Company Achieves Record Operating

Income of $108 million for 2013

Expects Strong First Quarter and

First Half 2014

Results for the Fourth Quarter of

2013

- Net income of $25.5 million

- Earnings per diluted share of $0.65

Results for the Full Year of

2013

- Net income of $43.4 million

- Earnings per diluted share of $1.26

Green Plains Renewable Energy, Inc. (Nasdaq:GPRE) announced today

its financial results for the fourth quarter and full year ended

December 31, 2013. Net income for the quarter was $25.5 million, or

$0.65 per diluted share, compared to net income of $6.7 million, or

$0.21 per diluted share, excluding a non-recurring gain, for the

same period in 2012. Reported net income and diluted earnings per

share for the fourth quarter of 2012 included a gain on the sale of

certain agribusiness assets of $26.3 million, after tax, or $0.73

per diluted share. Revenues were $712.9 million for the fourth

quarter of 2013 compared to $883.7 million for the same period in

2012.

Net income for the full year was $43.4 million, or $1.26 per

diluted share, compared to $11.8 million, or $0.39 per diluted

share for the same period in 2012. Revenues were $3.0 billion for

the full year of 2013 compared to $3.5 billion for the same period

in 2012.

"Green Plains generated operating income of $51 million in the

fourth quarter and a company record of $108 million for the full

year of 2013," stated Todd Becker, President and Chief Executive

Officer. "We have invested in our assets and employees which, we

believe, will continue to drive our financial results in the

future."

During the fourth quarter, Green Plains' ethanol production

segment produced approximately 209.6 million gallons of ethanol, or

approximately 100 percent of its daily average production capacity.

Following the integration of its most recent acquisition, completed

in November 2013, Green Plains can produce over one billion gallons

of ethanol, nearly three million tons of livestock feed and 250

million pounds of corn oil annually. Non-ethanol operating income,

from the corn oil production, agribusiness, and marketing and

distribution segments, was $28.2 million in the fourth quarter of

2013 compared to $17.9 million for the same period in 2012,

excluding the gain on sale of certain agribusiness assets. For the

full year, non-ethanol operating income totaled $80.9 million for

2013 compared to $62.3 million for 2012, excluding the gain on sale

of certain agribusiness assets.

"With our acquisitions and efficiency initiatives, we have

increased our ethanol production capacity by nearly 38 percent and

our corn oil production capacity by over 60 percent this past year.

As a result, we believe the earnings power of our platform has

increased significantly and the results in the fourth quarter began

to show that. In addition, we now expect our non-ethanol operating

segments to contribute approximately $75 million of operating

income in 2014. We will continue to execute our growth strategy by

expanding our existing businesses as well as focusing on

opportunities that leverage our expertise in risk management and

operational excellence," added Becker.

"Margins for the ethanol industry expanded during the fourth

quarter of 2013 and have remained strong in the near term. Ethanol

and distillers grains prices reflect robust demand and tight

supplies both domestically and internationally. As a result of

these factors, as well as our recent acquisitions, we anticipate

our first quarter 2014 results will be better than the fourth

quarter of 2013," concluded Becker. "Finally, with our current

hedging activities and visible margin structure, at this point we

expect the first half of 2014 to be our strongest on record."

Green Plains had $299.0 million in total cash and equivalents

and $135.4 million available under committed loan agreements at

subsidiaries (subject to satisfaction of specified lending

conditions and covenants) at December 31, 2013. Full-year 2013

EBITDA, which is defined as earnings before interest, income taxes,

depreciation and amortization, was $156.6 million compared to

$115.5 million for the same period in 2012. For reconciliations of

net income to EBITDA, see "EBITDA" below.

2013 Business Highlights

- Green Plains added 280 million gallons per year (a 37.8%

increase) of ethanol production capacity with the acquisition of an

ethanol plant in Atkinson, NE in June 2013, and the acquisition of

ethanol plants in Wood River, NE and Fairmont, MN in November 2013.

All of the acquired plants are fully operational for ethanol

production.

