Fannie Mae to Pay $919 Million Dividend to U.S. as Profit Falls

May 05 2016 - 8:40AM

Dow Jones News

Fannie Mae said it would send a $919 million dividend payment to

the U.S. Treasury Department in June, while reporting its profit

that fell in latest quarter amid low interest rates.

The mortgage-finance company reported a profit of $1.14 billion

for the first quarter, down from $1.89 billion a year ago and $2.47

billion in the fourth quarter.

Fannie Mae said the decrease was driven by lower long-term

interest rates, which hurt the value of the derivatives it uses to

manage risk. The decline was partially offset by increases in

credit-related income.

Fannie Mae booked $2.81 billion in fair-value losses in the

quarter, compared with losses of $1.92 billion in the prior-year

period.

Fannie Mae's revenue slipped 7.5% to $4.97 billion.

On Tuesday, rival Freddie Mac reported a loss for the first

quarter and said it wouldn't pay a dividend for the quarter.

Freddie cited lower interest rates and a widening credit spread for

the results.

Fannie and Freddie don't make mortgages. The companies buy loans

from lenders, wrap them into securities and provide guarantees to

make investors whole if the loans default.

The price of their portfolios rise and fall as interest rates

change. They use derivatives in an effort to counteract that

effect, but because of accounting rules, the derivatives can make

large profits or losses appear over short periods.

The results come amid uncertainty over Fannie and Freddie's

futures. The government took control of Fannie and Freddie through

a conservatorship during the financial crisis in 2008, eventually

injecting $71.3 billion into Freddie and $116.1 billion into

Fannie. The companies now pay nearly all of their profits to the

U.S. Treasury and are required to wind down their capital buffers

over time until they reach zero by 2018.

When the deal was put in place, Congress was considering

housing-finance legislation that would replace Fannie and Freddie

with a new system. However, a bipartisan effort to replace the

companies died in 2014, and legislators in an election year have

shown little willingness to consider that or another bill.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

May 05, 2016 08:25 ET (12:25 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

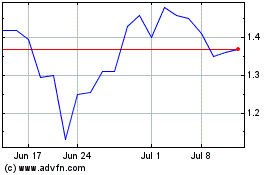

Fannie Mae (QB) (USOTC:FNMA)

Historical Stock Chart

From Aug 2024 to Sep 2024

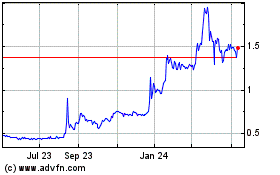

Fannie Mae (QB) (USOTC:FNMA)

Historical Stock Chart

From Sep 2023 to Sep 2024