U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10-Q

QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

For the quarterly period ended March 31, 2009

Commission File Number: 0-24970

ALL-AMERICAN SPORTPARK, INC.

-----------------------------------------------------------------

(Exact name of registrant as specified in its charter)

|

|

|

|

|

Nevada

|

|

88-0203976

|

|

-------------------------------

|

|

--------------------------------

|

(State of other jurisdiction of

incorporation or organization)

|

|

(IRS Employer Identification No. )

|

|

|

|

6730 South Las Vegas Boulevard, Las Vegas, Nevada 89119

----------------------------------------------------------

(Address of principal executive offices including zip code)

(702) 798-7777

---------------------------

(Registrant's telephone number)

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. [X] Yes [ ] No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non -accelerated filer, or a smaller reporting company. See the definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act.

|

|

|

|

|

Large accelerated filer [ ]

|

|

Accelerated filer [ ]

|

|

|

Non-accelerated filer (Do not check

If a smaller reporting company) [

]

|

|

Smaller reporting company [X]

|

|

|

|

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). [ ] Yes [X] No

As of March 31, 2009 3,570,000 shares of common stock were outstanding.

1

|

|

|

|

|

ALL-AMERICAN SPORTPARK, INC.

|

|

FORM 10-Q

|

|

INDEX

|

|

|

|

Page

Number

|

|

|

|

|

PART I:

|

FINANCIAL INFORMATION

|

|

|

Item 1.

|

Condensed Consolidated Financial Statements:

Condensed Consolidated Balance Sheets

March 31, 2009 (unaudited) and December 31, 2008

|

3

|

|

|

|

|

|

|

Condensed Consolidated Statements of Operations

Three Months Ended March 31, 2009 and 2008 (unaudited)

|

4

|

|

|

|

|

Condensed Consolidated Statements of Cash Flows

Three Months Ended March 31, 2009 and 2008 (unaudited)

|

5

|

|

|

|

|

Notes to Condensed Consolidated Financial Statements

(unaudited)

|

6

|

|

|

|

Item 2.

|

Management's Discussion and Analysis of Financial Condition

And Results of Operations

|

8

|

|

|

|

Item 3.

|

Quantitative and Qualitative Disclosures about Market Risk

|

10

|

|

Item 4T.

|

Controls and Procedures

|

10

|

|

|

|

|

|

PART II: OTHER INFORMATION

|

|

|

Item 1.

|

Legal Proceedings

|

10

|

|

Item 1A.

|

Risk Factors

|

10

|

|

Item 2.

|

Changes in Securities

|

10

|

|

Item 3.

|

Defaults Upon Senior Securities

|

10

|

|

Item 4.

|

Submission of Matters to a Vote of Security

Holders

|

10

|

|

Item 5.

|

Other Information

|

10

|

|

Item 6.

|

Exhibits and Reports on Form 8-K

|

10

|

|

SIGNATURES

|

11

|

2

ALL -AMERICAN SPORTPARK, INC. AND SUBSIDIARY

CONDENSED CONSOLIDATED BALANCE SHEETS

MARCH 31, 2009 AND DECEMBER 31, 2008

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2009

|

|

|

2008

|

|

|

|

|

(Unaudited)

|

|

|

|

|

|

Current assets:

