UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE

14D-9

Solicitation/Recommendation Statement

Under Section 14(d)(4) of the Securities Exchange Act of 1934

Magnetek, Inc.

(Name of

Subject Company)

Magnetek, Inc.

(Names

of Person(s) Filing Statement)

Common Stock, par value $0.01 per share

(Title of Class of Securities)

559424403

(CUSIP Number of Class of Securities)

Peter M.

McCormick

President and Chief Executive Officer

Magnetek, Inc.

N49

W13650 Campbell Drive

Menomonee Falls, Wisconsin 53051

(262) 783-3500

(Name,

address and telephone number of person authorized to receive notices and communications

on behalf of the person(s) filing statement)

With copies to:

|

|

|

| Scott S. Cramer

Vice President, General Counsel and

Corporate Secretary

Magnetek, Inc. N49 W13650

Campbell Drive Menomonee Falls, Wisconsin 53051

(262) 783-3500 |

|

Patrick G. Quick

Spencer T. Moats Foley

& Lardner LLP 777 East Wisconsin Avenue

Milwaukee, Wisconsin 53202-5306

(414) 271-2400 |

| x |

Check the box if the filing relates solely to preliminary communications made before the commencement of a tender offer. |

This Schedule 14D-9C consists of the following documents relating to the proposed acquisition of

Magnetek, Inc., a Delaware corporation (the “Company”), by Columbus McKinnon Corporation, a New York corporation (“Parent”), pursuant to the terms of an Agreement and Plan of Merger dated July 26, 2015, by and among the

Company, Parent and Megatron Acquisition Corp., a Delaware corporation and a wholly owned subsidiary of Parent (“Merger Sub”):

| |

(i) |

a message to the Company’s employees, dated July 27, 2015, from Peter McCormick, the Company’s President and Chief Executive Officer, which is attached hereto as Exhibit 99.1 and incorporated herein by

reference; and |

| |

(ii) |

an investor presentation of Parent, dated July 27, 2015. |

The information set forth under

Items 1.01 and 8.01 (including all exhibits attached thereto and incorporated therein by reference) of the Company’s Current Report on Form 8-K dated July 26, 2015 and filed on July 27, 2015 is incorporated herein by reference.

Notice to Investors

This report

does not constitute an offer to sell or the solicitation of an offer to buy any securities. The tender offer for the outstanding shares of the Company’s common stock described in this report has not commenced. At the time the tender offer is

commenced, Parent and Merger Sub will file or cause to be filed a Tender Offer Statement on Schedule TO with the Securities and Exchange Commission (“SEC”) and the Company will file a Solicitation/Recommendation Statement on Schedule 14D-9

with the SEC related to the tender offer. The Tender Offer Statement (including an Offer to Purchase, a related Letter of Transmittal and other tender offer documents) and the Solicitation/Recommendation Statement will contain important information

that should be read carefully before any decision is made with respect to the tender offer. Those materials will be made available to the Company’s stockholders at no expense to them by the information agent to the tender offer, which will be

announced. In addition, all of those materials (and any other documents filed with the SEC) will be available at no charge on the SEC’s website at www.sec.gov.

Forward-Looking Statements

Any

statements made concerning the proposed transaction between the Company, Parent and Merger Sub, the expected timetable for completing the transaction, the successful integration of the business, the benefits of the transaction, future revenue and

earnings and any other statements that are not purely historical fact are forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause actual results to differ

materially from the results expressed or implied by such statements, including general economic and business conditions, conditions affecting the industries served by the Company or Parent and their respective subsidiaries, conditions affecting the

Company’s or Parent’s customers and suppliers, competitor responses to the Company’s or Parent’s products and services, the overall market acceptance of such products and services, the integration of the businesses and other

factors disclosed in the Company’s and Parent’s periodic reports filed with the SEC. Consequently, such forward-looking statements should be regarded as the Company’s and Parent’s current plans,

estimates and beliefs. None of the Company, Parent or Merger Sub assumes any obligation to update the forward-looking information contained in this report, except as expressly required by law.

