UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of

August, 2016

Commission File Number 001-36535

GLOBANT S.A.

(Exact name of registrant as specified in

its charter)

GLOBANT S.A.

(Translation of registrant’s name

into English)

37A Avenue J.F. Kennedy

L-1855, Luxembourg

Tel: + 352 48 18 28 1

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover of Form 20-F or Form 40-F:

x

Form 20-F

¨

Form 40-F

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ____

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ____

GLOBANT S.A.

FORM 6-K

|

|

1.

|

LISTING AND ADMISSION TO TRADING ON THE LUXEMBOURG STOCK EXCHANGE

|

On 2 August 2016, Globant S.A. (the “Company”)

applied to the Luxembourg Stock Exchange for listing on the Official List of the Luxembourg Stock Exchange and for the admission

to trading on its regulated market of 34,594,324 existing common shares, issued in registered form, with a nominal value of US$

1.20 each (collectively, the “Shares”), representing the entire share capital of the Company.

On 11 August 2016, the Company applied

to the Luxembourg Financial Sector Supervisory Authority (

Commission de Surveillance du Secteur Financier

) (the “CSSF”)

in its capacity as competent authority under the Luxembourg law of July 10, 2005 relating to prospectuses for securities, as amended

(the “Luxembourg Prospectus Law”), for the approval of the Company’s prospectus (the “Luxembourg Listing

Prospectus”) for the purposes of Article 5(3) of Directive 2003/71/EC, as amended (the “Prospectus Directive”)

and Article 8(3) of the Luxembourg Prospectus Law implementing the Prospectus Directive in the Grand Duchy of Luxembourg. The Luxembourg

Listing Prospectus has been approved by the CSSF on 11 August 2016.

Trading of the Shares on the regulated

market of the Luxembourg Stock Exchange is expected to commence on or about 12 August 2016.

Distribution of the Luxembourg Listing

Prospectus may, in certain jurisdictions, be subject to specific regulations or restrictions. Persons and /or entities in possession

of Luxembourg Listing Prospectus are urged to inform themselves of any such restrictions which may apply in their jurisdiction

and to observe them. The Company disclaims all responsibility for any violation of such restrictions by any person.

THE LUXEMBOURG LISTING PROSPECTUS MAY NOT

BE FORWARDED OR DISTRIBUTED OTHER THAN AS PROVIDED BELOW AND MAY NOT BE REPRODUCED IN ANY MANNER WHATSOEVER. THE LUXEMBOURG LISTING

PROSPECTUS MAY ONLY BE DISTRIBUTED OUTSIDE THE UNITED STATES TO PERSONS THAT ARE NOT U.S. PERSONS AS DEFINED IN, AND IN RELIANCE

ON, REGULATION S UNDER THE U.S. SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”). FAILURE TO COMPLY WITH THIS

NOTICE MAY RESULT IN A VIOLATION OF THE SECURITIES ACT OR THE APPLICABLE LAWS OF OTHER JURISDICTIONS. NOTHING IN THIS COMMUNICATION

OR IN THE LUXEMBOURG LISTING PROSPECTUS CONSTITUTES AN OFFER OF SECURITIES FOR SALE IN ANY JURISDICTION WHERE SUCH OFFERS OR SOLICITATIONS

ARE NOT PERMITTED BY LAW.

The following information included in the

Luxembourg Listing Prospectus supplements and amends the Company’s Annual Report for the year ended December 31, 2015 filed

on Form 20-F on April 29, 2016 and the information contained in its Reports on Form 6-K furnished to the U.S. Securities and Exchange

Commission on May 9, 2016, May 11, 2016, June 1, 2016 and August 10, 2016:

Risk Factors

|

|

-

|

The newly elected government in Argentina declared a state of emergency with respect to the national

electrical system, which will be effective until December 31, 2017. Under this state of emergency, the Argentine government will

be permitted to take actions designed to guarantee the supply of electricity. In this context, subsidy policies were reexamined

and new electricity tariffs went into effect with varying increases depending on geographical location and consumption levels.

In addition, through Resolution No. 31/2016 of the Ministry of Energy and Mining, the government announced the elimination of certain

natural gas subsidies and adjustments to natural gas rated.

|

|

|

-

|

Certain investment fund holders of Argentine bonds governed by French law filed lawsuits against

The Bank of New York Mellon in London for breach of its fiduciary duties as a result of not transferring the amounts deposited

by Argentina on June 30, 2013. On February 13, 2015, London courts ruled that interest payments under euro-denominated Argentine

bonds are governed by English law, but declined to order that the funds held by the Bank of New York Mellon be distributed to the

bondholders. On May 11, 2015, the plaintiffs in this case that obtained pari passu injunctions requested the U.S. District Court

for the Southern District of New York to amend their complaints to include claims alleging that Argentina’s issuance and

servicing of its 2024 dollar-denominated bonds (BONAR 2024), and all its external indebtedness to be issued in the future, would

violate the pari passu clause. They also requested to extend the ratable payment injunction (which applied to the exchange bonds)

to the BONAR 2024. On June 16, 2015 the District Court granted the order to amend the plaintiffs’ complaints. In addition,

on June 5, 2015, the Second Circuit granted partial summary judgment to a group of 526 holdout creditors who requested the Court

to be granted the same treatment as the NML plaintiff (the so-called “me-too plaintiffs”) in 36 separate lawsuits,

finding that, consistent with the previous ruling of such court, Argentina violated the pari passu clause in bonds issued to the

“me-too” bondholders. The final resolution of the “me-too” claims is still pending before the U.S. courts.

