RNS Number:0671O

Xaar PLC

19 July 2000

MEETINGS TODAY

Analyst at 9:30am - Press at 11:15am

Venue: Buchanan Communications, 107 Cheapside

London, EC2V 6DN

Please call Lisa Baderoon on 020 7466 5000

if you are able to attend.

INTERIM RESULTS FOR THE SIX MONTHS TO 30 JUNE 2000

- RECORD TURNOVER AND A PROFIT

Xaar plc ('Xaar'), the ink jet printing technology group

headquartered in Cambridge, has announced its unaudited

interim results for the six months ended 30 June 2000.

Key points :

- Record turnover and a profit reflect the excellent progress

made during the first half of the year.

- Turnover doubled to #10.8m (1999 : #5.4m).

- Profit before tax turned round sharply to #0.7m (1999 : loss

of #0.4m).

- A good balance in revenue profile was achieved between

technology income and manufacturing turnover.

- As a result of strong operating cashflow, cash balances at

the end of the half year increased by #2.9m to #7.1m (#4.2m

at 31 December 1999).

- Major new licence was signed during the first half with

Sharp Corporation of Japan.

- Highly successful exhibition at Drupa, the major printing

industry show held every four years, with Xaar's digital

printing technology incorporated in products on display on

the stands of many customers, partners and licensees.

- Sales of XaarJet manufactured print heads and inks nearly

doubled on a like-for-like basis compared to the first half

of last year.

- Good progress was made in the development of next-generation

wide array printing technology together with partners, Agfa,

Kyocera and DuPont.

- On outlook, Chairman, Arie Rosenfeld commented :

'We see an enormous range of opportunities for Xaar's

technology - and there was solid evidence of this in the

number of applications using our technology which were on

show at the Drupa printing exhibition in May.

We have built on the real momentum created in 1999 and we

continue to look to the future with enthusiasm and

confidence.'

Graham Wylie, Chief Executive or Jonathan Lowe,

Finance Director at Xaar on 020-7466-5000 today or

01223-423663 thereafter

Lisa Baderoon at Buchanan Communications on 020-7466-5000

CHAIRMAN'S STATEMENT

Introduction

I am pleased to report that Xaar has made further excellent

progress in the first six months of the current year. We

achieved record revenues and a profit for the period and

concluded a major new licence deal with Sharp Corporation of

Japan.

Results and Finance

Turnover for the period was #10.8m (1999 : #5.4m) which

resulted in a profit before tax of #0.7m (1999 : loss before

tax #0.4m). The revenue profile showed a good balance

between technology revenues (licences and royalties) and

trading revenues (printhead and ink sales). Cashflow was

strong in the period with operating cash generated of #3.3m;

cash balances at 30 June 2000 stood at #7.1m compared with

#4.2m at 31 December 1999. Capital expenditure of #0.6m was

in line with our plans.

Business Review

The world's largest printing tradeshow, Drupa 2000, was held

in Germany in May and proved a resounding success for Xaar.

Many of our customers, partners and licensees exhibited

digital printing systems containing Xaar technology covering a

wide range of printing applications. The show is held once

every four years and it was widely agreed that the 2000 show

marked a key milestone in the transition from analogue

printing to digital printing. Xaar is recognised as one of

the leaders of this movement.

Xaar Technology is the division responsible for technology

development and licensing. A major licence was signed with

Sharp Corporation of Japan who are one of the world's leading

consumer electronics and imaging companies. We also saw a

number of product launches from licensees in the period.

Royalties were modest for the period; however with recent

product launches and strong licensing activity over the last

twelve months we remain confident that royalties will grow

significantly in the future.

XaarJet is the printhead and ink business based in Cambridge

and Sweden. High performance printheads and inks are sold to

a range of OEM customers and end users as the key enabling

components of digital printing systems. This business has

made excellent progress ever since we acquired the Swedish

operation in March 1999. XaarJet sales have nearly doubled on

a like-for-like basis since the corresponding period in 1999

and the business was profitable for the first time on a

combined basis. Work remains to be done to improve yields in

the UK and to strengthen the ink business but we are pleased

with the progress made in the last six months.

Xaar Digital deals with the technical development and

commercial exploitation of our next generation wide-printing

technology. We work with our partners Agfa, Kyocera and

DuPont on this development which will eventually take digital

ink-jet printing into new areas of commercial printing. The

technical challenge that is being undertaken is considerable

and there have been some technical delays over the past few

months. However we remain as firmly committed as ever to

developing the next generation of Xaar technology for wide

array printing and we are working even more closely and

effectively with our partners to ensure that the development

programmes will be successful.