EXHIBIT INDEX

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 99.1 |

|

Message to the Company’s employees, dated July 27, 2015, from Peter McCormick, the Company’s President and Chief Executive Officer. |

|

|

| 99.2 |

|

Investor Presentation of Parent, dated July 27, 2015. |

3

Exhibit 99.1

Magnetek to be acquired by Columbus McKinnon

I am pleased to announce today that Magnetek has agreed to be acquired by Columbus McKinnon Corporation, a worldwide designer, manufacturer and marketer of

material handling products, systems and services for commercial and industrial applications. Its key products include hoists, cranes, actuators and rigging tools. Headquartered in Amherst, New York, Columbus McKinnon is publicly traded on NASDAQ

under the symbol CMCO. Columbus McKinnon has approximately 2,800 employees and its latest annual revenue was $580 million.

Columbus McKinnon is an

industry leader in material handling, lifting and actuator businesses – and we are a great strategic and tactical fit with them. Our products and technology are very complementary to their products. We share a strong commitment to quality and

service and have excellent reputations in the industries we serve with very similar corporate cultures. Magnetek adds a great brand name, industry position and new products and capabilities to Columbus McKinnon’s broad and diverse material

handling products portfolio. Together we are creating a new industry leader by combining the controls and drives leader with the hoist leader. We will be a leading competitive American supplier of hoists and controls.

About 40% of Columbus McKinnon’s sales are to international markets. Combined we can expand Magnetek’s product offering geographically through

CM’s strong global sales force and distribution network. Columbus McKinnon plans to maintain the Magnetek brand and work closely with current Magnetek management as we continue to operate the business and serve as key members of the integration

team. We expect the acquisition to be completed in about 90 days.

Tim Tevens, the President and CEO of Columbus McKinnon will join me in Menomonee Falls

today to meet Magnetek employees and discuss Columbus McKinnon, its strategy and goals, the reason for the acquisition, and to respond to any questions.

We will have a Town Hall meeting at 7:30 CT this morning and invite you to join us in person or by phone. If joining by phone, the teleconference number

is 877-407-9039 or 201-689-8470. There will be time for Q&A as well.

I know that we will all do our part to make this combination a success.

We will continue to keep you informed of our progress and any expectations we have regarding your role in the integration process. We will also make every effort to respond to your questions and concerns in a timely manner as our two companies join

together.

I hope you will share in my excitement about the great opportunities ahead for growing the Magnetek business as part of Columbus McKinnon.

Peter McCormick

President & CEO

July 27, 2015

ADDITIONAL INFORMATION AND WHERE YOU CAN FIND IT: This communication does not constitute an offer to sell

or the solicitation of an offer to buy any securities. The tender offer for the outstanding shares of Magnetek’s common stock described in this communication has not commenced. At the time the tender offer is commenced, Columbus McKinnon

Corporation will file or cause to be filed a Tender Offer Statement on Schedule TO with the Securities and Exchange Commission (“SEC”) and Magnetek will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC related to

the tender offer. The Tender Offer Statement (including an Offer to Purchase, a related Letter of Transmittal and other tender offer documents) and the Solicitation/Recommendation Statement will contain important information that should be read

carefully before any decision is made with respect to the tender offer. Those materials will be made available to Magnetek’s stockholders at no expense to them by the information agent to the tender offer, which will be announced. In addition,

all of those materials (and any other documents filed with the SEC) will be available at no charge on the SEC’s website at www.sec.gov.

Safe Harbor Statement

Any statements made concerning the

proposed transaction between the Company and Magnetek, the expected timetable for completing the transaction, the successful integration of the business, the benefits of the transaction, future revenue and earnings and any other statements that are

not purely historical fact are forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from the results expressed or implied by

such statements, including general economic and business conditions, conditions affecting the industries served by the Company or Magnetek and their respective subsidiaries, conditions affecting the Company’s or Magnetek’s customers and

suppliers, competitor responses to the Company’s or Magnetek’s products and services, the overall market acceptance of such products and services, the integration of the businesses and other factors disclosed in the Company’s and

Magnetek’s periodic reports filed with the SEC. Consequently, such forward looking statements should be regarded as the Company’s and Magnetek’s current plans, estimates and beliefs. Neither the Company nor Magnetek assume any

obligation to update the forward-looking information contained in this report, except as expressly required by law.

Exhibit 99.2

Columbus McKinnon to Acquire Magnetek

Advancing

Productivity and Safety for Our Customers

July 27, 2015

Call Participants

Timothy T. Tevens

President and Chief Executive Officer, Columbus McKinnon Corporation

Gregory P. Rustowicz

Vice President – Finance and CFO, Columbus McKinnon Corporation

Peter M. McCormick

President and Chief Executive

Officer, Magnetek, Inc.