As of December 17, 2015 the newly elected government has re-opened negotiations with the plaintiffs conducted by Special Master

Daniel Pollack. On February 5, 2016 Argentina filed a proposal to resolve the claims of all holders of Argentina’s defaulted

debt that, if accepted by plaintiffs, would result in a total payment to plaintiffs of approximately $6.5 billion in cash. On February

19, 2016 the District Court issued an indicative ruling vacating the injunctions upon the occurrence of the following conditions

precedent: (i) that Argentina takes action necessary to repeal Law 26,017 and Law 26,984 and (ii) that any payment is made to the

plaintiffs as well as to the “me-too” plaintiffs in virtue of a settlement agreement entered into between the parties

on or before February 29, 2016. In order to comply with these conditions, on March 31, 2016 the Argentine Congress passed Law 27,249

which: (i) abrogated Law 26,017 and Law 26,984, (ii) approved the issuance of new bonds for up to $12.5 billion to finance the

execution of the settlement agreements, and (iii) conditioned the effective payment to the bondholders to the lifting of the injunctions

by the Court of Appeals for the Second Circuit. On April 13, 2016, the Court of Appeals confirmed Judge Griesa’s indicative

ruling of February 19, 2016. On April 22, 2016, the District Court ordered the vacatur of all pari passu injunctions upon confirmation

of such payments. Argentina issued US$16.5 billion of new debt securities in the international capital markets, and applied US$9.3

billion to satisfy settlement payments on agreements with holders of approximately US$8.2 billion principal amount of defaulted

bonds.

|

As of the date of this Report

on Form 6-K, litigation initiated by bondholders that have not accepted Argentina’s settlement offer continues in several

jurisdictions, although the size of the claims involved has decreased significantly.

Although the vacatur of the pari

passu injunctions removed a material obstacle to access to capital markets by the Argentine government, future transactions may

be affected as litigation with certain holdout bondholders continues, which in turn could affect the Argentine government’s

ability to implement certain expected reforms and foster economic growth, which may have a direct impact on the Company’s

ability to gain access to international credit markets in order to finance the Company’s operations and growth.

Share Capital

|

|

-

|

The Company’s issued share capital amounts to $41,513,188.80, represented by 34,594,324 common

shares with a nominal value of $1.20 each, of which 143,593 are treasury shares held by the Company. The Company has an authorized

share capital, excluding the issued share capital, of $6,966,615.50 consisting of 5,805,513 common shares with a nominal value

of $1.20 each.

|

Lock-up Provisions

|

|

-

|

As of the date of this Report on Form 6-K, 96,924 common shares are subject to contractual lock-up

provisions as further set out below:

|

|

|

o

|

On May 31, 2016 the Company and the sellers of We Are London Limited and We Are Experience, Inc.,

who became employees of the Company (the “Subscribers”), entered into certain subscription agreements for a total of

73,416 common shares in which the Subscribers agreed, among others, during a one-year period, not to offer, pledge, sell, announce

the intention to sell, contract to sell, sell any option or contract to purchase, purchase any option or contract to sell, grant

any option, right or warrant to purchase, or otherwise transfer or dispose of, directly or indirectly, such common shares, provided,

however, that the foregoing restrictions do not apply in the context of a range of exemptions.

|

|

|

o

|

On July 25, 2016 the Company issued a total of 23,508 common shares to the sellers of Clarice Technologies

Private Ltd. (now called “Globant India Private Ltd”) according to certain subscription agreements entered into by

the Company and certain individuals under which agreements such individuals agreed, among others, during a one-year period, not

to offer, pledge, sell, announce the intention to sell, contract to sell, sell any option or contract to purchase, purchase any

option or contract to sell, grant any option, right or warrant to purchase, or otherwise transfer or dispose of, directly or indirectly,

such common shares, provided, however, that the foregoing restrictions do not apply in the context of a range of exemptions.

