TIDMWSG

RNS Number : 3807W

Westminster Group PLC

18 August 2022

Westminster Group Plc

('Westminster', the 'Group' or the 'Company')

Interim Results for the six months to 30 June 2022

Westminster Group Plc (AIM: WSG), a leading supplier of managed

services and technology-based security solutions, announces its

unaudited interim results for the six months ended 30 June 2022

(the 'Period').

Operational Highlights:

-- Delivered products and services to 41 countries around the world.

-- Encouraging progress on DRC Ratification process and believed

to be on track to finalise in Q4 2022.

-- West African airport operations recovered from the Covid

impact and now operating at record levels.

-- Strong recovery in Training business with numerous new contracts including major UK airport.

-- Palace of Westminster and Tower of London projects

successfully underway with extension of scope in progress.

-- KSA office now fully operational and new contracts being secured.

Financial Highlights:

-- Group revenues up 13% from H1 2021 to GBP3.9 million (H1

2021: GBP3.5 million, H2 2021: GBP3.6 million).

-- Gross margin increased to 51% (2021: 45%).

-- Operating Loss of GBP0.78 million (H1 2021: Loss GBP0.93

million, H2 2021 Loss GBP0.99 million).

-- Loss per share of 0.24p (H1 2021: Loss 0.32p).

Commenting on the results and current trading, Peter Fowler,

Chief Executive of Westminster Group, said:

"As stated in our recent Annual Report, the outlook for 2022 is

positive as the impact of the global pandemic recedes and with the

worst of the disruption and travel challenges behind us. I am

encouraged to see improvements in the various areas of our business

that were heavily impacted during the past couple of years.

"Whilst we are seeing recovery and growth in various parts of

the business, I am particularly pleased to see our West African

airport operations operating at new record levels, ahead of

pre-pandemic volumes. Our training business is also showing strong

recovery with a number of important new contracts including a major

UK airport.

"It is also encouraging to see some of the larger project

opportunities we have been working on, which were delayed during

the pandemic, once again looking promising.

"I am also delighted to be able to report that progress has been

made on ratification process for the DRC airport security contract,

which we announced in June 2021, and believe we are on track to

finalise matters and commence operations in Q4 as previously

stated.

"H1 2022 has performed largely to expectation, delivering an

improvement on H1 2021 as our various business sectors recover from

the pandemic.

"Whilst we remain mindful of global challenges, given the

momentum and recovery we are seeing, together with our extensive

quote bank and the number of sizeable near-term project

opportunities we are working on, we remain optimistic we can meet

2022 financial year market expectations."

Westminster Group Plc Media enquiries via Walbrook

PR

Rt. Hon. Sir Tony Baldry - Chairman

Peter Fowler - Chief Executive Officer

Mark Hughes - Chief Financial Officer

Strand Hanson Limited (Financial & Nominated

Adviser)

James Harris 020 7409 3494

Ritchie Balmer

Richard Johnson

Arden Partners plc (Broker)

Ruari McGirr (Corporate)

Tim Dainton/Simon Johnson (Broking) 020 7614 5900

Walbrook (Investor Relations)

Tom Cooper 020 7933 8780

Paul Vann

Nick Rome Westminster@walbrookpr.com

Notes:

Westminster Group plc is a specialist security and services

group operating worldwide via an extensive international network of

agents and offices in over 50 countries.

Westminster's principal activity is the design, supply and

ongoing support of advanced technology security solutions,

encompassing a wide range of surveillance, detection (including

Fever Detection), tracking and interception technologies and the

provision of long-term managed services contracts such as the

management and running of complete security services and solutions

in airports, ports and other such facilities together with the

provision of manpower, consultancy and training services. The

majority of its customer base, by value, comprises governments and

government agencies, non-governmental organisations (NGOs) and

blue-chip commercial organisations.

The Westminster Group Foundation is part of the Group's

Corporate Social Responsibility activities.

www.wg-foundation.org

The Foundation's goal is to support the communities in which the

Group operates by working with local partners and other established

charities to provide goods or services for the relief of poverty

and the advancement of education and healthcare particularly in the

developing world.