- During 2013, Green Plains completed the construction of 9.4

million bushels of grain storage capacity at six ethanol plants and

three grain elevator locations. The expansion projects were

completed at a total cost of $6.0 million and bring the Company's

total grain storage capacity to 30.8 million bushels.

- In 2013, Green Plains completed a new $125 million senior

secured revolving credit facility for its agribusiness segment and

a new $130 million senior secured revolving credit facility for its

marketing and distribution segment. Each facility matures in

2016. On September 20, 2013, Green Plains issued $120 million of

3.25% Convertible Senior Notes due 2018. The net proceeds to the

Company from this issuance were approximately $115 million.

- In April 2013, BioProcess Algae LLC was selected to receive a

grant of up to $6.4 million from the U.S. Department of Energy as

part of a pilot-scale biorefinery project related to production of

hydrocarbon fuels meeting military specifications. The project will

use renewable carbon dioxide, lignocellulosic sugars and waste heat

through BioProcess Algae's Grower HarvesterTM technology platform,

co-located with the Green Plains' ethanol plant in Shenandoah, IA.

- In August 2013, Green Plains announced that its Board of

Directors approved the initiation of a quarterly cash dividend. An

initial dividend of $0.04 per common share was paid in September

2013. A second quarterly cash dividend of $0.04 per common share

was paid in December 2013. Green Plains paid $2.4 million in

dividends to its shareholders in 2013.

Conference Call

On February 6, 2014, Green Plains will hold a conference call to

discuss its fourth quarter and full-year 2013 financial results and

other recent developments. Green Plains' participants will include

Todd Becker, President and Chief Executive Officer, Jerry Peters,

Chief Financial Officer, and Jeff Briggs, Chief Operating Officer.

The time of the call is 11:00 a.m. ET / 10:00 a.m. CT. To

participate by telephone, the domestic dial-in number is

888-438-5519 and the international dial-in number is 719-325-2144.

The conference call will be webcast and accessible at

www.gpreinc.com. Listeners are advised to go to the website at

least 10 minutes prior to the call to register, download and

install any necessary audio software. A slide presentation will be

available on Green Plains' website at

http://investor.gpreinc.com/events.cfm. The conference call

will be archived and available for replay through February 12,

2014.

About Green Plains Renewable Energy,

Inc.

Green Plains Renewable Energy, Inc. (Nasdaq:GPRE), which is

North America's fourth largest ethanol producer, markets and

distributes over one billion gallons of ethanol annually. Green

Plains owns and operates grain storage assets in the corn belt and

biofuel terminals in the southern U.S. Green Plains is a joint

venture partner in BioProcess Algae LLC, which was formed to

commercialize advanced photo-bioreactor technologies for growing

and harvesting algal biomass.

Safe Harbor

This news release contains forward-looking statements within the

meaning of the Private Securities Litigation Reform Act of 1995, as

amended. Such statements are identified by the use of words such as

"anticipates," "believes," "estimates," "expects," "goal,"

"intends," "plans," "potential," "predicts," "should," "will," and

other words and terms of similar meaning in connection with any

discussion of future operating or financial performance. Such

statements are based on management's current expectations and are

subject to various factors, risks and uncertainties that may cause

actual results, outcome of events, timing and performance to differ

materially from those expressed or implied by such forward-looking

statements. Green Plains may experience significant fluctuations in

future operating results due to a number of economic conditions,

including, but not limited to, competition in the ethanol and other

industries in which the Company operates, commodity market risks

including those that may result from current weather conditions,

financial market risks, counter-party risks, risks associated with

changes to federal policy or regulation, risks related to closing

and achieving anticipated results from acquisitions, risks

associated with the joint venture to commercialize algae production

and the growth potential of the algal biomass industry, and other

risks detailed in the Company's reports filed with the Securities

and Exchange Commission, including its Annual Report on Form 10-K

for the year ended December 31, 2012, as amended, and in the

Company's subsequent filings with the SEC. In addition, the Company

is not obligated, and does not intend, to update any of its

forward-looking statements at any time unless an update is required

by applicable securities laws.