|

Capitalization

and Indebtedness

|

|

-

|

The following tables set forth the consolidated capitalization and indebtedness of the Company

as of June 30, 2016 on an actual basis:

|

|

in thousands of U.S. dollars

|

|

As of June 30, 2016

|

|

|

|

|

|

|

|

|

Total current liabilities

|

|

|

|

|

|

of which guaranteed

|

|

|

-

|

|

|

of which secured

|

|

|

-

|

|

|

of which unguaranteed/unsecured

|

|

|

45,023

|

|

|

|

|

|

|

|

|

Total non-current liabilities

|

|

|

|

|

|

of which guaranteed

|

|

|

-

|

|

|

of which secured

|

|

|

-

|

|

|

of which unguaranteed/unsecured

|

|

|

25,679

|

|

|

|

|

|

|

|

|

Shareholder’s equity

|

|

|

|

|

|

Share capital

|

|

|

41,300

|

|

|

Additional paid-in-capital

|

|

|

56,955

|

|

|

Other Reserves

|

|

|

(882

|

)

|

|

Non-controlling interest

|

|

|

42

|

|

|

|

|

|

|

|

|

Total

|

|

|

168,117

|

|

|

|

|

|

|

|

|

A. Cash

|

|

|

18,765

|

|

|

B. Cash equivalent

|

|

|

-

|

|

|

C. Trading securities

|

|

|

-

|

|

|

D. Liquidity (A)+(B)+(C)

|

|

|

18,765

|

|

|

|

|

|

|

|

|

E. Current Financial Receivable

|

|

|

105,128

|

|

|

|

|

|

|

|

|

F. Current Bank debt

|

|

|

(248

|

)

|

|

G. Current portion of non-current debt

|

|

|

-

|

|

|

H. Other current financial debt

|

|

|

(6,456

|

)

|

|

I. Current Financial Debt (F)+(G)+(H)

|

|

|

(6,704

|

)

|

|

|

|

|

|

|

|

J. Net Current Financial Indebtedness (I)-(E)-(D)

|

|

|

117,189

|

|

|

|

|

|

|

|

|

K. Non-current Bank loans

|

|

|

(90

|

)

|

|

|

|

|

|

|

|

L. Bonds Issued

|

|

|

-

|

|

|

|

|

|

|

|

|

M. Other non-current loans

|

|

|

-

|

|

|

|

|

|

|

|

|

N. Non-current Financial Indebtedness (K)+(L)+(M)

|

|

|

(90

|

)

|

|

|

|

|

|

|

|

O. Net Financial Indebtedness (J)+(N)

|

|

|

117,099

|

|

Equity Compensation

Arrangements

|

|

-

|

Including the Company’s newly-issued stock options, there were 1,497,466 outstanding stock

options as of December 31, 2013, 1,724,614 outstanding stock options as of December 31, 2014, 1,933,239 outstanding stock options

as December 31, 2015 and 2,060,613 outstanding stock options as of June 30, 2016. For 2015, 2014 and 2013, the Company recorded

$2.4 million, $0.6 million and $0.8 million of share-based compensation expense related to these share option agreements, respectively.

For the period ended June 30, 2016, the Company recorded $1,083 million of share-based compensation expense related to these share

option agreements.

|

Facilities and Infrastructure

|

|

-

|

As of June 30, 2016, the Company provided its services through a network of 33 delivery centers

in 22 cities throughout ten countries. The Company’s delivery locations are in Buenos Aires, Tandil, Rosario, Tucumán,

Mendoza, Santa Fe, Córdoba, Resistencia, Bahía Blanca, Mar del Plata and La Plata in Argentina; Montevideo, Uruguay;

Bogotá and Medellín, Colombia; São Paulo, Brazil; Mexico City, Mexico; Lima, Peru; Santiago, Chile; Pune and

Bangalore, India; London in the United Kingdom and San Francisco in the United States. The Company also has client management locations

in the United States (Boston, New York and San Francisco), Brazil (São Paulo), Colombia (Bogotá), Uruguay (Montevideo),

Argentina (Buenos Aires) and the United Kingdom (London). The main administrative offices of the Company’s principal subsidiary

(which also include a delivery center) are located in Buenos Aires. All of the Company’s facilities (with the exceptions

of Tucumán and Bahía Blanca) are leased. The Company also has two offices under construction in Buenos Aires and

La Plata.

|

|

|

-

|

The table below breaks down the Company’s locations by country and city and provides the

aggregate square footage (SQF) of the Company’s locations in each city as of June 30, 2016.

