November Gave Up Some Decent Jobs Numbers, Lifting Spirits... - Real Time Insight

December 07 2012 - 4:25AM

Zacks

November’s job adds provided optimism to stock markets this

morning, suggesting the markets needed a boost. Sentiment coming

into the Friday report had a more negative tone, due to the lower

ADP numbers reported on Wednesday.

Total nonfarm payroll employment increased by

+146,000 in November. October was revised to +138,000 from

+171,000. September was revised to +132,000 from

+148,000. Since the beginning of 2012, employment growth has

averaged +151,000 per month, about the same as the average monthly

job gain of +153,000 in 2011. That means November is

about as solid an example of average as one can get.

No worries.

The unemployment rate

edged down to 7.7%.

Inside the November job

numbers, the divide between growth driven by consumer spending, and

lethargic activity by businesses continues apace.

Many key sectors that led

were consumer sectors, i.e. Retail and Wholesale Trade, and Leisure

& Hospitality were among the leaders.

Construction and

Manufacturing sectors lost jobs.

Listed in order of

importance in November:

(1) Retail

trade employment rose by +53,000 and has increased by

+140,000 over the past 3 months. Over the month, job gains occurred

in clothing and clothing accessory stores (+33,000), in general

merchandise stores (+10,000), and in electronics and appliance

stores (+9,000). Employment in miscellaneous store retailers

decreased by 13,000.

(2) Professional

and business services rose by +43,000. Employment

continued to increase in computer systems design and related

services.

(3) Health

care employment continued to increase in November

(+20,000), with gains in hospitals (+8,000) and in nursing care

facilities (+5,000). Health care has added an average of 26,000

jobs per month this year.

(4) Wholesale

trade edged up over the month (+13,000). Since reaching an

employment trough in May 2010, the industry has added 228,000

jobs.

(5)

Information employment also edged up in November

(+12,000), with the increase concentrated in motion picture and

sound recording (+15,000). On net, information employment has

changed little over the past 12 months.

(6) Leisure and

hospitality employment continued to trend up (+23,000).

Over the past 12 months, the industry has added 305,000

jobs.

(7)

Construction declined by -20,000, with much of the loss

occurring in construction of buildings (-11,000). Since early 2010,

construction has shown no clear trend.

(8)

Manufacturing employment changed little over the month.

Within the industry, job losses in food manufacturing (-12,000) and

chemicals (-9,000) more than offset gains in motor vehicles and

parts (+10,000) and wood products (+3,000). On net, manufacturing

employment has changed little since this past

spring.

Share your personal view

of these numbers below…

SPDR-DJ IND AVG (DIA): ETF Research Reports

SPDR-GOLD TRUST (GLD): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

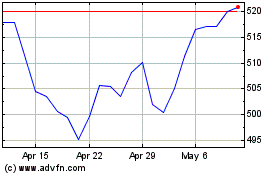

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From May 2024 to Jun 2024

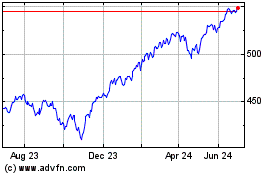

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Jun 2023 to Jun 2024