Consolidated Financial Results

The following are consolidated statements of operations for

Green Plains (in thousands, except per share amounts):

| |

Three Months

Ended December 31, |

Year Ended

December 31, |

| |

2013 |

2012 |

2013 |

2012 |

| |

|

|

|

|

| Revenues |

$ 712,869 |

$ 883,707 |

$ 3,041,011 |

$ 3,476,870 |

| Cost of goods sold |

640,697 |

841,736 |

2,867,991 |

3,380,099 |

| Gross profit |

72,172 |

41,971 |

173,020 |

96,771 |

| Selling, general and administrative

expenses |

(21,121) |

(20,669) |

(65,169) |

(79,019) |

| Gain on disposal of assets |

-- |

47,133 |

-- |

47,133 |

| Operating income |

51,051 |

68,435 |

107,851 |

64,885 |

| Other income (expense) |

|

|

|

|

| Interest income |

127 |

47 |

294 |

191 |

| Interest expense |

(9,916) |

(8,780) |

(33,357) |

(37,521) |

| Other, net |

(430) |

(540) |

(2,507) |

(2,399) |

| Total other income

(expense) |

(10,219) |

(9,273) |

(35,570) |

(39,729) |

| |

|

|

|

|

| Income before income taxes |

40,832 |

59,162 |

72,281 |

25,156 |

| Income tax expense |

15,371 |

26,142 |

28,890 |

13,393 |

| Net income |

25,461 |

33,020 |

43,391 |

11,763 |

| Net loss attributable to

noncontrolling interests |

-- |

3 |

-- |

16 |

| Net income attributable to

Green Plains |

$ 25,461 |

$ 33,023 |

$ 43,391 |

$ 11,779 |

| Earnings per share: |

|

|

|

|

| Basic |

$ 0.84 |

$ 1.11 |

$ 1.44 |

$ 0.39 |

| Diluted |

$ 0.65 |

$ 0.94 |

$ 1.26 |

$ 0.39 |

| Weighted average shares outstanding: |

|

|

|

|

| Basic |

30,427 |

29,691 |

30,183 |

30,296 |

| Diluted |

42,703 |

36,178 |

38,304 |

30,463 |

Consolidated revenues decreased by $170.8 million for the three

months ended December 31, 2013 compared to the same period in 2012

primarily as a result of lower grain and agronomy sales and a lower

average price per gallon of ethanol sold. The decline in grain and

agronomy sales resulted from the sale of certain grain elevators

and agronomy assets during the fourth quarter of 2012. Gross profit

increased by $30.2 million for the three months ended December 31,

2013 compared to the same period in 2012 primarily as a result of

improved margins for ethanol production offset partially by a

decrease in margins for grain and agronomy sales. Operating income

decreased by $17.4 million, to $51.1 million, for the three months

ended December 31, 2013 compared to the same period in 2012. The

fourth quarter of 2012 includes a $47.1 million gain on sale of

certain agribusiness assets. Excluding this non-recurring gain,

operating income increased by $29.7 million in the fourth quarter

of 2013 compared to the same period in 2012. Selling, general and

administrative expenses were higher by $0.5 million for the three

months ended December 31, 2013 compared to the same period in 2012

due mostly to the expanded scope of the Company's operations from

ethanol plant acquisitions and increased marketing and logistics

activities, partially offset by expenses related to the

agribusiness operations that were sold in December 2012. Interest

expense increased by $1.1 million for the three months ended

December 31, 2013 compared to the same period in 2012 due to the

issuance of $120 million of 3.25% convertible notes in September

2013. Income tax expense was $15.4 million for the three months

ended December 31, 2013 compared to $26.1 million for the same

period in 2012.