|

|

Country

|

|

City

|

|

Number of Offices

|

|

|

Amount of SQF

|

|

|

Argentina

|

|

Bahía Blanca

|

|

|

2

|

|

|

|

15,120

|

|

|

Argentina

|

|

Buenos Aires

|

|

|

3

|

|

|

|

107,000

|

|

|

Argentina

|

|

Córdoba

|

|

|

2

|

|

|

|

41,644

|

|

|

Argentina

|

|

La Plata

|

|

|

1

|

|

|

|

15,500

|

|

|

Argentina

|

|

Mar del Plata

|

|

|

1

|

|

|

|

20,451

|

|

|

Argentina

|

|

Resistencia

|

|

|

1

|

|

|

|

12,230

|

|

|

Argentina

|

|

Rosario

|

|

|

2

|

|

|

|

22,497

|

|

|

Argentina

|

|

Tandil

|

|

|

3

|

|

|

|

10,850

|

|

|

Argentina

|

|

Tucumán

|

|

|

1

|

|

|

|

10,764

|

|

|

Argentina

|

|

Mendoza

|

|

|

1

|

|

|

|

3,229

|

|

|

Argentina

|

|

Santa Fe

|

|

|

1

|

|

|

|

1,292

|

|

|

Brazil

|

|

São Paulo

|

|

|

1

|

|

|

|

7,804

|

|

|

Chile

|

|

Santiago

|

|

|

1

|

|

|

|

4,730

|

|

|

Colombia

|

|

Bogotá

|

|

|

2

|

|

|

|

28,933

|

|

|

Colombia

|

|

Medellín

|

|

|

1

|

|

|

|

13,207

|

|

|

United Kingdom

|

|

London

|

|

|

1

|

|

|

|

5,350

|

|

|

Mexico

|

|

Mexico City

|

|

|

1

|

|

|

|

28,622

|

|

|

United States

|

|

San Francisco

|

|

|

1

|

|

|

|

4,844

|

|

|

India

|

|

Pune

|

|

|

3

|

|

|

|

105,534

|

|

|

India

|

|

Bangalore

|

|

|

1

|

|

|

|

7,158

|

|

|

United States

|

|

Boston

|

|

|

1

|

|

|

|

124

|

|

|

United States

|

|

New York

|

|

|

2

|

|

|

|

5,500

|

|

|

Uruguay

|

|

Montevideo

|

|

|

1

|

|

|

|

26,824

|

|

|

Peru

|

|

Lima

|

|

|

1

|

|

|

|

7,535

|

|

|

Total

|

|

|

|

|

35

|

|

|

|

506,742

|

|

Organizational

Structure

|

|

-

|

The following chart reflects the Company’s organization structure including the significant

subsidiaries as of the date of this Report on Form 6-K. See note 2.2 to the Company’s audited consolidated financial statements

for more information about the Company’s consolidated subsidiaries.

|

|

|

-

|

The following table provides a summary of the Company’s significant subsidiaries as of the

date of this Report on Form 6-K:

|

|

Name

|

|

Place of Incorporation

|

|

Holding

|

|

Globant S.A.U.

|

|

Spain

|

|

100% Globant S.A. (Luxembourg)

|

|

Sistemas Colombia S.A.S.

|

|

Colombia

|

|

99.99% Globant S.A.U.

00.01% Software Product Creation SL

|

|

Globant, LLC

|

|

USA

|

|

100% Globant S.A.U.

|

|

Sistemas Globales Uruguay S.A.

|

|

Uruguay

|

|

100% Globant S.A.U.

|

|

Sistemas UK Ltd.

|

|

England & Wales

|

|

100% Globant S.A.U.

|

|

Sistemas Globales Chile Asesorías Ltda.

|

|

Chile

|

|

95.00% Globant S.A.U.

05.00% Software Product Creation S.L.

|

|

Global Systems Outsourcing S. de R.L. de C.V.

|

|

Mexico

|

|

99.99% Globant S.A.U.

00.01% 4.0 S.R.L.

|

|

IAFH Global S.A.

|

|

Argentina

|

|

93.15% Globant S.A.U.

06.51% Sistemas Globales Buenos Aires S.R.L.

00.34% 4.0 S.R.L.

|

|

Sistemas Globales S.A.

|

|

Argentina

|

|

63.95% Sistemas Globales Buenos Aires S.R.L.

03.76% 4.0 S.R.L.

32.29% Globant S.A.U.

|

|

Globant Brasil Consultoria Ltda.

|

|

Brazil

|

|

99.99% Globant S.A.U.

00.01% Software Product Creation SL

|

|

Huddle Investment LLP

|

|

England & Wales

|

|

93.125% Globant S.A. (Luxembourg)

06.875% Globant S.A.U.

|

|

Huddle Group Corp.

|

|

USA

|

|

100.00% Huddle Investment LLP

|

|

Globant Peru S.A.C.

|

|

Peru

|

|

99.99% Globant S.A.U.

00.01% Software Product Creation S.L.

|

|

Globant India Pvt. Ltd.

|

|

India

|

|

89.28% Globant S.A.U.

|

|

Dynaflows S.A.

|

|

Argentina

|

|

66.73% Sistemas Globales S.A.

|

|

We Are London Limited

|

|

UK

|

|

100% Globant S.A.U.

|

|

We Are Experience Inc.

|

|

USA

|

|

100% Globant S.A.U.

|

2014 Equity Incentive Plan

|

|

-

|

As of June 30, 2016, the aggregate amount of stock options regarding the common shares held by

(a) the Company’s directors amounts to 88,680 (of which all were granted under the Company’s 2014 Equity Incentive

Plan); and (b) the Company’s executive officers amounts to 963,347 (of which a total of 51,522 stock options were granted

under the Company’s 2012 Equity Incentive Plans and the remaining stock options were granted under the Company’s 2014

Equity Incentive Plan).

|

Further, out of the total aggregate

stock options held as of June 30, 2016 by the Company’s executive officers, a total of 325,929 stock options were already

vested while the remaining stock options shall become vested under a four-year vesting schedule.

