UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16

OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of APRIL 2015

Commission File Number: 001-32929

POLYMET MINING CORP.

(Translation of registrant's name into English)

100 King Street, Suite 5700

Toronto, ON Canada M5X 1C7

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

[ X ] Form 20-F [ ]

Form 40-F

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): [ ]

Indicate by check mark if the registrant is submitting the

Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): [ ]

EXPLANATORY NOTE

This report on Form 6-K and attached exhibit are incorporated by reference into Registration Statements No. 333-185071 and No. 333-192208 and this report on Form 6-K shall be deemed a part of such registration statements from the date on which this report on Form 6-K is filed, to the extent not superseded by documents or reports subsequently filed or furnished by PolyMet Mining Corp. under the Securities Act of 1933, as amended, or the Securities Exchange Act of 1934, as amended.

SUBMITTED HEREWITH

Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act

of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

| |

PolyMet Mining Corp. |

| |

(Registrant) |

| |

|

|

| Date: April 21, 2015 |

By: |

/s/ Jonathan Cherry |

| |

|

|

| |

|

Jonathan Cherry |

| |

Title: |

President and CEO |

|

100 King Street West, Suite 5700, Toronto,

Ontario, Canada, M5X 1C7 |

| Tel: +1 (416) 915-4149 |

| |

| 444 Cedar Street, Suite 2060, St. Paul, MN

55101 |

| Tel: +1 (651) 389-4100 |

| |

www.polymetmining.com

|

| TSX: POM, NYSE MKT: PLM |

|

| |

|

| NEWS RELEASE |

2015-02 |

POLYMET REPORTS

FISCAL 2015 RESULTS

St. Paul, Minn., April 21, 2015 – PolyMet Mining Corp.

TSX: POM; NYSE MKT: PLM – today reported that it has filed its financial results

for the year ended January 31, 2015. PolyMet controls 100 percent of the

development-stage NorthMet copper-nickel-precious metals ore-body and the nearby

Erie Plant, located near Hoyt Lakes in the established mining district of the

Mesabi Iron Range in northeastern Minnesota.

The financial statements have been filed at

www.polymetmining.com and on SEDAR and EDGAR and have been prepared in

accordance with International Financial Reporting Standards ("IFRS"). All

amounts are in U.S. funds. Copies can be obtained free of charge by contacting

the Corporate Secretary at First Canadian Place, 100 King Street West, Suite

5700, Toronto, Ontario M5X 1C7 or by e-mail at info@polymetmining.com.

HIGHLIGHTS OF

YEAR TO JANUARY

31, 2015

| • |

Completion of the public review and comment period on the

supplemental draft Environmental Impact Statement (SDEIS) on March 13,

2014. |

| |

|

| • |

U.S. Environmental Protection Agency EC-2 rating of the

SDEIS, the highest rating for a mine proposal, so far as we are aware.

|

| |

|

| • |

The Minnesota Department of Natural Resources (MDNR), the

U.S. Army Corps of Engineers and the U.S. Forest Service (the Co-lead

Agencies) made substantial progress on responding to the 58,000 public

comments received on the SDEIS. In October 2014, the Commissioner of the

MDNR indicated at a public meeting that he thought preparation of the

final EIS would be completed in the spring of 2015. |

| |

|

| • |

PolyMet advanced its Definitive Cost Estimate and Project

Update. |

| |

|

| • |

PolyMet secured a $30 million loan facility from

Glencore, which is expected to fund the company through fiscal 2016.

PolyMet received the first tranche of $8 million prior to January 31, 2015

and the second tranche of $8 million on April 15, 2015. The remaining $14

million is scheduled to be drawn in two further tranches on or before July

1, 2015 and October 1, 2015. Glencore also agreed to a one-year extension

of $25 million initial principal convertible debentures, originally issued

in 2008, that were due September 30, 2014. |

Reviewing the year, Jon Cherry, President and CEO of PolyMet

stated, “Our 2015 fiscal year demonstrated significant progress as a result of a

tremendous amount of hard work on the part of the PolyMet team and its technical

and legal advisors as well as by the various state and federal government

agencies and their advisors and consultants. We continue to enjoy strong support

for the project statewide and especially on the Iron Range, where we can

strengthen and diversify the economy of northeastern Minnesota and continue its

mining heritage.”

