A Gravity-Defying Market - Ahead of Wall Street

May 09 2013 - 5:52AM

Zacks

Thursday, May 9,

2013

Stocks continue to defy gravity and today’s market action will

likely be no different despite the frothy-looking inflation data

out of China and the soft tone of pre-open sentiment. Offsetting

the Chinese inflation numbers are the better than expected weekly

Jobless Claims data on the home front, which should help sustain

the positive sentiment created by last week’s better than expected

April jobs report.

Irrespective of the tone of today’s jobs data from the home front

or Chinese inflation news, the stock market seems to know only to

move in one direction. That’s not what history tells us, but that’s

what we have been seeing lately. The jobs data last week was

undoubtedly positive, as are this morning’s initial claims numbers.

But stocks had been moving higher even before the jobs numbers in

the face of all around underwhelming economic and earnings data.

The takeaway from this market behavior is that as long as the Fed

remains on its current course, the market will be more than willing

to overlook fundamentals.

The Q1 earnings season, now in its final stretch, has mostly been

'average' or 'below average', but you wouldn't see that in the

market's response. Including this morning’s reports from

Dean Foods (DF), Apache

(APA), and Dish

Network (DISH), we

now have Q1 results from 445 S&P 500 companies. Total earnings

for the 445 companies are up +3.6% from the same period last year,

with 65.6% beating earnings expectations. Revenues are down -0.9%,

with only 41.8% of the companies coming ahead of top-line

expectations. The composite growth rate for Q1, where we combine

the results of the 445 companies that have reported results with

the 55 still to come, is for +2.4% growth in earnings on -0.8%

lower revenues.

The Q1 earnings growth rate has turned to be better relative to

pre-season expectations, but top-line performance has undoubtedly

been on the weak side. Estimates for the coming quarters,

particularly Q2, have started coming down giving the overwhelmingly

soft tone of company guidance. However, expectations for the back

half of the year and next year still reflect a level of growth

rebound that is inconsistent with what we have seeen in the last

few quarters, including the Q1 earnings season.

Sheraz Mian

Director of Research

APACHE CORP (APA): Free Stock Analysis Report

DEAN FOODS CO (DF): Free Stock Analysis Report

DISH NETWORK CP (DISH): Free Stock Analysis Report

SPDR-SP 500 TR (SPY): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

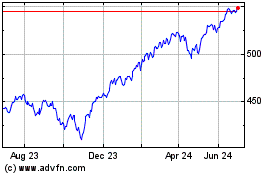

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Jun 2024 to Jul 2024

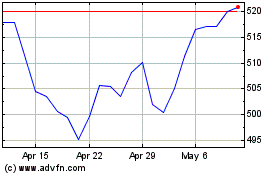

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Jul 2023 to Jul 2024