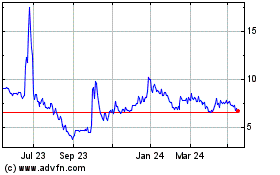

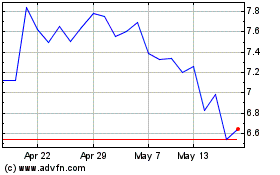

TIDMZIOC

RNS Number : 4472K

Zanaga Iron Ore Company Ltd

25 June 2014

25 June 2014

Zanaga Iron Ore Company Audited Results for the Year to 31

December 2013

Highlights 2013 and Post balance sheet events to May 2014

-- In May 2013, Glencore became the new JV partner, following the merger of Xstrata with Glencore

-- Zanaga Project scope revised to a staged development approach

-- Supplemental Agreement to the JVA signed in September 2013

-- Feasibility Study progressed on a staged development scope

-- Work programme and budget agreed until the end of 2014

-- Investigation of early Direct Shipping Ore opportunities

-- Feasibility Study completed in April 2014, confirming attractive project economics

-- Stage One 12Mtpa initial operation

-- US$32/t FOB bottom quartile operating costs including

royalty

-- US$2.2bn capital expenditure

-- Premium quality 66% Fe content iron ore pellet feed

product

-- Stage Two expansion to 30Mtpa operation

-- US$2.5bn capital expenditure for additional 18Mtpa

production

-- US$26/t FOB bottom quartile operating costs including

royalty

-- Premium quality 67.5% Fe content iron ore pellet feed

product

-- Benefits of staged development

-- Lowers capital and execution risk

-- Reduces financing requirements

-- Maximises return on capital

-- Mining Licence Application submitted to the Ministry of Mines in May 2014

-- Social Environmental Impact Assessment completed in April 2014

-- Environmental Permit application for Stage One lodged with

the Ministry of Environment in May 2014

-- Mining Convention negotiations underway

-- Cash balance of US$24m, as at 2013 year end

Clifford Elphick, Non-Executive Chairman of Zanaga Iron Ore

Company Limited, commented:

"The Zanaga Project achieved an important milestone in Q2 2014

with the completion of the Feasibility Study, which clearly

demonstrates the Zanaga Project is a highly attractive and globally

competitive iron ore project.

The Stage One development has been designed as a stand alone

business case and does not rely on, or require, the Stage Two

expansion. Stage One plans to produce 12Mtpa of premium quality 66%

Fe content iron ore pellet feed product at a forecast operating

cost of US$32/t FOB including royalty, which positions the Project

in the industry's bottom quartile of operating costs.

The Stage Two expansion of 18Mtpa has been nominally scheduled

to suit the project mine development and will increase the

Project's total production capacity to 30Mtpa. It will produce a

premium quality 67.5% Fe content iron ore pellet feed product at a

forecast operating cost of US$26/t FOB including royalty,

maintaining the Project's ranking in the industry's bottom quartile

of operating costs.

The Project is now progressing through the next phase of

development. Applications for both the Mining Licence and

Environmental Permit to the relevant ministries have been

submitted. Negotiations have started on the Mining Convention that

will establish the Project's fiscal regime. We expect to update the

market as to progress on these developments during the course of

2014. Separately, the Project team will shortly be engaging with

international contractors in preparation for commencing the FEED

phase."

The Company will post its Annual Report and Accounts for the

year ended 31 December 2013 ("2013 Annual Report and Accounts"),

together with the Notice of its Annual General Meeting ("AGM"),

which will be held at Adelaide House, London Bridge, London EC4R

9HA, England on 23 July 2014 at 10.00 a.m. BST, the form of proxy

and form of instruction for holders of Depositary Interests for use

at the AGM to shareholders on 27 June 2014.

A copy of the Notice of AGM and the 2013 Annual Report and

Accounts will be available on the Company's website

www.zanagairon.com.

For further information please contact:

Zanaga Iron Ore

Corporate Development and Andrew Trahar

Investor Relations Manager +44 20 7399 1105

Liberum Capital Limited

Nominated Adviser, Financial Simon Atkinson

Adviser and Corporate Broker and Christopher Britton

+44 20 3100 2000

Bell Pottinger

Financial PR Marianna Bowes

and Daniel Thole

+44 20 7861 3232

About us:

Zanaga Iron Ore Company Limited (AIM ticker: ZIOC) is the owner

of 50% less one share in the Zanaga Iron Ore Project based in the

Republic of Congo (Congo Brazzaville) through its joint venture

partnership with Glencore. The Zanaga Iron Ore Project is one of

the largest iron ore deposits in Africa and has the potential to

become a world-class iron ore producer.

Chairman's Statement

Dear Shareholder,

The Zanaga Project achieved an important milestone in Q2 2014

with the completion of the Feasibility Study ("FS"), whichclearly

demonstrates the Zanaga Project is a highly attractive and globally

competitive iron ore project, and the subsequent submission of a

Mining Licence Application to the Republic of Congo ("RoC")

Ministry of Mines.

This is the culmination of over six years of comprehensive study

work, as borne out by the depth and quality of the FS, which along

with the completed Social Environmental Impact Assessment("SEIA")

is a tremendous achievement by the Project team.

We now enter the next phase of development, in which the Project

team will be progressing permits, negotiating the Mining

Convention, which will establish the Project's fiscal regime,

advancing project financing initiatives and preparing to commence

Front End Engineering Design ("FEED"), ahead of a potential

investment and construction decision.

Staged Development Approach

The scope of the FS was modified in September 2013, following a

review of the Project, discussions between Glencore plc

("Glencore") and ZIOC and the negotiation of the Supplemental

Agreement (the "Supplemental Agreement") which modified the

exisiting Joint Venture Agreement (the "JVA"). As part of that

review, the JV partners also agreed to jointly explore funding

options with a view to attracting third party debt and equity

financing for project implementation.

Unlocking Value through Staged Development

Glencore's staged approach to development has yielded

substantial value add for the Zanaga Project. It has lowered the

capital and execution risks, thereby significantly reducing the

Project's financing requirements whilst maximising capital

returns.

Compared to the Pipeline Pre-Feasibility Study ("Pipeline PFS")

announced in November 2012, which considered a single stage 30Mtpa

development at a capital cost of US$7.5bn, the results of the FS on

a staged development basis have demonstrated significant

advantages. Development costs of the Project have been

substantially reduced to US$2.2bn for the Stage One operation, and

US$2.5bn for the Stage Two expansion, while ultimately achieving

the same production rate of 30Mtpa. But importantly, the Project's

forecast bottom quartile operating costs presented by the Pipeline

PFS have been maintained. In addition, phasing the capital cost

provides the potential to finance the Stage Two expansion through

existing Project cash flows from Stage One to achieve a total

30Mtpa scale operation, thereby limiting the level of additional

equity required.

Highly Attractive FS Results

The Stage One development has been designed as a stand alone

business case and does not rely on, or require, the Stage Two

expansion. Stage One plans to produce 12Mtpa of premium quality 66%

Fe content iron ore pellet feed product at a forecast operating

cost of US$32/t FOB including royalty, which positions the Project

in the industry's bottom quartile of operating costs. The capital

cost is estimated at US$2.2bn, including contingency. The initial

cash flows and project returns are maximised by commencing mining

of the higher grade near surface ore for the first eight years of

operation.

The Stage Two expansion of 18Mtpa has been nominally scheduled

to suit the project mine development, construction timing and

forecast cash flow generation and will increase the Project's total

production capacity to 30Mtpa. It will produce a premium quality

67.5% Fe content iron ore pellet feed product at a forecast

operating cost of US$26/t FOB including royalty, maintaining the

Project's ranking in the industry's bottom quartile of operating

costs. The US$2.5bn capital expenditure for the additional 18Mtpa

production, including contingency, can potentially be financed from

the cash flows from Stage One, which is a compelling expansion

case.