Intellectual Property

We have continued to expand our patent portfolio including a

number of important patent applications in the field of wide

printing. Our total patent portfolio has increased to over

520 patents and patent applications.

Board Changes

After many years of continuity on the Board, there have been

two recent resignations; Bob Hook, one of our non-executive

directors and a previous chairman, has decided to concentrate

on his many other business interests. Mark Shepherd has

decided to move on to a fresh challenge, having been involved

with Xaar since the earliest days. We wish them both well.

No immediate replacements are planned.

Outlook

There are enormous opportunities for Xaar's technology in a

wide range of consumer, office, industrial and commercial

applications requiring a high speed digital printing solution.

This was evidenced by the number of applications utilising the

technology at Drupa in May. We will continue to develop and

to exploit these opportunities in the way best suited to each

market segment; technology licensing for consumer and office

products; manufacture and sale of high performance printheads

and inks for industrial applications; and joint collaborations

with leading global corporations for next generation

commercial applications.

Our technology revenues remain by their nature less

predictable than our trading revenues. However our proprietary

technology is the firm platform on which all our business

opportunities are built and we remain totally committed to the

continued development of Xaar's technology to meet the needs

of our customers and partners in the years ahead.

In the first six months of this year we have built on the real

momentum created in 1999 and we continue to look to the future

with enthusiasm and confidence.

Arie Rosenfeld

Chairman

19 July 2000

CONSOLIDATED PROFIT AND LOSS ACCOUNT

FOR THE SIX MONTHS ENDED 30 JUNE 2000

Notes 6 months 6 months 12 months

to to to

30 June 30 June 31

2000 1999 December

(un- (un- 1999

audited) audited) (audited)

#'000 #'000 #'000

Turnover 10,755 5,400 15,064

Cost of sales (5,098) (2,498) (6,957)

--------- -------- ---------

Gross profit 5,657 2,902 8,107

Other operating expenses

(net) 3 (5,041) (3,412) (7,781)

--------- -------- ---------

Operating profit/(loss) 616 (510) 326

Interest receivable

(net) 83 154 216

--------- -------- ---------

Profit/(loss) on

ordinary activities

before taxation 699 (356) 542

Tax on profit/(loss) on

ordinary activities (347) (131) (338)

--------- -------- ---------

Retained profit/(loss)

for the financial period 352 (487) 204

===== ===== =====

Earnings/(loss) per

share - basic 1 0.6p (0.9p) 0.4p

Earnings/(loss) per

share - diluted 0.6p - 0.4p

===== ===== =====

Consolidated statement of total recognised gains and losses

6 months 6 months 12 months

to to to

30 June 30 June 31

2000 1999 December

(un- (un- 1999

audited) audited) (audited)

#'000 #'000 #'000

Retained profit/(loss) for

the financial period 352 (487) 204

Gain/(loss) on foreign

currency translation 117 (5) (80)

--------- -------- ---------

Total recognised gains and

losses relating to the

period 469 (492) 124

===== ===== =====

CONSOLIDATED BALANCE SHEET

AS AT 30 JUNE 2000

As at As at As at

30 June 30 June 31

2000 1999 December

(un- (un- 1999

audited) audited) (audited)

#'000 #'000 #'000

Fixed assets

Goodwill 1,203 1,341 1,272

Tangible assets 4,513 4,875 4,789

Investments 20 20 20

-------- ------- --------

5,736 6,236 6,081

Current assets

Stocks 995 835 842

Debtors 4,315 3,120 5,709

Cash and liquid resources 7,141 5,665 4,217

-------- ------- --------

12,451 9,620 10,768

Creditors: amounts falling due

within one year (4,281) (3,564) (3,682)

-------- ------- --------

Net current assets 8,170 6,056 7,086

-------- ------- --------

Total assets less current

liabilities 13,906 12,292 13,167

Creditors: amounts falling due

after more than one year (232) (351) (415)

-------- ------- --------

Net assets 13,674 11,941 12,752

===== ===== =====

Capital and reserves

Called-up share capital 5,697 5,439 5,568

Share premium account 10,408 10,114 10,116

Other reserves 1,042 946 1,010

Accumulated deficit (3,473) (4,558) (3,942)

-------- ------- --------

Shareholders' funds - all

equity 13,674 11,941 12,752

===== ===== =====

CONSOLIDATED CASH FLOW STATEMENT

FOR THE SIX MONTHS ENDED 30 JUNE 2000

6 months 6 months 12 months

to to to

30 June 30 June 31

2000 1999 December

(unau- (unau- 1999

dited) dited) (audited)

