UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM SD

SPECIALIZED DISCLOSURE REPORT

MAGNETEK, INC.

(Exact Name of Registrant as Specified in its Charter)

|

| | | | |

Delaware | | 1-10233 | | 95-3917584 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

|

| | |

N49 W13650 Campbell Drive | | |

Menomonee Falls, WI | | 53051 |

(Address of Principal Executive Offices) | | (Zip Code) |

|

| | |

Hungsun Hui | | (262) 252-2918 |

Vice President, Operations | | |

(Name and telephone number, including area code, of the

person to contact in connection with report.)

Check the appropriate box to indicate the rule pursuant to which this form is being filed, and provide the period to which the information in this form applies:

ý Rule 13p-1 under the Securities Exchange Act (17 CFR 240.13p-1) for the reporting period from January 1 to December 31, 2014.

Section 1 - Conflict Minerals Disclosure

Items 1.01 and 1.02 Conflict Minerals Disclosure and Report Exhibits

Conflict Minerals Disclosure

Magnetek, Inc. is providing a Conflict Minerals Report as Exhibit 1.01 hereto, and it is publicly available at www.magnetek.com/ConflictMinerals.

Section 2 - Exhibits

Exhibit 1.01 - Conflict Minerals Report as required by Items 1.01 and 1.02 of this Form.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

| | |

| MAGNETEK, INC. |

| |

| |

Dated: June 1, 2015 | By: | /s/ Hungsun S. Hui |

| | Hungsun S. Hui |

| | Vice President, Operations |

EXHIBIT INDEX

|

| | |

Exhibit No. | | Description |

| | |

1.01 | | Conflict Minerals Report for calendar year 2014

|

Exhibit 1.01

Magnetek, Inc.

Conflict Minerals Report

For The Year Ended December 31, 2014

INTRODUCTION

This Conflict Minerals Report (“Report”) has been prepared by Magnetek, Inc. (“Magnetek,” “Company,” “we,” “us,” or “our”) to comply with Rule 13p-1 under the Securities Exchange Act of 1934 (the “Rule”). The Securities and Exchange Commission (“SEC”) adopted the Rule to implement reporting and disclosure requirements related to conflict minerals, as directed by the Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (“Dodd-Frank Act”). The Rule imposes certain reporting obligations on SEC registrants (a “Covered Company” or “Covered Companies”) whose manufactured products contain conflict minerals which are necessary to the functionality or production of their products. Conflict Minerals are defined as cassiterite, columbite-tantalite, gold, wolframite, and their derivatives, which are limited to tin, tantalum, tungsten, and gold (collectively “3TG”) for the purposes of this assessment. These reporting requirements apply to Covered Companies regardless of the geographic origin of the 3TG and regardless of whether or not the 3TG funds armed conflict in the Democratic Republic of the Congo or an adjoining country (the “Covered Countries”).

If a Covered Company has reason to believe that any of the 3TG in its supply chain may have originated in the Covered Countries, or if it is unable to determine the country of origin of those conflict minerals, then the issuer must conduct a “Reasonable Country of Origin” analysis and exercise further due diligence on the conflict minerals’ source and chain of custody, as appropriate. This Report has been prepared by Magnetek in accordance with the Rule, after conducting a Reasonable Country of Origin analysis and the additional due diligence discussed below.

1. COMPANY OVERVIEW

Magnetek is a global provider of digital power control systems that are used to control motion and power primarily in material handling, elevator and mining applications. Magnetek is listed on the NASDAQ Global Market (NASDAQ: MAG). Our products are sold directly or through manufacturers' representatives to original equipment manufacturers (“OEMs”) for incorporation into their products, to system integrators and value-added resellers for assembly and incorporation into end-user systems, to distributors for resale to OEMs and contractors, and to end users for repair and replacement purposes. We were incorporated in Delaware in 1984. Our headquarters are located at N49 W13650 Campbell Drive, Menomonee Falls, WI 53051.

In preparation for preparing this Report, we conducted an analysis of our product lines and determined that 3TG are in all of our product lines, which is necessary for product functionality. Magnetek does not source any 3TG contained in our product lines directly from any smelter or refiner.

Our Supply Chain

Magnetek’s product lines are classified in the following categories: Crane Controls; Mining Drives; Radio Remote Controls; Elevator Drives; Brakes and Accessories; Power Delivery Systems; and Renewable Energy Components.

Our product lines move people, lift, hold and carry loads for a wide variety of customers. These applications require that we procure components and devices from leading suppliers around the world. Our product lines may contain hundreds of complex parts requiring a very large and diverse supply chain. We have approximately 540 active direct suppliers in our supply chain to support building our product lines.