|

|

|

|

|

|

|

|

Cash

|

$

|

82,894

|

|

$

|

-

|

|

|

Accounts receivable

|

|

1,478

|

|

|

1,478

|

|

|

Prepaid expenses and other

|

|

22,762

|

|

|

13,939

|

|

|

|

|

----------

|

|

|

----------

|

|

|

Total current assets

|

|

107,134

|

|

|

15,417

|

|

|

|

|

Leasehold improvements and equipment, net

|

|

866,544

|

|

|

887,127

|

|

|

Due from related entities

|

|

-

|

|

|

-

|

|

|

Other Assets

|

|

-

|

|

|

-

|

|

|

|

|

----------

|

|

|

----------

|

|

|

Total assets

|

$

|

973,678

|

|

$

|

902,544

|

|

|

|

|

===========

|

|

|

===========

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY DEFICIENCY

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

Bank overdraft

|

$

|

-

|

|

$

|

17,631

|

|

|

Current portion of notes payable to

|

|

|

|

|

|

|

|

related entities

|

|

4,567,448

|

|

|

4,542,935

|

|

|

Interest payable to related entities

|

|

3,579,065

|

|

|

3,467,379

|

|

|

Accounts payable and accrued expenses

|

|

158,649

|

|

|

81,670

|

|

|

|

|

----------

|

|

|

----------

|

|

|

Total current liabilities

|

|

8,305,162

|

|

|

8,109,615

|

|

|

|

|

Notes payable to related entities, net of

|

|

|

|

|

|

|

|

current portion

|

|

14,440

|

|

|

10,782

|

|

|

Interest payable to related entities

|

|

2,500

|

|

|

-

|

|

|

Due to related entities

|

|

1,384,265

|

|

|

1,452,671

|

|

|

Deferred rent liability

|

|

688,452

|

|

|

565,843

|

|

|

|

|

----------

|

|

|

----------

|

|

|

Total liabilities

|

|

10,394,819

|

|

|

10,138,911

|

|

|

|

|

----------

|

|

|

----------

|

|

|

Commitments and contingencies:

|

|

|

|

|

|

|

|

|

|

Minority interest in subsidiary

|

|

-

|

|

|

-

|

|

|

|

|

----------

|

|

|

----------

|

|

|

Shareholders' equity deficiency:

|

|

|

|

|

|

|

|

Series B Convertible Preferred Stock,

|

|

|

|

|

|

|

|

$. 001 par value, no shares issued

|

|

|

|

|

|

|

|

and outstanding

|

|

-

|

|

|

-

|

|

|

Common Stock, $. 001 par value, 10,000,000

|

|

|

|

|

|

|

|

shares authorized, 3,570,000 shares

|

|

|

|

|

|

|

|

issued and outstanding at March 31,

|

|

|

|

|

|

|

|

2009, and December 31, 2008, respectively

|

|

3,570

|

|

|

3,570

|

|

|

Additional paid-in capital

|

|

13,692,240

|

|

|

13,692,240

|

|

|

Accumulated deficit

|

|

(23,116,951

|

)

|

|

(22,932,177

|

)

|

|

|

|

----------

|

|

|

----------

|

|

|

Total shareholders' equity deficiency

|

|

(9,421,141

|

)

|

|

(9,236,367

|

)

|

|

|

|

----------

|

|

|

----------

|

|

|

|

|

|

|

|

|

|

|

Total liabilities and shareholders'

equity deficiency

|

$

|

973,678

|

|

$

|

902,544

|

|

|

|

|

===========

|

|

|

===========

|

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

3

ALL-AMERICAN SPORTPARK, INC. AND SUBSIDIARY

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

FOR THE THREE MONTHS ENDED MARCH 31, 2009 AND 2008

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

2009

|

|

|

2008

|

|

|

Revenues

|

$

|

550,019

|

|

$

|

590,947

|

|

|

Cost of revenues, excluding depreciation

|

|

104,888

|

|

|

151,042

|

|

|

|

|

----------

|

|

|

----------

|

|

|

|

|

Gross profit

|

|

445,131

|

|

|

439,905

|

|

|

|

|

----------

|

|

|

----------

|

|

|

|

|

Operating expenses:

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative

|

|

480,791

|

|

|

530,823

|

|

|

Depreciation and amortization

|

|

20,583

|

|

|

21,762

|

|

|

|

|

----------

|

|

|

----------

|

|

|

Total operating expenses

|

|

501,374

|

|

|

552,585

|

|

|

|

|

----------

|

|

|

----------

|

|

|

|

|

Operating loss

|

|

(56,243

|

)

|

|

(112,680

|

)

|

|

|

|

Other income (expense):

|

|

|

|

|

|

|

|

Interest expense

|

|

(128,517

|

)

|

|

(135,144

|

)

|

|

Other income

|

|

(14

|

)

|

|

6,768

|

|

|

|

|

----------

|

|

|

----------

|

|

|

Income (Loss) before minority

|

|

|

|

|

|

|

|

interest

|

|

(184,774

|

)

|

|

(241,056

|

)

|

|

|

|

Minority interest

|

|

-

|

|

|

-

|

|

|

|

|

----------

|

|

|

-----------

|

|

|

Net Income (loss)

|

$

|

(184,774

|

)

|

$

|

(241,056

|

)

|

|

|

|

===========

|

|

|

============

|

|

|

NET INCOME (LOSS) PER SHARE:

|

|

|

|

|

|

|

|

Basic and diluted net income (loss)

per share

|

$

|

(0.05

|

)

|

$

|

(0.07

|

)

|

|

|

|

===========

|

|

|

============

|

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

4

ALL-AMERICAN SPORTPARK, INC. AND SUBSIDIARY

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS

FOR THE THREE MONTHS ENDED MARCH 31, 2009 AND 2008

(UNAUDITED)

|

|

|

|

|

|

|

|

|

|

|

2009

|

|

|

2008

|

|

|

CASH FLOWS FROM OPERATING ACTIVITIES:

|

|

|

|

|

|

|

|

Net income (loss)

|

$

|

(184,774

|

)

|

$

|

(241,056

|

)

|

|

Adjustment to reconcile net income (loss)

|

|

|

|

|

|

|

|

to net cash used in operating activities:

|

|

|

|

|

|

|

Depreciation and amortization

|

|

20,583

|

|

|

21,762

|

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

Decrease in accounts

receivable

|

|

-

|

|

|

4,345

|

|

|

(Increase) prepaid expenses

and other

|

|

(8,823

|

)

|

|

(9,049

|

)

|

|

Decrease in bank overdraft

|

|

(17,631

|

)

|

|

(53,473

|

)

|

|

(Decrease)increase in accounts payable

|

|

|

|

|

|

|

|

and accrued expenses

|

|

76,979

|

|

|

8,469

|

|

|

Increase in interest payable to

|

|

|

|

|

|

|

|

related entities

|

|

114,186

|

|

|

122,513

|

|

|

Increase in deferred rent liability

|

|

122,609

|

|

|

1,094

|

|

|

|

|

----------

|

|

|

---------

|

|

|

|

|

|

|

|

|

|

|

Net cash provided by (used in)

operating activities

|

|

123,129

|

|

|

(145,395

|

)

|

|

|

|

CASH FLOWS FROM INVESTING ACTIVITIES:

|

|

|

|

|

|

|

|

Capital expenditures

|

|

-

|

|

|

-

|

|

|

|

|

----------

|

|

|

---------

|

|

|

Net cash used in investing

activities

|

|

-

|

|

|

-

|

|

|

|

|

CASH FLOWS FROM FINANCING ACTIVITIES:

|

|

|

|

|

|

|

|

|

|

(Decrease) increase in due to related entities

|

|

(68,406

|

)

|

|

292,602

|

|

|

Proceeds from notes payable to

related entities

|

|

30,000

|

|

|

25,000

|

|

|

Principal payments on notes payable

to related entities

|

|

1,829

|

|

|

(104,386

|

)

|

|

Principal payments on other notes payable

|

|

-

|

|

|

(23,292

|

)

|

|

|

-----------

|

|

|

---------

|

|

|

Net cash provided by (used in)

financing activities

|

|

(40,235

|

)

|

|

189,924

|

|

|

|

-----------

|

|

|

---------

|

|

|

NET INCREASE IN CASH

|

|

82,894

|

|

|

44,529

|

|

|

|

|

CASH, beginning of period

|

|

-

|

|

|

-

|

|

|

|

-----------

|

|

|

----------

|

|

|

CASH, end of period

|

$

|

82,894

|

|

$

|

44,529

|

|

|

|

===========

|

|

|

==========

|

|

|

SUPPLEMENTAL CASH FLOW INFORMATION:

|

|

|

|

|

|

|

|

Cash paid for interest

|

$

|

-

|

|

$

|

1,708

|

|

|

|

===========

|

|

|

==========

|

|

|

Cash paid for taxes

|

$

|

-

|

|

$

|

-

|

|

|

|

===========

|

|

|

==========

|

|

The accompanying notes are an integral part of these condensed consolidated financial statements.

