By Ellie Ismailidou and Barbara Kollmeyer, MarketWatch

Energy stocks rise; dollar briefly drops below Yen100; Dudley

hints at September hike

U.S. stocks on Tuesday pulled back from the records set a day

earlier, as investors weighed hawkish comments by Federal Reserve

officials against sharp gains for oil futures, a weakening dollar

and fresh consumer-price data that showed U.S. inflation remains

tepid.

William Dudley, president of the New York Federal Reserve Bank

(http://www.marketwatch.com/story/feds-dudley-says-september-rate-hike-is-possible-2016-08-16),

on Tuesday said the time for another interest-rate increase is

approaching and a rate increase as soon as September is a

possibility, adding to the selling pressures on U.S. equities.

The S&P 500 index fell 8 points, or 0.4%, to 2,183, led by a

1.6% drop in telecom stocks, followed by a 0.7% loss in utility

shares. Telecom and utilities are two income-paying stock sectors

traditionally viewed as bond alternatives--which typically take a

hit when the market's interest-rate expectations rise.

The energy and materials sector were the only S&P 500

sectors in positive territory, both up roughly 0.2%, boosted by

strong gains in crude-oil futures

(http://www.marketwatch.com/story/oil-stumbles-as-investors-cash-in-on-gains-but-sentiment-still-upbeat-2016-08-16).

The Dow Jones Industrial Average fell 53 points, or 0.3%, to

18,583, pressured by a 1.2% drop in Johnson & Johnson but

boosted by a 0.4% gain in Apple Inc.(AAPL), which moved higher

after regulatory filings showed Warren Buffett's Berkshire Hathaway

Inc. (BRKA) (BRKA) loaded up on shares. Others, such as George

Soros's hedge fund Soros Asset Management and David Einhorn's

Greenlight Capital, reduced their stakes in the iPhone maker.

Read: Why Warren Buffett is grabbing Apple stock while other big

names run away

(http://www.marketwatch.com/story/why-warren-buffett-is-grabbing-apple-stock-while-other-big-names-run-away-2016-08-15)

Among individual companies, Home Depot Inc.(HD), was dipping in

and out of negative territory after the do-it-yourself retailer

reported same-store sales rose 5.4% in the second quarter.

The Nasdaq Composite Index was down 24 points, or 0.5%, to

5,237.

The S&P 500, Dow industrials, and Nasdaq Composite all set

all-time closing highs

(http://www.marketwatch.com/story/us-stock-futures-inch-higher-ahead-of-empire-state-reading-2016-08-15)

Monday, marking the second time in three sessions that all three

indexes notched records on the same day. Until last Thursday,

however, the benchmarks hadn't scored simultaneous record closes

since 1999.

Read: The golden lesson from this wild market's past 6 months

(http://www.marketwatch.com/story/dont-miss-this-golden-lesson-from-the-last-6-months-in-markets-2016-08-16)

Stock investors were focusing Tuesday on the yen's strength

(http://www.marketwatch.com/story/yen-soars-to-one-month-high-against-dollar-2016-08-16),

which broke below the Yen100-mark against the dollar early in the

morning, a level not seen since shortly after the U.K.'s vote to

leave the European Union, but later retreated somewhat. The dollar,

as gauged by the U.S. ICE Dollar Index was down 0.5% at 94.80.

Opinion:Here's the safest place for your money with stocks at

record highs

(http://www.marketwatch.com/story/heres-the-safest-place-for-your-money-with-stocks-at-record-highs-2016-08-15)

(http://www.marketwatch.com/story/heres-the-safest-place-for-your-money-with-stocks-at-record-highs-2016-08-15)Given

the yen's status as the haven currency for global investors, "there

is a sense that when the yen is stronger, it represents broader

risk aversion in global markets," said Quincy Krosby, market

strategist at Prudential Financial.

Still, Krosby argued that low liquidity in the summer months

along with expectations of dovish central banks in the European

Union and in the U.K. were contributing to the yen's

strength--rather than a feeling of panic or extreme risk aversion

in the market. That also explained why U.S. stocks were still

hovering near their all-time highs, despite a slight pullback.

"When stocks reach new highs and volumes are at August's [low]

levels, you will see some consolidation and some digesting begin,"

she said.

Also weighing on stocks was a report showing the U.

S.consumer-price index was unchanged in July

(http://www.marketwatch.com/story/consumer-price-index-unchanged-in-july-2016-08-16),

adding to the risk-off sentiment that started in Asia, where the

Nikkei 225 index dropped 1.6%, and in Europe, where stocks were

also struggling.