Marty J. Schwenner

Vice President and CFO, Magnetek, Inc.

2

© 2015 Columbus McKinnon Corporation

Safe Harbor Statement

Any statements made

concerning the proposed transaction between the Company and Magnetek, the expected timetable for completing the transaction, the successful integration of the business, the benefits of the transaction, future revenue and earnings and any other

statements that are not purely historical fact are forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause actual results to differ materially from the results

expressed or implied by such statements, including general economic and business conditions, conditions affecting the industries served by the Company or Magnetek and their respective subsidiaries, conditions affecting the Company’s or

Magnetek’s customers and suppliers, competitor responses to the Company’s or Magnetek’s products and services, the overall market acceptance of such products and services, the integration of the businesses and other factors disclosed

in the Company’s and Magnetek’s periodic reports filed with the SEC. Consequently, such forward looking statements should be regarded as the Company’s and Magnetek’s current plans, estimates and beliefs. Neither the Company nor

Magnetek assume any obligation to update the forward-looking information contained in this report, except as expressly required by law.

3

© 2015 Columbus McKinnon Corporation

Additional Information

Additional Information and

Where to Find it

This communication does not constitute an offer to sell or the solicitation of an offer to

buy any securities. The tender offer for the outstanding shares of Magnetek’s common stock described in this communication has not commenced. At the time the tender offer is commenced, the Company will file or cause to be filed a Tender Offer

Statement on Schedule TO with the SEC and Magnetek will file a Solicitation/Recommendation Statement on Schedule 14D-9 with the SEC related to the tender offer. The Tender Offer Statement (including an Offer to Purchase, a related Letter of

Transmittal and other tender offer documents) and the Solicitation/Recommendation Statement will contain important information that should be read carefully before any decision is made with respect to the tender offer. Those materials will be made

available to Magnetek’s stockholders at no expense to them by the information agent to the tender offer, which will be announced. In addition, all of those materials (and any other documents filed with the SEC) will be available at no charge on

the SEC’s website at www.sec.gov.

4

© 2015 Columbus McKinnon Corporation

Strategic Imperatives

Superior Customer

Satisfaction

Grow Profitably

Geographic Market Expansion

Acquisitions and

Strategic Alliances

Global Product Development and Key Vertical Markets

Operational Excellence

5

© 2015 Columbus McKinnon Corporation

Productivity

Safety

Acquisition Aligned with Growth Strategy

Combination of America’s largest supplier of digital power control systems for industrial cranes and hoists with

leading global hoist manufacturer

Acquisition accelerates plan to achieve $1B in revenue

Complementary adjacencies: Brain and brawn

“Smart power” with mechanical lifting and positioning

New product lines and markets

Strong strategic

and cultural fit

Commitment to quality, service and superior customer satisfaction

Customer intimacy as strategic advantage

6

© 2015 Columbus McKinnon Corporation

Magnetek

March 2015 TTM financial data:

Revenue: $112.2 million

Adj. Operating income: $12.4 million, 11.1% of sales

EBITDA: $13.2 million or 11.8% of sales

America’s largest supplier of digital power control systems for industrial cranes and hoists

Leading position in radio controls

World leading independent designer of digital motion-control systems for elevators

Serves sub-surface mining industry with new generation of digital drive systems

Founded in 1984; ~ 340 employees HQ: Menomonee Falls, WI

NASDAQ: MAG

Magnetek 2014 Revenue Mix

5% 21% 74%

Material Handling Elevator Mining

7

© 2015 Columbus McKinnon Corporation

Combination Creates Strategic Value

Stronger

Value

Proposition

Revenue

Synergies

Cost

Synergies

Blending strong brands in lifting and positioning

Complete solutions for key vertical markets

Improves safety with wireless control

Larger addressable market combined

Push Magnetek

products through CMCO global market channels

Bring smart power solutions to vertical markets

Public company costs

Administrative costs

Manufacturing and sourcing

costs

8

© 2015 Columbus McKinnon Corporation

Transaction Highlights

Purchase Price

Consideration

Pro Forma Financials1

Cost Synergies

EPS Impact

Transaction Close

$50 per share: $188.9 million

total value 55% premium to 7/24/15 close

8.9x on first full fiscal year Adj. EBITDA with cost

synergies & PV of NOLs 100% cash consideration financed with cash and available committed line