Cherry continued, “Complete and thorough analysis and review of

the extensive comments on the SDEIS has been essential in order for the Co-lead

Agencies to develop a robust final EIS and lay the basis for permits to be

issued. This groundwork places PolyMet in a strong position as we progress

through completion of permitting, arranging finance and then to the ultimate

objective of building and operating the NorthMet Project.”

GOALS AND

OBJECTIVES FOR YEAR TO

JANUARY 31,

2016

| • |

Publication of the final EIS in the Minnesota

Environmental Quality Board Monitor and the Federal Register, which

PolyMet anticipates will be in the summer of 2015. |

| |

|

| • |

Submission of permit applications around the same time as

publication of the final EIS. |

| |

|

| • |

Decision on state permits within 150 days of application

under state guidelines. |

| |

|

| • |

Records of Decision on the federal 404 Wetland Permit and

the Land Exchange. |

| |

|

| • |

Completion of the Definitive Cost Estimate and Project

Update. |

| |

|

| • |

Construction finance plan including commitment of debt

prior to the issuance of permits but subject to typical conditions

precedent, such as receipt of permits. |

FINANCIAL

HIGHLIGHTS OF FY

2015

| • |

Loss for the year ended January 31, 2015 was $7.276

million compared with $8.132 million for the prior year period. General

and administrative expenses excluding non- cash stock-based compensation

in the year ended January 31, 2015 were $4.368 million compared with

$4.957 million in the prior year period. |

| |

|

| • |

At January 31, 2015 PolyMet had cash and cash equivalents

of $9.301 million compared with $32.790 million at January 31, 2014.

|

| |

|

| • |

PolyMet invested $27.153 million into its NorthMet

project during the year ended January 31, 2015, compared with $25.224

million in the prior year period. |

| |

|

| • |

As of January 31, 2015 PolyMet had spent $85.4 million on

environmental review and permitting, of which $78.9 million has been spent

since the NorthMet Project moved from exploration to development stage.

|

| Key Statistics |

| |

| (in ‘000 US dollars, except per share amounts)

|

| |

| Balance Sheet |

|

January 31, 2015 |

|

|

January 31, 2014 |

|

| |

|

|

|

|

|

|

| Cash & equivalents |

$ |

9,301 |

|

$ |

32,790 |

|

| Working capital (deficit) (see note) |

|

(31,672 |

) |

|

30,095 |

|

| Total assets |

|

313,229 |

|

|

287,525 |

|

| Total liabilities (see note) |

|

120,853 |

|

|

91,193 |

|

| Shareholders’ equity |

|

192,376 |

|

|

196,332 |

|

Note: $33.451 million convertible debt shown as short-term

liability although PolyMet anticipates the term will be extended or the debt

will be converted on or before September 30, 2015.

| |

|

Year ended Jan 31, |

|

| Income Statement |

|

2015 |

|

|

2014 |

|

| General & administrative expense |

|

|

|

|

|

|

| excluding non-cash share-based |

|

|

|

|

|

|

| compensation |

$ |

4,368 |

|

$ |

4,957 |

|

| Non-cash share-based |

|

|

|

|

|

|

| compensation |

$ |

1,121 |

|

$ |

1,697 |

|

| Other Expenses |

$ |

1,787 |

|

$ |

1,478 |

|

| Income (loss)