The high grade pellet feed products that the Project will

produce under Stage One and Stage Two will have an iron grade of

66% and 67.5% respectively, similar to existing high grade

Brazilian supply. Impurities are expected to be low. It is

anticipated that the products would command a price premium

relative to the 62% Fe IODEX, both as a function of the Fe content

and the low impurities, and will be attractive feed for pellet

plants or as part of a sinter feed blend.

Iron Ore Market

Before I discuss the potential funding option for the Project,

I'd like to comment on the iron ore market, which at the time of

writing is experiencing a period of relative weakness, with iron

ore prices currently trading between U$90/t and U$100/t and much

market commentary about forecast oversupply.

Looking back over 2013, many were surprised by the buoyancy of

iron ore prices which averaged around US$135/t (CIF China), in

spite of the threat of looming expansion of supply. Although

significant investments in new production from the major iron ore

producers did come onstream, it was mainly Chinese demand that

drove prices higher to unexpectedly high levels. Interestingly,

despite talk of a slowdown in China, Chinese crude steel production

grew by 9% in 2013, outpacing GDP as monetary stimulus measures and

expansion of the shadow banking system increased credit

availability and growth in the Chinese economy.

Whilst prices in 2013 surprised to the upside, I believe we are

looking ahead to a lower price environment in the second half of

the decade. This will put pressure on more marginal producers.

Fortunately, the Zanaga Project's competitive operating costs,

premium quality product, and resulting high profit margins, ensure

that it will still be able to deliver a strong return on capital,

even in a weak iron ore price environment of US$80/t. Indeed, we

expect that the Zanaga Project will be able to compete, on a

benchmark 62% iron ore price equivalent basis, with some of the

lowest cost mining operations in Australia and Brazil.

Joint Funding Initiative

Low operating costs, a high quality premium product and a long

mine life combine to make the Zanaga Iron Ore Project a very

attractive investment opportunity to potential investors who are

looking to gain a foothold in the iron ore sector.

A joint funding process has been initiated with our JV partner

Glencore and we have been encouraged by the level of interest the

Project has received. This funding process continues and we will

update the market in due course.

The JV partners are looking to finance Stage One through a

combination of equity and debt. A number of attractive

opportunities have been identified in the debt market, such as

debt-backed infrastructure agreements as well as export-credit

finance, which could be linked to proposals from EPC contractors

with whom the Project team is currently engaging.

Cash Reserves

We have cash reserves of US$24m as at 31 December 2013, and

continue to be prudent with our cash. Following the Supplemental

Agreement with our JV partner Glencore in September 2013, at the

year end, a further US$7m contribution was required (of which US$5m

paid June 2014) of the Company to complete its US$17m contribution

total to extend project development preparatory work from September

2013 to to the end of 2014. ZIOC believes it has sufficient funds

to meet its working capital requirements up to, and well beyond,

the end of 2014.

Outlook

As mentioned earlier, the Project is progressing through the

next phase of development. Applications for both the Mining Licence

and Environmental Permit to the relevant ministries have been

submitted. Negotiations have started on the Mining Convention that

will establish the Project's fiscal regime. We expect to update the

market as to progress on these developments during the course of

2014. Separately, the Project team will shortly be engaging with

international contractors in preparation for commencing the FEED

phase.

We continue to engage regularly across all relevant Congolese

government ministries and are pleased to say that the Project

enjoys strong support for its actvities.

Finally, I would like to take this opportunity to extend a very

heartfelt thank you to the Zanaga Project team and all the local

and international consultants who worked on the FS, the SEIA and

related documentation. A huge amount of creative thinking, long

hours, attention to detail and study work have gone into producing

the Project's FS and the SEIA. I would also like to thank my fellow

Board members and ZIOC staff for their support.

Whilst we have achieved a significant milestone, the Project's

development schedule maintains significant momentum and I look

forward to updating you on our progress during the course of the

year.

Clifford Elphick

Non-Executive Chairman

Business Review

The FS, managed by ZIOC's JV partner Glencore, has been

completed on the basis of a staged development of the Zanaga Iron

Ore Project. Stage One consists of a 12Mtpa operation, with Stage

Two expanding the operation by a further 18Mtpa to produce a total

30Mtpa of high quality iron ore product over a 30 year life of mine

("LOM"). Transportation to port will be via a slurry pipeline in

both stages, which facilitates the low cost delivery solution.

A mine design and schedule has been completed for the Stage One

development to allow this to be evaluated as a stand alone business

case. A second set of designs and schedules have then been

developed incorporating the Stage Two expansion. This allows for

evaluation of the combined development stages as well as the

incremental value of Stage Two.

Feasibility Study Overview

The Stage One development has been designed as a stand alone

business case and does not rely on, or require, the Stage Two

expansion. The Stage One operation will mine the higher grade upper

hematite ores which supports a 12Mtpa operation over a 30 year mine

life, producing a 66% Fe content, premium quality iron ore pellet

feed product with low impurities.

The initial open pit mining operation will use contractor mining

to exploit free dig material with a very low strip ratio, with

simpler processing requirements resulting in low initial power

demand. The ore will be upgraded into a high grade pellet feed

using conventional gravity and flotation concentration methods

before being pumped to the port via a slurry pipeline. The

Project's "on-shore" port facilities and infrastructure will

include a filter plant for dewatering of the concentrate and a

covered ore storage facility located at a proposed new third party

port to be constructed 9km north of the existing port of

Pointe-Noire ("Pointe Indienne"). Operating costs are estimated at

US$32 per tonne FOB, including royalty, which would position Zanaga

at the bottom quartile of the industry's cost curve. The capital

cost is estimated at US$2.2bn including contingency.

The Stage Two 18Mtpa expansion to 30Mtpa of total production

will involve open pit mining of the magnetite orebody. The strip

ratio will be lower than Stage One as the upper hematite cap will

have been mined. The processing plant will be expanded with a

second concentrator using magnetic separation to produce a blended

67.5% Fe content, premium quality iron ore pellet feed product. The

increased power requirements are expected to be supplied by planned

power generation expansion projects in RoC. A second slurry

pipeline will be constructed to transport the ore to port where the

port facilities will be expanded as part of the proposed deepwater

port development.

Mining

The mining process will be a conventional excavator and truck

operation using contractor mining. For the initial years the

operation will be free dig, after which both waste and ore will

require drilling and blasting prior to excavation. A very low strip

ratio contributes significantly to the low operating costs of the

Project.

The Stage One operation will mine the higher grade upper

hematite ores with a strip ratio of 0.47:1 over 30 years. During

the first eight years of operation the strip ratio is less than

0.2:1 with greater than 50% process plant recovery. The hematite

ore types in the defined mineral resource will support the Stage

One process plant for approximately 30 years.

The Stage Two expansion to 30Mtpa of total production will

involve mining of the magnetite orebody at a reduced average strip

ratio of 0.37:1. There is sufficient magnetite ore within the

defined mineral resource to extend the mine life beyond the planned

30 years, which only consumes approximately 2Bt of the Project's

2.5Bt Ore Reserves and 6.9Bt Mineral Resource.

Process Plant

The Zanaga deposit is composed of shallow and friable hematite

zones and deeper more competent magnetite zones. The staged

development of the process plants allows for the sequential

treatment of the upper hematite ores in Stage One, followed by the

treatment of the magnetite zones in the Stage Two expansion through

the construction of a separate plant. The sequencing of the

processing of the different ores provides advantages in the

allocation of capital as well as the reduction of technical

risk.