The table below sets out the

amount of stock options held by each of the Company’s executive officers and directors as of June 30, 2016:

|

Executive Officers

|

|

|

Andres Angelani

|

64,079

|

|

Gustavo Barreiro

|

21,250

|

|

Guibert Englebienne

|

107,500

|

|

Natalia Kanefsck

|

8,318

|

|

Guillermo Marsicovetere

|

123,333

|

|

Martín Migoya

|

297,750

|

|

Nestor Nocetti

|

12,500

|

|

Patricio Pablo Rojo

|

67,499

|

|

Alejandro Scannapieco

|

66,667

|

|

Martín Umaran

|

82,500

|

|

Guillermo Willi

|

91,951

|

|

Wanda Weigert

|

20,000

|

|

Directors

|

|

|

Marcos Galperin

|

22,170

|

|

Timothy Mott

|

22,170

|

|

Philip A. Odeen

|

22,170

|

|

Mario Vazquez

|

22,170

|

Director Compensation

On May 6, 2016 the Company’s

shareholders approved to pay an aggregate of $300,000 in director fees for the year 2016 to certain members of the Company’s

board of directors who are considered independent. On May 6, 2016, the Company’s shareholders approved a grant of options

to purchase the Company’s common shares in favor of Martin Migoya, Martin Umaran and Guibert Englebienne in the amount of

90,000, 20,000 and 30,000, respectively.

Compensation Committee

|

|

-

|

The current members of the Company’s compensation committee are Mario Vazquez, Philip Odeen

and Marcos Galperin, with Mr. Vazquez serving as chairman. Each of Messrs. Vazquez, Odeen and Galperin satisfies the “independence”

requirements within the meaning of Section 303A of the NYSE Listed Company Manual.

|

Corporate Governance

|

|

-

|

Upon the listing on the official list of the Luxembourg Stock Exchange and admission to trading

on the regulated market of the Luxembourg Stock Exchange the Company will have to comply with the 10 Principles of Corporate Governance

of the Luxembourg Stock Exchange in all respects or explain why in accordance with to the flexible “comply or explain”

standard, in case the Company deviates.

|

Employees

|

|

-

|

The following tables show the Company’s total number of full-time employees as of June 30,

2016 broken down by functional area and geographical location:

|

|

|

|

Number of employees

|

|

|

Technology

|

|

|

4,575

|

|

|

Operations

|

|

|

348

|

|

|

Sales and Marketing

|

|

|

81

|

|

|

Management and administration

|

|

|

376

|

|

|

Total

|

|

|

5,380

|

|

|

|

|

|

Number of employees

|

|

|

Argentina

|

|

|

2,806

|

|

|

Brazil

|

|

|

48

|

|

|

Colombia

|

|

|

718

|

|

|

Chile

|

|

|

83

|

|

|

United Kingdom

|

|

|

42

|

|

|

Uruguay

|

|

|

440

|

|

|

United States

|

|

|

336

|

|

|

Mexico

|

|

|

343

|

|

|

Peru

|

|

|

73

|

|

|

India

|

|

|

478

|

|

|

Spain

|

|

|

13

|

|

|

Total

|

|

|

5,380

|

|

Mandatory Takeover,

Squeeze-Out and Sell-Out Rights under the Luxembourg Takeover Law

|

|

-

|

The Luxembourg law of May 19, 2006 implementing Directive 2004/25/EC of the European Parliament

and the Council of April 21, 2004 on takeover bids (the “Luxembourg Takeover Law”) provides that, once a listing on

the Luxembourg Stock Exchange has occurred, if a person, acting alone or in concert, obtains voting securities of the Company which,

when added to any existing holdings of the Company’s voting securities, give such person voting rights representing 33

1

/

3

%

of all of the voting rights attached to the voting securities in the Company, this person is obliged to make an offer for the remaining

voting securities in the Company at a fair price.

|

Following the

implementation of the Directive 2004/25/EC of the European Parliament and of the Council of April 21, 2004 (the “Takeover

Directive”), any mandatory or voluntary bid, which follows or has as its objective the acquisition of control of the Company,

will be subject to regulation by the CSSF pursuant to the Luxembourg Takeover Law.

The Luxembourg

Takeover Law provides that, when as a result of an offer (mandatory or voluntary) addressed to all of the holders of voting securities

of the Company, the offeror holds voting securities representing not less than 95% of the share capital that carry voting rights

to which the offer relates and 95% of the voting rights, the offeror may require the holders of the remaining voting securities

to sell those securities to the offeror. The price offered for such securities must be a “fair price.” The price offered

in a voluntary offer would be considered a “fair price” in the squeeze-out proceedings if at least 90% of the securities

representing share capital that carry voting rights and which were comprised in the bid were acquired in such voluntary offer.

