Walmart Rethinks Store-Card Affiliation -- WSJ

July 13 2018 - 3:02AM

Dow Jones News

By AnnaMaria Andriotis and Liz Hoffman

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (July 13, 2018).

Walmart Inc. is talking to Capital One Financial Corp. about

taking over its store credit card, according to people familiar

with the matter.

The discussions, which are expected to wrap up in coming weeks,

could end Synchrony Financial's nearly 20-year run as the exclusive

issuer of Walmart cards.

Synchrony has been Walmart's exclusive credit-card issuer since

1999. Synchrony issues both a private-label card, which can only be

used at Walmart's stores and website, and a co-branded card that is

accepted almost everywhere.

This is the first time Walmart launched a formal request for

bids from other card issuers, people familiar with the matter said.

The retailer met earlier this year with executives from Capital One

and Goldman Sachs Group Inc., which has been exploring its own

entry into credit cards, according to people familiar with the

matter.

One option that Walmart has looked at is whether to keep its

credit card that can only be used at its stores with Synchrony and

move the co-branded card to Capital One, people familiar with the

discussions said. Walmart's talks with Capital One were previously

reported by Bloomberg News.

Losing Walmart would be a blow to Synchrony, which counts the

retail giant among its five-largest accounts. Walmart credit-card

balances total around $10 billion, according to a person familiar

with the matter, accounting for 19% of Synchrony's retail card

balances and 13% of its total balances, which also include retail

installment loans and medical loans.

Walmart is being advised by boutique investment bank Moelis

& Co., while Kessler Financial Services, a credit-card

consultant, is working with Capital One, people familiar with the

matter said.

Walmart, Capital One and Synchrony all declined to comment.

Walmart and Synchrony have encountered challenges on several

fronts of late. Synchrony executives have expressed frustration

that Walmart isn't putting enough marketing muscle behind the cards

and wants more in-store promotion, people familiar with the matter

said.

Walmart executives believe Synchrony is keeping too much of the

cards' revenue, the people said. The executives aired those

concerns in a meeting with Synchrony's board last year, one person

said.

The retailer also wants Synchrony to approve a higher percentage

of applicants, the people said. Walmart recently partnered with

fintech startup Affirm Inc. to offer installment loans to some

shoppers as an alternative to credit cards.

Facing intense competition from Amazon.com Inc., Walmart has

been investing in self-checkout and mobile payments, pushing

customers toward its own digital wallet, Walmart Pay. It sees

Capital One as a more tech-forward partner whose broader banking

capabilities could aid Walmart's digital ambitions, some of the

people said.

Synchrony's shares plunged 5.3% Thursday to $32.96. The stock is

down nearly 15% this year amid rising loan losses and myriad

challenges facing traditional retailers, including declining health

of brick-and-mortar stores. Synchrony recently lost Toys "R" Us, a

high-profile store partner, to bankruptcy.

The company is diversifying beyond retail store cards. Earlier

this month, Synchrony closed a deal with PayPal Holdings Inc. in

which it bought $7.6 billion in U.S. consumer balances. It also

recently began issuing a general purpose credit card to consumers

who previously had Toys "R" Us credit cards.

There have been other challenging spots in Walmart's

relationship with Synchrony. Less than 5% of Walmart sales are made

on Walmart credit cards, a person familiar with the matter said.

That is well below the 40% of retail sales that store cards

typically account for, according to analysts.

Separately, Walmart has been talking to banks about potentially

launching a separate credit card for consumers who shop at its

e-commerce subsidiary, Jet.com, people familiar with the matter

said.

Write to AnnaMaria Andriotis at annamaria.andriotis@wsj.com and

Liz Hoffman at liz.hoffman@wsj.com

(END) Dow Jones Newswires

July 13, 2018 02:47 ET (06:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

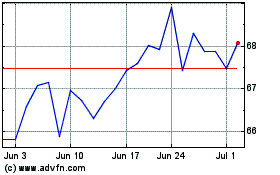

Walmart (NYSE:WMT)

Historical Stock Chart

From Aug 2024 to Sep 2024

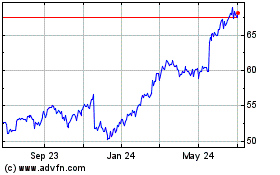

Walmart (NYSE:WMT)

Historical Stock Chart

From Sep 2023 to Sep 2024