TIDMXLM

RNS Number : 8405T

XLMedia PLC

27 July 2022

27 July 2022

XLMedia PLC

("XLMedia" or the "Group" or the "Company")

Trading Update

&

Notice of Results

XLMedia (AIM: XLM), a leading global digital performance

publisher, connecting advertisers with consumers , today provides

the following trading update for the six months ended 30 June

2022.

Financial update

The Group expects H1 2022 revenue of approximately US$44.5

million (H1 2021: US$32.2 million) and Adjusted EBITDA of

approximately US$10.5 million (H1 2021: US$6.6 million).

The Company has traded well across the first six months of the

current financial year, buoyed by its newest vertical, US Sports,

which produced a strong performance in the period and accounted for

68% of the Group's revenue, US$30.2 million.

Trading for the current financial year is performing in line

with expectations.

Sports

The Group's Sports vertical delivered strong growth during the

period, generating revenue of US$34.0 million (H1 2021: US$11.7

million), up 191%.

The North American sports business is underpinned by the Groups

strategic acquisitions* enabling XLMedia to provide exclusive

relevant local content through the national footprint of Sports

Betting Dime and Saturday Football Inc businesses.

The opening of new regulated markets and the signing of new

media partnership agreements has allowed the US Sports business to

capitalise on the full US sports calendar, in particular the Super

Bowl, and deliver strong growth in H1 2022, with revenues of US$

30.2 million in the period (H1 2021: US$5.9 million).

There are currently 21 states in the US and one in Canada that

permit online sports betting. Ohio, the seventh largest US state in

terms of population, is expected to permit sports betting in

January 2023.

The Group's European Sports vertical delivered a solid

performance in H1 2022, with revenues of US$3.8 million.

Gaming

XLMedia's recently restructured casino and bingo vertical is

trading in line with targets, generating revenue of US$8.4 million

(H1 2021: US$12.5 million).

Gaming revenues are expected to continue to trade below historic

levels, in line with expectations, although the business is now

showing signs of stabilising, having suffered from a year-on-year

decline in tail revenue. The business has reduced its cost base to

reflect this reduction in the scale of its activities and continues

to be a cash generator for the Group.

Personal Finance

The Group's Personal Finance vertical delivered revenues of

US$0.8 million (H1 2021: US$6.6 million) and now represents 2% of

Group revenue.

The decline results from the need to replace aging technology,

re-evaluate marketing tactics and align with best practice. The

management and production teams are now based within the Group's US

division, and the Personal Finance vertical is focussed on

completing the redesign and re-platforming of its primary websites,

with the objective of improving site performance and enhancing the

consumer experience and stabilising revenues.

Cash

The Group's acquisition program was part funded through an

equity raise in March 2021, with future acquisition payments and

earn out elements of the consideration largely funded from the

Group's free cashflow. The Group expects to make deferred

consideration payments of approximately US$7.7 million in H2

2022.

Cash balances at the end of June 2022 were approximately US$17.7

million (H1 2021: US$36.9 million).

Operations and infrastructure

H1 2022 saw the appointments of XLMedia's new Chair and CFO, and

on 1 July, the appointment of its new CEO.

XLMedia's new organisational design, as outlined in the Group's

FY 2021 results, was largely completed in H1 2022 and is expected

to generate annualised cost savings of US$ 5-6 million.

Central to this program has been a fundamental rationalisation

of the Group's online portfolio, in particular Casino which has

been reduced from over 3,000 sites to some c.45 sites, enabling the

commencement of an upgraded site infrastructure and the development

of shared working practices while supporting the provision of

targeted content.

Notice of H1 Results

XLMedia expects to report results for the six months ending 30

June 2022, in the week commencing 26 September 2022.

The Company will hold a webcast for shareholders and will

provide details of the facility nearer the time.

* XLMedia acquired CBWG in December 2020, Sports Betting Dime in

March 2021, and Saturday Football Inc in September 2021.

The information contained within this announcement is deemed to

constitute inside information as stipulated under the retained EU

law version of the Market Abuse Regulation (EU) No. 596/2014 (the

"UK MAR") which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018. The information is disclosed in accordance

with the Company's obligations under Article 17 of the UK MAR. Upon

the publication of this announcement, this inside information is

now considered to be in the public domain .

For further information, please contact:

XLMedia plc ir@xlmedia.com

David King, Chief Executive Officer via Vigo Consulting

Caroline Ackroyd, Chief Financial Officer

www.xlmedia.com

Vigo Consulting Tel: 020 7390 0233

Jeremy Garcia / Kendall Hill

www.vigoconsulting.com

Cenkos Securities plc (Nomad and Joint Broker) Tel: 020 7397 8900

Giles Balleny / Max Gould

www.cenkos.com

Berenberg (Joint Broker) Tel: 020 3207 7800

Mark Whitmore / Richard Andrews / Jack Botros

www.berenberg.com

About XLMedia:

XLMedia (AIM:XLM) is a global digital performance publisher.

connecting advertisers with consumers, operating across sports,

gaming and personal finance.

The Group manages a portfolio of premium brands that cover a

range of attractive geographies with a primary emphasis on

regulated markets. The XLMedia portfolio is designed to reach

targeted audiences with the desire to engage and take action.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTLQLLLLDLBBBK

(END) Dow Jones Newswires

July 27, 2022 02:00 ET (06:00 GMT)

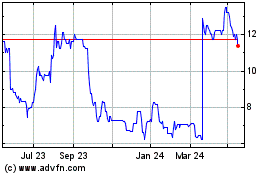

Xlmedia (LSE:XLM)

Historical Stock Chart

From Jun 2024 to Jul 2024

Xlmedia (LSE:XLM)

Historical Stock Chart

From Jul 2023 to Jul 2024