By Saabira Chaudhuri and Sarah Nassauer

LONDON -- Two years ago, Gemma Williams switched to Aldi from

Asda for her grocery shopping, and thanks to the GBP200 ($249) she

and her husband estimate they are saving every month, they aren't

going back.

"If we go to Asda we always notice we end up spending almost

double what we would at Aldi," said Ms. Williams, a psychology

student at the University of Lincoln in eastern England.

Wal-Mart Stores Inc., which owns Asda, is looking to woo back

customers like Ms. Williams as it attempts to turn around its

struggling international businesses. The U.K., where Wal-Mart

operates 625 Asda stores, is the Bentonville, Ark., retailer's

biggest overseas market by revenue, and the only one where sales in

stores open at least a year are declining. Sales at Asda haven't

grown in the past 13 consecutive quarters.

Wal-Mart acquired Asda in 1999, and for years it has been one of

the company's most profitable businesses, contributing about 4% to

Wal-Mart's earnings in 2015, according to an estimate from Morgan

Stanley. Wal-Mart doesn't break out Asda sales or profit as a

percentage of business.

But the chain has struggled in England's competitive supermarket

sector, losing share to discount retailers such as Aldi and Lidl

even as other rivals have shored up their customer service and made

price-cutting moves. According to Kantar Worldpanel, Asda's market

share dropped to 15.6% as of late January, compared with 17.1% in

May 2014; during that period, Aldi's share rose to 6.2% from 4.7%,

and Lidl's to 4.5% from 3.6%.

Wal-Mart has been attempting to turn those figures around. Last

summer it replaced Asda's chief executive, Andy Clarke, who had

been with the company for more than 20 years, with Sean Clarke, a

rising star who previously led Wal-Mart's China operations. (The

two are unrelated.)

On Tuesday, Wal-Mart reported that Asda's same-store sales fell

2.9% in its most recent quarter, an improvement from its 5.8%

decline in the previous one.

"In the U.K. we faced some challenges this past year and we're

addressing these with urgency," Doug McMillon, Wal-Mart's chief

executive, said on an earnings call. "I visited stores in the

market a few weeks ago and the team has us pointed in the right

direction."

Mr. Clarke has been given the go-ahead to compete more on price

with discount retailers, according to people familiar with those

plans. Last month, Asda halved prices on popular items such as

Napolina canned tomatoes and Pot Noodle soups.

The move was overdue, says Wal-Mart's chief administrative

officer, Scott Price. "Roughly 18 months ago we saw -- ha! --

pricing is getting more competitive," he said in an interview this

month. "We should have become more aggressive then."

Wal-Mart also plans to ramp up the use of its massive size to

get lower prices from suppliers, Mr. Price said. It wants to stock

Asda shelves with more U.S. products that can't be found elsewhere

in England, such as the Shopkins Shoppies Gemma Stone doll it sold

there last Christmas. It has also recently used its heft to secure

deals on everything from olive oil to refrigeration units for

Asda.

England's supermarket sector, because of the steep competition

and large numbers of online shoppers, is billed by many retail

executives as the world's toughest, a bellwether for challenges

that could eventually hit the U.S. market. Still, analysts and

former Asda executives say many of Wal-Mart's British woes are of

its own making.

"Asda and its Wal-Mart International superiors misjudged the

U.K. market and what the business needed to do to be better

positioned for its customers in the evolving scene," said Shore

Capital analyst Clive Black.

In recent years, U.K. rivals Tesco PLC, J Sainsbury PLC and Wm

Morrison Supermarkets PLC poured money into their operations, but

Wal-Mart held back. It tapped a string of Asda's most senior

executives, including its operations chief, e-commerce head and two

chief financial officers, and put them in positions with its U.S.

business -- weakening Asda's talent pool, say analysts.

Under Mr. Clarke, Asda is working on more quickly identifying

product shortages and putting more staff on shop floors, said Mr.

Price, efforts that he added are showing "green shoots."

Asda nevertheless has an uphill battle to win back some

customers. Amraze Khan, a communications executive based in the

northern England town of Halifax for the past two years, has been

bypassing an Asda store five minutes from his home, instead driving

20 minutes to a Tesco.

"At Asda there wasn't any care at all," Mr. Khan said. "I'd

rather go to Tesco because they're very attentive."

Write to Saabira Chaudhuri at saabira.chaudhuri@wsj.com and

Sarah Nassauer at sarah.nassauer@wsj.com

(END) Dow Jones Newswires

February 25, 2017 09:14 ET (14:14 GMT)

Copyright (c) 2017 Dow Jones & Company, Inc.

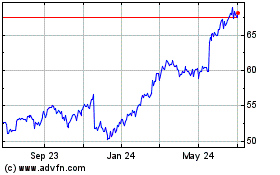

Walmart (NYSE:WMT)

Historical Stock Chart

From Dec 2024 to Jan 2025

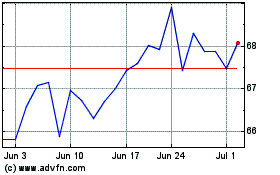

Walmart (NYSE:WMT)

Historical Stock Chart

From Jan 2024 to Jan 2025