5

ALL-AMERICAN SPORTPARK, INC. AND SUBSIDIARY

NOTES TO CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

(UNAUDITED)

1. CONSOLIDATED FINANCIAL STATEMENTS

The accompanying unaudited condensed consolidated financial statements of All-American SportPark, Inc. ("AASP" or the "Company"), include the accounts of AASP and its wholly owned subsidiary, All- American Golf Center, Inc. ("AAGC"), (collectively the "Company"). All significant intercompany accounts and transactions have been eliminated. The operations of the Callaway Golf Center ("CGC") are included in AAGC.

The accompanying interim unaudited condensed consolidated financial statements have been prepared by the Company pursuant to the rules and regulations of the Securities and Exchange Commission relating to interim financial statements. Accordingly, certain information and footnote disclosures normally included in financial statements prepared in accordance with accounting principles generally accepted in the United States have been condensed or omitted. In the opinion of management, all necessary adjustments have been made to present fairly, in all material respects, the financial position, results of operations and cash flows of the Company at March 31, 2009 and for all prior periods presented.

The preparation of financial statements in conformity with generally accepted accounting principles requires management to make estimates and assumptions that may require revision in future periods.

These consolidated financial statements should be read in conjunction with the Company's Annual Report on Form 10-K for the year ended December 31, 2008, from which the December 31, 2008, audited balance sheet information was derived.

2. INCOME (LOSS) PER SHARE AND SHAREHOLDER'S EQUITY DEFICIENCY

Basic and diluted income (loss) per share is computed by dividing the reported net income or loss by the weighted average number of common shares outstanding during the period. The weighted-average numbers of common shares used in the calculation of basic and diluted loss per share were 3,570,000 for the three-month periods ended March 31, 2009 and 2008.

3. LEASES

The land underlying the Callaway Golf Center is leased by AAGC. The original lease expires in 2012 and the Company has exercised one of two five year renewal options extending the lease through 2017. Also, the lease has a provision for contingent rent to be paid by AAGC upon reaching certain levels of gross revenues. The CGC did not reach the gross revenues that would require the payment of contingent rent as of March 31, 2009. The lease has a corporate guarantee by AASP.

4. RELATED PARTY TRANSACTIONS

The Company provides administrative/accounting support for (a) The Company Chairman's wholly- owned golf retail store in Las Vegas, Nevada, (the "Paradise Store" (b) three golf retail stores, two are named Saint Andrews Golf Shop ("SAGS")and one is a Las Vegas Golf and Tennis, owned by the Company's President and his brother. Administrative/accounting payroll and employee benefits are allocated based on an annual review of the personnel time expended for each entity. Amounts allocated to these related parties by the Company approximated $30,214 and $30,663 for the three months ended March 31, 2009 and 2008, respectively. Related party interest expense was $114,186 and $122,513 for the three months period ending March 31, 2009 and 2008.

6

5. LEGAL MATTERS

There are no legal matters that the Company is involved in at this time.

6. GOING CONCERN MATTERS

The accompanying consolidated financial statements have been prepared on a going concern basis, which contemplates the realization of assets and the satisfaction of liabilities in the normal course of business. Historically, with some exceptions, the Company has incurred net losses. As of March 31, 2009, the Company had a working capital deficit of $8,198,028 and a shareholders' equity deficiency of $ 9,421,141. CGC did generate a positive cash flow before corporate overhead that is in place to support of the CGC and public company operations and interest expense.