We must rely upon our direct suppliers, many of which are not subject to the Rule, to canvas their upstream suppliers to provide information on the origin of the 3TG in the components and materials which we purchase and incorporate into our product lines.

We reviewed our suppliers list and eliminated service providers, equipment vendors and other non-manufacturing suppliers. We identified approximately 540 direct suppliers with possibly multiple tiers between our direct suppliers and the 3TG smelter or refiners for any particular component. As a result, it is inherently difficult to ascertain the source of the 3TG contained in our product lines.

As it was determined impracticable to conduct a survey of all our direct suppliers, we developed a risk-based approach that initially identified approximately ninety percent (90%) of our supply chain expenditures. Thereafter, our operations and procurement personnel analyzed the remainder of our direct suppliers and we included additional direct suppliers in our survey where the nature of the component indicated that those components had a greater likelihood to contain 3TG. We assessed our industry and others, confirming that this risk-based approach is consistent with how many companies are approaching the Rule in conjunction with the framework of The Organisation for Economic Cooperation and Development (“OECD”) Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas (“OECD Guidance”). Utilizing this approach, we surveyed 114 direct suppliers representing approximately ninety-three percent (93%) of our 2014 expenditures for directly purchased components and materials.

We are unable to determine with any reasonable degree of certainty the origin of the 3TG in our product lines and, therefore, cannot exclude the possibility that some may have originated in the Covered Countries. As a result, we are required under the Rule to submit to the SEC this Report as an Exhibit to Form SD.

In accordance with the Rule and OECD Guidance, this Report is available on our website www.magnetek.com/ConflictMinerals.

Our Conflict Minerals Policy

We have adopted a Conflict Minerals Statement, which is publicly available on our website at www.magnetek.com/ConflictMinerals.

2. OUR DUE DILIGENCE PROCESS

2.1 Design of Due Diligence Measures

Our due diligence measures have been designed in conjunction, in all material respects, with the OECD Guidance. Our conflict minerals due diligence process includes: operation of governance structures with cross functional team members and senior executives, communication to, and engagement of, suppliers, due diligence compliance process and measurement, record keeping and a grievance mechanism. We periodically report to the Board of Directors with respect to our due diligence process and compliance obligations. Our specific due diligence efforts are further discussed below.

2.2 Management Systems

We have adopted a Conflict Minerals Statement related to 3TG sourcing which we posted on our website.

2.3 Our Internal Team

Magnetek established a multi-functional conflict minerals team to support our supply chain due diligence related to 3TG. Our conflict minerals team includes subject matter experts from relevant functions, including operations, legal, internal audit, procurement and supply chain supplemented from time-to-time by engineering and information systems.

Our conflict minerals team is responsible for implementing our overall conflict minerals compliance program, led by our Vice President Operations. Our senior management is regularly briefed about the results of our due diligence efforts, as is our Board of Directors.

2.4 Supplier Engagement

With respect to our suppliers, we recognized that most are not SEC registrants subject to the Rule, and therefore are not familiar with its requirements. To educate our suppliers, we developed a dedicated Conflict Minerals web portal, at www.magnetek.com/ConflictMinerals. On this website, we posted our supplier letter, our frequently asked questions and responses, the Revision 3.02 template developed by the Electronic Industry Citizen Coalition (“EICC”) and the Global e-Sustainability Initiative (“GeSI”), known as the EICC-GeSI Conflict Minerals Reporting Template (the “Reporting Template”).

We sent detailed communications to 114 direct suppliers, outlining our expectations concerning supply chain due diligence, and directing suppliers to utilize the Reporting Template to provide this information. A follow-up letter was sent to our suppliers in late December 2014, followed by a second letter in early February 2015. We then personally contacted each supplier that had not responded by mid-February 2015. We intend to review our supplier outreach program at least annually to ensure it is continuously aligned with current regulations, our initiatives, and the tools we use.

2.5 Control Systems

We do not have direct commercial relationships with 3TG smelters and refineries. We are, however, engaged and participate with other manufacturers in industry-wide supply chain initiatives, particularly we access the EICC-GeSI Conflict-Free Smelter Program (“CFS Program”) which reviews smelters and refiners and

certifies compliant smelters and refiners as being conflict-free. We are utilizing this program as part of our due diligence efforts.

Our internal controls include our Code of Conduct and Business Ethics which outlines expected behaviors for all our employees and our dedicated Conflict Minerals web portal, on which we have posted our conflict minerals-related materials, including our supplier communications and the Reporting Template.