The price paid in a mandatory offer is deemed a “fair price.” The consideration paid in the squeeze-out proceedings

must take the same form as the consideration offered in the offer or consist solely of cash. Moreover, an all-cash option must

be offered to the remaining shareholders of the Company. Finally, the right to initiate squeeze-out proceedings must be exercised

within three months following the expiration of the acceptance period of the offer.

The Luxembourg

Takeover Law provides that, when as a result of an offer (mandatory or voluntary) addressed to all of the holders of voting securities

of the Company, the offeror (and any person acting in concert with the offeror) holds voting securities carrying more than 90%

of the voting rights, the remaining security holders may require that the offeror purchase the remaining voting securities. The

price offered in a voluntary offer would be considered “fair” in the sell-out proceedings if at least 90% of the securities

representing share capital that carry voting rights of the company to which the offer relates were acquired in such voluntary offer.

The price paid in a mandatory offer is deemed a “fair price.” The consideration paid in the sell-out proceedings must

take the same form as the consideration offered in the offer or consist solely of cash. Moreover, an all-cash option must be offered

to the remaining shareholders of the Company. Finally, the right to initiate sell-out proceedings must be exercised within three

months following the expiration of the acceptance period of the offer.

Shareholdings Disclosure

Requirements

|

|

-

|

Holders of common shares, including depositary receipts representing common shares admitted to

trading on a regulated market and for which Luxembourg is the home Member State and to which voting rights are attached (the “Securities”)

and derivatives or other financial instruments linked to the Securities may be subject to notification obligations pursuant to

the Luxembourg law of 11 January 2008 on transparency requirements for issuers, as amended (the “Luxembourg Transparency

Law”) and the Grand ducal regulation of 11 January 2008 on transparency requirements for issuers, as amended. The following

description summarises these obligations. The Company’s common shareholders are advised to consult with their own legal advisers

to determine whether the notification obligations apply to them.

|

The Luxembourg Transparency Law

provides that, if a person acquires or disposes of a Securities holding in the Company, and if following the acquisition or disposal

the proportion of voting rights held by the person reaches, exceeds or falls below one of the thresholds of 5%, 10%, 15%, 20%,

25%, 33

1

/

3

%, 50% or 66

2

/

3

% (each a “Relevant Threshold”) of the total voting

rights existing when the situation giving rise to a declaration occurs, such person must simultaneously notify the Company and

the CSSF of the proportion of voting rights held by it further to such event.

A person must also notify the

Company and the CSSF of the proportion of his or her voting rights if that proportion reaches, exceeds or falls below the abovementioned

thresholds as a result of events changing the breakdown of voting rights and on the basis of the information disclosed by the Company.

The same notification requirements apply to a natural person or legal entity to the extent he/the Company it is entitled to acquire,

to dispose of, or to exercise voting rights in any of the following cases or a combination of them:

|

|

o

|

voting rights held by a third party with whom that person or entity has concluded an agreement,

which obliges them to adopt, by concerted exercise of the voting rights they hold, a lasting common policy towards the management

of the issuer;

|

|

|

o

|

voting rights held by a third party under an agreement concluded with that person or entity providing

for the temporary transfer for consideration of the voting rights in question;

|

|

|

o

|

voting rights attaching to Securities which are lodged as collateral with that person or entity,

provided the person or entity controls the voting rights and declares his intention of exercising them;

|

|

|

o

|

voting rights attaching to Securities in which that person or entity has the life interest;

|

|

|

o

|

voting rights which are held, or may be exercised within the meaning of points (a) to (d), by an

undertaking controlled by that person or entity;

|

|

|

o

|

voting rights attaching to Securities deposited with that person or entity which the person or

entity can exercise at his discretion in the absence of specific instructions from the Securities holders;

|

|

|

o

|

voting rights held by a third party in its own name on behalf of that person or entity;

|

|

|

o

|

voting rights which that person or entity may exercise as a proxy where the person or entity can

exercise the voting rights at his discretion in the absence of specific instructions from the Securities holders.

|

The above notification requirements

also apply to a natural person or legal entity that holds, directly or indirectly, financial instruments linked to Globant S.A.

shares.