Management believes that its operations, and existing cash balances as of March 31, 2009 may not be sufficient to fund operating cash needs and debt service requirements over the next 12 months. Management continues to seek other sources of funding, which may include Company officers or directors or other related parties. In addition, management continues to analyze all operational and administrative costs of the Company and has made and will continue to make the necessary cost reductions as appropriate.

Among its alternative courses of action, management of the Company may seek out and pursue a business combination transaction with an existing private business enterprise that might have a desire to take advantage of the Company's status as a public corporation. There is no assurance that the Company will acquire a favorable business opportunity through a business combination. In addition, even if the Company becomes involved in such a business opportunity, there is no assurance that it would generate revenues or profits, or that the market price of the Company's common stock would be increased thereby.

Management continues to seek out financing to help fund working capital needs of the Company. In this regard, management believes that additional borrowings against the CGC could be arranged although there can be no assurance that the Company would be successful in securing such financing or with terms acceptable to the Company.

The consolidated financial statements do not include any adjustments relating to the recoverability of assets and the classification of liabilities that might be necessary should the Company be unable to continue as a going concern.

7. RECENT ACCOUNTING POLICIES

In December 2007, the FASB issued SFAS No. 141 (revised 2007), “Business Combinations” (SFAS 141R). SFAS 141R establishes principles and requirements for how an acquirer recognizes and measures in its financial statements the identifiable assets acquired, the liabilities assumed, any noncontrolling interest in the acquiree, and the goodwill acquired. SFAS 141R also establishes disclosure requirements to enable the evaluation of the nature and financial effects of the business combination. SFAS 141R is effective for the Company with respect to business combinations for which the acquisition date is on or after January 1, 2009. The adoption of SFAS No. 141 (revised 2007) did not have an impact on the consolidated financial statements and relatd disclosures.

In May 2008, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 162, “The Hierarchy of Generally Accepted Accounting Principles”. SFAS No. 162 sets forth the level of authority to a given accounting pronouncement or document by category. Where there might be conflicting guidance between two categories, the more authoritative category will prevail. SFAS No. 162 will become effective 60 days after the SEC approves the PCAOB’s amendments

to AU Section 411 of the AICPA Professional Standards. SFAS No. 162 has no effect the Company’s financial position, statements of operations, or cash flows at this time.

7

In April 2009, the FASB issued FSP FAS 157-4, “Determining Fair Value When the Volume and Level of Activity for the Asset or Liabilty Have Significantly Decreased and Identifying Transactions That Are Not Orderly” (“FSP FAS 157-4), to address the challenges in estimating fair value when the volume and level of activity for an asset or liability have significantly decreased. This FSP emphasizes that even if there has been a significant decrease in the volume and level of activity for the asset or liability and regardless of the valuation technique(s) used, the objective of a fair value measurement remains the same. Fair value is the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction (that is, not a forced liquidation or distressed sale) between market participants at the measure date under current market conditions. This FSP is effective for interim and unusual reporting periods ending after June 15, 2009. The Company is currently evaluating the potential impact, if any, of FSP FAS 157-4 on the consolidated financial statements and related disclosures.

8

ITEM 2. MANAGEMENT'S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATION

The following information should be read in conjunction with the Company's consolidated financial statements and related notes included in this report.

OVERVIEW

The Company's operations consist of the management and operation of the Callaway Golf Center (CGC). The CGC includes a par 3 golf course fully lighted for night golf, a 110-tee two-tiered driving range, and a 20,000 square foot clubhouse which includes the Callaway Golf fitting center. Also located within the clubhouse are two sub-leased spaces. The first is occupied by the Saint Andrews Golf Shop retail store. The other space was for a restaurant and bar that was unoccupied as of the beginning of 2006. A lease was signed with a new tenant on January 25, 2006 and the restaurant reopened in February 2006. The lease was for an initial one-year period. The Company and the tenant agreed to extend the lease on a month to month basis.