#'000 #'000 #'000

Net cash inflow/(outflow) from

operating activities 3,333 (1,050) (2,210)

-------- ------- --------

Returns on investments and

servicing of finance 76 206 275

Capital expenditure and

financial investment (634) (330) (581)

Acquisitions (net of cash

acquired) - (2,942) (2,942)

-------- ------- --------

Cash inflow/(outflow) before

management of liquid resources

and financing 2,775 (4,116) (5,458)

-------- ------- --------

Management of liquid resources (2,040) 4,093 5,728

Financing 80 1,042 960

-------- ------- --------

Increase in cash in the period 815 1,019 1,230

===== ===== =====

Cash and liquid resources comprise:

As at As at As at

30 June 30 June 31

2000 1999 December

(unau- (unau- 1999

dited) dited) (audited)

#'000 #'000 #'000

Cash at bank and in hand 2,116 1,045 1,232

Treasury deposits 5,025 4,620 2,985

--------- ------- --------

7,141 5,665 4,217

===== ===== =====

Notes to the interim financial information

1. Earnings/(loss) per ordinary share - basic and diluted

The calculation of earnings/(loss) per share is based on

the profit/(loss) for the period after taxation and on

the weighted average number of ordinary shares in issue

during the period of 56,572,163 (1999: 52,963,518) in

respect of basic earnings/(loss) per share, and

60,591,331 in respect of diluted earnings per share (the

only difference being in relation to exercises of share

options). Due to the loss incurred in 1999 no share

options were deemed to be dilutive.

2. Comparative figures

The comparative figures for the financial year ended 31

December 1999 do not constitute statutory accounts for

that financial year within the meaning of section 240 of

the Companies Act 1985. These figures have been

extracted from the audited accounts for that year, which

have been delivered to the Registrar of Companies. The

report of the auditors was unqualified and did not

contain a statement under section 237(2) or (3) of the

Companies Act 1985.

3. Other operating expenses (net)

In June 2000 the pension provider in Sweden confirmed to

XaarJet AB that a contribution surplus of some #700,000

would be returned to the company in two portions:

#143,000 by way of a cash payment, with the remainder to

be offset against future pension contributions.

Accordingly, net other operating expenses for the period

include a one-off credit of #143,000, with the remaining

surplus to be credited as and when future contributions

are reduced.

Independent Review Report to Xaar plc

Introduction

We have been instructed by the company to review the financial

information and we have read the other information contained

in the interim report and considered whether it contains any

apparent misstatements or material inconsistencies with the

financial information.

Directors' responsibilities

The interim report, including the financial information

contained therein, is the responsibility of, and has been

approved by, the directors. The directors are responsible

for preparing the interim report in accordance with the

Listing Rules of the Financial Services Authority and

applicable United Kingdom accounting standards. The Listing

Rules require that the accounting policies and presentation

applied to the interim figures should be consistent with those

applied in preparing the preceding annual accounts except

where any changes, and the reasons for them, are disclosed.

Review work performed

We conducted our review in accordance with guidance contained

in Bulletin 1999/4 issued in the United Kingdom by the

Auditing Practices Board and with our profession's ethical

guidance. A review consists principally of making enquiries of

group management and applying analytical procedures to the

financial information and underlying financial data and, based

thereon, assessing whether the accounting policies and

presentation have been consistently applied unless otherwise

disclosed. A review excludes audit procedures such as tests of

controls and verification of assets, liabilities and

transactions. It is substantially less in scope than an audit

performed in accordance with Auditing Standards and therefore

provides a lower level of assurance than an audit.

Accordingly we do not express an audit opinion on the

financial information.

Review conclusion

On the basis of our review we are not aware of any material

modifications that should be made to the financial

information as presented for the six months ended 30 June

2000.

Arthur Andersen

Chartered Accountants

Betjeman House

104 Hills Road

Cambridge

CB2 1LH

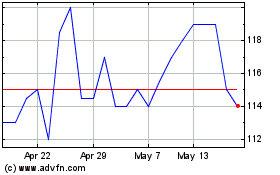

Xaar (LSE:XAR)

Historical Stock Chart

From Oct 2024 to Nov 2024

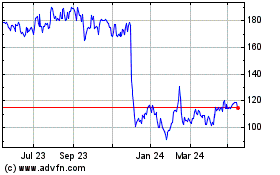

Xaar (LSE:XAR)

Historical Stock Chart

From Nov 2023 to Nov 2024