Major Shareholders

|

|

-

|

As of August 1, 2016, the Company had 34,594,324 issued and outstanding common shares. Beneficial

ownership for the purposes of the following table is determined in accordance with the rules and regulations of the SEC. These

rules generally provide that a person is the beneficial owner of securities if such person has or shares the power to vote or direct

the voting thereof, or to dispose or direct the disposition thereof, to receive the economic benefit of ownership of the securities,

or has the right to acquire such powers within 60 days. common shares subject to options, warrants or other convertible or exercisable

securities that are currently convertible or exercisable or convertible or exercisable within 60 days of July 26, 2016 are deemed

to be outstanding and beneficially owned by the person holding such securities. common shares issuable pursuant to share options

or warrants are deemed outstanding for computing the percentage ownership of the person holding such options or warrants but are

not outstanding for computing the percentage of any other person. To the Company’s knowledge, except as indicated in the

footnotes to this table and pursuant to applicable community property laws, the persons named in the table have sole voting and

investment power with respect to all of the Company’s common shares.

|

|

Directors and Senior Management

|

|

Number

|

|

|

Percent

|

|

|

|

|

|

|

|

|

|

|

Francisco Álvarez-Demalde

(1)

|

|

|

3,175

|

|

|

|

*

|

|

|

Andres Angelani

(2)

|

|

|

29,079

|

|

|

|

*

|

|

|

Gustavo Barreiro

(3)

|

|

|

53,885

|

|

|

|

*

|

|

|

Guibert Englebienne

(4)

|

|

|

355,508

|

|

|

|

1.03

|

%

|

|

Marcos Galperin

(5)

|

|

|

22,170

|

|

|

|

*

|

|

|

Natalia Kanefsck

(6)

|

|

|

3,735

|

|

|

|

*

|

|

|

Guillermo Marsicovetere

(7)

|

|

|

62,965

|

|

|

|

*

|

|

|

Martín Migoya

(8)

|

|

|

372,633

|

|

|

|

1.08

|

%

|

|

Timothy Mott

(9)

|

|

|

22,170

|

|

|

|

*

|

|

|

Nestor Nocetti

(10)

|

|

|

407,343

|

|

|

|

1.18

|

%

|

|

Philip A. Odeen

(11)

|

|

|

22,170

|

|

|

|

*

|

|

|

Patricio Pablo Rojo

(12)

|

|

|

71,249

|

|

|

|

*

|

|

|

Alejandro Scannapieco

(13)

|

|

|

82,456

|

|

|

|

*

|

|

|

Martín Umaran

(14)

|

|

|

505,911

|

|

|

|

1.47

|

%

|

|

Mario Vazquez

(15)

|

|

|

22,170

|

|

|

|

*

|

|

|

Guillermo Willi

(16)

|

|

|

87,102

|

|

|

|

*

|

|

|

David Moore

|

|

|

0

|

|

|

|

*

|

|

|

Wanda Weigert

(17)

|

|

|

7,500

|

|

|

|

*

|

|

|

All executive officers and directors as a group

|

|

|

2,131,221

|

|

|

|

6.19

|

%

|

|

*Less than 1%

|

|

|

|

|

|

|

|

|

|

|

(1)

|

Represent 3,175 common shares held by NPI Group Family Limited Partnership, a family investment

vehicle controlled by Mr. Alvarez-Demalde, who indirectly holds shared voting and dispositive power over the 13,175 common shares

held by such company.

|

|

|

(2)

|

Represent 29,079 common shares issuable upon exercise of vested options.

|

|

|

(3)

|

Include 8,124 common shares issuable upon exercise of vested options.

|

|

|

(4)

|

Include 26,250 common shares issuable upon exercise of vested options; and 207,166 common shares

held by a revocable trust formed under New Zealand law (the “Revocable Englebienne Trust Shares”) formed by Mr. Englebienne

that was established for the benefit of Mr. Englebienne, his wife and certain charitable organizations. Subsequently, the trust

transferred its Revocable Englebienne Trust Shares to a Uruguayan company wholly owned by the trust. New Zealand Trust Corporation

Limited acts as the independent trustee of the trust. Marcelo Cabrera Errandonea is the sole director of the Uruguayan company

and holds voting and dispositive power over the common shares held by such company.

|

|

|

(5)

|

Represent 22,170 common shares issuable upon exercise of vested options.

|

|

|

(6)

|

Represent 3,735 common shares issuable upon exercise of vested options.

|

|

|

(7)

|

Include 26,666 common shares issuable upon exercise of vested options.

|

|

|

(8)

|

Include 66,374 common shares issuable upon exercise of vested options and 207,040 common shares

held by a revocable trust formed under New Zealand law (the “Revocable Migoya Trust Shares”) formed by Mr. Migoya that

was established for the benefit of Mr. Migoya, his wife and certain charitable organizations. Subsequently, the trust transferred

its Revocable Migoya Trust Shares to a Uruguayan company wholly owned by the trust. New Zealand Trust Corporation Limited acts

as the independent trustee of the trust. Marcelo Cabrera Errandonea is the sole director of the Uruguayan company and holds voting

and dispositive power over the 207,040 common shares held by such company.

|

|

|

(9)

|

Represent 22,170 common shares issuable upon the exercise of vested options.

