Is the Market Overvalued? - Investment Ideas

March 18 2013 - 9:47PM

Zacks

Valuation Lessons From Shiller’s CAPE Model

Yale Professor Robert Shiller’s price-earnings ratio is getting

fresh press these days. U.S. stock markets (tickers: SPY,

QQQ, DIA) have all hit multi-year highs. They recorded their

best quarter in 15 years.

The question the stock market highs raise: Is this market

overvalued?

Robert Shiller’s valuation ratio provides us one avenue to address

the current valuation concern. His price to earnings (P/E)

ratio is based on average inflation-adjusted earnings from the

previous 10 years. This P/E ratio gives investors a view on

stock market valuation over a full business cycle, smoothing out

both recessions and booms in corporate earnings.

This P/E ratio is also known as the Cyclically Adjusted P/E Ratio

(the CAPE Ratio), the Shiller P/E Ratio, or the P/E 10.

How to Compute Shiller’s CAPE

- Look at yearly earnings on the S&P 500 for each of the past

ten years.

- Adjust earnings for inflation, using the CPI. In other

words, quote each earnings figure in 2012 dollars.

- Average these values. In other words, add them up and

divide by ten. This gives us “e10.”

- Then, take the current price of the S&P 500 and divide by

e10.

The chart below shows Shiller’s CAPE Ratio over the last 160 years

of U.S. stock market data.

Bob Shiller likes to look over the long sweep of history.

Interestingly, this chart included long-term interest rate data

from fixed income markets over the same 160-year period.

That is what attracted me.

What History Shows

Note: long-term interest rates hit a major high in 1921.

At the same time, the stock market Shiller valuation hit a major

low.

Then, long-term interest rates declined. As rates

declined, stock market Shiller valuations rushed up into the Crash

of 1929. Rates continued their decline until 1940.

When interest rates reversed upwards after WWII, the long-term

valuation of the stock market went with it.

Until 1966…

Then, the Vietnam War and Arab Oil Embargo squelched a 25-year

stock market valuation rally, and gave the U.S. economy a battle

with high consumer price inflation.

From 1940 to 1980, forty years in a rising rate formation

materializes. A historic high in long-term U.S.

interest rates is placed in 1981.

Again, once interest rates hit a major high in 1981, the U.S.

stock market hit a major Shiller valuation low.

This may be the key insight of this valuation model: History

shows us that Shiller CAPE valuation lows in stock markets tie

directly into the major highs in long-term interest rates.

Stock market valuation bulls ran for the next 20 years, all the way

to a peak in the Shiller P/E Ratio in 2000.

What About Today?

Long-term interest rates have been declining since 1981. This

long run down in rates is now over 30 years old. Pundits keep

calling for a turn upwards in long-term rates. It has not

materialized.

Lesson #1

The Fed is working overtime to manage down the long-term 10-year

U.S. Treasury rate to 2.0%. This chart tells us one reason

why. Keeping long-term interest rates near historic lows

makes stock valuations relatively more attractive. A

risk trade is made better.

The long sweep of history confirms the simple logic in that

policy.

If long-term rates rise, history also says that is NOT the end of

the bull market in terms of Shiller valuations. Stock

valuations can keep going up for years, as long as the rise in

long-term rates is modest and steady.

However, if inflation blasts upwards like in the late 1970s to

early 1980s, as some predict, this model says the results for

stocks would not be so simple. It would be disastrous.

Lesson #2

Today’s stock market trades at 23.40 on the Shiller CAPE.

That looks high in historic terms. This is Bob Shiller’s big

point.

However, remember the past 10 years of earnings data include the

2008 and 2009 years. There was a deep, leveraged collapse in

earnings here. Take those earnings years out, and the current

valuation alarm falls away.

The lesson here is to look out for a major market event to derail

market matters, like an Oil Embargo, or an Over-Leveraged Housing

Crash. Something in broader Europe looks appropriate today.

A future valuation trip up, with the Shiller CAPE ratio rising

above 30, would be the zone for concern. That is a +30%

valuation-only move from here.

Lesson #3

For a competing valuation perspective, consider this.

Trailing 12-month P/E ratios for the S&P 500 index show us a 15

valuation. The forward 12-month S&P 500 valuation is

around 14.5 at the moment.

The former is valued in line with its historic 160-year norm.

The latter is slightly undervalued. The final lesson is

this. The trailing-forward 12-month P/E gap is constructive

-- as long as the +3% to +5% earnings growth this gap predicts

materializes this year.

As long as we stay away from valuation extremes, we are good to

go.

SPDR-DJ IND AVG (DIA): ETF Research Reports

NASDAQ-100 SHRS (QQQ): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

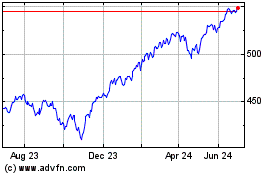

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Jul 2024 to Aug 2024

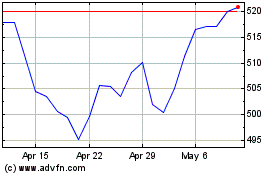

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Aug 2023 to Aug 2024