UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 7, 2014

MYRIAD GENETICS, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

0-26642 |

|

87-0494517 |

| (State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

320 Wakara Way

Salt Lake City, Utah 84108

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (801) 584-3600

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

ITEM 1.01 ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT.

The disclosure provided under Item 5.02(c) below is incorporated herein by reference.

ITEM 5.02 DEPARTURE OF DIRECTORS OR PRINCIPAL OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF PRINCIPAL OFFICERS.

(a) Not applicable.

(b) The disclosure provided under

Item 5.02(c) below is incorporated herein by reference.

(c) On October 8, 2014, Myriad Genetics, Inc. (the “Company”) announced the

appointment of R. Bryan Riggsbee as Executive Vice President, Chief Financial Officer and Treasurer to replace James S. Evans, who is retiring as Chief Financial Officer and Treasurer, each effective as of October 16, 2014.

Employment Arrangements with Mr. Riggsbee

Mr. Riggsbee, age 44, began his career with the international accounting firm KPMG, LLP, where he held several positions. Subsequently, Mr. Riggsbee

held various positions in finance and accounting with General Electric Company before joining Laboratory Corporation of America Holdings (“LabCorp”) in 2004. While with LabCorp, Mr. Riggsbee served as Chief Financial Officer of

DynaLife Diagnostic Laboratories, a LabCorp subsidiary, Vice President, Corporate Finance and most recently Senior Vice President, Corporate Finance. Mr. Riggsbee received a B.A. Political Science degree from the University of North Carolina, a

B.A. Accounting degree from North Carolina State University, a Master of Business Administration from Northwestern University and is a Certified Public Accountant licensed in the state of North Carolina.

In connection with his hiring, Mr. Riggsbee and the Company have entered into an offer letter dated October 7, 2014 (the “Offer Letter”)

and an employment agreement dated October 8, 2014 (the “Employment Agreement”) governing the terms of Mr. Riggbee’s employment and his initial compensation arrangements. Mr. Riggsbee will be an at-will employee with no

defined employment term. Pursuant to the Employment Agreement, either party may terminate the employment relationship at any time for any reason, with or without notice or cause. The Employment Agreement also provides that Mr. Riggsbee will not

disclose confidential information of the Company during and after employment and will not compete with the Company or solicit the Company’s employees and customers during the term of employment and for one year following employment.

Upon hire, Mr. Riggsbee will receive an annual base salary of $375,000 per year, a $10,000 sign-on bonus, and 30,000 restricted stock units which vest on

a pro rata basis over four years, which units are subject to Compensation Committee approval, and will be eligible to receive an annual cash incentive bonus of up to 50% of his base salary and a three-year cash incentive bonus of up to 15% of his

base salary, with the actual amounts to be determined by the Compensation Committee under the Company’s compensation programs, as described under the heading

Page 2 of 6 pages

“Executive Compensation – Compensation Discussion and Analysis – Elements of Our Compensation Program” in the Company’s definitive proxy statement for its 2013 annual

meeting of stockholders, as filed with the Securities and Exchange Commission on October 15, 2013 (the “Proxy Statement”). Mr. Riggsbee will also receive the Company’s standard relocation package for executives and

reimbursement of specified travel expenses during the initial six months of his employment.

The foregoing description of the Offer Letter and Employment

Agreement does not purport to be complete and is qualified in its entirety by reference to such agreements, copies of which are filed as Exhibit 10.1 and Exhibit 10.2, respectively, to this Current Report on Form 8-K and are incorporated by

reference into this Item 5.02.

Mr. Riggsbee will also be recommended to the Compensation Committee to enter into the Company’s standard

Executive Retention Agreement for executive officers (the “Retention Agreement”). Under the terms of the Retention Agreement, if Mr. Riggsbee is terminated without “Cause” or he separates from the Company for “Good

Reason” within 24 months of a “Change in Control” (each as defined in the Retention Agreement), Mr. Riggsbee will receive: (i) all salary earned through the date of termination, as well as a pro rata bonus and any

compensation previously deferred; (ii) an amount equal to three times Mr. Riggsbee’s highest annual base salary and three times his highest annual bonus at the Company during the three-year period prior to the Change in Control;

(iii) continued benefits for 36 months after the date of termination; (iv) outplacement services in an aggregate amount of up to $25,000; and (v) a gross-up payment with respect to any excise taxes or penalties due on account of any

payments made to the executive under the Retention Agreement. In addition, upon the occurrence of a Change in Control, all of Mr. Riggsbee’s equity incentive compensation would become fully vested, whether or not he is terminated.

Additional information about the standard Retention Agreement is set forth under the heading “Executive Compensation – Potential Payments Upon Termination or Change-in-Control” in the Proxy Statement. A form of the Retention Agreement

and an amendment to the agreement were previously filed as Exhibit 10.1 and Exhibit 10.2, respectively, to the Company’s Quarterly Report on Form 10-Q for the period ending March 31, 2010, File No. 0-26642.