Diluted earnings per share is computed by dividing net income on

an if-converted basis available to common stockholders by the

weighted average number of common shares outstanding during the

period, adjusted for the dilutive effect of any outstanding

dilutive securities. For the year ended December 31, 2012, the

Company's net income and weighted average number of common shares

outstanding are not adjusted since the effect would be

antidilutive. The following summarizes the effects of this method

on net income attributable to Green Plains and weighted average

shares outstanding for the periods indicated (in thousands):

| |

Three Months

Ended December 31, |

Year Ended

December 31, |

| |

2013 |

2012 |

2013 |

2012 |

| Net income attributable to Green Plains |

$ 25,461 |

$ 33,023 |

$ 43,391 |

$ 11,779 |

| Interest and amortization on convertible

debt, net of tax effect: |

|

|

|

|

| 5.75% convertible notes due

2015 |

898 |

922 |

3,578 |

-- |

| 3.25% convertible notes due

2018 |

1,393 |

-- |

1,473 |

-- |

| Net income on an if-converted basis |

$ 27,752 |

$ 33,945 |

$ 48,442 |

$ 11,779 |

| Effect on weighted average shares outstanding

- diluted |

|

|

|

|

| 5.75% convertible notes due

2015 |

6,300 |

6,280 |

6,286 |

-- |

| 3.25% convertible notes due

2018 |

5,756 |

-- |

1,624 |

-- |

| Total effect on weighted average shares

outstanding - diluted |

12,056 |

6,280 |

7,910 |

-- |

Operating Segment Information

Green Plains' operating segments are as follows: (1) production

of ethanol and distillers grains, collectively referred to as

ethanol production, (2) corn oil production, (3) grain handling and

storage, collectively referred to as agribusiness, and (4)

marketing and logistics services for Company-produced and

third-party ethanol, distillers grains, corn oil and other

commodities, and the operation of blending and terminaling

facilities, collectively referred to as marketing and distribution.

Selling, general and administrative expenses, primarily consisting

of compensation of corporate employees, professional fees and

overhead costs not directly related to a specific operating

segment, are reflected in the table below as corporate activities.

The following is selected operating segment financial information

for the periods indicated (in thousands):

| |

Three Months

Ended December 31, |

Year Ended

December 31, |

| |

2013 |

2012 |

2013 |

2012 |

| |

|

|

|

|

| Revenues: |

|

|

|

|

| Ethanol production |

$ 494,710 |

$ 491,276 |

$ 2,051,042 |

$ 1,909,243 |

| Corn oil production |

19,860 |

14,324 |

69,163 |

57,844 |

| Agribusiness |

272,351 |

149,908 |

813,718 |

584,684 |

| Marketing and distribution |

715,151 |

723,850 |

2,894,646 |

2,867,631 |

| Intersegment eliminations |

(789,203) |

(495,651) |

(2,787,558) |

(1,942,532) |

| |

$ 712,869 |

$ 883,707 |

$ 3,041,011 |

$ 3,476,870 |

| |

|

|

|

|

| Gross profit (loss): |

|

|

|

|

| Ethanol production |

$ 44,881 |

$ 15,715 |

$ 79,109 |

$ (4,895) |

| Corn oil production |

11,184 |

7,183 |

36,615 |

32,388 |

| Agribusiness |

3,273 |

8,616 |

6,258 |

35,973 |

| Marketing and distribution |

18,597 |

10,593 |

57,671 |

32,362 |

| Intersegment eliminations |

(5,763) |

(136) |

(6,633) |

943 |

| |

$ 72,172 |

$ 41,971 |

$ 173,020 |

$ 96,771 |

| |

|

|

|

|

| Operating income (loss): |

|

|

|

|

| Ethanol production |

$ 40,505 |

$ 12,042 |

$ 63,012 |

$ (20,393) |

| Corn oil production |

11,343 |

7,129 |

36,569 |

32,140 |

| Agribusiness |

2,543 |

51,114 |

3,324 |

60,030 |

| Marketing and distribution |

14,317 |

6,744 |

40,971 |

17,290 |

| Intersegment eliminations |

(5,762) |

(136) |

(6,588) |

977 |

| Segment operating income |

62,946 |

76,893 |

137,288 |

90,044 |

| Corporate activities |

(11,895) |

(8,458) |

(29,437) |

(25,159) |

| |

$ 51,051 |

$ 68,435 |

$ 107,851 |

$ 64,885 |

During the normal course of business, the Company enters into

transactions between segments. These intersegment activities are

recorded by each segment at prices approximating market and treated

as if they are third-party transactions. Consequently, these

transactions impact segment performance. Intersegment revenues and

corresponding costs are eliminated in consolidation and do not

impact consolidated results.

