What will the Fed do Next Week? - Real Time Insight

December 04 2012 - 9:15AM

Zacks

While

most investors are currently fixated on the “fiscal-cliff” talks,

the market will also be impacted by the November jobs report due

Friday and then the outcome of the Federal Reserve’s FOMC meeting

next week.

Even though

jobs numbers are likely to be impacted by Super-storm Sandy; this

report will still be a factor in the outcome of FOMC's last meeting

of 2012.

Operation

Twist—which involves buying longer-term bonds and selling a like

amount of shorter-term treasuries—is expiring at the end of this

month.

Additionally,

Fed buys 40 billion of agency mortgage-backed securities each

month, under QE3. QE3 is an open-ended program, implying the Fed

will continue to buy bonds until they see a substantial improvement

in the job market.

In all, Fed

buys about $85 billion of long-term bonds each month under the two

programs.

Several FOMC

members have indicated that they support additional bond purchases.

Some of them have suggested adopting specific thresholds for

unemployment and inflation and continuing asset purchases until

those thresholds are hit.

On the other

hand, some members are not in favor of extending Twist or

thresholds.

What do you

think the Fed will decide in the next meeting?

1) Ramp up QE3 to buy $85 billion of mortgage

backed securities

2) Start outright purchase of long-term treasury

bonds to make up for the Twist shortfall

3) Start outright purchase but scale down the

amount as outright purchases are more “stimulative” than swapping

the shorter-term securitiies for longer-term securities

4) Do nothing now and act later in case the

economy actually goes over the cliff

SPDR-GOLD TRUST (GLD): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

ISHARS-BR 20+ (TLT): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

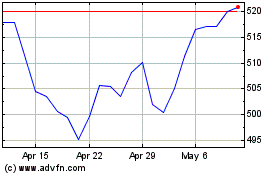

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From May 2024 to Jun 2024

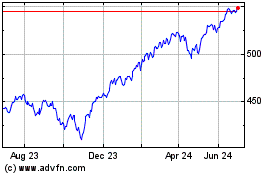

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Jun 2023 to Jun 2024