Stage One Process Plant

A single process plant has been designed to treat the shallow

hematite ore types to produce 12Mtpa of a 66% Fe content pellet

feed concentrate with low impurities (approximately 4% combined

silica and alumina). The plant will utilise a gravity separation

circuit with flotation to treat feed grades of 30% to 50% iron. The

base case flowsheet consists of semi-autogenous mills and two

spiral circuits, followed by further size reduction and final

separation through flotation. Due to the fact that the operation

will be processing higher grade ores in the initial years the Stage

One plant will be able to produce at a rate of 13.2Mtpa during the

first five years of operation, which will subsequently reduce to

12Mtpa for the remaining mine life (see pipeline section

below).

Stage Two Process Plant

Stage Two targets the treatment of the deeper magnetite ore

types/layers using an autogenous milling circuit followed by

regrinding and magnetic separation using low intensity magnetic

separation equipment. The second process plant will produce an

additional 18Mpta of 68.5% Fe content pellet feed concentrate with

similarly low impurities as Stage One. It is envisaged that this

will be blended with the Stage One product to produce a total

30Mtpa of 67.5% Fe pellet feed, however there is an option to sell

two distinct products.

Tailings

The design of the Project's tailings storage facility

accommodates international best practice including requirements for

the safe, efficient, and environmentally acceptable disposal of the

tailings waste products.

Two main tailings dams will be constructed during the Project's

30 year LOM, the timing and scale of which will be dependent on the

decision to proceed with the Stage Two expansion. In Stage One the

two dams will provide storage for a tailings mine life tonnage of

664Mt. In a scenario where Stage Two is developed the two dams will

contain a tailings mine life tonnage of 1,338Mt.

Pipeline

The transport option considered in the FS is a 366km slurry

pipeline from the Project site to a port facility at Pointe

Indienne, 9km north of the existing port of Pointe-Noire. Stages

One and Two of the Project will involve the construction of

separate pipelines, running along the same pipeline route.

The Stage One pipeline will have a diameter of 500mm which will

be sufficient to transport 12Mtpa over the 30 year mine life. The

Stage One pipeline has been designed to accommodate a higher

production level of 13.2Mtpa in the first five years of operation

through the inclusion of a corrosion allowance and thicker initial

pipeline wall to accommodate the increased pumping pressure

associated with this capacity. This is in line with the higher

initial production rate of the Stage One process plant.

To pump the slurry from the mine site to the port, one primary

pumping station at the mine site and a further intermediate pumping

station will be constructed, the capacities of which will be

increased for the Stage Two expansion.

In Stage Two the pipeline will require a diameter of 600mm to

transport an additional 18Mtpa, increasing total production

capacity to 30Mtpa.

Port Infrastructure and Development

Currently there is no suitable bulk material handling port

facility in the RoC. In March 2013 the RoC signed a Memorandum of

Understanding with China Communications Construction Company

("CCCC"), and its subsidiary China Road and Bridge Corporation

("CRBC"), for the development of a new multi-user port facility 9km

north of the existing port of Pointe-Noire at Pointe Indienne,

including a deepwater bulk export facility for the iron ore

industry. CRBC is in the process of completing a feasibility study

on this port development.

The FS provides for the construction of new "on-shore" portside

facilities and infrastructure at Pointe Indienne, including a

filter plant and stockyard, which will be owned and operated by the

Zanaga Project and will be located within the proposed new

multi-user port facility. The FS economics have been based on the

"marine" port area and infrastructure required by the Zanaga

Project being a third party facility with a capital charge based

upon the estimated capital for the construction of such required

port area.

To cover all eventualities, the Zanaga Project FS also

incorporates a design for a staged marine port development to suit

the Project's production profile. This includes a Stage One

transhipping solution and Stage Two direct loading port solution,

which are described below. In other words, the Project can proceed

with a multi-user, state sponsored mineral port development, which

is both the Project and the RoC's preference, however, the Project

also has the option of a stand alone interim development which

remains both practical and attractive.

In the event that the marine infrastructure is constructed by

the Zanaga Project, and not by a third party, the capital charge

and associated return would be transferred to the Zanaga Project,

with minimal change to overall economics.

In either scenario, finalisation of a port access agreement with

the RoC will be a key objective prior to taking a construction

decision.

Stage One Port and Facilities

The basis for the "marine" infrastructure required for Stage One

is a relatively shallow berth jetty for self-unloading shuttle

ships to serve a transhipping operation for loading of capesize

ocean going vessels in deeper water.

The shuttle distance to deepwater suitable for capesize vessels

up to 250k DWT is three nautical miles. The complete transhipping

cycle is approximately 10 hours which enables a loading rate of up

to 60,000 tonnes per day.

The Project's planned on-shore port facilities consist of three

main areas: process plant and ponds, stockyard and support

infrastructure. The filter plant and stockyard is designed to

dewater the pipeline concentrate to 8% moisture before stockpiling

ready for export. The stockpile is covered to ensure that the

pellet feed product is not exposed to rain and will not exceed the

transportable moisture limit.

Stage Two Port and Facilities

To handle the increased production from Stage Two, the Project

envisages that the marine facility will be expanded into a deep

water port with direct loading capability of capesize ocean going

vessels.

The relevant on-shore portside facilities would be expanded to

accommodate the 30Mtpa capacity, including the installation of a

second covered stockpile. Such facilities will be expanded to

de-water and handle an additional 18Mtpa of concentrate.

Additionally, space has been proposed within the port boundary

area design for the development of possible future pelletisation

plants, which may be considered an opportunity by potential

partners for the Project.

Power

The power sector in the RoC has seen significant investment over

the past five years, including construction of new power plants and

extension and rehabilitation of the transmission grid. ENI has

constructed and commissioned the first 300MW phase of a gas fired

power station at Djeno, near Pointe-Noire. Plans are in place to

expand capacity to 450MW, and ultimately 900MW.

In addition to this, there are multiple options for new

hydro-electric generation projects. The RoC has potential for up to

3,000MW of power generated from hydro-electric schemes and the

Government has confirmed its intention to develop these as the next

stage of generation.

Power Supply

The initial Stage One power demand totals 100MW, with 90MW at

the mine site, mostly consumed by the process plant facilities, and

10MW for the Project's port site facilities which can be supplied

by existing and planned power generation capacity in the country.

The intermediary slurry pump station is assumed to include a local

diesel power generation plant, however there remains the

opportunity that this could also be connected to the grid in the

future.

Connection points to the current 220kV transmission network are

available within 160km and 200km of a proposed new transmission

line to the east and south of the mine site respectively. The

proposed new port site area at Pointe Indienne lies within 15km of

a potential connection point to the existing 220kV network. For

Stage One the options exist for a power offtake agreement to be

concluded directly with the government power agency ("SNE") or with

an existing or new power provider.

The FS is based upon power being supplied at the mine site based

on the current national electrical tariff rates. This is considered

a conservative assumption given the significance of the Zanaga

Project as a base load consumer. The strategy to connect the

Project to the national network gives the potential for provision

of regional power in the vicinity of the mine area. The Zanaga

Project is committed to cooperate with the RoC government to ensure

the Project's development is coordinated with regional power

development.

The Stage Two development increases the power demand to

approximately 230MW at the mine site and 16MW for the Project's

facilities at the proposed new port. The increased mine site demand

cannot be supported by the existing network and will require

significant new generation and transmission infrastructure. The

timing of the Stage Two development will need to be co-ordinated

with the availability of power and aligned with the envisaged major

power infrastructure developments that are planned. If the required

power is not available for Stage Two, alternative solutions,

including the construction of a separate power plant will be

required.

Capital Costs

The FS has demonstrated significant advantages from the staged

development approach. The sequential development of the Project and

resultant staged capital profile provides major improvements on the

previous Pipeline PFS capital cost estimate of US$7.5bn for a

single stage 30Mtpa development, announced in November 2012.