The Westminster Group Foundation is a Charitable Incorporated

Organisation, CIO, registered with the Charities Commission number

1158653.

[THIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION AS DEFINED IN

ARTICLE 7 OF THE MARKET ABUSE REGULATION NO. 596/2014 ("MAR") WHICH

IS PART OF UK LAW BY VIRTUE OF THE EUROPEAN UNION (WITHDRAWAL) ACT

2018. UPON THE PUBLICATION OF THIS ANNOUNCEMENT, THIS INSIDE

INFORMATION IS NOW CONSIDERED TO BE IN THE PUBLIC DOMAIN]

Chief Executive O cer's Review

Overview

We stated in our recent Annual Report that the outlook for 2022

is positive as the impact of the global pandemic recedes, despite

the first few months of the year being impacted. However, with the

worst of the pandemic disruption and travel challenges behind us,

global uncertainty remains with conflicts and the economic crisis,

and we continue to monitor events and plan accordingly.

Against that backdrop I am encouraged therefore to see

improvements in the various areas of our business that were heavily

impacted during the past couple of years. It is also encouraging to

see some of the larger project opportunities we have been pursuing,

which were delayed during the pandemic, once again looking

promising.

H1 2022 has performed largely to expectation, delivering an

improvement on H1 2021 as our various business sectors recover from

the pandemic. Revenues for H1 2022 (GBP3.9m) were a 13% improvement

on H1 2021 (GBP3.5m) whilst gross profit improved by 27% to GBP2.0m

(H1 2021: GBP1.6m), resulting in an EBITDA loss of GBP648k (H1

2021: loss GBP810k).

In the Period we have supplied products and services to 41

countries around the world, including some important new contract

wins such as the US military and the Organization for Security and

Co-operation in Europe (OSCE). We continue to have an active

business development programme and continue to develop a number of

large-scale project opportunities in both our Services and

Technology Divisions. Whilst there is never certainty of timing or

outcome, we expect to secure one or more such projects in the

current year.

A key focus during the Period has been to work with the various

stakeholders and authorities within the DRC to finalise the

ratification process for the airport security contract, which we

announced in June 2021. I am encouraged by the progress that has

now been made on this long outstanding issue and believe we are on

track to finalise matters and commence operations in Q4 2022 as

previously stated.

Our West Africa airport operations have recovered to

pre-pandemic levels earlier than expected. June passenger numbers

were the highest June total ever recorded and are not only ahead of

budget but also 1.2% above the previous highest ever H1,

pre-pandemic in 2019, which is very encouraging and bodes well for

future trading.

Our Ghana port operations continue to perform to expectations

although the recent agreement between the port operator and MPS and

Ghana Ports and Harbours Authority to move 20% of container traffic

out of terminal 3 for a period of 2 years commencing on 1 August

2022, is likely to have an impact and limit growth for that

period.

Our other West Africa port project has yet to commence

operations as we wait for our client to finalise the land

allocation issues with the government, but we remain ready to start

once access is granted.

I am pleased to report that our KSA office is now fully

operational and starting to win business. As previously mentioned,

we expect KSA will produce meaningful contribution to our future

revenues.

In the UK our Palace of Westminster and Tower of London projects

are running smoothly and we are already discussing additional

security measures to be put in place under separate contracts.

Our Training business has also rebounded strongly and, in the

Period, we have secured a number of new training contracts for

clients around the world, including a sizeable contract for one of

the UK's largest airports.

