Northern Technologies International Corporation (Nasdaq:NTIC) today

reported its financial results for the three and nine months ended

May 31, 2010.

Net income was $1,734,314, or $0.41 per diluted common share,

for the nine months ended May 31, 2010 compared to a net loss of

$(2,139,484), or $(0.57) per diluted common share, for the nine

months ended May 31, 2009. Net income was $951,698, or $0.22 per

diluted common share, for the three months ended May 31, 2010

compared to a net loss of $(638,679), or $(0.17) per diluted common

share, for the three months ended May 31, 2009. This return to

profitability is primarily attributed to significant increases in

NTIC's North American sales as well as significant increases in

income from NTIC's international joint

ventures.

NTIC's consolidated net sales increased 93.4% and 32.1% during

the three and nine months ended May 31, 2010 compared to the three

and nine months ended May 31, 2009, respectively. These

increases were primarily a result of increased sales of ZERUST®

rust and corrosion inhibiting packaging products and services to

customers in North America and sales to NTIC's joint

ventures.

During the nine months ended May 31, 2010, 96.1% of NTIC's

consolidated net sales were derived from sales of ZERUST® products

and services, which increased 37.8% to $8,485,046 during the nine

months ended May 31, 2010 compared to $6,159,096 during the nine

months ended May 31, 2009 due to increased demand primarily due to

an economic recovery of the domestic manufacturing sector. NTIC

experienced a significant increase in sales orders from existing

customers during the second and third quarters of fiscal 2010

compared to the same periods in fiscal 2009. NTIC has focused

its sales efforts of ZERUST® products and services by strategically

targeting customers with specific corrosion issues in new market

areas, including oil and gas industry and other industrial sectors

that offer sizable growth opportunities.

During the nine months ended May 31, 2010, $340,032, or 3.9%, of

NTIC's consolidated net sales were derived from sales of Natur-Tec®

products. Net sales of Natur-Tec® products increased 1077.3%

and decreased 31.9% during the three and nine months ended May 31,

2010 compared to the three and nine months ended May 31, 2009,

respectively. The increase in the three-month comparison was

primarily due to the addition of new Natur-Tec® distributors on the

West Coast of the United States and the decrease in the nine-month

comparison was due to several large stocking orders of Natur-Tec®

products that occurred early in 2009 that were not repeat

orders. NTIC is continuing to fortify and expand its West

Coast Natur-Tec® distribution network in California, while

expanding its industrial distribution reach to geographical

environmentally focused hotspots such as Oregon, Washington,

Minnesota and New England. Additionally, NTIC is targeting key

national and regional retailers utilizing independent sales

agents.

NTIC recognized a 24.7% increase in fee income for technical and

support services provided to joint ventures during the nine months

ended May 31, 2010. NTIC's equity in income of joint ventures

increased 346.9% to $2,909,120 during the nine months ended May 31,

2010 compared to $650,900 during the nine months ended May 31,

2009. Both of these increases were primarily a result of a

33.6% increase in total net sales of NTIC's joint ventures during

the nine months ended May 31, 2010 compared to the same prior year

period. The increase in total net sales of NTIC's joint

ventures was primarily a result of the economic recovery of the

international manufacturing sector that the NTIC joint venture

network serves.

NTIC's total operating expenses increased 38.0% during the three

months ended May 31, 2010 compared to the three months ended May

31, 2009 primarily as a result of increased sales efforts in both

the ZERUST® and the Natur-Tec® markets and increased general and

administrative costs due to increased employee count to

pre-recession levels.

NTIC's working capital was $5,536,087 at May 31, 2010, including

$1,103,620 in cash and cash equivalents.

G. Patrick Lynch, President and Chief Executive Officer of NTIC

said, "Both NTIC and many of our joint ventures experienced

significant sales increases in Q3 as compared to Q3 of last year

for the core business of ZERUST® corrosion inhibiting products.