Mr. Riggsbee has no direct or indirect material interest in any transaction required to be disclosed pursuant to Item 404(a) of Regulation S-K.

Resignation Agreement with Mr. Evans

On

October 8, 2014, the Company also entered into a Resignation Agreement with Mr. Evans. Pursuant to the Resignation Agreement, Myriad will pay Mr. Evans $490,000, less all applicable taxes and withholding amounts and accelerate the

vesting of stock options that are due to vest on or before September 30, 2015 in order to (i) retain Mr. Evans as a non-employee consultant to provide certain consulting services to the Company through December 31, 2014, and

(ii) provide Mr. Evans a bonus payment for the accomplishment to-date of his FY 2015 management business objectives through the date of his retirement, as well as his contributions to the success of the Company during his 19 years of

service to Myriad. All of Mr. Evans’ restricted stock unit awards shall terminate effective upon his resignation. The Resignation Agreement also provides for the release of all claims by Mr. Evans against the Company, subject to

specific exceptions, and the release of all claims by the Company against Mr. Evans.

Page 3 of 6 pages

The foregoing description of the Resignation Agreement does not purport to be complete and is qualified in its

entirety by reference to such agreement, a copy of which is filed as Exhibit 10.3 to this Current Report on Form 8-K and is incorporated by reference into this Item 5.02.

(d) Not applicable.

(e) The disclosure provided under

Item 5.02(c) above is incorporated herein by reference.

(f) Not applicable.

| ITEM 9.01 |

Financial Statements and Exhibits. |

(d)

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 10.1 |

|

Offer Letter between Myriad Genetics, Inc. and R. Bryan Riggsbee dated October 7, 2014. |

|

|

| 10.2 |

|

Employment Agreement between Myriad Genetics, Inc. and R. Bryan Riggsbee dated October 8, 2014. |

|

|

| 10.3 |

|

Resignation Agreement between Myriad Genetics, Inc. and James S. Evans dated October 8, 2014. |

Page 4 of 6 pages

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

MYRIAD GENETICS, INC. |

|

|

|

|

| Date: October 9, 2014 |

|

|

|

By: |

|

/s/ Peter D. Meldrum |

|

|

|

|

|

|

Peter D. Meldrum |

|

|

|

|

|

|

President and Chief Executive Officer |

Page 5 of 6 pages

EXHIBIT INDEX

|

|

|

| Exhibit

Number |

|

Description |

|

|

| 10.1 |

|

Offer Letter between Myriad Genetics, Inc. and R. Bryan Riggsbee dated October 7, 2014. |

|

|

| 10.2 |

|

Employment Agreement between Myriad Genetics, Inc. and R. Bryan Riggsbee dated October 8, 2014. |

|

|

| 10.3 |

|

Resignation Agreement between Myriad Genetics, Inc. and James S. Evans dated October 8, 2014. |

Page 6 of 6 pages

Exhibit 10.1

Myriad Genetics, Inc. 320 Wakara Way | Salt Lake City | Utah | 84108 | www.myriad.com | Tel.

801-584-3600 | Fax. 801-584-3741 | Email tjacobse@myriad.com

October 6, 2014

Bryan Riggsbee

605 Rockford Road

Greensboro, NC 27408

Reference: Employment

Information & Materials

Dear Bryan,

Myriad Genetics (the “Company”) is delighted to offer you the position of Executive Vice President, Chief Financial Officer,

reporting to Peter Meldrum, President & Chief Executive Officer. We sincerely hope our relationship will be mutually rewarding. To ensure we have communicated clearly the full terms of our employment offer, we ask that you

carefully consider the following information:

Your first day of employment will be targeted for 10/16/2014, and you will be paid at an annual rate

of $375,000.00, in bi-monthly installments of $15,625.00 (gross).

Upon your employment with Myriad, you will be nominated for 30,000

shares of Restricted Stock Units (full value shares), subject to a four-year vesting schedule, and approval by the Myriad Board of Directors. You will be nominated for an additional grant of 50,000 Restricted Stock Units during the September

2015 grant cycle, also subject to a four-year vesting schedule, upon approval by the Myriad Board of Directors.

Also included in this offer is an annual

bonus target of 50% which will be based on MBOs determined by you and your manager. To assist in your transition we will be offering you a one-time sign on bonus of $10,000.00 (less applicable withholding), normally paid with first

available paycheck.

As a key member of the executive management team, you will be eligible to participate in Myriad’s Long-Term Cash Incentive

Program beginning in July, 2015. This program is focused on a three-year performance period and is in addition to your annual performance bonus. You will be eligible to receive a long-term cash bonus of 15% of your annual base salary if

Myriad achieves its target performance goals payable in FY2018. You will receive more details on this program within 30 days of your hire date.