The forthcoming Protect Duty legislation, which is expected to

come into force within the UK later this year, will set out

standards to protect patrons and the general public from terrorist

attacks when in crowded spaces. The Home Office estimates that

650,000 UK businesses could be affected. This could include

settings such as pubs, shopping centres, music venues, parks,

places of worship and any other place where gatherings of people

occur. We have been extremely busy preparing for this, working in

collaboration with a number of stakeholders, including public

figures, magazines, industry experts and the police in readiness

for the upcoming legislation. With Westminster's expertise and

portfolio of products and services we are well placed to assist

businesses and organisation improve their security in this respect

we have already secured important new business and are in contract

discussions with a number of potential customers. We believe this

could be a sizeable business opportunity for the Group. For more

information on protect duty see here

https://www.wg-plc.com/protect-duty#

We continue to monitor the JCPOA talks and are maintaining

discussions with stakeholders (including the UK Government). There

is some optimism that an EU brokered deal may yet be reached to

remove many of the current sanctions, including banking, and should

this happen we are well placed to re-energise our airport security

contract, which was signed but put on hold when the US unilaterally

pulled out of the JCPOA in 2018.

Financial

Revenues at GBP3.9 million (H1 2021: GBP3.5 million) for the

first half year were 13% ahead of last year. This represented a

strong recovery in the Services side of the business with our West

African Airport and Training leading the way.

The Group generated a gross profit of GBP2.0 million (H1 2021:

GBP1.6 million) which equates to a gross margin of 51% (H1 2021:

45%). The percentage increase is due to the increase in high margin

managed services sales in H1 2022 changing the margin mix.

The operating loss was GBP0.78 million (H1 2021: loss of GBP0.93

million). This is primarily driven by the drop in product sales due

to market uncertainty offset by improving gross margin.

Cash balance as at 30 June 2022: GBP0.4 million (30 June 2021:

GBP3.1 million, 31 December 2021: GBP0.9 million). The group also

has overdraft facilities which were unutilised at 30 June 2022. We

are pleased to have secured UKEF for projects and working capital

continues to remain strong with debtor balances at GBP3.7m vs

creditors of GBP2.1m.

Earnings per share were a loss of 0.24 pence (H1 2021: 0.32p

loss).

Outlook

We continue to invest in our worldwide business development

programmes in order to deliver on our growth potential,

particularly in our long-term managed services projects and as

previously advised we anticipate securing at least one, possibly

more, additional large-scale projects this year.

In addition, with the recovery from the pandemic impact we are

seeing in our existing revenue streams, together with new and

expected contracts coming on stream, we remain confident of our

future growth.

This year was always expected to be H2 weighted as we emerged

for the global pandemic, and this remains the case. With our

recurring revenues now running at circa GBP5m per annum and with

over GBP3.5m in new orders secured so far this year, the majority,

if not all of which, we expect to deliver in the year, we expect to

secure and deliver further revenue in the remainder of H2 in line

with current market expectations.

The Board is mindful of the current global situation with

serious conflicts in Ukraine and potentially Taiwan, which may

present both opportunities and challenges for our business, and the

growing economic crisis around the world, which may yet impact our

forecasts. However, given the momentum and recovery we are seeing

together with our extensive quote bank and the number of sizeable

near-term project opportunities we are working on, we remain

optimistic we can meet 2022 financial year market expectations.

Peter Fowler,

Group Chief Executive

18 August 2022

Condensed consolidated statement of comprehensive income

(unaudited)

for the six months ended 30 June 2022

Note Six months Six months Year ended

ended 30 ended 30 31 December

June 2022 June 2021 2021

Total Total Total

GBP'000 GBP'000 GBP'000

Revenue 5 3,916 3,477 7,051

Cost of sales (1,934) (1,912) (3,789)

Gross profit 1,982 1,565 3,262

Administrative expenses (2,764) (2,492) (5,179)

Operating loss 7a (782) (927) (1,917)

Analysis of operating loss (782) (927) (1,917)

Add back depreciation and amortisation 134 117 244

----------- ----------- -------------

EBITDA loss from underlying operations 6 (648) (810) (1,673)

---------------------------------------- ----- ----------- ----------- -------------

Finance Costs 8 (5) (2) (3)

(Loss) before taxation (787) (929) (1,920)

Taxation 7b - - (11)

Total comprehensive income for

the Period (787) (929) (1,931)

Profit / (loss) and total comprehensive income attributable

to:

Owners of the parent (788) (920) (1,921)

Non-controlling interest 1 (9) (10)

Loss and total comprehensive income (787) (929) (1,931)

