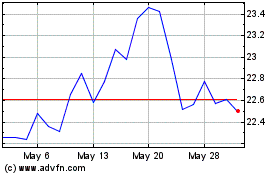

VanEck Merk Gold (AMEX:OUNZ)

Historical Stock Chart

From Apr 2024 to May 2024

VanEck Merk Gold (AMEX:OUNZ)

Historical Stock Chart

From May 2023 to May 2024