The staged development FS has reduced initial development costs

to US$2.2bn and significantly lowered capital and execution risk,

while providing a pathway to achieving the same 30Mtpa production

scale presented by the Pipeline PFS.

Total Stage One capital expenditures are estimated to be

US$2.2bn, with US$1.2bn of direct costs and US$1bn of indirect

costs and contingency.

Total Stage Two capital expenditures are estimated to be

US$2.5bn, with US$1.5bn of direct costs and US$1bn of indirect

costs and contingency.

Capital cost estimate (US$m)

Stage Stage

One Two

Front End Engineering (FEED) 22 11

---------------------------------------- ------ ------

Pre-Production 23 -

Mine Area 614 814

---------------------------------------- ------ ------

Transport Corridor 399 467

Port Yard Facilities 173 243

---------------------------------------- ------ ------

Total Direct Costs 1,231 1,535

Construction Indirects & Owner's

costs 529 353

---------------------------------------- ------ ------

Engineering Procurement & Construction

Management (EPCM) 203 236

Contingency 256 365

---------------------------------------- ------ ------

Total Costs 2,219 2,489

---------------------------------------- ------ ------

Notes:

Stage One capital costs have been estimated to an FS level of

definition.

The Stage Two costs are supported by a lower level of

engineering (PFS level) but significantly leverages the work

completed for the Stage One development.

Cost escalation is excluded from the capital cost estimate. The

capital cost estimate assumes the use of a third party port

facility at Pointe-Indienne.

Operating Costs

The average LOM production costs of the Zanaga Project are

highly competitive for both Stage One on a stand alone basis and

Stage Two. The LOM annual cash cost is US$30 per dry metric tonne

("dmt") excluding royalties and freight. Cash costs are lower in

years 1 - 8 at US$28/dmt FOB (including royalty) driven by the very

low strip ratio, higher feed grade and higher plant recovery.

Stage One LOM CFR costs to China are estimated at US$57/t,

ensuring robust free cash flow generation even in a low price

environment. Stage One CFR costs for years 1 - 8 are estimated at

US$53/dmt. If the Stage Two expansion production commences in Year

9 unit operating costs decrease. The increased efficiency of the

expansion case is attributable to economies of scale in all the

supporting areas and infrastructure. Average Stage Two cash cost is

US$23 per dry metric tonne excluding royalties and freight, with

average CFR costs to China, including royalty, estimated at

US$50/t.

The Project's forecast low operating costs would place Zanaga in

a highly competitive position on the seaborne iron ore trade cost

curve, especially given the high iron grade of the products. The

ability to maintain the Project's bottom quartile operating cost

position, presented by the previous Pipeline PFS estimates, under

the revised staged development approach, has been a significant

outcome of the FS.

Operating cost estimate (US$/dmt)

Stage One Stage Two

30 Year Avg 9 - 30 Year

Avg

Mining and Processing 19.1 17.4

Pipeline 2.4 2.1

Port Area 6.5 2.7

G&A 2.0 0.9

Cash Cost 29.9 23.1

Royalty 2.3 2.5

Cost - FOB 32.1 25.7

Shipping 24.5 24.5

Cost - CFR China

(not adjusted for product

premium received) 56.6 50.1

---------------------------- ------------- -------------

Notes: The figures shown are rounded; they may not sum to the

subtotals shown due to the rounding used.

The capital cost estimate assumes the port is built by a third

party with a capital charge being included in the operating

cost.

The capital charge is based on the capital cost of the port

development and allows for a theoretical 12% unlevered real rate of

return to the port investor over the life of the Project.

Economic returns

The Zanaga Project economic outcomes have been reviewed across a

range of long term IODEX 62% Fe prices from US$80/dmt to

US$140/dmt. A summary of the unlevered internal rates of return

("IRR") is presented below.

The Stage One operation demonstrates the potential to

self-finance the Stage Two expansion through project cash flows,

thereby limiting the level of additional equity required from the

Project owners, while ultimately resulting in the same 30Mtpa

production scale outlined by the Pipeline PFS.

Stage One returns

Iron Ore Price

(62% IODEX) US$/dmt 80 90 100 110 120 130 140

================== ========= ====== ====== ====== ====== ====== ====== ======

Internal Rate of

Return % 12.7% 17.1% 21.0% 24.7% 27.9% 31.1% 34.1%

================== ========= ====== ====== ====== ====== ====== ====== ======

Stage One and Two returns

Iron Ore Price

(62% IODEX) US$/dmt 80 90 100 110 120 130 140

================== ========= ====== ====== ====== ====== ====== ====== ======

Internal Rate of

Return % 15.0% 19.0% 22.3% 25.6% 28.8% 31.7% 34.6%

================== ========= ====== ====== ====== ====== ====== ====== ======

Zanaga Project Product Specification

The indicative product specifications, which will vary over the

LOM, for the Zanaga Project are as follows:

Pellet Feed Specification

Stage Stage Two expansion Stage One

One & Two combined

12Mtpa 18Mtpa 30Mtpa

Hematite Magnetite Blend

Fe % 66.0 68.5 67.5

FeO% 1-5 26-29 17-19

SiO(2)

% 3.0 3.3-3.7 3.2-3.4

Al(2)

O(3)

% 0.8 0.3-0.4 0.5-0.6

CaO% < 0.01 0.2 0.12

MgO% 0.04 0.2 0.14

P 0.04 < 0.01 0.02

S 0.014 0.015 0.015

Na(2)

O 0.015 0.015 0.015

K(2)

O < 0.01 0.036 0.025

Mn 0.11 0.10 0.10

TiO(2) 0.07 0.02 0.04

V < 0.01 < 0.01 <0.01

1.6

LOI to 2.0 -2.9 to -3.2 -0.9 to -1.3

-------- --------- -------------------- ----------------

Product size : approximately 80% passing 45 microns (suitable

for direct feed to pellet plants)

The Stage One operation will produce a hematite concentrate,

while the Stage Two expansion will produce 18Mtpa of incremental

magnetite concentrate. While the intention is to market a blended

product, it will be possible to keep all or part of the products

separate.

Product Pricing and Adjustments

The Zanaga pellet feed product is expected to receive a

significant price premium relative to the 62% Fe IODEX reference

price. This will be supported by its superior iron grade, low level

of impurities, and its product sizing being suitable for direct

feed to pellet plants.

Shipping

The Stage One transhipping solution and the Stage Two direct

loading port solution as proposed by the FS will be able to load

capesize vessels up to 250kDWT. It has been assumed that the

average size vessel will be approximately 180kDWT.

The shipping distance between Pointe-Noire and Qingdao is

approximately 9,700 nautical miles. Based on the above vessel and

port assumptions a cost of US$22.50 per wet metric tonne has been

assumed which is equivalent to approximately US$24.50 on a dry

basis for the pellet feed product at 8% moisture. By way of

comparison the distance from Tubarao, Brazil to Qingdao is

approximately 11,100 nautical miles.

Project Schedule

The indicative Stage One Development Project Schedule is shown

below, subject to a positive investment decision at the appropriate

time.

Activity Key Date

-------------------------------------------- ------------

Mining Licence Application Submitted May 2014

-------------------------------------------- ------------

Preparation for Front End Engineering H2 2014

(FEED)

-------------------------------------------- ------------

FEED 2015

-------------------------------------------- ------------

Finalise all necessary licences, approvals, 2015

infrastructure access & user agreements,

and financing

-------------------------------------------- ------------

Construction Phase 2016 - 2018

-------------------------------------------- ------------

Mining Commences Q4 2018

-------------------------------------------- ------------

First Shipment Q1 2019

-------------------------------------------- ------------

The Stage Two development is subject to a separate investment

decision and, if proceeded with, has a similar three year

construction period to the Stage One development. The Stage Two

development has nominally been scheduled to commence five years

following first production from Stage One. Based on this nominal

schedule, production from Stage Two is targeted to commence in Q1

2027 and, depending on prevailing iron ore prices, this expansion

demonstrates the potential to be self-financed by existing project

cash flows.