----------------------------------------------- ----------- ----------- -------------

Earnings per share (pence) 7c (0.24p) (0.32p) (0.62p)

Condensed consolidated balance sheet (unaudited)

as at 30 June 2022

As at As at As at 31

30 June 30 June December

2022 2021 2021

Note GBP'000 GBP'000 GBP'000

Goodwill 614 613 614

Other intangible assets 120 151 150

Property, plant and equipment 1,924 1,882 1,895

Deferred Tax 953 956 953

Total Non-Current Assets 3,611 3,602 3,612

--------- --------- ----------

Inventories 795 585 681

Trade and other receivables 3,747 2,328 3,661

Cash and cash equivalents 398 3,054 944

Total Current Assets 4,940 5,967 5,286

--------- --------- ----------

Non-current receivable 411 484 424

Total Assets 8,962 10,053 9,322

========= ========= ==========

Called up share capital 9 331 16,322 331

Share premium account - 16,346 -

Merger relief reserve - 300 -

Share based payment reserve 1,007 1,050 1,043

Revaluation reserve 139 139 139

Retained earnings 5,589 (25,162) 6,340

--------- --------- ----------

Equity attributable to

Owners of the parent 7,066 8,995 7,853

Non-controlling interest (389) (544) (390)

Total Shareholders' Equity 6,677 8,451 7,463

--------- --------- ----------

Non-current borrowings 10 49 16 12

Total Non-Current Liabilities 49 16 12

--------- --------- ----------

Current borrowing 10 60 32 32

Contractual liabilities 69 97 87

Trade and other payables 2,107 1,457 1,728

Total Current Liabilities 2,236 1,586 1,847

--------- --------- ----------

Total Liabilities 2,285 1,602 1,859

Total Liabilities and Shareholders'

Equity 8,962 10,053 9,322

========= ========= ==========

Condensed consolidated statement of changes in equity

(unaudited)

for the six months ended 30 June 2022

Called Share Merger Share Revaluation Retained Total Non-controlling Total

up premium relief based reserve earnings interest share-holders'

share account reserve payment equity

capital reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1(st)

January

2022 331 - - 1,043 139 6,340 7,853 (390) 7,463

Loss for the

Period - - - - - (788) (788) 1 (787)

Total

comprehensive

expense for

the

Period - - - - - (788) (788) 1 (787)

-------- -------- -------- -------- ------------ --------- -------- ---------------- ---------------

Transactions with owners

in their capacity as

owners:

Lapse of share

options - - - (36) - 36 - - -

Other movement

in

equity - - - - - 1 1 - 1

- - - (36) - 37 1 - 1

--------------- -------- -------- -------- -------- ------------ --------- -------- ---------------- ---------------

As at 30th

June

2022 331 - - 1,007 139 5,589 7,066 (389) 6,677

--------------- -------- -------- -------- -------- ------------ --------- -------- ---------------- ---------------

for the six months ended 30 June 2021

Called Share Merger Share Revaluation Retained Total Non-controlling Total

up premium relief based reserve earnings interest share-holders'

share account reserve payment equity

capital reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

As at 1(st)

January

2021 16,278 14,069 300 1,050 139 (24,242) 7,594 (535) 7,059

Loss for the

Period - - - - - (920) (920) (9) (929)

Total

comprehensive

expense for

the Period - - - - - (920) (920) (9) (929)

-------- -------- -------- -------- ------------ --------- -------- ---------------- ---------------

Transactions with owners in their

capacity

as owners:

Shares issued

for cash 44 2,456 - - - - 2,500 - 2,500

Cost of share

issues - (179) - - - - (179) - (179)

44 2,277 - - - - 2,321 - 2,321

--------------- -------- -------- -------- -------- ------------ --------- -------- ---------------- ---------------

