EU Clears Qualcomm Takeover Of NXP -- WSJ

January 19 2018 - 3:02AM

Dow Jones News

By Natalia Drozdiak

This article is being republished as part of our daily

reproduction of WSJ.com articles that also appeared in the U.S.

print edition of The Wall Street Journal (January 19, 2018).

BRUSSELS -- Qualcomm Inc. on Thursday said it won antitrust

approval in the European Union and South Korea for its $39 billion

acquisition of NXP Semiconductors NV after agreeing to a package of

measures to assuage regulators' competition concerns.

The approvals move Qualcomm closer to completing its acquisition

of Netherlands-based NXP, a deal that would make it one of the top

suppliers of chips used in cars at a time when auto makers are

increasingly embracing digital technology. The deal, which was

announced in October 2016, won U.S. approval the following

April.

The latest clearances come as Qualcomm fends off an unsolicited

bid from Broadcom Ltd. An enlarged Qualcomm that folds in NXP could

make it more challenging for Broadcom to take over the company,

given that that prospect has already stirred speculation about

antitrust obstacles.

"We are pleased that both the European Commission and the Korean

Fair Trade Commission have granted authorization of the NXP

acquisition, and we are optimistic that China will expeditiously

grant its clearance," said Qualcomm Chief Executive Steve

Mollenkopf. China is the last regulator to review the deal.

Even if approved by China, the deal could face an uphill battle

with NXP investors. NXP's stock price has exceeded Qualcomm's

$110-a-share offer since the summer, and shareholders had tendered

only 1.7% of outstanding common shares as of Jan. 12, when Qualcomm

last extended its offer. Investment manager Ramius LLC, a unit of

Cowen Inc., on Tuesday joined activist investor Elliott Management

Corp. in seeking a higher price.

Qualcomm has said it expects to close the deal early this year

at the original offer price.

In Nasdaq trading Thursday, NXP shares were ahead 0.6% at $120,

while Qualcomm was virtually flat at $68.05.

The EU opened an in-depth investigation into the merger in June,

citing concerns about higher prices and less choice in the

semiconductor industry. To address those issues, Qualcomm agreed to

grant rivals for a period of eight years licenses to NXP's

fare-collection technology used by transportation authorities in

Europe, the EU said.

The San Diego-based company also committed to ensure that its

own baseband chipset and NXP's near-field communications and

secure-element products would continue to function with those of

competitors for a period of eight years. The baseband chips allow

smartphones to connect to cellular networks while

near-field-communications and secure-element chips enable

short-range connectivity, which is used in particular for mobile

payments.

In addition, Qualcomm agreed not to acquire NXP's standard

essential patents as well as some nonessential patents for

near-field communications services, the EU said. NXP will instead

transfer those patents to a third party that would be obliged, for

three years, to grant others royalty-free licenses to use those

patents.

So-called standard essential patents are those deemed crucial to

compliance with an industry standard, such as 3G wireless

communication, and must be licensed on a fair, reasonable, and

nondiscriminatory basis -- known as FRAND.

Qualcomm would acquire some of NXP's other nonstandard essential

patents for near-field communications, but be obliged to grant

royalty-free licenses for their use.

Regulatory review of the NXP deal is only one of several

antitrust hurdles confronting Qualcomm. In Brussels, the EU

formally accused Qualcomm in 2015 of illegally paying Apple Inc. to

exclusively use its chips and selling chips below cost to force a

competitor, Icera Inc., out of the market. Qualcomm has said its

sales practices comply with EU competition law.

In the U.S., the Federal Trade Commission sued Qualcomm a year

ago alleging it engaged in unlawful tactics to maintain a monopoly

on cellular-communications chips. Qualcomm has said the suit is

based on flawed legal theory and misconceptions about its

business.

Broadcom is also currently under investigation by the FTC over

whether it engaged in anticompetitive tactics in negotiations with

customers, The Wall Street Journal reported Wednesday. Broadcom in

response said the review was "immaterial to our business, does not

relate to wireless and has no impact on our proposal to acquire

Qualcomm."

Broadcom, which is co-headquartered in San Jose, Calif., and

Singapore, launched a bid in November for Qualcomm that was

rejected by the latter's board. Broadcom has since proposed

replacing Qualcomm's board of directors and the matter will be put

to a shareholder vote in March.

--Ted Greenwald contributed to this article.

Write to Natalia Drozdiak at natalia.drozdiak@wsj.com

(END) Dow Jones Newswires

January 19, 2018 02:47 ET (07:47 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

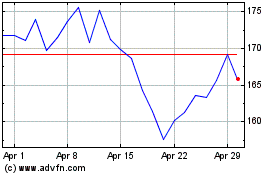

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Aug 2024 to Sep 2024

QUALCOMM (NASDAQ:QCOM)

Historical Stock Chart

From Sep 2023 to Sep 2024