How do You play This Market? - Real Time Insight

October 22 2012 - 10:58AM

Zacks

Third quarter results

reported so far are lackluster in most cases and many companies

have provided bleak guidance for the fourth quarter.

On the other hand, recent U.S.

economic data has been largely positive. Improving macro picture

and the central banks’ support will continue to make the market

somewhat resilient.

And while the outlook for the

Euro-zone is still very cloudy, China is showing some signs of

bottoming out.

However, with the presidential

race in a dead heat and the looming fiscal cliff, the investors are

hesitant to make any big moves in the market.

The market may thus continue to

move sideways (possibly with a downward bias) in the coming

weeks.

So, what’s your strategy for

this market?

1) Buy the dips since you believe

that the long-term direction is still up

2) Use options/ leveraged ETFs for

short-term hedging/trading

3) Buy defensive and

low-volatility stocks or ETFs to limit downside risk

4) Stay away from the market until

there is better visibility

Please share your

thoughts.

SPDR-SP 500 TR (SPY): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

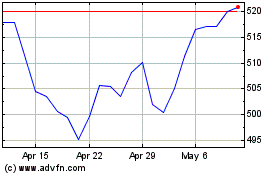

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Jun 2024 to Jul 2024

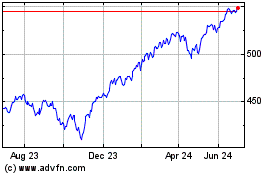

SPDR S&P 500 (AMEX:SPY)

Historical Stock Chart

From Jul 2023 to Jul 2024