As at 30th

June 2021 16,322 16,346 300 1,050 139 (25,162) 8,995 (544) 8,451

--------------- -------- -------- -------- -------- ------------ --------- -------- ---------------- ---------------

for the twelve months ended 31 December 2021

Called Share Merger Share Revaluation Retained Total Non-controlling Total

up premium relief based reserve earnings interest share-holders'

share account reserve payment equity

capital reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

AS AT 1

JANUARY

2021 as

previously

stated 16,278 14,069 300 1,050 139 (24,242) 7,594 (535) 7,059

Prior year

adjustment - - - - (150) (150) 150 -

---------

AS AT 1

JANUARY

2021 Restated 16,278 14,069 300 1,050 139 (24,392) 7,444 (385) 7,059

--------------- --------- --------- -------- -------- ------------ --------- -------- ---------------- ---------------

Shares issued

for

cash 44 2,456 - - - - 2,500 - 2,500

Cost of share

issues - (179) - - - - (179) - (179)

Lapse of share

options - - - (7) - 7 - - -

Exercise of

warrants

and share

options - 9 - - - - 9 - 9

Capital

Reduction (15,991) (16,355) (300) - - 32,646 - - -

TRANSACTIONS

WITH

OWNERS (15,947) (14,069) (300) (7) - 32,653 2,330 - 2,330

--------------- --------- --------- -------- -------- ------------ --------- -------- ---------------- ---------------

Total

comprehensive

expense for

the

year - - - - - (1,921) (1,921) (5) (1,926)

AS AT 31

DECEMBER

2021 331 - - 1,043 139 6,340 7,853 (390) 7,463

--------------- --------- --------- -------- -------- ------------ --------- -------- ---------------- ---------------

Consolidated Cash Flow Statement (unaudited)

for the six months ended 30 June 2022

Six months Six months Year ended

ended 30 ended 30 31 December

June 2022 June 2021 2021

Total Total Total

Note GBP'000 GBP'000 GBP'000

Loss after taxation (787) (929) (1,931)

Tax - - 11

------------------- ------------------- -------------

Loss before taxation (787) (929) (1,920)

Non-cash adjustments 8 136 122 244

Net changes in working capital 8 175 (517) (1,632)

------------------- ------------------- -------------

Cash outflow from operating activities (476) (1,324) (3,308)

------------------- ------------------- -------------

Investing activities

Purchase of property, plant and equipment (132) (65) (160)

Purchase of intangible assets - - (41)

------------------- ------------------- -------------

Cash outflow from investing activities (132) (65) (201)

------------------- ------------------- -------------

Financing activities

Gross proceeds from the issue of ordinary

shares and exercise of warrants - 2,500 2,509

Costs of share issues - (179) (179)

Increase / (decrease) in finance lease

debt 65 (19) (17)

Finance cost on lease liabilities (3) (2) (3)

------------------- ------------------- -------------

Cash inflow from financing activities 62 2,300 2,310

------------------- ------------------- -------------

(Decrease) / increase in cash and

cash equivalents in the Period (546) 911 (1,199)

Cash and cash equivalents at the

beginning of the Period 944 2,143 2,143

Cash and cash equivalents at the

end of the Period 398 3,054 944

------------------- ------------------- -------------

Notes to the unaudited financial statements

for the six months ended 30 June 2022

1. General information and nature of operations

This condensed consolidated interim financial report for the

half-year reporting period ended 30 June 2022 has been prepared in

accordance with Accounting Standard IAS 34 Interim Financial

Reporting. These unaudited interim financial statements were

approved by the board on 17 August 2022. The 31 December 2021

numbers are extracted from the Group's audited accounts.

The interim report does not include all the notes of the type

normally included in an annual financial report. Accordingly, this

report is to be read in conjunction with the annual report for the

year ended 31 December 2021 and any public announcements made by

Westminster Group Plc during the interim reporting period

Westminster Group Plc (the "Company") was incorporated on 7

April 2000 and is domiciled and incorporated in the United Kingdom

and quoted on AIM. The Group's financial statements for the

six-month period ended 30 June 2022 consolidate the individual

financial information of the Company and its subsidiaries. The

Group designs, supplies and provides advanced technology security

solutions and services to governmental and non-governmental

organisations on a global basis.

The Group does not show any distinct seasonality.