RESULTS OF OPERATIONS - THREE MONTHS ENDED MARCH 31, 2009 AS COMPARED TO THE THREE MONTHS ENDED MARCH 31, 2008.

REVENUES. Revenues of the Callaway Golf Center ("CGC") for the three months ended March 31, 2009 were down as compared to the three months ended March 31, 2008 to $550,019 from $ 590,947. This is attributed to the colder, windier weather in the 2009 period and a downturn in the economy.

COST OF REVENUES. Cost of revenues consists mainly of commissions paid to golf instructors, payroll and benefits expenses of CGC staff, and operating supplies. Cost of revenues decreased by $46,154 to $104,888 from $151,042 for the same period in the prior year. Commissions paid to golf instructors decreased by $24,163 to $13,974 in 2009 from $38,137 in 2008 due directly to a decrease in golf lesson fees received in the current quarter which is attributed to the weather and the downturn in the economy. In 2008 a large order of golf balls for the driving range was placed in the first quarter for $21,725. An order was placed in the fourth quarter of 2008, so a ball order was not necessary during the first quarter of 2009.

SELLING, GENERAL AND ADMINISTRATIVE. These expenses consist principally of landscaping services and professional fees, ground lease, utilities, insurance and administrative payroll. These expenses decreased by $50,032 to $480,790 for the three months ending March 31, 2009 as compared to $530,823 during the same period in 2008. The reduction is a result of a decrease in wages due to better staff scheduling, and a reduction in legal expenses. During 2008, the Company was involved in litigation that was settled in September 2008.

OTHER INCOME AND EXPENSE. Other income and expense consists principally of interest expense and non-operating income. For the three months ended March 31, 2009 there was a decrease in interest expense of $ 6,627 as compared to the same period in 2008. The reduction in interest expense was a result of the Company paying off some of the debt owed to affiliates in September 2008.

NET INCOME (LOSS). The net loss for the three months ending March 31, 2009 was $184,774 compared to a net loss of $241,056 in the prior year. The reduction in the net loss was due to the reasons described above.

LIQUIDITY AND CAPITAL RESOURCES

As of March 31, 2009, the Company had a working capital deficit of $8,198,028 as compared to a working capital deficit of $ 8,094,198 at December 31, 2008. The CGC did generate a positive cash flow before corporate overhead.

9

Management believes that the CGC operations and existing cash balances as of March 31, 2009 may not be sufficient to fund operating cash needs and debt service requirements over the next 12 months. In its report on the Company's annual financial statements for 2008, the Company's auditors expressed substantial doubt about the Company's ability to continue as a going concern.

The Company anticipates that the Town Square project will continue to increase traffic flow in the area of the golf center, which is expected to result in increased revenues for the golf center. The Town Square is a 1.5 million square foot super regional lifestyle center with a mix of retail, dining and office space that is being developed across the street from the golf center. In addition, the continued aggressive level of growth at the south end of the Las Vegas strip is expected to draw more local and tourist business to the golf center.

Management continues to seek other sources of funding, which may include Company officers or directors or other related parties. In addition, management continues to analyze all operational and administrative costs of the Company and has made and will continue to make the necessary cost reductions as appropriate.

Among its alternative courses of action, management of the Company may seek out and pursue a business combination transaction with an existing private business enterprise that might have a desire to take advantage of the Company's status as a public corporation. At this time, management does not intend to target any particular industry but, rather, intends to judge any opportunity on its individual merits. Any such transaction would likely have a dilutive effect on the interests of the Company's stockholders that would, in turn, reduce each shareholders proportionate ownership and voting power in the Company. There is no assurance that the Company will acquire a favorable business opportunity through a business combination. In addition, even if the Company becomes involved in such a business opportunity, there is no assurance that it would generate revenues or profits, or that the market price of the Company's common stock would be increased thereby.

The Company has no commitments to enter into or acquire a specific business opportunity and; therefore, is able to disclose the risks of a business or opportunity that it may enter into only in a general manner, and unable to disclose the risks of any specific business or opportunity that it may enter into. An investor can expect a potential business opportunity to be quite risky. Any business opportunity acquired may be currently unprofitable or present other negative factors.