We

recognize in your new position you may have concerns if an acquisition or merger were to occur during your employment with Myriad and there was a change of control in the ownership of the Company. As an officer of the Company, Pete Meldrum will

strongly recommend to the Board of Directors that you receive an Executive Retention Agreement. Once this has been approved by the Board of Directors, you will receive a separate agreement that will determine the terms and conditions of the

Executive Retention Agreement.

As agreed, you are eligible for 25 days of paid time off (PTO) upon hire. Your PTO will

initially be based off of your start date, and subsequently your calendar year anniversary. Regular full-time employees are eligible to accrue personal leave during each pay period, and you will be granted an initial forty hours upfront upon

hire. You will be eligible for a higher PTO amount upon completion of five years of service, and your PTO bank is intended for all personal paid time off, including both vacation and sick time.

As a regular, full-time Myriad employee you will be eligible to participate in the following benefit programs:

| |

• |

|

Comprehensive medical, dental and vision insurance |

| |

• |

|

Life/AD&D and long term disability insurance |

| |

• |

|

Section 125 cafeteria plan (flexible spending accounts) |

| |

• |

|

Health Savings Accounts |

| |

• |

|

401k retirement plan w/ company match |

| |

• |

|

Employee Stock Purchase Plan (ESPP) |

The Company will provide a full executive level relocation package

including relocation of household goods, transportation, and a house hunting trip for you and your spouse. All travel, temporary housing, and moving expenses must be conducted through the providers designated by Myriad Genetics. You will be

receiving more detailed information regarding this relocation package in a subsequent e-mail.

Myriad will share the travel expenses for a 6 month interim

period travelling between Greensboro NC and Salt Lake City, Utah, which will include 3 months of temporary housing plus travel costs of one trip per month. Travel reservations must use the travel desk when making plane reservations, and reserving

rental cars and hotels. Please call the travel desk at 1-801-584-1160, or email them at travel@myriad.com.

Please note: If you voluntarily

terminate your employment with Myriad within 12 months from your hire date, you will be required to reimburse the Company 100% of the expenses incurred by you or on your behalf related to your relocation. Additionally, if you

voluntarily terminate your employment with Myriad between 12 - 24 months from your hire date, you will be required to reimburse the Company 50% of the expenses incurred by you or on your behalf related to your

relocation.

As a condition of this offer of employment with the Company, you agree to execute the enclosed Employment Agreement. You also

agree to abide by the Company’s policies and practices. Furthermore, you acknowledge that your employment is not for a stated period of time, nor is any material which you received from the Company to be construed as a contract of

employment. You also acknowledge that your employment may be terminated by you or by the Company at any time with or without cause.

By accepting

this offer, you represent that you are not a party to any employment agreements that could interfere with your employment with the Company, and you also represent that it is not necessary or inevitable that you utilize or disclose any trade secrets

or confidential information of your past employers while performing your duties with the Company. You are also required to agree with restrictive covenants including those restricting your abilities to compete with the Company in certain ways,

and this offer is conditional upon your ability to perform the physical requirements of the job.

To accept this offer, sign (see signature page) and

return a copy of the offer letter within 7 business days along with the signed Employment Agreement. Please also review the New Employee Data Checklist included with this letter which further instructs you regarding new hire employment material

and information. This will confirm your acceptance of our employment offer. These can be returned to me via scan and e-mail or by fax at 801-584-3741.

This offer letter and the ancillary employment agreement enclosed herewith states our entire agreement with

regard to your potential employment with Myriad and replaces any prior written or oral statements or understandings between you and Myriad. The terms of this offer may not be modified except in writing and mutually agreed upon by you and

Myriad.

We look forward to welcoming you to Myriad. Please accept my best wishes for success. Myriad is committed to maintaining its leadership

position in the gene discovery field and to the commercialization of diagnostic and therapeutic products for major human diseases. Our success depends upon bright, dedicated staff such as you. We are pleased to welcome you, and we are

confident that you will find Myriad to have the stimulating and rewarding environment that you seek.

I appreciate your attention to these important

matters. If you have questions, please contact Jayne Hart at 801.584.3534.

Sincerely,

Myriad Genetics, Inc.

Jayne Hart

EVP Human Resources

I hereby acknowledge receipt and review of

the enclosed documents and hereby agree to the terms and conditions by signing below.

|

| /s/ Bryan Riggsbee |

| Signature (Bryan Riggsbee) |

|

| 10/7/14 |

| Date |

Enclosures

Exhibit 10.2

Version: November 2013

MYRIAD

GENETICS, INC.

EMPLOYMENT AGREEMENT

THIS AGREEMENT is made and entered into by and between Myriad Genetics, Inc. (hereinafter referred to as the “Company”), and

Bryan Riggsbee (hereinafter referred to as “Employee”).