But housing starts rose to their second-highest rate

(http://www.marketwatch.com/story/housing-starts-rise-to-second-highest-rate-since-recession-on-multifamily-rebound-2016-08-16)since

the recession on multifamily-home rebound, the Commerce Department

said Tuesday. And industrial production in July

(http://www.marketwatch.com/story/us-industrial-output-jumps-in-july-2016-08-16)

saw the biggest one-month gain in 20 months, suggesting that the

factory sector could be on the mend.

Overnight, San Francisco Fed President John Williams said the

central bank should consider aiming for higher inflation

(http://www.marketwatch.com/story/feds-williams-says-inflation-target-should-be-increased-2016-08-15)

than the current 2% target. The current target "is not well suited"

for the new low-interest-rate era because "there is simply not

enough room for central banks to cut interest rates in response to

an economic downturn," Williams said.

Putting Dudley's and Williams's comments in context, it seems

like "Fed officials are trying to tell the market that [a rate hike

in] September might be on the table, but the market doesn't believe

that," said Nick Burwell, a portfolio manager at Cabot Wealth

Management.

Meanwhile, the flurry of data on Tuesday showed, according to

Burwell, that "this recovery is led by jobs and housing," while

inflation is lagging--a combination that falls short of the Fed's

requirements for a rate hike and supports risk assets in the short

term.

More Fed speakers: A fairly busy speaking week for Federal

Reserve officials will kick off with Atlanta Fed President Dennis

Lockhart, who is set to speak to the Rotary Club of Knoxville,

Tennessee at 12:30 p.m. Eastern. The minutes of the Fed's July 27

meeting are coming Wednesday.

Stocks to watch: Dicks Sporting Goods Inc.(DKS) shares jumped 7%

after the retailer beat second-quarter earnings estimates

(http://www.marketwatch.com/story/dicks-sporting-goods-shares-rise-after-earnings-beat-guidance-raised-2016-08-16)and

raised its full-year outlook.

TJX Cos.(TJX) shares tumbled 5.4% despite the fact that its

earnings beat estimates, as its outlook for the current quarter

(http://www.marketwatch.com/story/tjx-third-quarter-outlook-disappoints-stock-falls-2016-08-16)landed

below expectations.

Urban Outfitters Inc.(URBN) and La-Z-Boy Inc.(LZB) are scheduled

to report results after the close.

The weeks's earnings docket includes other retailers such as

Target Corp.(TGT). Here's what to watch for in Target's earnings

(http://www.marketwatch.com/story/what-to-watch-for-in-target-earnings-2016-08-15).

BHP Billiton Ltd.(BHP.AU) (BLT.LN) (BHP.AU) was up 1% even as

the Anglo-Australian mining giant swung to its worst-ever loss of

$6.39 billion

(http://www.marketwatch.com/story/bhp-billiton-posts-64-bln-loss-cuts-dividend-2016-08-16)

and cut its final dividend by 77%, grappling with a slump in

commodity prices.

Among other quarterly changes, hedge-fund manager John Paulson

shed big positions

(http://www.marketwatch.com/story/john-paulson-adds-facebook-office-depot-sheds-t-mobile-allergan-2016-08-15)

in T-Mobile US Inc.(TMUS) and Activision Blizzard Inc.(ATVI). But

he created a new position in Facebook Inc.(FB) and doubled his

stake in Office Depot Inc.(ODP)

Other markets: As the dollar pulled lower, gold pushed higher,

up 0.4% to $1,352.2 an ounce.

Data showed inflation in the U.K. rose a forecast-beating 0.6%

in July

(http://www.marketwatch.com/story/weak-pound-after-brexit-lifts-uk-inflation-to-highest-since-2014-2016-08-16),

on fallout from the Brexit vote, which made imported goods pricier

in that country. Sterling rose to $1.3010 after the inflation

release, up from $1.2880 late Monday in New York.

(END) Dow Jones Newswires

August 16, 2016 12:39 ET (16:39 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

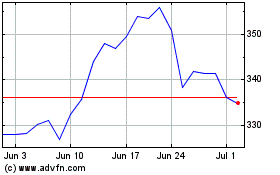

Home Depot (NYSE:HD)

Historical Stock Chart

From Apr 2024 to May 2024

Home Depot (NYSE:HD)

Historical Stock Chart

From May 2023 to May 2024