Working capital needs have been helped by deferring payments of interest and notes payable balances due to affiliates. Management believes that additional deferrals of such payments can be negotiated, if necessary. Management continues to seek out financing to help fund working capital needs of the Company. In this regard, management believes that additional borrowings against the CGC could be arranged although there can be no assurance that the Company would be successful in securing such financing or with terms acceptable to the Company.

SPECIAL CAUTIONARY NOTICE REGARDING FORWARD-LOOKING STATEMENTS

Certain information included in this quarterly report contains statements that are forward-looking such as statements relating to plans for future expansion and other business development activities, as well as other capital spending and financing sources. Such forward -looking information involves important risks and uncertainties that could significantly affect anticipated results in the future and, accordingly, such results may differ from those expressed in any forward-looking statements made by or on behalf of the Company. These risks and uncertainties include, but are not limited to, those relating to dependence on existing management, leverage and debt

service (including sensitivity to fluctuations in interest rates), domestic

or global

10

economic conditions, changes in federal or state tax laws or the administration of such laws, and changes in regulations and application for licenses and approvals under applicable jurisdictional laws and regulations.

ITEM 3. QUANTITATIVE AND QUALITATIVE DISCLOSURES ABOUT MARKET RISK.

Not Required.

ITEM 4T. CONTROLS AND PROCEDURES

As of March 31, 2009, under the supervision and with the participation of the Company's Chief Executive Officer and Principal Financial Officer, management has evaluated the effectiveness of the design and operations of the Company's disclosure controls and procedures. Based on that evaluation, the Chief Executive Officer and Principal Financial Officer concluded that the Company's disclosure controls and procedures were effective as of March 31, 2009.

There have been no changes in internal control over financial reporting that occurred during the period covered by this report that have materially affected, or are reasonably likely to affect, the Company's internal control over financial reporting.

PART II - OTHER INFORMATION

ITEM 1. LEGAL PROCEEDINGS.

There are no legal matters that the Company is involved in at this time.

ITEM 1A. RISK FACTORS.

Not required.

ITEM 2. UNREGISTERED SALES OF EQUITY SECURITIES AND USE OF PROCEEDS. None.

ITEM 3. DEFAULTS UPON SENIOR SECURITIES. None

ITEM 4. SUBMISSION OF MATTERS TO A VOTE OF SECURITY HOLDERS. None.

ITEM 5. OTHER INFORMATION. None.

ITEM 6. EXHIBITS

|

|

|

|

|

31

|

Certification of Chief

Executive Officer and Principal

Financial Officer Pursuant

to Section 302 of the

Sarbanes-Oxley Act of 2002

|

Filed herewith electronically

|

|

|

|

|

|

|

|

|

|

|

|

|

|

32

|

Certification of Chief

Executive Officer and Principal

Financial Officer Pursuant

to Section 18 U. S. C. Section 1350

|

Filed herewith electronically

|

|

|

|

|

|

|

|

|

|

11

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

ALL-AMERICAN SPORTPARK, INC.

Date: May 15, 2009

|

|

|

By:

/s/ Ronald Boreta

Ronald Boreta, President and

Chief Executive (Officer Principal

Executive Officer) and Treasurer

(Principal Financial Officer)

|

12

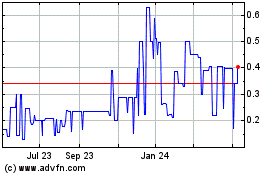

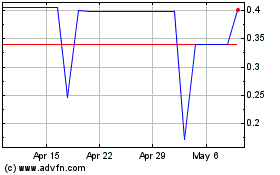

Global Acquisitions (PK) (USOTC:AASP)

Historical Stock Chart

From Apr 2024 to May 2024

Global Acquisitions (PK) (USOTC:AASP)

Historical Stock Chart

From May 2023 to May 2024