Pro

forma revenue: $690 million

Pro forma adjusted EBITDA: $85 million

Expected savings in first full year of at least $5 million

Expect approximately $0.40 per share accretive impact in first full fiscal year following close excluding purchase

accounting; $7.5 to $8.5 million pre-tax one-time costs

Tender offer subject to HSR, 50% minimum tender and

other customary conditions; closing expected by September 30th

(1) Pro forma is sum of CMCO and MAG

financials for trailing 12 months as of March 2015, adjusted for consolidation. Pro forma does not include transaction costs, estimates for purchase accounting adjustments and synergy benefits. See reconciliation of GAAP to Non-GAAP measures on

slide 12.

9

© 2015 Columbus McKinnon Corporation

Acquisition Financing

Sources & Uses

Sources: Amount Uses: Amount

Existing $150 million RC facility $ 106.8 Purchase Price $ 188.9

Incremental $75 million CM Est. Fees

RC facility

75.0 & Expenses 5.0

CMCO Cash 5.0

Magnetek Cash1 7.1

Total Sources $ 193.9 Total

Uses $ 193.9

_ Secured new incremental $75 million revolving facility

_ Same terms as existing credit facility

_ Ample liquidity2 of ~$94.8 million after closing

_ Debt/total capitalization of 53.4% in line with strategic target when flexed for acquisition

_ Combination quickly de-levers the Balance Sheet

1 Balance as of 3.29.15

2 Liquidity calculated as

undrawn Revolver plus Cash minus estimated outstanding letters of credit ($6.5 million)

Pro Forma

Capitalization

3/31/2015 3/31/2015

Reported Pro Forma

Cash and cash equivalents $

63.1 $ 58.1

Existing $150 million revolving

credit facility due 2020 - 106.8

Existing $125 million term loan

facility due 2020

124.4 124.4

New incremental $75 million

revolving credit facility due 2020 - 75.0

Capital leases 2.3 2.3

Total debt 126.7 308.5

Total net debt 63.6 250.4

Shareholders’ equity 268.7 268.7

Total

capitalization $ 395.4 $ 577.2

Debt/total capitalization 32.0% 53.4%

Net debt/net total capitalization 19.2% 48.2%

10

© 2015 Columbus McKinnon Corporation

Appendix

Pro Forma Adjusted EBITDA Reconciliation

Pro

Forma Reconciliation for Trailing Twelve Months March 2015

Eliminations/

Magnetek CMCO Adjustments Total

TTM FYE

3/29/2015 3/31/2015 Pro Forma

Revenue $112,212 $579,643 ($1,500) $690,355

GAAP Net Income (26,013) 27,190 1,177

Add

Back:

Income tax expense 516 8,825 9,341

Interest and debt expense 12,390 12,390

Cost of bond redemption 8,567 8,567

Investment

(income) (2,725) (2,725)

Foreign currency exchange loss 863 863

Other income, net (462) (462)

Depreciation & amortization 810 14,562 15,372

European facility consolidation costs 1,726 1,726

Acquisition inventory step-up expense 659 659

Loss from discontinued operations 837 837

One

time pension settlement charge 37,092 37,092

Adjusted EBITDA 13,242 71,595 84,837

Pro forma is the sum of Columbus McKinnon and Magnetek financials for the trailing 12 months as of 3/31/2015, adjusted for

the impact of the merger. Pro forma excludes transaction costs, estimates for purchase accounting adjustments and synergy benefits.

12

© 2015 Columbus McKinnon Corporation

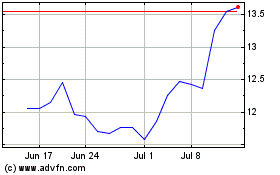

MAG Silver (AMEX:MAG)

Historical Stock Chart

From Jun 2024 to Jul 2024

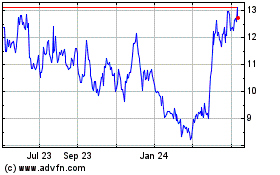

MAG Silver (AMEX:MAG)

Historical Stock Chart

From Jul 2023 to Jul 2024