In consideration of the undersigned’s employment,

compensation, and other valuable consideration and mutual covenants contained herein, the parties agree as follows:

1. At Will

Employment. The Company employs Employee on an at-will basis, which means that either Employee or the Company can terminate the employment relationship at any time for any reason, with or without notice or cause. Employee’s employment with

the Company is not for any particular period of time. No manager or supervisor of the Company has authority to modify or alter the Company’s at-will employment relationship with Employee, and any statements or promises contrary to at-will

employment may not be relied upon by Employee. Employee’s at-will employment with the Company may not be modified or changed in any way, except through a new written employment agreement signed by the President and CEO of the Company and

Employee.

2. Compensation. In consideration for the obligations entered into by Employee, the Company initially shall pay Employee

in full for Employee’s services hereunder at the rate of $ 375,000.00 per year, commencing on the October day of 16, 2014.

3.

Duties. Employee shall at all times faithfully, industriously, and to the best of his/her ability, experience, and talents, perform all of the duties that may be required of him/her pursuant to the express and implicit terms hereof, to the

reasonable satisfaction of the Company. Without the Company’s expressed written approval, signed by an officer of the Company, Employee shall not, directly or indirectly, in any manner or in any capacity, engage in an outside business endeavor

of any kind which: (a) is in the fields of pharmaceutical, biotechnology, or genetic products, services, or research, or would be in competition with the existing or foreseeable future business operations of the Company; or (b) requires a

level of time and attention so as to not enable the Employee to fully perform his/her duties in the manner as agreed to herein.

4.

Intellectual Property and Rights of Publicity. Employee hereby agrees and acknowledges that any and all inventions, discoveries, know-how, improvements, trademarks, trade secrets, and works of authorship and any copyright therein (whether or

not created in the normal course of Employee’s duties), which Employee may conceive, reduce to practice, create, author, make, invent, or develop during his or her employment by Company, relating to any matter or thing, that may be connected in

any way with Employee’s work or related in any way to Company’s business or Company’s foreseeable future business, whether or not resulting from work performed during normal working hours (all “Intellectual Property”), shall

be the absolute property of Company. All Intellectual Property are WORKS-FOR-HIRE. Employee hereby assigns and agrees to assign to Company all of Employee’s right, title and interest in and to Intellectual Property

as well as any patent applications filed or patents granted thereon, copyright or trademark applications or any registrations granted thereon, and any reexamination, reissue and extension

thereof, including but not limited to the right to claim the benefit of priority to any patent application filed in Employee’s name disclosing and/or claiming such Inventions. Employee agrees to execute such further documents and to do such

further acts as may be reasonably necessary to perfect, register or enforce Company’s ownership of any Intellectual Property. Employee hereby appoints Company as Employee’s attorney-in-fact (this appointment being irrevocable and coupled

with an interest) to execute such documents on Employee’s behalf.

Without any royalties or compensation beyond that expressly

provided for in this Agreement, Employee further specifically waives any and all claims and assigns to Company any and all rights Employee may have in any creative work produced by the company during Employee’s employment that specifically

relates to Employee’s employment with or at the Company, or the business or business operations of the Company, in any media format, including but not limited to any audio or video recording and any written transcript of such recording,

including but not limited to any rights Employee may have in Employee’s image, Employee’s likeness, the sound of Employee’s voice, as well as any underlying subject matter (all collectively “Materials”). Employee agrees that

these Materials may be edited, copied, exhibited, published or distributed and Employee hereby waives any right to inspect or approve the finished product. Employee agrees that Company may use or display the Materials in any geographical location

for any purpose, including but not limited to electronic display, including but not limited to via the Internet, conference presentations, educational presentations or courses, informational presentations, on-line presentations, educational videos,

and commercial and promotional activities relating to Company’s products and services.

5. Nondisclosure and Nonuse of

Information. Employee agrees that during his/her employment and thereafter, he/she will not use or disclose to any person, agency, company, business, or organization, unless authorized by the Company, any confidential or proprietary information

concerning the Company, including but not limited to any inventions, discoveries, know-how, improvements, processes, products, services, proposals, solicitations, negotiations, customers, manner and method of operations, trade secrets, business

plans, financial information, salary information of other Myriad employees and the like. Employee understands that confidential information may be submitted to Employee by other persons or businesses and agrees to treat that confidential information

with the same degree of care afforded to confidential information proprietary to the Company.

6. Noncompetition Agreement.

Employee agrees that during the term of his/her employment, and for a period of one (1) year following the voluntary or involuntary termination of employment, Employee will not compete with the Company in any substantive matter or area of the

Employee’s work responsibilities while at the Company. Employee agrees that he/she will not use the Company’s name, facilities, confidential material, trade secrets, know-how, or privileged information to solicit from any agency, company,

business, or organization, work that would result in income or compensation of any form to Employee or another company or business organization.

7. Nonsolicitation Agreement

a. Nonsolicitation of Customers. During the period of Employee’s employment, and for a period of one (1) year following the

voluntary or involuntary termination of employment with the Company, Employee will not solicit the business being provided by the Company to any customer of the Company or any business of any customer of the Company for use in any activities in

competition with activities of the Company of which Employee acquired knowledge and/or with whom Employee had contact during his/her period of employment relationship with the Company.

b. Nonsolicitation of Employees. During the period of Employee’s employment, and for a period of one (1) year following the

voluntary or involuntary termination of employment with the Company, Employee agrees not to recruit or solicit any employees (including consultants and independent contractors) of the Company to work for Employee or any other person or company.