Ethanol Production Segment

The table below presents key operating data within the ethanol

production segment for the periods indicated:

| |

Three Months

Ended December 31, |

Year Ended

December 31, |

| |

2013 |

2012 |

2013 |

2012 |

| Ethanol sold |

213,314 |

169,159 |

734,483 |

677,082 |

| (thousands of gallons) |

|

|

|

|

| Ethanol produced |

209,569 |

168,476 |

729,165 |

676,834 |

| (thousands of gallons) |

|

|

|

|

| Distillers grains sold |

582 |

486 |

2,038 |

1,882 |

| (thousands of equivalent dried

tons) |

|

|

|

|

| Corn consumed |

74,514 |

59,816 |

257,663 |

238,740 |

| (thousands of bushels) |

|

|

|

|

Revenues in the ethanol production segment increased by $3.4

million for the three months ended December 31, 2013 compared to

the same period in 2012 primarily due to higher volumes sold,

partially offset by lower average ethanol and distillers grains

prices. Revenues in the fourth quarter of 2013 included production

from the Atkinson plant, which began operations on July 25, 2013,

and the Wood River plant, which was acquired on November 22, 2013.

The Fairmont plant, which was not operational at the time of its

acquisition in November 2013, began production in early January

2014. The ethanol production segment produced 209.6 million gallons

of ethanol, which represents approximately 100% of the daily

average production capacity, during the fourth quarter of 2013.

Cost of goods sold in the ethanol production segment decreased

by $25.7 million for the three months ended December 31, 2013

compared to the same period in 2012. Consumption of corn increased

by 14.7 million bushels due to the acquired plants, but the average

cost per bushel decreased by 39.9% during the three months ended

December 31, 2013 compared to the same period in 2012. As a result

of the factors identified above, gross profit and operating income

for the ethanol production segment increased by $29.2 million and

$28.5 million, respectively, for the three months ended December

31, 2013 compared to the same period in 2012. Depreciation and

amortization expense for the ethanol production segment was $11.7

million for the three months ended December 31, 2013 compared to

$11.0 million during the same period in 2012.

Corn Oil Production Segment

Revenues in the corn oil production segment increased by $5.5

million for the three months ended December 31, 2013 compared to

the same period in 2012. During the three months ended December 31,

2013, the corn oil production segment sold 50.9 million pounds of

corn oil compared to 36.6 million pounds in the same period of 2012

due to higher yields and the acquisition of the Wood River plant in

November 2013. The average price for corn oil was 0.4% lower for

the fourth quarter of 2013 compared to the same period in 2012.

Gross profit and operating income in the corn oil production

segment increased by $4.0 and $4.2 million, respectively, for the

three months ended December 31, 2013 compared to the same period in

2012. Beginning in February 2014, all 12 ethanol plants are

producing corn oil with an annual expected production capacity of

250 million pounds.

Agribusiness Segment

Revenues in the agribusiness segment increased by $122.4 million

and gross profit decreased by $5.3 million for the three months

ended December 31, 2013 compared to the same period in 2012. The

agribusiness segment sold 60.6 million bushels of grain, including

59.6 million bushels to the ethanol production segment, and had no

fertilizer sales during the three months ended December 31, 2013

compared to sales of 12.5 million bushels of grain, including 5.5

million bushels to the ethanol production segment, and 20.4

thousand tons of fertilizer during the same period in 2012.

Operating income for the segment decreased by $48.6 million for the

three months ended December 31, 2013 compared to the same period in

2012 due to a $47.1 million gain on sale of certain agribusiness

assets in the fourth quarter of 2012. Subsequent to the sale of

certain grain elevators and the agronomy business during the fourth

quarter of 2012, the segment increased its focus on supplying corn

to the ethanol plants. The decrease in gross profit and operating

income is due to the factors discussed above.