|

|

|

(10)

|

Include 6,250 common shares issuable upon exercise of vested options and 272,770 common shares

held by a revocable trust formed under New Zealand law (the “Revocable Nocetti Trust Shares”) formed by Mr. Nocetti

that was established for the benefit of Mr. Nocetti, his wife and certain charitable organizations. Subsequently, the trust transferred

its Revocable Nocetti Trust Shares to a Uruguayan company wholly owned by the trust. New Zealand Trust Corporation Limited acts

as the independent trustee of the trust. Marcelo Cabrera Errandonea is the sole director of the Uruguayan company and holds voting

and dispositive power over the 212,770 common shares held by such company.

|

|

|

(11)

|

Represent 22,170 common shares issuable upon exercise of vested options.

|

|

|

(12)

|

Include 41,249 common shares issuable upon exercise of vested options.

|

|

|

(13)

|

Include 14,584 common shares issuable upon exercise of vested options.

|

|

|

(14)

|

Include 23,750 common shares issuable upon exercise of vested options and 359,241 common shares

held by a revocable trust formed under New Zealand law (the “Revocable Umaran Trust Shares”) formed by Mr. Umaran that

was established for the benefit of Mr. Umaran, his wife and certain charitable organizations. Subsequently, the trust transferred

its Revocable Umaran Trust Shares to a Uruguayan company wholly owned by the trust. New Zealand Trust Corporation Limited acts

as the independent trustee of the trust. Marcelo Cabrera Errandonea is the sole director of the Uruguayan company and holds voting

and dispositive power over the 359,241 common shares held by such company.

|

|

|

(15)

|

Represent 22,170 common shares issuable upon the exercise of vested options.

|

|

|

(16)

|

Include 72,368 common shares issuable upon the exercise of vested options.

|

|

|

(17)

|

Include 7,500 common shares issuable upon the exercise of vested options.

|

As of the date of this Report on

Form 6-K, there are no persons that have major holdings within the meaning of Article 8 or Article 9 of the Luxembourg Transparency

Law except the persons mentioned under the paragraph entitled “5% or More Shareholders” below.

|

|

|

Number

|

|

|

Percent*

|

|

|

|

|

|

|

|

|

|

|

5% or More Shareholders:

|

|

|

|

|

|

|

|

|

|

WPP Luxembourg Gamma Three S.à r.l.

(18)

|

|

|

6,687,548

|

|

|

|

19.33

|

%

|

|

Ivy Investment Management Company

(19)

|

|

|

2,827,787

|

|

|

|

8.17

|

%

|

|

Capital World Investors (U.S.)

(20)

|

|

|

2,717,510

|

|

|

|

7.86

|

%

|

|

GIC Private Limited

(21)

|

|

|

2,159,464

|

|

|

|

6.24

|

%

|

|

|

*

|

For purposes of the calculation of these percentages the treasury shares held by the Company have

not been deducted from the total amount of shares in issue.

|

|

|

(18)

|

The ultimate parent of WPP Luxembourg Gamma Three S.à r.l. is WPP plc, a company incorporated

in Jersey. Paul W.G. Richardson, Group Finance Director of WPP plc, holds voting and dispositive power over the 6,687,548 common

shares indirectly held by WPP plc.

|

|

|

(19)

|

Based upon a Schedule 13G dated February 12, 2016, Ivy Investment Management Company and Waddell

& Reed Investment Management Company are direct and indirect subsidiaries, respectively, of Waddell & Reed Financial, Inc.,

and hold dispositive and voting power with respect to 2,827,787 shares.

|

|

|

(20)

|

Based upon a Schedule 13G dated February 12, 2016, showing sole dispositive and voting power with

respect to 2,717,510 shares.

|

|

|

(21)

|

GIC Private Limited (“GIC”) is a fund manager and only has 2 clients – the Government

of Singapore (“GoS”) and the Monetary Authority of Singapore (“MAS”). Under the investment management agreement

with GoS, GIC has been given the sole discretion to exercise the voting rights attached to, and the disposition of, any shares

managed on behalf of GoS. As such, GIC has the sole power to vote and power to dispose of the 1,781,623 securities beneficially

owned by it. GIC shares power to vote and dispose of 377,841 securities beneficially owned by it with MAS.

|

Signatures

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly

authorized.

|

|

GLOBANT S.A.

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/ ALEJANDRO SCANNAPIECO

|

|

|

|

Name: Alejandro Scannapieco

|

|

|

|

Title: Chief Financial Officer

|

|

|

|

|

Date: August 11, 2016

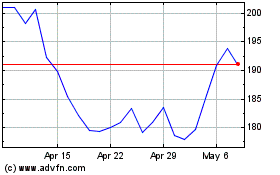

Globant (NYSE:GLOB)

Historical Stock Chart

From Apr 2024 to May 2024

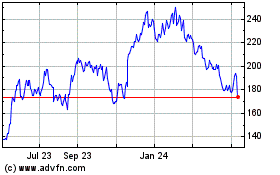

Globant (NYSE:GLOB)

Historical Stock Chart

From May 2023 to May 2024