Permitting

The Mining Licence Application has been submitted to the RoC

Ministry of Mines and the application for the Environmental Permit

for Stage One has also been lodged with the RoC Ministry of

Environment. Negotiations of the Mining Convention which will

establish the Project's fiscal regime are in progress.

Potential DSO

An opportunity has been identified to supplement the Project's

pipeline pellet feed production with up to 2Mtpa of direct shipping

ore ("DSO"). The defined mineral resource includes some high grade

material that can be classified as DSO and an area of the deposit

has been identified that includes a concentration of material at

surface which can be simply crushed and screened to produce a

saleable iron ore lump and / or fines product without any

requirement for beneficiation.

Further information on the DSO opportunity will be provided

during H2 2014. Any decision to proceed will be dependent upon

confirmation of a suitable transport solution, including obtaining

access to rail and port infrastructure on acceptable terms.

Next Steps

The Project team have commenced the permitting phase and is

progressing the establishment of the Project's fiscal regime. The

Project team will shortly be engaging with international

contractors in advance of commencing FEED engineering. The JV

partners, supported by the Project team are actively pursuing the

funding round initiative in connection with the financing of Stage

One and preparatory work for this stage.

Financial Review

Results from operations

The financial statements contain the results for the Group's

fourth full year of operations following its incorporation on 19

November 2009. The Group made a profit in the year of US$4.0m

(2012: profit US$0.5m). The profit for the year comprised:

2013 2012

US$000 US$000

------------------------------------------------------------------- ------- -------

General expenses (5,161) (6,020)

Net foreign exchange (loss)/gain (32) 1,673

Share-based payments (397) (723)

Share of loss of associate (1,202) (765)

Interest income 97 154

------------------------------------------------------------------- ------- -------

Loss before tax (6,695) (5,681)

Tax (58) (47)

Currency translation - (36)

Share of other comprehensive income of associate -foreign exchange 10,706 6,250

------------------------------------------------------------------- ------- -------

Total comprehensive income 3,953 486

------------------------------------------------------------------- ------- -------

General expenses of US$5.2m (2012: US$6.0m) consists of US$2.2m

professional fees (2012: US$3.5m), US$0.6m Directors' fees (2012:

US$0.5m) and US$2.4m (2012: US$2.0m) of other general operating

expenses.

The share-based payment charge reflects the expense associated

with the grant of options to ZIOC's Directors and senior managers

under ZIOC's long-term incentive plan ("LTIP") and to the expense

associated with the grant of share options to one of ZIOC's

consultants. Further details of the LTIP and options granted can be

found in the notes to the financial statements.

The 2013 reductions in LTIP costs in the Company are the result

of the previously unvested remaining options issued under the 2010

LTIP scheme having vested during 2013.

The share of loss of associate reflected above relates to ZIOC's

investment in the Project (through the Jumelles group) which

generated a loss of US$1.2m in the year to 31 December 2013 (2012:

loss US$0.7m). US$1.1m restructuring costs were incurred during the

year (2012: US$nil)

During the year Jumelles spent US$45.4m (2012 US$74.7m) on

exploration (includes currency gain US$10.7m (2012: gain US$6.3m)),

increasing its capitalised exploration assets to US$286.9m (2012:

US$241.5m). The 2013 $10.7m currency gain of associate Jumelles,

results from the strengthening against the US$, of Jumelles

subsidiary MPD Congo's local currency Fcfa (Symbol XAF - Euro tied

currency), where the Project asset is held.

Financial Position

ZIOC's Net Asset Value (NAV) of US$232.1m (2012: US$228.1m)

comprises of US$208.5m (2012: US$189.0m) investment in Jumelles,

US$24.0m (2012: US$40.4m) of cash balances and US$0.5m (2012:

US$1.4m) of other net current liabilities.

2013 2012

US$000 US$000

------------------------------ ------- -------

Investment in associate 208,513 189,009

Fixed Assets 62 80

Cash 24,009 40,383

Other net current liabilities (455) (1,365)

------------------------------ ------- -------

Net assets 232,129 228,107

------------------------------ ------- -------

Cost of investment

The investment in associate relates to the carrying value of the

investment in Jumelles which as at 31 December 2013 owned 100% of

the Project. The carrying value of this investment has increased by

US$19.5m (2012 increase US$6.0m) due to the US$10.0m funding

provided by the Company under the JVA Supplemental Agreement (2012:

US$0.5m under agreement to 50% fund the survey of an additional

land area), and the Jumelles Total Comprehensive Income of US$9.5m

(2012: Income US$5.5m).

As at 31 December 2013, Jumelles had aggregated assets of

US$299.2m (2012: US$266.5m) and aggregated liabilities of US$8.4m

(2012: US$8.9m). Assets consisted of US$286.9m (2012: US$241.5m) of

capitalised exploration assets, US$7.4m (2012: US$10.4m) of other

fixed assets, US$nil related party receivable from XPS (2012:

US$8.5m), US$4.0m cash (2012: US$4.9m) and US$0.9m other assets

(2012: US$1.2m). A total of US$45.4m (2012: US$74.7m) of

exploration costs were capitalised during the year.

Cash flow

Cash balances decreased by US$16.4m during 2013 (2012 decrease

US$4.7m), net of interest income US$0.1m (2012 US$0.2m) and a

foreign exchange loss of US$0.03m (2012 gain US$1.6m) on bank

balances held in UK Sterling. Additional investment in Jumelles

required under the Supplemental Agreement (outline details in Note

1 to the financial statements) utilised US$10.0m (2012: US$nil),

operating activities utilised US$6.1m (2012: US$5.5m), and share

repurchases utilised US$0.3m (2012: US$0.4m).

Fundraising activities

There were no fundraising activities during 2013 (2012:

nil).

Reserves & Resource Statement

As part of the FS, CSA Global (UK) Ltd, has produced an updated

Mineral Resource Estimate for the Zanaga Project as at 30 September

2013.

The Project has defined a 6.9bn tonne Mineral Resource and a

2.5bn tonne Ore Reserve, reported in accordance with the 2004 JORC

Code, and defined from only 25km of the 47km orebody

identified.

Ore Reserve Statement

The Ore Reserve Statement is a key milestone for the Project and

supports the economic viability of mining at least 2.5bn tonnes of

the 4.7bn tonnes Measured and Indicated Mineral Resource. The Ore

Reserve estimate was undertaken by independent consultants, CSA

Global Pty Ltd ("CSA") and is based on the 30Mtpa Pipeline PFS

which is based on the August 2012 resource estimate, not the 2013

updated resource estimate update presented below.

As stipulated by the 2004 JORC Code, a Probable Ore Reserve is

of sufficient quality to serve as the basis for a decision on the

development of the deposit. Based on the studies performed a mine

plan has been determined that is technically achievable and

economically viable. The level of definition and size of the

reserves will be the subject of further review as the Project

progresses.

Ore Reserve Statement (1 November 2012)

Classification Tonnes (Mt) Fe (%)

Probable Ore Reserves 2,500 34

Proved Ore Reserves - -

Total Ore Reserves 2,500 34

======================= ============ =======

Notes:

1. Metal Price Assumptions US$85/dmt FOB for 68% Fe product

(equivalent to US$77.5/dmt for 62% Fe product) at Pointe Noire,

Republic of Congo, in line with consensus pricing.

2. Discount Rate 10%

3. Mining Dilution 5%

4. Mining Recovery 95%

Revised Mineral Resource Statement (30 September 2013)

The Project has defined a 6.9bn tonne Mineral Resource,

inclusive of Ore Reserves, reported in accordance with the 2004

JORC Code, of which 69% is in the Measured & Indicated

category.