2.6 Grievance/Compliance Reporting Mechanism

We have longstanding grievance mechanisms whereby employees, suppliers and customers can report violations of our policies, including our conflict minerals policy. This includes maintaining an independent third party call center, which is referenced in our Code of Business Conduct and Ethics and is available on our corporate website, http://investorinfo.magnetek.com/phoenix.zhtml?c=107102&p=irol-govhighlights.

2.7 Records Maintenance

We have retained all relevant documentation received in connection with our due diligence in accordance with our Records Retention Policy.

3. IDENTIFY AND ASSESS RISK IN OUR SUPPLY CHAIN

We analyzed all direct suppliers which comprise approximately 1,130 suppliers. After eliminating service providers, equipment vendors and other non-manufacturing suppliers, we concentrated our initial efforts on larger expenditure suppliers that received approximately ninety percent (90%) of our 2014 expenditures for components and materials. Thereafter, we added other direct suppliers where the nature of the components purchased indicated these components had a greater likelihood to contain 3TG. As a result, we identified 114 direct suppliers representing approximately ninety-three percent (93%) of our 2014 expenditures for directly purchased components and materials.

We received responses from approximately seventy percent (70%) of the suppliers surveyed. Eighty-seven percent (87%) of these responses were provided using the Reporting Template and thirteen percent (13%) utilized other forms of replies such as Conflict Minerals statements or policies. The majority of our suppliers provided data at a company or divisional level, rather than a product specific level.

We rely on our direct suppliers to provide us with information about the source of 3TG contained in their materials or components supplied to us. Our direct suppliers similarly rely upon information provided to them by their suppliers. We reviewed the supplier responses against criteria developed by our conflict minerals team to determine which required further investigation. The criteria included incomplete responses, inconsistencies within the data reported by suppliers, and responses inconsistent with the 3TG analysis of our sourcing, purchasing and materials personnel. In such instances, we worked directly with select suppliers in an effort to secure revised responses.

Five of our direct suppliers surveyed reported that their products contain 3TG originating from a smelter that sources from a Covered Country. Specifically, all of those suppliers reported tin and one of the suppliers reported tantalum in addition to tin as being sourced from said smelters located in Malaysia, China and Kazakhstan. However, the three smelters identified are certified smelters pursuant to the CFS Program. Twenty-seven of our direct suppliers submitted smelter lists based upon information provided by their suppliers and eight of them were able to identify all smelters utilized within their supply chain. Two suppliers validated all of its provided smelters as compliant with the CFS Program whereas the remaining twenty-five suppliers reported a mix of certified and active smelters in accordance with CFS Program standards as

prescribed by the Conflict Free Smelter Initiative. Twenty-two suppliers provided us with at least one smelter that could not be identified on the Conflict Free Smelter Initiative’s list of conflict free smelters and refiners. After independently verifying the information provided to us, we found that over half of all the smelters reported are currently in compliance with the CFS Program. Almost one third of our direct suppliers surveyed indicated that their materials or components are conflict free and the remainder of our direct suppliers either indicated that their materials and components are DRC conflict undeterminable, as defined in the Rule, or that they receive their materials from a recycler or scrap supplier.

4. DESIGN AND IMPLEMENT A STRATEGY TO REPOND TO RISKS

We implemented the following steps to respond to potential risks we have identified in our supply chain:

| |

• | Our senior management has been briefed on our due diligence efforts on a regular basis and in turn, they have briefed our Board of Directors as to the status of our compliance efforts. |

| |

• | We adopted a statement on conflict minerals and enumerated our specific supplier expectations in our supplier communications as well as the inclusion of a conflict minerals flow-down clause in our standard terms and conditions of purchase. |

| |

• | We implemented a risk management plan that outlines our responses to any identified risks. As part of our risk management plan, we contacted each direct supplier that collectively represented approximately ninety-three percent (93%) of our 2014 expenditures for directly purchased components and materials and surveyed by letter, and followed up by a follow-up letter, telephone, and email, as needed. |

| |

• | In our 2014 review, we found no instance where it was necessary to implement risk mitigation efforts, temporarily suspend trade or disengage with a supplier. We engage in regular on-going risk assessment through our suppliers’ annual data submissions. |

| |

5. | CARRY OUT INDEPENDENT THIRD PARTY AUDIT OF SUPPLY CHAIN DUE DILIGENCE AT IDENTIFIED POINTS IN THE SUPPLY CHAIN |

We do not have a direct commercial relationship with 3TG smelters and refiners and do not perform or direct such audits of these entities within our supply chain. We rely upon smelter audits through our access to the EICC-GeSI Conflict-Free Smelter Program. We have not conducted an independent private sector audit of this Report as none is required at this time under the Rule.