As used above in Sections 7a and 7b, the terms recruit and solicit include, but are not limited to, providing names of employees of the

Company, information about employees of the Company, providing Company’s proprietary information to another individual, or entity, and allowing the use of Employee’s name by any company (or any employees of any other company) other than

the Company, in the solicitation of the business of Company’s customers.

8. Right to Deduct From Pay. Employee agrees to

reimburse and pay the Company for all amounts due and owing the Company by Employee arising from or related to Employee’s employment with the Company, including Employee’s termination of employment (hereinafter referred to as the

“Reimbursement Amount”). The Company may deduct all or any portion of the Reimbursement Amount from one or more of Employee’s paychecks or other payments to Employee, including any final paycheck due and owing Employee upon

Employee’s termination of employment with Company. By way of illustration and not limitation, Reimbursement Amounts shall include any amounts paid by the Company, either to a third party on behalf of Employee or to Employee by way of

reimbursement, for moving, relocation, temporary housing and/or other related expenses where the Employee’s employment with the Company is terminated voluntarily or involuntarily for cause within 12 months of Employee’s first day of work.

Reimbursement Amounts may also include the cost of any equipment, including computers, mobile telephones, or other property of the Company, which is not returned to the Company upon the termination of Employee’s employment with the Company.

Finally, the Reimbursement Amount may also include any amounts which were improperly submitted to, and reimbursed by, the Company.

9.

GOVERNING LAW AND FORUM. THE PARTIES HERETO AGREE THAT THE TERMS OF THIS AGREEMENT SHALL BE GOVERNED BY AND CONSTRUED IN ACCORDANCE WITH THE LAWS OF THE STATE OF UTAH WITHOUT GIVING EFFECT TO CONFLICTS OF LAW PRINCIPLES. ANY LITIGATION

BETWEEN THE PARTIES CONCERNING THIS AGREEMENT, OR ANY CLAIM OR LAWSUIT RELATING TO EMPLOYEE’S EMPLOYMENT WITH THE COMPANY, INCLUDING TERMINATION, MUST BE FILED NO MORE THAN SIX (6) MONTHS AFTER THE DATE OF THE EMPLOYMENT ACTION THAT IS THE

SUBJECT OF THE CLAIM OR LAWSUIT, AND EMPLOYEE WAIVES ANY STATUTE OF LIMITATIONS TO THE

CONTRARY AND ANY RIGHT TO A JURY TRIAL. ANY SUCH LITIGATION, CLAIM OR LAWSUIT SHALL ONLY BE FILED IN A STATE OR FEDERAL COURT IN AND FOR SALT LAKE COUNTY IN THE STATE OF UTAH.

10. Severability. If any provisions hereof should be held invalid, illegal, or unenforceable in any respect in any jurisdiction, then,

to the fullest extent permitted by law, all other provisions hereof shall remain in full force and effect in such jurisdiction and shall be liberally construed in order to carry out the intentions of the parties hereto as nearly as may be possible.

To the extent permitted by applicable law, the parties hereto hereby waive any provision of law that would render any provisions hereof prohibited or unenforceable in any respect.

11. Entire Agreement. This Agreement supercedes any prior agreement or understandings between Employee and Company with respect to

employment, noncompetition, nonsolicitation and nondisclosure, and constitutes the entire agreement between Employee and Company. No modification or amendment of this Agreement shall be effective unless made in writing and signed by Employee and

Company.

12. Representations and Warranties. Employee represents and warrants to the Company that:

| |

a. |

All prior confidentiality and non-compete agreements with former employers have been disclosed to the Company. |

| |

b. |

All proprietary or confidential materials that are the property of a former employer have been returned to such former employer. |

| |

c. |

Employment with the Company will not violate any prior confidentiality or non-compete agreements and will not result in misappropriation of another company’s trade secrets. |

13. Non-Violation of Prior Agreements. Employee acknowledges that any misuse of a prior employer’s confidential information or

trade secrets or any intellectual property which is proprietary to any other person or business or violation of a prior non-compete agreement, are not authorized by Company and are outside the scope of Employee’s job responsibilities at the

Company.

14. Damages and Injunctive Relief. Employee acknowledges and agrees that any violation of the terms of this Agreement

will result in serious and irreparable damage to Company, and agrees that Company will be entitled to seek appropriate remedies for those damages, including, without limitation, injunctive relief to enforce any provision of this Agreement.

15. Attorneys’ Fees. In the event of any litigation between the parties relating to this Agreement or its subject matter,

including Employee’s employment with the Company, or Employee’s termination of employment, the prevailing party shall be entitled to receive from the nonprevailing party any and all reasonable costs, including attorneys’ fees,

incurred by the prevailing party in connection with such litigation.