Classification Tonnes Fe SiO(2) Al(2) P (%) Mn (%) LOI

(Mt) (%) (%) O(3) (%)

(%)

Measured 2,330 33.7 43.1 3.4 0.05 0.11 1.46

Indicated 2,460 30.4 46.8 3.2 0.05 0.11 0.75

Inferred 2,100 31 46 3 0.1 0.1 0.9

Total 6,900 32 45 3 0.05 0.11 1.05

================ ======= ===== ======= ====== ====== ======= =====

Note: The figures shown are rounded; they may not sum to the

subtotals shown due to the rounding used.

Resource modelling for the Zanaga Project has been updated for

the entire resource area using additional drilling data and

geological interpretation to produce a resource within a

lithological boundary (and therefore at 0% Fe cut-off) as at 30

September 2013.

The Mineral Resource was estimated as a block model within

constraining wireframes based upon logged geological boundaries.

Tonnages and grades have been rounded to reflect appropriate

confidence levels and for this reason may not sum to totals

stated.

Geological Summary

The Zanaga Iron Ore deposit is located within a North-South

oriented (metamorphic) Precambrian greenstone belt in the eastern

part of the Chaillu Massif in South Western Congo. From airborne

geophysical survey work, and morphologically, the mineralised trend

constitutes a complex elongation in the North-South direction, of

about 48 km length and 0.5 to 3 km width.

The ferruginous beds are part of a metamorphosed,

volcano-sedimentary Itabirite/BIF and are inter-bedded with

amphibolites and mafic schists. It exhibits faulted and sheared

contacts with the crystalline basement. As a result of prolonged

tropical weathering the BIF has developed a distinctive supergene

iron enrichment profile.

At surface there is sometimes present a high grade (+60% Fe)

canga of apparently limited thickness (<5m) capping a

discontinuous, soft, high grade, iron supergene zone of

structure-less hematite/goethite of limited thickness (<7m). The

base of the high grade supergene iron zone grades quickly at depth

into a relatively thick, leached, well-weathered to moderately

weathered friable hematite Itabirite with an average thickness of

approximately 25 metres and grading 45-55% Fe.

The base of the friable Itabirite zone appears to correlate with

the moderately weathered/weakly weathered BIF boundary, and fresh

BIF comprises bands of chert and magnetite/grunerite layers.

Competent Persons

The information that relates to Ore Reserves is based on

information compiled by Kent Bannister, of CSA Global Pty Ltd. Kent

Bannister takes overall responsibility for the Report as Competent

Person. He is a Fellow of The Australasian Institute of Mining and

Metallurgy and has sufficient experience, which is relevant to the

style of mineralisation and type of deposit under consideration,

and to the activity he is undertaking, to qualify as a Competent

Person in terms of the JORC Code. The Competent Person, Mr Kent

Bannister, has reviewed the Ore Reserve Statement and given his

permission for the publication of this information in the form and

context within which it appears.

The Mineral Resource statement is reported in accordance with

the terms and definitions included in the Australasian Code for

Reporting of Exploration Results, Mineral Resources and Ore

Reserves (JORC Code 2004 edition) as at 29 August 2012. The

information in the Report that relates to Mineral Resources is

based on information compiled by Malcolm Titley, BSc MAusIMM MAIG,

of CSA Global (UK) Ltd. Malcolm Titley takes overall responsibility

for the Report as Competent Person. He is a Member of the

Australasian Institute of Mining and Metallurgy ("AUSIMM") and has

sufficient experience, which is relevant to the style of

mineralisation and type of deposit under consideration, and to the

activity he is undertaking, to qualify as a Competent Person in

terms of the JORC Code. The Competent Person, Mr Malcolm Titley,

has reviewed this Mineral Resource statement and given his

permission for the publication of this information in the form and

context within which it appears.

Definition of JORC Code

The 2004 Australasian Code for Reporting of Exploration Results,

Mineral Resources and Ore Reserves as published by the Joint Ore

Reserves Committee of the Australasian Institute of Mining and

Metallurgy, Australian Institute of Geoscientists and Minerals

Council of Australia.

Principal Risks & Uncertainties

Risks and uncertainties

The principal risks facing ZIOC are set out below. A summary of

risks associated with ZIOC was set out in Part V of ZIOC's AIM

Admission Document of 18 November 2010. Risk assessment and

evaluation is an essential part of the Group's planning and an

important aspect of the Group's internal control system.

The principal business of ZIOC currently comprises managing

ZIOC's interest in the Zanaga Project, which is majority controlled

at both a shareholder and Director level by Glencore, and

monitoring the development of the Project.

The successful development of the Zanaga Project depends on

adequate infrastructure: a transportation system through which it

can deliver future iron ore product to a port for onward export by

sea.

Risks relating to the agreement with Glencore

Under the amended JVA with Glencore, Glencore has an obligation

to solely fund the Work Programme over the period 1 January 2013 to

31 December 2014 (but taking into account the Company's

contribution of US$17m). Thereafter there is no obligation on the

Company or Glencore to provide further funding to Jumelles. There

is a risk that after 31 December 2014 Jumelles may be subjected to

funding constraints and this could have an adverse impact upon the

Project.

Risks relating to future development and funding

The future development of the mine and related infrastructure

and consequently the future funding requirements of Jumelles will

be determined by the Board of Jumelles. There can be no certainty

that the board of Jumelles will approve the construction of the

mine and related infrastructure, including the taking of

preparatory steps associated with the construction of the mine and

related infrastructure, such as front end engineering and design.

The Board of Jumelles is controlled by Glencore, and as such there

are risks associated with the future development of the Project and

the future funding requirements not being within the control of

ZIOC.

If construction of the mine and related infrastructure proceeds

(including any preparatory steps associated with the construction

of the mine and related infrastructure), and ZIOC elects to fund

its pro rata equity share of construction capital expenditure,

there is no certainty as to its ability to raise the required

finance or the terms on which such finance may be available. If

ZIOC raises additional funds through further issuances of

securities, the holders of ordinary shares could suffer significant

dilution, and any new securities that ZIOC issues could have

rights, preferences and privileges superior to those of the holders

of the ordinary shares.

Exploration and mining risks

The business of exploration for, and identification of, iron ore

deposits is speculative and involves a high degree of risk. Future

results, including resource recoveries and work programme plans and

schedules, will be affected by changes in market conditions,

commodity price levels, political or regulatory developments,

timely completion of exploration programme commitments or projects,

the outcome of commercial negotiations and technical or operating

factors. Even where there are economically recoverable deposits,

delays in the construction and commissioning of mining projects or

other difficulties, including relating to infrastructure and/or

permitting and/or financing, may make the deposits difficult to

exploit or may delay exploitation of deposits.

Risk relating to Ore Reserves estimation

Ore Reserves estimates include diluting materials and allowances

for losses, which may occur when the material is mined. Appropriate

assessments and studies have been carried out, and include

consideration of and modification by realistically assumed mining,

metallurgical, economic, marketing, legal, environmental, social

and governmental factors. These assessments demonstrate at the time

of reporting that extraction could reasonably be justified. Ore

Reserve estimates are by their nature imprecise and depend, to a

certain extent, upon statistical inferences and assumptions which

may ultimately prove unreliable.

Transportation and other infrastructure

The successful development of the Project depends on the

existence of adequate infrastructure and the terms on which the

Project can own, use or access such infrastruture. The region in

which the Project is located is sparsely populated and difficult to

access. Central to the Zanaga Project becoming a commercial mining

operation is access to a transportation system through which it can

transport future iron ore product to a port for onward export by

sea. In order to achieve this it will be necessary to access a port

at Pointe-Indienne, which is still to be constructed, and build a

pipeline and on-shore facilities at the proposed new port for which

permits, authorisations and land rights will be required and

substantial finance will be required.

