UPDATE: SEC Seeks Greater Penalties In Fraud Cases

November 29 2011 - 1:31PM

Dow Jones News

WASHINGTON (Dow Jones)--The Securities and Exchange Commission

is asking lawmakers for authority to impose greater financial

penalties on individuals and Wall Street firms that commit fraud

following a federal judge's ruling questioning the adequacy of a

proposed $285 million SEC settlement with Citigroup Inc. (C)

In a letter to key senators late Monday, SEC Chairman Mary

Schapiro said the agency is constrained by statute from imposing

financial penalties that match investor losses. She also warned the

agency can't adequately take into account the seriousness of

misconduct nor its impact on victims.

Schapiro's letter asks Sens. Jack Reed (D., R.I.) and Mike Crapo

(R., Idaho), to increase the legal formulas by which the agency

calculates financial penalties. The senators hosted a hearing this

month on the issue of SEC structural reforms.

For civil cases such as the Citi matter, Schapiro is asking for

authority to seek penalties equal to three times the "pecuniary

gain," or a firm's net profits, from a fraudulent transaction. The

SEC is currently limited to seeking penalties equal to a firm's net

profits in such deals.

"That would allow the commission to address situations where the

actual pecuniary gain to the violator is relatively small compared

to the nature or magnitude of the wrongdoing," Schapiro wrote.

Another proposed statutory change would allow the agency to

calculate penalties based on the amount of investor losses incurred

as a result of the misconduct, for both civil cases and

administrative proceedings.

A third change, which would also be used in civil cases and

administrative proceedings, would allow the agency to impose

penalties of up to $1 million per violation for individuals and $10

million for financial firms. That would represent an increase from

current caps of $150,000 and $725,000, respectively.

A spokesman said Reed is working on legislation "to improve the

SEC's ability to obtain meaningful monetary sanctions for serious

securities fraud violations."

The legislation also would seek to improve the SEC's ability to

sanction companies and individuals with a pattern of repeated

violations of the federal securities laws, another focus of

Schapiro's letter. Schapiro said current law "does not provide the

commission with adequate tools to deter this category of

violators."

The letter came the same day as U.S. District Judge Jed S.

Rakoff rejected a $285 million deal by Citi to settle civil fraud

charges that it failed to disclose to investors its role in

selecting investments in a $1 billion mortgage-bond deal that it

was simultaneously betting would fail.

Rakoff ordered the matter to go to trial next summer, saying the

settlement was "neither fair, nor reasonable, nor adequate, nor in

the public interest."

-By Andrew Ackerman, Dow Jones Newswires; 202-569-8390;

andrew.ackerman@dowjones.com

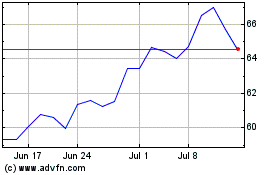

Citigroup (NYSE:C)

Historical Stock Chart

From Apr 2024 to May 2024

Citigroup (NYSE:C)

Historical Stock Chart

From May 2023 to May 2024