U.S. Objects to Abengoa Bankruptcy-Exit Plan

December 01 2016 - 6:00PM

Dow Jones News

The U.S. government, which pumped more than $130 million into

Spanish renewable-energy company Abengoa SA's U.S.-based projects,

is asking a federal judge to put the brakes on the company's plan

to exit bankruptcy.

Several federal agencies—including the Energy and Justice

departments—are objecting to the bankruptcy-exit plan, demanding

changes and at least partial repayment on the government's

investments.

A spokesman for Abengoa couldn't immediately be reached for

comment Thursday on the government's objections.

Judge Kevin Carey is slated to consider the bankruptcy-exit plan

for Abenoga's primary U.S. subsidiary at a hearing on Tuesday at

the U.S. Bankruptcy Court in Wilmington, Del.

The Energy Department had awarded $137 million to fund a total

of 11 Abengoa projects over the past 13 years, according to an

agency spokeswoman. The department says the funds were intended to

help the it meet federal energy policies that promote the

production of ethanol and other renewable energy sources.

In one objection to the plan, the Energy Department said it is

owed about $611,000 from the sale of a York, Neb., ethanol plant as

well as a robotic arm. Beginning in 2003, the federal agency spent

$17 million to help build the plant and to purchase the robot as

part of a program intended to help develop and improve

ethanol-production technologies.

Abengoa is looking to sell the Nebraska plant to Green Plains

Inc. for approximately $1.25 million, and the Energy Department

wants its share of the proceeds. Similarly, a robotic arm the

government purchased with Abengoa for $4 million was recently sold

for $50,000, and the department says it is owed half of the

proceeds.

The Nebraska ethanol plant currently isn't operating, court

papers show. It sits on the site of a 56 million gallon

ethanol-production facility, which was also sold to Green Plains

for $37.4 million. According to court papers, technology and

equipment developed at the pilot plant supported the startup of one

of the first large-scale, second-generation cellulosic ethanol

plants in the U.S.

"That project successfully demonstrated cellulosic ethanol could

be produced at pilot scale and ended in 2012," a spokeswoman for

the Energy Department said Thursday. "The Energy Department has not

incurred a loss as a result of York pilot plant funding—DOE funds

such projects without expectation or means of repayment."

U.S. Trustee Andrew Vara, who serves as a bankruptcy watchdog

for the Justice Department, raised another obstacle to Abengoa's

restructuring plan. In court papers filed Wednesday, he said the

plan is too generous with legal protections that are intended to

shield the company, its current or former management and others

from lawsuits after the bankruptcy. Lawyers for the trustee said in

an objection that the so-called releases are so broad that they may

violate federal law.

The Internal Revenue Service has also weighed in with an

objection, saying it is owed nearly $19 million. Lawyers for the

IRS said in court papers filed Thursday that Abengoa has failed to

file a "significant number" of federal tax returns. Until those tax

returns are filed, the agency asked Judge Carey to keep Abengoa in

bankruptcy.

Founded in Seville, Spain, in 1941, Abengoa is the flagship of

Spain's renewable-energy industry and now develops clean-energy

projects around the world. The company says cuts in clean-energy

subsidies following Spain's 2013 economic crisis forced it to take

on substantial debt—more than $5 billion—to survive.

After a new investment deal fell through, the company launched

preliminary insolvency proceedings in Spain to restructure its

mountain of debt. The move bought Abengoa time to negotiate a

restructuring agreement with creditors and to avoid filing

bankruptcy in Spain, though earlier this year it did launch

bankruptcy proceedings in the U.S.

A Spanish judge has already approved Abengoa's master

restructuring plan, which puts the company under the control of its

banks and bondholders. Abengoa is now asking a U.S. court to

enforce that plan here as well as to approve repayment terms for

U.S. creditors.

Write to Tom Corrigan at tom.corrigan@wsj.com

(END) Dow Jones Newswires

December 01, 2016 17:45 ET (22:45 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

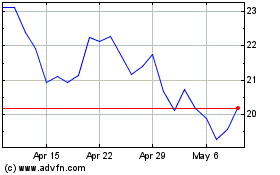

Green Plains (NASDAQ:GPRE)

Historical Stock Chart

From Aug 2024 to Sep 2024

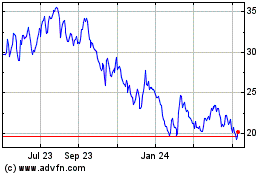

Green Plains (NASDAQ:GPRE)

Historical Stock Chart

From Sep 2023 to Sep 2024