In relation to the pipeline and facilities at the proposed new

port and (to the extent needed) other infrastructure, the necessary

permits, authorisations and access, usage or ownership rights have

not yet been obtained. Failure to construct the proposed pipeline

and/or facilities at the proposed port and/or other needed

infrastructure or a failure to obtain access to and use of other

needed infrastructure or a failure to do this in an economically

viable manner or in the required timescale could have a material

adverse effect on the Project.

The availability of reliable and continuous delivery of

sufficient quantity of power to the Project at an affordable price

will also be a significant factor on the costs at which iron ore

may be produced and so may impact on the attractiveness and

viability of the Project.

Iron ore prices, markets and products

The principal business of the Zanaga Project is the exploration

for, and the planned exploitation of, iron ore. The ability to

raise finance and the Project's future financial performance is

largely dependent on movements in the price of iron ore. Although

the Feasibility Study identifies the product from the Project and

the potential demand for such product there are no assurances that

the demand for the Project's product will be sufficient in quantity

or in price to ensure the economic viability of the Project.

Host country related risks

The operations of the Zanaga Project are located entirely in the

Republic of Congo. These operations will be exposed to various

levels of political, regulatory, economic, taxation, environmental

and other risks and uncertainties. As in many other countries,

these (varying) risks and uncertainties include, but are not

limited to: political, military or civil unrest; fluctuations in

global economic and market conditions impacting on the Congolese

economy; terrorism; hostage taking; extreme fluctuations in

currency exchange rates; high rates of inflation; labour unrest;

nationalisation; changes in taxation; illegal mining; restrictions

on foreign exchange and repatriation. In addition, the Republic of

Congo is an emerging market and, as a result, is generally subject

to greater risks than in the case of more developed markets. These

risks could be relevant both as regards day-to-day operations and

the raising of debt and equity finance for the Project.

Risks relating to the Project's licences

The Project's exploration licences are now fully extended. An

application has been made for a mining licence. There can be no

guarantee that the mining licence will be granted or, if it is, the

terms on which it is granted.

A mine operator to whom an exploitation licence has been granted

is also required to enter into a mining agreement with the

government of the Republic of Congo. On the grant of any mining

licence to the Project, it will enter into a mining agreement with

the government, which must specifically address a number of issues,

including coordination of operations and taxation. The terms of the

Mining Convention are the subject of current negotiations; there

can be no guarantee as to the outcome of such negotiations and the

eventual terms of such agreement.

The holder of an exploitation licence is required to incorporate

a Congolese company to be the operating entity and the Congolese

Government is entitled to a free participatory interest in projects

which are at the production phase. This participation cannot be

less than 10%. There is, therefore, a risk that the Government will

seek to obtain a higher participation in the Project.

Risks relating to financing

Although the recently completed Feasibility Study confirms the

potential technical and economic viability of the Zanaga Project,

there can be no guarantee that funding for carrying out the Project

or any stage of it will be forthcoming.

Risks relating to outsourcing

The recently completed Feasibility Study envisages that certain

aspects of the Zanaga Project will be carried out by third parties

pursuant to contracts to be negotiated with such third parties.

There is a risk that agreement might not be reached with such third

parties or that the terms of any such agreement are more stringent

than currently anticipated; this could adversely impact upon the

Project and/or the proposed timescale for carrying out the

Project.

Financial Statements

Consolidated statement of comprehensive Income

for year ended 31 December 2013

2013 2012

Note US$000 US$000

-------------------------------------------------------------------------------- ---- ------- -------

Administrative expenses (5,590) (5,070)

Share of loss of associate (1,202) (765)

-------------------------------------------------------------------------------- ---- ------- -------

Operating loss 4 (6,792) (5,835)

Interest income 97 154

-------------------------------------------------------------------------------- ---- ------- -------

Loss before tax (6,695) (5,681)

Taxation 5 (58) (47)

-------------------------------------------------------------------------------- ---- ------- -------

Loss for the year (6,753) (5,728)

-------------------------------------------------------------------------------- ---- ------- -------

Foreign exchange translation - foreign operations - (36)

Share of other comprehensive income of associate - foreign exchange translation 10,706 6,250

-------------------------------------------------------------------------------- ---- ------- -------

Other comprehensive income 10,706 6,214

-------------------------------------------------------------------------------- ---- ------- -------

Total comprehensive income 3,953 486

-------------------------------------------------------------------------------- ---- ------- -------

Loss per share (basic and diluted) (Cents) 12 (2.4) (2.1)

The loss for the year is attributable to the equity holders of

the parent company.

Consolidated statement of changes in equity

for year ended 31 December 2013

Foreign

currency

Share Retained translation Total

capital earnings reserve equity

US$000 US$000 US$000 US$000

--------------------------------------- ------- -------- ----------- -------

Balance at 1 January 2012 264,993 (29,801) (7,943) 227,249

Consideration for share-based payments 755 - - 755

Share buy backs (383) - - (383)

Loss for the year - (5,728) - (5,728)

Other comprehensive income - - 6,214 6,214

--------------------------------------- ------- -------- ----------- -------

Total comprehensive loss - (5,728) 6,214 486

--------------------------------------- ------- -------- ----------- -------

Balance at 31 December 2012 265,365 (35,529) (1,729) 228,107

--------------------------------------- ------- -------- ----------- -------

Balance at 1 January 2013 265,365 (35,529) (1,729) 228,107

Consideration for share-based payments 397 - - 397

Share buy backs (328) - - (328)

Loss for the year - (6,753) - (6,753)

Other comprehensive income - - 10,706 10,706

--------------------------------------- ------- -------- ----------- -------

Total comprehensive loss - (6,753) 10,706 3,953

--------------------------------------- ------- -------- ----------- -------

Balance at 31 December 2013 265,434 (42,282) 8,977 232,129

--------------------------------------- ------- -------- ----------- -------

Consolidated balance sheet

for year ended 31 December 2013

2013 2012

Note US$000 US$000

---------------------------------------------------- ---- -------- --------

Non-current assets

Property, plant and equipment 6a 62 80

Investment in associate 6b 208,513 189,009

---------------------------------------------------- ---- -------- --------

208,575 189,089

---------------------------------------------------- ---- -------- --------

Current assets

Other receivables 7 165 282

Cash and cash equivalents 8 24,009 40,383

---------------------------------------------------- ---- -------- --------

24,174 40,665

---------------------------------------------------- ---- -------- --------

Total Assets 232,749 229,754

---------------------------------------------------- ---- -------- --------

Current liabilities

Trade and other payables 9 (620) (1,647)

---------------------------------------------------- ---- -------- --------

Net assets 232,129 228,107

---------------------------------------------------- ---- -------- --------

Equity attributable to equity holders of the parent

Share capital 10 265,434 265,365

Retained earnings (42,282) (35,529)

Foreign currency translation reserve 8,977 (1,729)

---------------------------------------------------- ---- -------- --------

Total equity 232,129 228,107

---------------------------------------------------- ---- -------- --------

Consolidated cash flow statement

for year ended 31 December 2013

2013 2012

Note US$000 US$000

------------------------------------------------- ---- -------- -------

Cash flows from operating activities

Total comprehensive income for the year 3,953 486

Adjustments for:

Depreciation 29 23

Interest receivable (97) (154)

Taxation expense 58 47

Decrease/(Increase) in other receivables 117 (178)

(Decrease)/Increase in trade and other payables (1,027) 761

Net exchange gain/(loss) 32 (1,673)

Share of Total Comprehensive Income of associate (9,504) (5,485)

Share-based payments 397 723

Tax paid (51) (27)

------------------------------------------------- ---- -------- -------

Net cash from operating activities (6,093) (5,477)

------------------------------------------------- ---- -------- -------

Cash flows from financing activities

Repurchase of own shares (328) (383)

------------------------------------------------- ---- -------- -------

Net cash from financing activities (328) (383)

------------------------------------------------- ---- -------- -------

Cash flows from investing activities

Interest received 97 154

Acquisition of property, plant and equipment (11) (90)

Investment in associate (10,000) (515)

------------------------------------------------- ---- -------- -------

Net cash from investing activities (9,914) (451)

------------------------------------------------- ---- -------- -------

Net decrease in cash and cash equivalents (16,335) (6,311)

Cash and cash equivalents at beginning of year 40,383 45,047

Effect of exchange rate difference (39) 1,647

------------------------------------------------- ---- -------- -------

Cash and cash equivalents at end of year 8 24,009 40,383

------------------------------------------------- ---- -------- -------

The notes form an integral part of the financial statements.

