Do ''Economic Thresholds'' Make Sense to Financial Markets? - Real Time Insight

November 14 2012 - 9:31AM

Zacks

The big issue the

latest FOMC members debated in today’s minutes was a move to

“specific threshold values” for unemployment and

inflation.

Specific targets for

these two variables would provide “forward guidance regarding the

timing of the initial increase in the Fed Funds rate”.

Currently, the Fed relies solely on a mid-2015 calendar date to

communicate when the Fed Funds rate is to move off its zero

level.

This new approach

would be some version of a plan offered by Chicago Fed President

Charles Evans. He wants the Fed to tell financial markets

that it will keep Fed Fund rates low -- until the unemployment rate

falls below 7%, and as long as inflation remains below

3%.

FOMC minutes showed

three issues needed to be resolved, before officials would use

"economic thresholds."

The three

issues:

(1) Whether to specify

such thresholds in terms of realized or projected values of

inflation and the unemployment rate. And, in either case,

what values for those thresholds would best balance the Committee’s

objectives of promoting maximum employment and price

stability?

(2) Whether to

supplement thresholds expressed in terms of the unemployment rate

and inflation with additional indicators of economic and financial

conditions that might signal a need either to raise the federal

funds rate before a threshold is crossed, or to delay until well

afterward.

(3) Whether the

statement should also provide forward guidance about the likely

path of the federal funds rate after the initial increase. It

was noted that such guidance could have significant effects on

financial conditions and the economy.

At the conclusion of

the discussion, Chairman Bernanke asked the staff present to

provide additional background material, taking into account the

range of participants’ views.

What do you think?

Would using “specific threshold values”, i.e. an unemployment below

7% and inflation below 3%, better communicate an upward change in

the Fed Funds rate from zero?

Or

would adding these two variables just add confusion?

SPDR-DJ IND AVG (DIA): ETF Research Reports

SPDR-GOLD TRUST (GLD): ETF Research Reports

NASDAQ-100 SHRS (QQQ): ETF Research Reports

SPDR-SP 500 TR (SPY): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

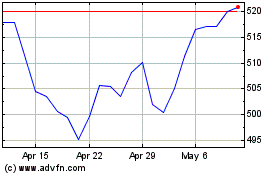

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From May 2024 to Jun 2024

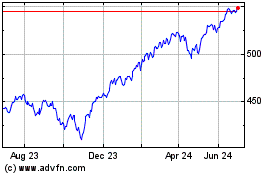

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Jun 2023 to Jun 2024