6. REPORT ON SUPPLY CHAIN DUE DILIGENCE

This Report is being filed with the SEC as an exhibit to our specialized disclosure report on Form SD. It is available on our website at www.magnetek.com/ConflictMinerals.

6.1 Reasonable Country of Origin Inquiry (“RCOI”)

We conducted a good faith Reasonable Country of Origin Inquiry of our direct suppliers representing approximately ninety-three percent (93%) of our 2014 expenditures for directly purchased components and materials in conjunction with the OECD Guidance.

6.2 Efforts to Determine Mine or Location of Origin

We have determined that requesting our direct suppliers to complete the Reporting Template represents our reasonable best efforts to determine the mines or locations of origin of 3TG in our supply chain. We have reached this conclusion, in part, because the EICC-GeSI Conflict-Free Smelter Program, which is widely considered to be the industry leader in efforts to certify conflict-free smelters and refiners and provide a list of such smelters and refiners for manufacturers’ use.

6.3 Smelters or Refiners and Country of Origin of 3TG

Five of our direct suppliers surveyed reported that their products contain 3TG originating from a smelter that sources from a Covered Country. Specifically, all of those suppliers reported tin and one of the suppliers reported tantalum in addition to tin as being sourced from said smelters located in Malaysia, China and Kazakhstan. However, the three smelters identified are certified smelters pursuant to the CFS Program. Twenty-seven of our direct suppliers submitted smelter lists based upon information provided by their suppliers and eight of them were able to identify all smelters utilized within their supply chain. Two suppliers validated all of its provided smelters as compliant with the CFS Program whereas the remaining twenty-five suppliers reported a mix of certified and active smelters in accordance with CFS Program standards as prescribed by the Conflict Free Smelter Initiative. Twenty-two suppliers provided us with at least one smelter that could not be identified on the Conflict Free Smelter Initiative’s list of conflict free smelters and refiners. After independently verifying the information provided to us, we found that over half of all the smelters reported are currently in compliance with the CFS Program. Almost one third of our direct suppliers surveyed indicated that their materials or components are conflict free and the remainder of our direct suppliers either indicated that their materials and components are DRC conflict undeterminable, as defined in the Rule, or that they receive their materials from a recycler or scrap supplier.

7. STEPS TO BE TAKEN TO MITIGATE RISK

In the compliance period for calendar year 2015, we intend to take the following steps to improve our conflict minerals program and further mitigate any risk that the necessary 3TG in our products could benefit armed groups in a Covered Country.

| |

• | Utilize the Conflict-Free Sourcing Initiative (“CFSI”) Version 4.0 Conflict Minerals Reporting Template for the direct supplier survey. |

| |

• | Engage with suppliers as part of our efforts to increase the response rate and improve the content of the supplier survey responses. |

| |

• | Evaluate and implement a system to attempt to provide the conflict minerals information and the CFSI Version 4.0 Conflict Minerals Reporting Template to every new supplier. |

| |

• | Work with our trade associations and other groups to define and improve best practices and encourage responsible sourcing of 3TG in accordance with the OECD Guidance. |

| |

• | Utilize existing software to record suppliers’ responses and evaluate obtaining and inputting data on a product and/or parts level to enhance the analytical capabilities within the application resulting in advanced reporting and auditing functions. |

Caution Concerning Forward-Looking Statements

Certain statements in this Report may contain “forward-looking statements,” as defined in the Private Securities Litigation Reform Act of 1995. The forward-looking statements in this Report relate to developments, results, conditions, or other events we expect or anticipate will occur in the future. Words such as “believes,” “anticipates,” “estimate,” “may,” “should,” “could,” “plans,” “expects” and similar expressions identify forward-looking statements. Examples of forward-looking statements include statements relating to our future plans, and any other statement that does not directly relate to any historical or current fact. Forward-looking statements are based on our current expectations and assumptions, which may not prove to be accurate. These statements are not guarantees and are subject to risks, uncertainties and changes in circumstances that are difficult to predict. We undertake no obligation to update or revise any forward-looking statements, except as required by federal securities laws. Actual results could differ materially from those anticipated in the forward-looking statements and from any prospective actions included in this Report.

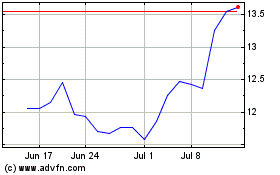

MAG Silver (AMEX:MAG)

Historical Stock Chart

From Jun 2024 to Jul 2024

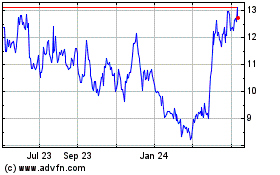

MAG Silver (AMEX:MAG)

Historical Stock Chart

From Jul 2023 to Jul 2024