Notes to the financial statements

1 Business information and going concern basis of

preparation

Background

Zanaga Iron Ore Company Limited (the "Company"), was

incorporated on 19 November 2009 under the name of Jumelles

Holdings Limited. The Company changed its name on 1 October 2010.

The Company is incorporated in the British Virgin Islands ("BVI")

and the address of its registered office, is situated at Coastal

Building, 2nd Floor, Wickham's Cay II, Road Town, Tortola, BVI. The

Company's principal place of business as an investment holding

vehicle is situated in Guernsey, Channel Islands.

At 31 December 2010 the Company held 100% of the share capital

of Jumelles Limited ("Jumelles") subject to the then Xstrata Call

Option (as defined below).

On 14 March 2011 the Company incorporated and acquired the

entire share capital of Zanaga UK Services Limited for US$2, a

company registered in England and Wales which provides investor

management and administration services.

In 2007, Jumelles became the special purpose holding company for

the interests of its then ultimate 50/50 founding shareholders,

Garbet Limited ("Garbet") and Guava Minerals Limited ("Guava"), in

Mining Project Development Congo SAU ("MPD Congo") which, owns and

operates 100% of the Zanaga Project (the "Project") in the Republic

of Congo (subject to a minimum 10% free carried interest in MPD

Congo in favour of the Government of the Republic of Congo).

In December 2009 Garbet and Guava contributed their then

respective 50/50 joint shareholding in Jumelles to the Company.

Garbet is majority owned by Strata Limited ("Strata"), a private

investment holding company based in Guernsey, which specialises in

the investment and development of early stage natural resource

projects in emerging markets, predominately Africa. Garbet owns

approximately 41.49% of the share capital of the Company.

Guava is majority owned by African Resource Holdings Limited

("ARH"), a BVI company that specialises in the investment and

development of early stage natural resource projects in emerging

markets. Guava owns approximately 31.83% of the share capital of

the Company.

Jumelles has three subsidiary companies, namely Jumelles M

Limited, Jumelles Technical Services (UK) Limited and MPD

Congo.

Xstrata Transaction

On 16 October 2009, Garbet and Guava and Jumelles entered into a

transaction with Xstrata (Schweiz) AG (on 3 December 2009, Xstrata

(Schweiz) AG was substituted by Xstrata Projects (pty) Limited

("Xstrata Projects")), comprising of two principal transaction

agreements (together the "Xstrata Transaction"):

-- a call option deed which gave Xstrata Projects an option to

subscribe for 50% plus 1 share of the fully diluted and outstanding

shares of Jumelles ("Majority Stake") in return for providing

funding towards ongoing exploration of the Zanaga exploration

licence area and a pre-feasibility study (the "PFS") subject to a

minimum amount of US$50 million (the "Xstrata Call Option"). Under

the terms of the Xstrata Call Option, the consideration payable by

Xstrata Projects for the option shares that would be issued by

Jumelles Limited would comprise (i) a commitment to fund all costs

to be incurred by Jumelles Limited in completing a Feasibility

Study on the Project (the "FS") (provided such amount shall be

greater than US$100 million) or to carry out such a feasibility

study at its own cost and (ii) payment of an amount (up to a

maximum of US$25 million) equal to the amount that Jumelles Limited

owes to Garbet and Guava as loans which would be used to repay the

latter; and

-- a Joint Venture Agreement which regulated the respective

rights of the Company, Jumelles and Xstrata Projects in relation to

Jumelles following exercise of the Xstrata Call Option.

Subsequently:

o Xstrata merged with Glencore on 2 May 2013 to form Glencore

Xstrata which then took the role of JV partner in place of Xstrata,

and has subsequently changed its name to Glencore plc.

o Under the terms of the Supplemental Agreement announced on 13

September 2013, the scope of the above mentioned FS was modified to

a staged development basis, and the revised basis FS was completed

in May 2014. The Supplemental Agreement also extended the work

programme beyond the conclusion of the FS, up to December 2014

(towards which the Company has agreed to contribute US$17m from

existing resources), and the Glencore call option over the

Company's remaining 50% less one share shareholding in Jumelles Ltd

has been deleted.

During 2010, the PFS progressed and following completion of

Phase I of that study Xstrata Projects countersigned a further

funding letter confirming in writing its agreement (subject to the

provisions of the Xstrata Call Option) to contribute further

funding and confirming its approval of the phase II work programme,

budget and funding amount (up to US$56.49 million) as set out in

that letter.

On 11 February 2011 Xstrata Projects exercised the Xstrata Call

Option. Having repaid the founding shareholder loans, the

outstanding elements of the call option price consideration at 31

December 2013 were the completion of the Feasibility Study and

costs thereof.

Relationship between Jumelles and its shareholders after

exercise of the Xstrata Call Option

The Company, Jumelles and Xstrata Projects agreed to regulate

their respective rights in relation to the Project following

exercise of the Call Option under the terms of the JVA. Under the

terms of the JVA, all significant decisions regarding the conduct

of Jumelles' business (other than certain protective rights which

require the agreement of shareholders holding at least 95% of the

voting rights in Jumelles) are made by the Board of Directors.

Each shareholder holding 15% or more of the votes in Jumelles

has the right to appoint a director to the Board of that company.

At any Board meeting, each such director has such number of votes

as represents the appointing shareholder's voting rights in the

general meetings of Jumelles.

As a consequence, following exercise of the Xstrata Call Option

in February 2011, Xstrata's merger with Glencore to form Glencore

Xstrata (May 2013) and the renaming of Glencore Xstrata to Glencore

(May 2014), Glencore controls Jumelles at both a shareholder and

director level and therefore controls what was the Company's sole

mineral asset, the Zanaga Project. Going forward the Company has a

strategic partnership in respect of the Project with Glencore.

Following exercise of the Xstrata Call Option, the principal

business of the Company has comprised managing its 50% less one

share interest in the Project and monitoring both the finalisation

of the pre-feasibility study and the preparation of the feasibility

study.

Future funding requirements and going concern basis of

preparation

In common with many exploration and development companies in the

mining sector, the Company raises funding in phases as its projects

develop.

Pursuant to the JVA, as amended by the Supplemental Agreement,

the staged production FS prepared by Jumelles has been finalised

and the Mining Licence Application has been submitted to the

Ministry of Mines of the Republic of Congo.

Based on its management's own internal evaluation, Jumelles

believes the proposed staged development of the Zanaga project (as

set out in the FS) offers high grade ore at competitive cost,

thereby offering an attractive rate of return, at an acceptable

level of risk, although substantial capital expenditure will be

required both at the prospective mine site and in respect of

transportation and other associated infrastructure. Revenues from

mining are not forecast to be earned for several years.

The current exploration licences, which were due to expire in

August 2014, are extended pending the outcome of the Mining Licence

Application. Based on information received and the provisions of

the Congolese Mining Code, Jumelles believes that there is a

reasonable expectation that the Mining Licence application will be

successfully completed by Q4 2014.

Jumelles has a preferred development plan. In relation to such