Statement of Changes in Beneficial Ownership (4)

December 10 2019 - 6:45PM

Edgar (US Regulatory)

FORM 4

[ ]

Check this box if no longer subject to Section 16. Form 4 or Form 5 obligations may continue. See Instruction 1(b).

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

STATEMENT OF CHANGES IN BENEFICIAL OWNERSHIP OF SECURITIES

|

OMB APPROVAL

OMB Number:

3235-0287

Estimated average burden

hours per response...

0.5

|

|

Filed pursuant to Section 16(a) of the Securities Exchange Act of 1934 or Section 30(h) of the Investment Company Act of 1940

|

|

|

1. Name and Address of Reporting Person

*

Schell Christoph |

2. Issuer Name and Ticker or Trading Symbol

HP INC

[

HPQ

]

|

5. Relationship of Reporting Person(s) to Issuer

(Check all applicable)

_____ Director _____ 10% Owner

__X__ Officer (give title below) _____ Other (specify below)

Chief Commercial Officer |

|

(Last)

(First)

(Middle)

C/O HP INC., 1501 PAGE MILL RD |

3. Date of Earliest Transaction

(MM/DD/YYYY)

12/6/2019 |

|

(Street)

PALO ALTO, CA 94304

(City)

(State)

(Zip)

|

4. If Amendment, Date Original Filed

(MM/DD/YYYY)

|

6. Individual or Joint/Group Filing

(Check Applicable Line)

_X

_ Form filed by One Reporting Person

___ Form filed by More than One Reporting Person

|

Table I - Non-Derivative Securities Acquired, Disposed of, or Beneficially Owned

|

1.Title of Security

(Instr. 3)

|

2. Trans. Date

|

2A. Deemed Execution Date, if any

|

3. Trans. Code

(Instr. 8)

|

4. Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5)

|

5. Amount of Securities Beneficially Owned Following Reported Transaction(s)

(Instr. 3 and 4)

|

6. Ownership Form: Direct (D) or Indirect (I) (Instr. 4)

|

7. Nature of Indirect Beneficial Ownership (Instr. 4)

|

|

Code

|

V

|

Amount

|

(A) or (D)

|

Price

|

| Common Stock | 12/7/2019 | | M | | 84899.00 | A | $0.00 | 144684.00 | D | |

| Common Stock | 12/7/2019 | | F | | 42095.00 (1) | D | $20.50 | 102589.00 | D | |

| Common Stock | 12/10/2019 | | S | | 42804.00 (2) | D | $19.99 | 59785.00 | D | |

Table II - Derivative Securities Beneficially Owned (e.g., puts, calls, warrants, options, convertible securities)

|

1. Title of Derivate Security

(Instr. 3) | 2. Conversion or Exercise Price of Derivative Security | 3. Trans. Date | 3A. Deemed Execution Date, if any | 4. Trans. Code

(Instr. 8) | 5. Number of Derivative Securities Acquired (A) or Disposed of (D)

(Instr. 3, 4 and 5) | 6. Date Exercisable and Expiration Date | 7. Title and Amount of Securities Underlying Derivative Security

(Instr. 3 and 4) | 8. Price of Derivative Security

(Instr. 5) | 9. Number of derivative Securities Beneficially Owned Following Reported Transaction(s) (Instr. 4) | 10. Ownership Form of Derivative Security: Direct (D) or Indirect (I) (Instr. 4) | 11. Nature of Indirect Beneficial Ownership (Instr. 4) |

| Code | V | (A) | (D) | Date Exercisable | Expiration Date | Title | Amount or Number of Shares |

| Performance Adjusted Restricted Stock Units | (3) | 12/6/2019 | | A | | 157165.00 | | (3) | (3) | Common Stock | 157165.00 | (3) | 157165.00 | D | |

| Restricted Stock Units | (4) | 12/6/2019 | | A | | 112195.00 | | (5) | (5) | Common Stock | 112195.00 | (5) | 112195.00 | D | |

| Restricted Stock Units | (4) | 12/7/2019 | | M | | | 30007.00 | (6) | (6) | Common Stock | 30007.00 | (6) | 58148.00 | D | |

| Restricted Stock Units | (4) | 12/7/2019 | | M | | | 25729.00 | (7) | (7) | Common Stock | 25729.00 | (7) | 24353.00 | D | |

| Restricted Stock Units | (4) | 12/7/2019 | | M | | | 29163.00 | (8) | (8) | Common Stock | 29163.00 | (8) | 0.00 | D | |

| Explanation of Responses: |

| (1) | 42,095 shares were withheld by HP to satisfy tax withholding on vesting of Restricted Stock Units ("RSUs"). |

| (2) | The sales reported on this Form 4 were executed pursuant to a Rule 10b5-1 trading plan adopted by the reporting person on 6/25/2019. |

| (3) | On 12/6/2019, the reporting person was granted 157,165 Performance Adjusted Restricted Stock Units ("PARSUs"), 100% of which will only be earned after certification of financial results as of 10/31/22, subject to certain earnings per share and relative total stockholder return conditions being met as of that date. Dividend equivalent rights accrue with respect to these PARSUs when and as dividends are paid on HP common stock. |

| (4) | Each RSU represents a contingent right to receive one share of HP common stock. |

| (5) | On 12/6/2019, the reporting person was granted 112,195 RSUs, one-third of which vest annually over three years on each of 12/7/2020, 12/7/2021 and 12/7/2022. Dividend equivalent rights accrue with respect to these RSUs when and as dividends are paid on HP common stock. |

| (6) | On 12/7/2018, the reporting person was granted 87,222 RSUs, 29,074 of which vested on 12/7/2019, and 29,074 of which are scheduled to vest on each of 12/7/2020 and 12/7/2021. Dividend equivalent rights accrue with respect to these RSUs when and as dividends are paid on HP common stock. The number of derivative securities in column 5 includes 933 vested dividend equivalent rights. |

| (7) | On 12/7/2017, the reporting person was granted 73,057 RSUs, 24,352 of which vested on each of 12/7/2018 and 12/7/2019, and 24,353 of which are scheduled to vest on 12/7/2020. Dividend equivalent rights accrue with respect to these RSUs when and as dividends are paid on HP common stock. The number of derivative securities in column 5 includes 1,377 vested dividend equivalent rights. |

| (8) | On 12/7/2016, the reporting person was granted 80,495 RSUs, 26,831 of which vested on 12/7/2017 and 26,832 of which vested on each of 12/7/2018 and 12/7/2019. Dividend equivalent rights accrue with respect to these RSUs when and as dividends are paid on HP common stock. The number of derivative securities in column 5 includes 2,331 vested dividend equivalent rights. |

Reporting Owners

|

| Reporting Owner Name / Address | Relationships |

| Director | 10% Owner | Officer | Other |

Schell Christoph

C/O HP INC.

1501 PAGE MILL RD

PALO ALTO, CA 94304 |

|

| Chief Commercial Officer |

|

Signatures

|

| /s/ Katie Colendich as Attorney-in-Fact for Christoph Schell | | 12/10/2019 |

| **Signature of Reporting Person | Date |

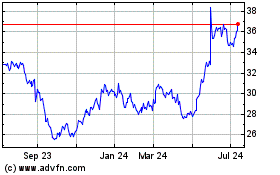

HP (NYSE:HPQ)

Historical Stock Chart

From Aug 2024 to Sep 2024

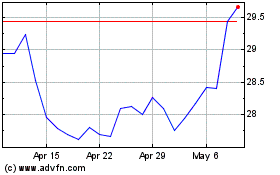

HP (NYSE:HPQ)

Historical Stock Chart

From Sep 2023 to Sep 2024