UPS Executives Look to Accelerate 'Transformation'

April 26 2018 - 11:50AM

Dow Jones News

By Paul Ziobro

United Parcel Service Inc. is ramping up a "transformation" plan

to cut costs across the organization as the delivery firm responds

to changes in how people shop and nontraditional competitors such

as Amazon.com Inc.

UPS executives on Thursday spoke often of accelerating a review

of the company's operations after it reported its latest quarterly

results. The company is now delivering a majority of packages to

consumers, rather than businesses, in the U.S., a more expensive

delivery since it means delivering fewer packages to more

stops.

"The pace of change of business is accelerating so quickly,"

Chief Executive David Abney said on the company's first-quarter

earnings call. "We feel like we had to respond with a sense of

urgency."

At the same time, UPS is facing new entrants encroaching its

delivery turf, from Amazon's expanding delivery operations to other

startups vying to deliver packages to homes.

The review is being led by Scott Price, a former Walmart Inc.

executive who joined UPS in December with a seat on the company's

top leadership committee, a rare appointment for an outsider.

The changes from his review are just starting to trickle out.

The first involves a voluntary early retirement program available

to nonunion management workers in nonoperations roles. Mr. Price is

also looking to lower procurement costs across the global

organization.

"These are really just the beginning of what is going to be a

very extensive program," Mr. Price said.

In an interview, Mr. Abney said in addition to the growth in

e-commerce, the restructuring will look at opportunities in

emerging markets and how to incorporate new technology into

operations. "We know we have to be on the front edge of technology

to make sure nobody tries to get inside our business," he said.

Other details on cost cuts were scant. UPS plans to hold a

meeting with investors in the coming months that will focus on more

potential changes.

The cost cuts are being paired with the start of a three-year

period of ramped up spending to upgrade and expand UPS's network,

including up to $7 billion in capital spending this year.

UPS's first-quarter results showed some of the obstacles.

Revenue rose 7%, to $10.2 billion, in its large U.S. domestic

package business, but segment profit fell on higher costs from

several items, including expanding Saturday delivery, network

upgrades and severe winter weather.

Overall, UPS's profit rose 15%, to $1.3 billion, from $1.2

billion last year. The company's international and freight business

offset the drop in the domestic business. Total revenue rose 10%,

to $17.1 billion.

The changes UPS is planning come as the company is engaged with

the Teamsters union over the renewal of its contract, which expires

July 31. Mr. Abney said the two sides have made progress on some of

the union's demands. "We are confident that we can reach an

agreement," Mr. Abney said.

Write to Paul Ziobro at Paul.Ziobro@wsj.com

(END) Dow Jones Newswires

April 26, 2018 11:35 ET (15:35 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

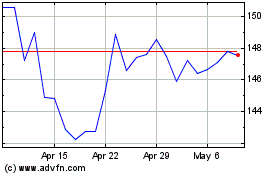

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Aug 2024 to Sep 2024

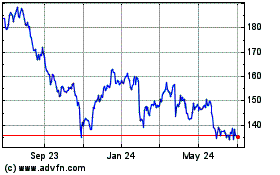

United Parcel Service (NYSE:UPS)

Historical Stock Chart

From Sep 2023 to Sep 2024