Many of our international joint ventures reported their best sales

quarters ever which for NTIC results in fees for services and

equity income from joint ventures."

Lynch continued, "While still relatively small, we are also

starting to supply ZERUST® products and services to an increasing

number of companies in the oil & gas industry."

"Furthermore, market acceptance of our Natur-Tec® certified

fully compostable and biodegradable products continues to grow in

major U.S. regional "green" hotspots including Oregon, Washington,

Minnesota and New England as we have continued to make inroads with

key regional and national retailers," Lynch further

stated.

Financial Results

| NORTHERN TECHNOLOGIES

INTERNATIONAL CORPORATION AND SUBSIDIARIES |

| CONSOLIDATED STATEMENTS

OF OPERATIONS (UNAUDITED) |

| FOR THE THREE AND

NINE MONTHS ENDED MAY 31, 2010 AND 2009 |

| |

|

|

|

|

| |

Three Months

Ended |

Nine Months

Ended |

| |

May 31, 2010 |

May 31, 2009 |

May 31, 2010 |

May 31, 2009 |

| NORTH AMERICAN OPERATIONS: |

|

|

|

|

| Net sales, excluding joint

ventures |

$ 2,559,467 |

$1,555,065 |

$ 7,164,784 |

$ 5,855,536 |

| Net sales, to joint ventures |

677,731 |

118,569 |

1,660,294 |

823,212 |

| |

3,237,198 |

1,673,634 |

8,825,078 |

6,678,748 |

| Cost of goods sold |

2,172,902 |

995,672 |

5,771,045 |

4,444,075 |

| Gross profit |

1,064,296 |

677,962 |

3,054,033 |

2,234,673 |

| |

|

|

|

|

| JOINT VENTURE OPERATIONS: |

|

|

|

|

| Equity in income (loss) of joint

ventures |

1,511,534 |

(6,838) |

2,909,120 |

650,900 |

| Fees for services provided to joint

ventures |

1,140,295 |

821,810 |

3,441,563 |

2,760,379 |

| |

2,651,829 |

814,972 |

6,350,683 |

3,411,279 |

| |

|

|

|

|

| OPERATING EXPENSES: |

|

|

|

|

| Selling |

819,572 |

591,559 |

2,004,094 |

1,975,387 |

| General and administrative |

869,183 |

599,012 |

2,628,447 |

2,184,974 |

| Expenses incurred in support of

joint ventures |

208,444 |

224,887 |

682,828 |

1,152,654 |

| Research and development |

960,780 |

655,281 |

2,526,478 |

2,222,576 |

| Loss on impairment |

— |

— |

— |

554,000 |

| |

2,857,979 |

2,070,739 |

7,841,847 |

8,089,591 |

| |

|

|

|

|

| OPERATING INCOME (LOSS) |

858,146 |

(577,805) |

1,562,869 |

(2,443,639) |

| |

|

|

|

|

| INTEREST INCOME |

864 |

6,509 |

5,607 |

7,828 |

| INTEREST EXPENSE |

(23,867) |

(27,933) |

(73,637) |

(102,271) |

| OTHER INCOME |

6,825 |

4,550 |

20,475 |

18,200 |

| MINORITY INTEREST |

— |

— |

— |

3,398 |

| |

|

|

|

|

| INCOME (LOSS) BEFORE INCOME TAX EXPENSE |

841,968 |

(594,679) |

1,515,314 |

(2,516,484) |

| |

|

|

|

|

| INCOME TAX (BENEFIT) EXPENSE |

(110,000) |

44,000 |

(219,000) |

(377,000) |

| |

|

|

|

|

| NET INCOME (LOSS) |

$ 951,698 |

$ (638,679) |

$ 1,734,314 |

$ (2,139,484) |

| |

|

|

|

|

| NET INCOME (LOSS) PER COMMON SHARE: |

|

|

|

|

| Basic |

$ 0.23 |

$ (0.17) |

$ 0.41 |

$ (0.57) |

| Diluted |

$ 0.22 |

$ (0.17) |

$ 0.41 |

$ (0.57) |

| |

|

|

|

|

| WEIGHTED AVERAGE COMMON SHARES ASSUMED

OUTSTANDING: |

|

|

|

|

| Basic |

4,244,086 |

3,754,596 |

4,213,465 |

3,746,977 |

| Diluted |

4,299,855 |

3,754,596 |

4,252,735 |

3,746,977 |

About Northern Technologies International

Corporation

Northern Technologies International Corporation develops and

markets proprietary environmentally beneficial products and

technical services either directly or via a network of joint

ventures and independent distributors in over 55

countries. NTIC's primary business is corrosion prevention.

NTIC has been selling its proprietary ZERUST® rust and corrosion

inhibiting products and services to the automotive, electronics,