16. EMPLOYEE ACKNOWLEDGMENT. EMPLOYEE ACKNOWLEDGES THAT HE/SHE HAS CAREFULLY READ AND

UNDERSTANDS ALL OF THE PROVISIONS OF THIS AGREEMENT AND IS SIGNING IT VOLUNTARILY AND WITHOUT COERCION. EMPLOYEE FURTHER ACKNOWLEDGES THAT HE/SHE HAS BEEN GIVEN THE OPPORTUNITY TO CONSULT WITH AN ATTORNEY OR ADVISOR AND THAT ENTERING THIS AGREEMENT

IS A CONSCIOUS DECISION WITH FULL APPRECIATION OF ITS CONSEQUENCES.

[SIGNATURES ON FOLLOWING PAGE]

IN WITNESS WHEREOF, the parties hereto have executed this Agreement on this 8th day of October, 2014.

|

|

|

| EMPLOYEE: |

|

|

| Print Name: |

|

Bryan Riggsbee |

|

|

| Signature: |

|

/s/ Bryan Riggsbee |

|

|

|

|

|

| Position: |

|

Executive Vice President – Chief Financial Officer & Treasurer |

|

| COMPANY: |

|

|

| Print Name: |

|

Jayne Hart |

|

|

| Signature: |

|

|

|

|

|

|

|

| Position: |

|

Executive VP, Human Resources, Myriad Genetics, Inc. |

Exhibit 10.3

RESIGNATION AGREEMENT

This Resignation Agreement (“Agreement”) is entered into by and between Myriad Genetics, Inc., a Delaware corporation, with its

principal office at 320 Wakara Way, Salt Lake City, Utah 84108 (hereinafter referred to as “Myriad” or the “Company”) and James S. Evans (hereinafter referred to as “Evans”).

RECITALS

A. Evans has

been employed by Myriad since March 1, 1995, currently holds the job title of Chief Financial Officer and Treasurer, and is resigning from such offices.

B. In order to facilitate a smooth transition for the new Chief Financial Officer and Treasurer, Myriad desires to retain Evans as a

non-employee consultant to provide certain consulting services, and Evans is willing to provide certain consulting services to the Company.

C. Myriad desires to provide Evans a bonus payment for the accomplishment to-date of his fiscal year 2015 MBOs and for his accomplishments and

contributions to the success of the Company from his 19 years of service to Myriad.

D. Evans and Myriad desire to resolve any and all

disputes that may exist, whether know or unknown, between them, including, but not limited to, disputes relating to Evans’s employment with Myriad and the termination of that employment relationship.

E. Myriad is willing to provide the consideration provided for herein to Evans in return for the commitments, releases and agreements set

forth herein.

AGREEMENT

NOW, THEREFORE, in consideration of the mutual promises, covenants and agreements set forth herein, the parties mutually agree as follows:

1. Effective Date. This Agreement is effective on the eighth day following Evans’s signing this Agreement, provided that

Evans does not revoke his execution of this Agreement as provided in Paragraph 22 below.

2. Resignation. Evans resigns his

position with Myriad as CFO effective October 16, 2014, and resigns his employment with Myriad effective October 31, 2014.

3.

Benefits. In reliance on the releases and agreements set forth herein and following the expiration of the revocation period described in Paragraph 22 below and the unrevoked signing of this Agreement by Evans, Myriad shall provide the

following benefits to Evans:

| |

a. |

Position: Evans will hold the title “Chief Financial Officer” and “Treasurer” until October 16, 2014; all responsibilities with the Company will cease on October 31, 21014. Evans may

not represent to third parties that he is an employee of Myriad after October 31, 2014. |

b. Payment: Myriad will pay Evans the sum of $490,000, subject to all applicable taxes.

Myriad will pay Evans a lump sum of $490,000, less applicable withholding amounts, immediately following the completion of the 7 day Revocation period, or on October 31, 2014, whichever date is later.

c. Stock Options: All unvested stock options issued and outstanding to Evans which would otherwise vest on or before September 30,

2015, shall vest as of October 31, 2014, and shall be exercisable in accordance with the terms of the respective underlying stock option grant.

d. Restricted Stock Unit Award. All restricted stock unit awards made to Evans shall terminate effective upon the resignation of Evans.

4. Consulting Services. As partial consideration of the amounts paid to Evans hereunder, Evans agrees to provide up to 100 hours

of consulting services to Myriad through December 31, 2014.

