Hartford CEO: Seeing Signs Of 'Gradual Economic Recovery'

February 09 2010 - 10:07AM

Dow Jones News

Hartford Financial Services Group Inc. (HIG) is seeing signs of

a gradual economic recovery, as midterm policy cancellations have

stabilized and, if the trends hold, could see a "modest top-line

benefit in 2010," said Liam McGee, Hartford's chief executive,

during the company's earnings conference call Tuesday.

He said in April, at its investors meeting, the company will

outline its capital plan for repaying the $3.4 billion in

government assistance it received through the Capital Purchase

Program.

"We recognize that the government's preferred stock is not

permanent capital, and we will repay it," McGee said. "But as I

have said previously, we will be prudent" in repaying it.

He said the company would balance the company's capital

resources, shareholder dilution, the future impact on its business

and the views of regulators.

Hartford posted a fourth-quarter profit of $557 million, or

$1.19 a share, compared with a year-earlier loss of $806 million,

or $2.71 a share.

Core earnings, excluding net realized and unrealized investment

gains and losses, were $1.51 a share, compared with a year-earlier

loss of 72 cents. Last month, Hartford said it expected $1.45 to

$1.60, up from its November view.

The company said its guidance doesn't include potential changes

in reserves from previous years, or changes in charges related to

acquisition costs.

Shares of Hartford traded down 23 cents recently to $23.69.

-By Lavonne Kuykendall, Dow Jones Newswires; (312) 750 4141;

lavonne.kuykendall@dowjones.com

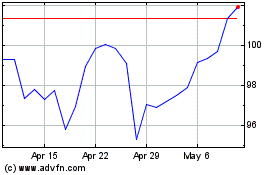

Hartford Financial Servi... (NYSE:HIG)

Historical Stock Chart

From Apr 2024 to May 2024

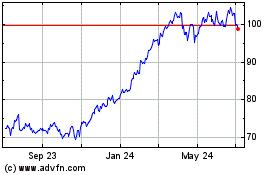

Hartford Financial Servi... (NYSE:HIG)

Historical Stock Chart

From May 2023 to May 2024