Marketing and Distribution Segment

Revenues in the marketing and distribution segment decreased by

$8.7 million for the three months ended December 31, 2013 compared

to the same period in 2012. The decrease in revenues was primarily

due to a decrease in average price per gallon of ethanol sold by

8.1% as compared to the same period a year ago. This decrease was

partially offset by increased margins on our merchant trading

activity within the marketing and distribution segment and an

increase in ethanol volumes sold.

The Company sold 263.9 million and 258.6 million gallons of

ethanol during the three months ended December 31, 2013 and 2012,

respectively, within the marketing and distribution segment. Gross

profit and operating income for the marketing and distribution

segment increased by $8.0 million and $7.6 million, respectively,

for the three months ended December 31, 2013 compared to the same

period in 2012, primarily due to increased margins from merchant

trading activity.

Non-GAAP Reconciliation

EBITDA

Management uses EBITDA to measure the Company's financial

performance and to internally manage its businesses. Management

believes that EBITDA provides useful information to investors as a

measure of comparison with peer and other companies. EBITDA should

not be considered an alternative to, or more meaningful than, net

income or cash flow as determined in accordance with generally

accepted accounting principles. EBITDA calculations may vary from

company to company. Accordingly, the Company's computation of

EBITDA may not be comparable with a similarly-titled measure of

another company. The following sets forth the reconciliation of net

income to EBITDA for the periods indicated (in thousands):

| |

Three Months

Ended December 31, |

Year Ended

December 31, |

| |

2013 |

2012 |

2013 |

2012 |

| Net income |

$ 25,461 |

$ 33,020 |

$ 43,391 |

$ 11,763 |

| Interest expense |

9,916 |

8,780 |

33,357 |

37,521 |

| Income tax expense |

15,371 |

26,142 |

28,890 |

13,393 |

| Depreciation and

amortization |

13,196 |

12,907 |

51,002 |

52,828 |

| EBITDA |

$ 63,944 |

$ 80,849 |

$ 156,640 |

$ 115,505 |

Summary Balance Sheets

The following is condensed consolidated balance sheet

information (in thousands):

| |

December 31,

2013 |

December 31,

2012 |

| ASSETS |

|

|

| |

|

|

| Current assets |

$ 633,305 |

$ 568,035 |

| Property and equipment, net |

806,046 |

708,110 |

| Other assets |

92,694 |

73,589 |

| Total assets |

$ 1,532,045 |

$ 1,349,734 |

| |

|

|

| LIABILITIES AND

STOCKHOLDERS' EQUITY |

|

|

| |

|

|

| Current liabilities |

$ 409,197 |

$ 432,384 |

| Long-term debt |

480,746 |

362,549 |

| Other liabilities |

96,744 |

64,299 |

| Total liabilities |

986,687 |

859,232 |

| Total stockholders' equity |

545,358 |

490,502 |

| Total liabilities and

stockholders' equity |

$ 1,532,045 |

$ 1,349,734 |

As of December 31, 2013, Green Plains had $299.0 million in

total cash and equivalents and $135.4 million available under

committed loan agreements at subsidiaries (some of which was

subject to satisfaction of specified lending conditions and

covenants). Total debt at December 31, 2013 was $735.2 million,

including $171.5 million outstanding under working capital

revolvers and other short-term borrowing arrangements in the

marketing and distribution and agribusiness segments. As of

December 31, 2013, Green Plains had total assets of approximately

$1.5 billion and total stockholders' equity of approximately $545.4

million. As of December 31, 2013, Green Plains had approximately

30.5 million common shares outstanding.

CONTACT: Jim Stark, Vice President - Investor and Media Relations,

Green Plains. (402) 884-8700

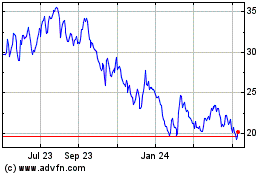

Green Plains (NASDAQ:GPRE)

Historical Stock Chart

From Feb 2025 to Mar 2025

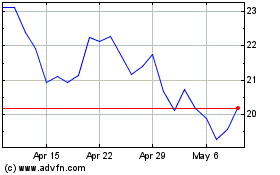

Green Plains (NASDAQ:GPRE)

Historical Stock Chart

From Mar 2024 to Mar 2025