5. Receipt of this Agreement. Evans understands and acknowledges

that on October 8, 2014, he received a copy of this Agreement, and that he has 21 days from receipt of this Agreement in which to consider and consult with an attorney regarding this Agreement. Evans acknowledges that he has an adequate amount of

time in which to consult with any person of his choice with respect to the contents of this Agreement prior to signing.

|

|

|

| /s/ James S. Evans |

|

October 8, 2014 |

|

|

| James S. Evans |

|

Date |

6. Release of Claims by Evans. Evans, for himself and for all persons claiming by, thorough, or under

his, hereby completely and unconditionally releases and discharges Myriad and each of Myriad’s parents, subsidiaries, affiliates, successors, assigns, agents, directors, officers, employees, representatives, attorneys and all persons acting by,

through, under or in concert with any of them (hereinafter collectively referred to as “Releasees”) from any and all claims, demands, charges, grievances, damages, debts, liabilities, accounts, costs, attorney’s fees, expenses, liens

and causes of action of every kind and nature whatsoever (hereinafter collectively referred to as “Claims”). The Claims from which Evans is releasing Releasees herein include without limitation, breach of implied or express contract,

breach of implied covenant of good faith and fair dealing, libel, slander, misrepresentation, fraud, wrongful discharge, discrimination claims under the Age Discrimination in Employment Act, the Older Workers Benefit Protection Act, Title VII of the

Civil Rights Act of 1964, the Utah Antidiscrimination Act, and any other laws prohibiting age, race, religion, sex, national origin, disability and other forms of discrimination, and any tort or other claim arising in any way out of the employment

relationship or termination of that relationship between Myriad and Evans whether now known or unknown, suspected or unsuspected, accrued or unaccrued. Evans specifically waives any and all claims for back pay, front pay, or any other form of

compensation for services, except as set forth herein. This release and waiver of claims by Evans releases and waives all claims against Myriad which may accrue as of the date of this Agreement.

Evans hereby waives any right to recover damages, costs, attorneys’ fees, and any other

relief in any proceeding or action brought against Myriad by any other party, including without limitation the Equal Employment Opportunity Commission and the Utah Antidiscrimination and Labor Division, on Evans’s behalf asserting any claim,

charge, demand, grievance, or cause of action released by Evans as stated above.

Notwithstanding the foregoing, Evans does not waive

rights, if any; Evans may have to unemployment insurance benefits or workers’ compensation benefits. Myriad agrees that if Evans is unable to find employment before his severance runs out and he applies for unemployment benefits, Myriad will

not oppose that application. Nothing in this paragraph prohibits Evans from paying COBRA premiums to maintain Evans’s participation, if any, in Myriad’s group health plan to the extent allowed by the terms, conditions, and limitations of

the health plan.

In addition, notwithstanding this release language, Evans is not waiving any rights and interests he has in the Myriad 401(k) retirement

plan, and Evans’s individual account balance in such plan is and remains fully vested in Evans. Evans will be sent the necessary paperwork to allow his to withdraw his money from those retirement accounts.

7. Release of Claims by Myriad. Myriad, for itself, its heirs, assigns and representatives, hereby releases and waives all claims it

has or may have, whether known, unknown, actual, potential or contingent, against Evans, including any of his agents and representatives, in any way arising out of or relating to Evans’s employment with Myriad and/or the termination of

Evans’s employment with Myriad. This release and waiver of claims by Myriad covers, but is not limited to, all claims for misrepresentation, fraud, breach of implied or express contract, breach of implied covenant of good faith and fair

dealing, defamation, and interference with economic relations. This release and waiver of claims by Myriad releases and waives all claims against Evans which may accrue as of the date of this Agreement.

8. Amendment. This Agreement may not be supplemented, amended, or modified except through a new written agreement signed by both

parties.

9. No Assignment of Claims. Evans represents and warrants that he has not previously assigned or transferred, or

attempted to assign or transfer, to any third party, any of the Claims waived and released herein.

10. No Claim Filed. Evans

represents that he has not filed any claim, complaint, charge or lawsuit against Myriad or any other Releasee with any governmental agency or any state or federal court, and covenants not to file any lawsuit at any time hereafter for any matter,

claim or incident known or unknown which occurred or arose out of occurrences prior to the date hereof.

11. Additional

Consideration. Evans agrees and acknowledges that the payment and benefits provided pursuant to this Agreement are in addition to any payments or benefits to which Evans would be entitled without signing this Agreement.

12. Confidential Information. As a further material inducement to Myriad to enter into

this Agreement, Evans agrees that he will not divulge the following information or types of information to anyone without the prior written consent of Myriad which will not be unreasonably withheld: trade secrets, salaries, financial information,

franchise information, marketing information, pricing, products, product lists, product information, sales information, personal employee information, or any other information of a similar confidential, sensitive or competitive nature. Evans

acknowledges that he has previously signed a confidentiality agreement with Myriad that remains in effect and under which he continues to be obliged to not disclose or make use of confidential or proprietary company information.

13. Company Properly. Evans hereby represents and warrants that he has returned to Myriad all documents, property and records owned by,

belonging to or created by Myriad or other Releasees, including, but not limited to all copies thereof (hereinafter referred to as “Properties”), except as permitted by Myriad, For the purposes of this Agreement, “Properties”

includes but is not limited to keys, small wares, complete and partial documents, correspondence, reports, memoranda, laboratory records of any kind, notes, software, computer disks, manuals, computerized information and reports.