before tax |

$ |

(7,276 |

) |

$ |

(8,132 |

) |

| Recovery of future income tax

|

$ |

- |

|

$ |

- |

|

| |

|

|

|

|

|

|

| Income (loss) per share |

$ |

(0.03 |

) |

$ |

(0.04 |

) |

| Investing Activities |

|

|

|

|

|

|

| NorthMet Property |

$ |

27,153 |

|

$ |

25,224 |

|

| Weighted average shares

outstanding |

|

275,726,953 |

|

|

236,303,304 |

|

* * * * *

About PolyMet

PolyMet Mining Corp. (www.polymetmining.com) is a

publicly-traded mine development company that owns 100 percent of Poly Met

Mining, Inc., a Minnesota corporation that controls 100 percent of the NorthMet

copper-nickel-precious metals ore body through a long-term lease and owns 100

percent of the Erie Plant, a large processing facility located approximately six

miles from the ore body in the established mining district of the Mesabi Range

in northeastern Minnesota. Poly Met Mining, Inc. has completed its Definitive

Feasibility Study and is seeking environmental and operating permits to enable

it to commence production. The NorthMet project is expected to require

approximately two million hours of construction labor, creating approximately

360 long-term jobs, a level of activity that will have a significant multiplier

effect in the local economy.

| |

POLYMET MINING CORP. |

| |

|

|

| |

|

|

| |

Per: |

"Jon Cherry" |

| |

Jon Cherry, CEO |

For further information, please contact:

Media

Bruce Richardson

Corporate

Communications

Tel: +1 (651) 389-4111

brichardson@polymetmining.com

Investor Relations

Jenny Knudson

Investor

Relations

Tel: +1 (651) 389-4110

jknudson@polymetmining.com

This news release does not constitute an offer to sell or

the solicitation of an offer to buy any of the securities mentioned in this

release. This press release is being issued pursuant to and in accordance with

Rule 135c under the Securities Act of 1933, as amended. These securities

described in this release have not been registered under the Securities Act of

1933, as amended, or any state securities laws, and may not be offered or sold

in the United States absent an effective registration statement covering such

securities or an applicable exemption from such registration requirements.

This news release contains certain forward-looking

statements concerning anticipated developments in PolyMet’s operations in the

future. Forward-looking statements are frequently, but not always, identified by

words such as “expects,” “anticipates,” “believes,” “intends,” “estimates,”

“potential,” “possible,” “projects,” “plans,” and similar expressions, or

statements that events, conditions or results “will,” “may,” “could,” or

“should” occur or be achieved or their negatives or other comparable words.

These forward-looking statements may include statements regarding the ability to

receive environmental and operating permits, job creation, or other statements

that are not a statement of fact. Forward-looking statements address future

events and conditions and therefore involve inherent known and unknown risks and

uncertainties. Actual results may differ materially from those in the

forward-looking statements due to risks facing PolyMet or due to actual facts

differing from the assumptions underlying its predictions.

PolyMet’s forward-looking statements are based on the

beliefs, expectations and opinions of management on the date the statements are

made, and PolyMet does not assume any obligation to update forward-looking

statements if circumstances or management’s beliefs, expectations and opinions

should change.

Specific reference is made to PolyMet’s most recent Annual

Report on Form 20-F for the fiscal year ended January 31, 2015 and in our other

filings with Canadian securities authorities and the U.S. Securities and

Exchange Commission for a discussion of some of the risk factors and other

considerations underlying forward-looking statements.

The TSX has not reviewed and does not accept responsibility

for the adequacy or accuracy of this release.

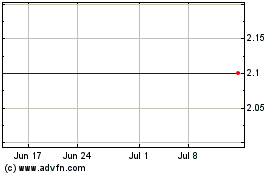

Polymet Mining (AMEX:PLM)

Historical Stock Chart

From Oct 2024 to Nov 2024

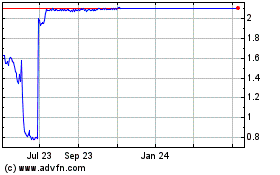

Polymet Mining (AMEX:PLM)

Historical Stock Chart

From Nov 2023 to Nov 2024