electrical, mechanical, military and retail consumer markets, for

over 35 years. NTIC also offers worldwide on-site technical

consulting for rust and corrosion issues. NTIC's technical

service consultants work directly with the end users of NTIC's

products to analyze their specific needs and develop systems to

meet their technical requirements. In addition, NTIC markets

proprietary bio-plastic technologies under the Natur-Tec®

brand. Finally, NTIC's Polymer Energy® joint venture

manufactures and sells advance waste plastic to fuel conversion

machines.

The Northern Technologies International Corporation logo is

available at

http://www.globenewswire.com/newsroom/prs/?pkgid=5481

Forward-Looking Statements

Statements contained in this press release that are not

historical information are forward-looking statements as defined

within the Private Securities Litigation Reform Act of 1995. Such

statements include our expectations regarding the future

performance of our new businesses and other statements that can be

identified by words such as "expect," "intend," "continue,"

"anticipate," "estimate," "potential," "will," "would," or words of

similar meaning and any other statements that are not historical

facts. Such forward-looking statements are based upon the current

beliefs and expectations of NTIC's management and are inherently

subject to risks and uncertainties that could cause actual results

to differ materially from those projected or implied. Such

potential risks and uncertainties include, but are not limited to,

in no particular order: NTIC's dependence on the success of its

joint ventures and technical fees and dividend distributions that

NTIC receives from them; NTIC's relationships with its joint

ventures and its ability to maintain those relationships; risks

associated with NTIC's international operations; exposure to

fluctuations in foreign currency exchange rates; the health of the

U.S. and worldwide economies, including in particular the U.S.

automotive industry; the level of growth in NTIC's markets; NTIC's

investments in research and development efforts; acceptance of

existing and new products; increased competition; the success of

NTIC's new businesses; the costs and effects of complying with

changes in tax, fiscal, government and other regulatory policies,

including rules relating to environmental, health and safety

matters, NTIC's reliance on its intellectual property rights and

the absence of infringement of the intellectual property rights of

others, the ability of NTIC's lender to declare outstanding

indebtedness immediately due and payable and current and potential

litigation. More detailed information on these and additional

factors which could affect NTIC's operating and financial results

is described in the company's filings with the Securities and

Exchange Commission, including its most recent annual report on

Form 10-K and subsequent quarterly reports on Form 10-Q. NTIC urges

all interested parties to read these reports to gain a better

understanding of the many business and other risks that the company

faces. Additionally, NTIC undertakes no obligation to publicly

release the results of any revisions to these forward-looking

statements, which may be made to reflect events or circumstances

occurring after the date hereof or to reflect the occurrence of

unanticipated events.

CONTACT: NTIC

Investor and Media Contacts:

Matthew Wolsfeld, CFO

(763) 225-6600

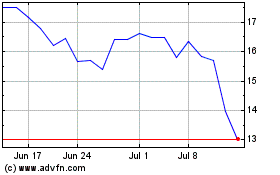

Northern Technologies (NASDAQ:NTIC)

Historical Stock Chart

From Apr 2024 to May 2024

Northern Technologies (NASDAQ:NTIC)

Historical Stock Chart

From May 2023 to May 2024