14. Evans Personal Property. Myriad hereby represents and warrants that it will return to Evans all documents, property and records

owned by, belonging to or created by Evans prior to his employment at Myriad. “Properties” include but are not limited to personal effects currently stored in his former office, complete and partial documents, correspondence, reports,

memoranda, laboratory records of any kind, notes, software, computer disks, manuals, computerized information and reports, except to the extent that any of the foregoing constitutes property of Myriad. Evans will not be prevented from creating

electronic copies of all personal computer files that are stored on his former computer at Myriad.

15. Nondisparagement. Evans

agrees not to damage, disparage or criticize, orally or in writing, Myriad, its officers, executives, management or operations to any third person or entity. Myriad agrees, through its executives and officers, not to damage, disparage or criticize

Evans to any third person or entity.

16. Entire Agreement. This Agreement contains the entire agreement and understanding of

Myriad and Evans concerning the subject matter hereof and this Agreement supersedes and replaces all prior negotiations, proposed agreements, agreements or representations whether written or oral. Myriad and Evans agree and acknowledge that neither

Myriad nor Evans, including any agent or attorney of either, has made any representation, guarantee or promise whatsoever not contained in this Agreement to induce the other to execute this Agreement, and neither party is relying on any

representations, guarantee, or promise not contained in this Agreement in entering into this Agreement.

17. Governing Law. This

Agreement shall be governed by and construed in accordance with the laws of the State of Utah, without giving effect to Utah’s choice of law rules.

18. Submission to Jurisdiction. Evans and Myriad each submits to the jurisdiction of any state or federal court sitting in the State of

Utah in any action or proceeding arising out of or

relating to this Agreement, and each party agrees that all claims of whatever type relating to or arising out of this Agreement may be heard and determined only in a state or federal court

sitting in the State of Utah. Evans and Myriad each waives any defense of inconvenient forum to the maintenance of any action or proceeding so brought, and waives any bond, surety, or other security that might be required of any other party with

respect thereto. Evans and Myriad each agrees that if any action or proceeding relating to or arising out of this Agreement is brought in any other court or forum other than a state or federal court sitting in the State of Utah, the action or

proceeding shall be dismissed with prejudice and the party bringing the action or proceeding shall pay the other party’s legal fees and costs.

19. Consultation with Attorney. Evans understands and acknowledges that Myriad has advised Evans to consult with an attorney of

Evans’s choice prior to signing this Agreement.

20. Voluntary and Knowing Signing. Evans acknowledges that he has read this

Agreement carefully and fully understands this Agreement. Evans acknowledges that he executes this Agreement voluntarily and of his own free will, and that he is knowingly and voluntarily releasing and waiving all Claims he may have against

Releasees, including Myriad.

21. Breach of Agreement. Breach of any terms of this agreement by Evans including any obligation of

nondisparagement, failure of any representation or warranty, and any obligation not to divulge confidential information, shall be grounds for termination of any or all of the separation benefits, including vested stock options.

22. Revocation Period. Evans has seven (7) days from the date on which he signs this Agreement to revoke this Agreement by

providing written notice of his revocation to:

Jayne Hart

Executive Vice President of Human Resources

Myriad Genetics, Inc.

320 Wakara

Way

Salt Lake City, Utah 84108

Evans’s revocation, to be effective, must be received by the above-named person by the end of the seventh day after Evans signs this Agreement. This

Agreement becomes effective on the eighth day after Evans signs this Agreement, providing that Evans has not revoked this Agreement as provided above.

23. Indemnification. Nothing herein shall be construed to diminish any rights of Evans, or obligations of Myriad, to indemnify Evans to

the extent provided for under the By-Laws of the Company and Delaware General Corporation Law as a result of any claim arising from or relating to the fact that Evans was an officer of Myriad.

IN WITNESS WHEREOF, the parties have executed this Agreement on the dates indicated to be effective for all

purposes as of the Effective Date indicated above.

|

|

|

|

|

|

|

| MYRIAD GENETICS, INC. |

|

|

|

JAMES S. EVANS |

|

|

|

|

| By: |

|

/s/ Jayne Hart |

|

|

|

/s/ JAMES S. EVANS |

| Its: |

|

EVP, Human Resources |

|

|

|

|

|

|

|

|

| Date: |

|

October 8, 2014 |

|

|

|

Date: October 8, 2014 |

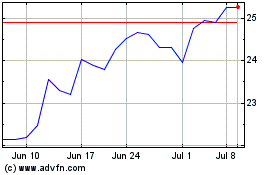

Myriad Genetics (NASDAQ:MYGN)

Historical Stock Chart

From Aug 2024 to Sep 2024

Myriad Genetics (NASDAQ:MYGN)

Historical Stock Chart

From Sep 2023 to Sep 2024