2. Significant changes in the current reporting period

The impact of the pandemic is receding, but uncertainty remains

in the global economy. However, we continue to supply globally with

an active business development program. The West African Airport

has returned from the pandemic hiatus to levels above the

pre-pandemic passenger numbers. Training is also recovering

strongly with a buoyant market both in the UK and overseas.

3. Basis of preparation

This condensed consolidated interim financial report for the

half-year reporting period ended 30 June 2022 has been prepared in

accordance with Accounting Standard IAS 34 Interim Financial

Reporting.

The interim report does not include all the notes of the type

normally included in an annual financial report. Accordingly, this

report is to be read in conjunction with the annual report for the

year ended 31 December 2021 and any public announcements made by

Westminster Group Plc during the interim reporting period.

The accounting policies adopted are consistent with those of the

previous financial year and corresponding interim reporting period

and the adoption of new and amended standards as set out below.

These consolidated interim financial statements for the six

months ended 30 June 2022 have neither been audited nor formally

reviewed by the Group's auditors. The financial information for the

year ended 31 December 2021 set out in this interim report does not

constitute statutory accounts as defined in section 435 of the

Companies Act 2006 but is derived from those accounts. The

statutory financial statements for the year ended 31 December 2021

have been reported on by the Company's auditors and delivered to

the Registrar of Companies. A copy is available at

https://www.wsg-corporate.com/investor-relations/publications/

.

3(a) New and amended standards adopted by the Group

There are no new or amended standards relevant to the group

which became applicable for the current reporting period. However,

the group has adopted early the following amended Standards:

-- IAS 16 - Property, Plant and Equipment

-- IAS 37 - Provisions, Contingent Liabilities and Contingent Assets

The Group did not have to change its accounting policies or make

retrospective adjustments as a result of adopting these

standards.

3(b) Impact of standards issued but not yet applied by the entity

The Group does not expect to be significantly impacted by the

adoption of standards issued but not yet applied.

4. Going concern

The directors have considered the impact of Covid-19 and the way

the Group has traded positively through the crisis although at a

lower level. Projections have demonstrated that the group has

sufficient funds to perform its obligations. At the time of

approving this interim report, and in view of the foregoing, the

directors have a reasonable expectation that the Group has adequate

resources to continue in operational existence for the foreseeable

future. Thus, they continue to adopt the going concern basis of

accounting in preparing the financial statements.

5. Segment reporting

Operating segments

The Board considers the Group on a Business Unit basis. Reports

by Business Unit are used by the chief decision-makers in the

Group. The Business Units operating during the Period are the main

operating work streams, Services and Technology (products and

solutions).

30 June

6 Months to 2022

Services Technology Group Group Total

and Central

------------------------------------ --- --------------------- ---------------- ---------------- --------------

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------ --- --------------------- ---------------- ---------------- --------------

6 MONTHS TO JUNE 2022

Supply of products - 621 - 621

Supply and installation contracts - - - -

Maintenance and services 3,014 155 - 3,169

Training courses 126 - - 126

Revenue 3,140 776 - 3,916

------------------------------------ --- --------------------- ---------------- ----------------

Segmental underlying EBITDA 1,705 (184) (2,169) (648)

Depreciation & amortisation (72) (2) (60) (134)

--------------

Segment operating result 1,633 (186) (2,229) (782)

Finance cost - (1) (4) (5)

------------------------------------ --- --------------------- ---------------- ---------------- --------------

Profit/ (loss) before tax 1,633 (187) (2,233) (787)

Income tax charge - - - -

Profit/(loss) for the financial

year 1,633 (187) (2,233) (787)

------------------------------------ --- --------------------- ---------------- ----------------

Segment assets 5,182 1,142 2,638 8,962

------------------------------------ --- --------------------- ---------------- ---------------- --------------

Segment liabilities 1,194 550 541 2,285

------------------------------------ --- --------------------- ---------------- ---------------- --------------

Capital expenditure 117 - 15 132

------------------------------------ --- --------------------- ---------------- ---------------- --------------

30 JUNE

6 Months to 2021

Services Technology Group Group Total

and Central

------------------------------ ---- -------------------------- ----------- ----------------- --------------

GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ ---- -------------------------- ----------- -----------------

6 MONTHS TO JUNE 2021

Supply of products 10 678 - 688

Supply and installation contracts - 329 - 329

Maintenance and services 2,209 153 - 2,362

Training courses 51 47 - 98

------------------------------------

Revenue 2,270 1,207 - 3,477

------------------------------------ -------------------------- ----------- -----------------

Segmental underlying EBITDA 966 1,060 (2,836) (810)

Depreciation & amortisation (54) (4) (59) (117)

Segment operating result 912 1,056 (2,895) (927)

Finance cost - - (2) (2)

------------------------------------ -------------------------- ----------- ----------------- --------------

Profit/ (loss) before tax 912 1,056 (2,897) (929)

Income tax charge - - - -

Profit/(loss) for the financial

year 912 1,056 (2,897) (929)

-------------------------- ----------- -----------------

Segment assets 3,912 1,136 5,005 10,053

------------------------------------ -------------------------- ----------- -----------------

Segment liabilities 716 474 412 1,602

------------------------------------ -------------------------- ----------- -----------------

Capital expenditure 20 - 45 65

------------------------------------ -------------------------- ----------- -----------------

Marketing segments

Our extensive portfolio of products and services are categorised

in three key focus sectors - Land, Sea and Air. We are starting to

report on these sectors.

Six months Six months Twelve months

ended 30 June ended 30 June ended 31 December

2022 2021 2021

--------------- ---------------

GBP'000 GBP'000 GBP'000

Land 1,056 1,069 1,300

Sea 593 1,175 3,379

Air 2,267 1,233 2,372

--------------- --------------- --------------- -------------------

Total revenue 3,916 3,477 7,051

--------------- --------------- --------------- -------------------

Geographical areas

The Group's international business is conducted on a global

scale, with agents present in all major continents. The following

table provides an analysis of the Group's sales by geographical

market, irrespective of the origin of the goods/services.

Six months Six months Year ended

ended 30 June ended 30 June 31 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

--------------- -------------

United Kingdom and

Europe 1,005 805 2,161

Africa 2,710 1,934 4,296

Middle East 58 51 122

Rest of the World 143 687 472

Total revenue 3,916 3,477 7,051

--------------------

6. Reconciliation of adjusted EBITDA

A reconciliation of adjusted EBITDA to operating profit before

income tax is provided as follows:

Six months Six months Year ended

ended ended 30 31 December

30 June June 2021 2021

2022

GBP'000 GBP'000 GBP'000

(Loss) from Operations (782) (927) (1,917)

Depreciation, amortisation and impairment

charges 134 117 244

----------- -----------

Reported EBITDA (648) (810) (1,673)

Share based expense - - -

Exceptional Items - - -

Adjusted EBTIDA (loss) (648) (810) (1,673)

--------------------------------------------

Adjusted EBITDA is an alternative reporting measure. For further

details refer to the 31 December 2021 accounts.

7. Income statement information

a. Significant Items

Profit for the half year to 30 June 2022 includes no items that

are unusual because of their nature, size or incidence.

b. Income Tax

Income tax expense is recognised based on management's estimate.

The Group has significant tax losses in the UK brought forward from

prior years and does not expect to have to provide any material

amount for tax.

Deferred tax assets are recognised to the extent that it is

probable that taxable profits will be available against which

deductible temporary differences can be utilised. The Group's

projections show the expectation of future profits, hence in 2018 a

deferred tax asset was recognised. Reviews were performed in 2019,

2020, 2021 and again this year, considering Covid-19, which has

confirmed those expectations.

c. Earnings per share

Earnings per share is calculated by dividing the earnings

attributable to ordinary shareholders by the weighted average

number of ordinary shares outstanding during the Period. For

diluted earnings per share the weighted average number of ordinary

shares in issue is adjusted to assume conversion of all dilutive

potential ordinary shares. Only those outstanding options that have

an exercise price below the average market share price in the

Period have been included. For each period, the issue of additional

shares on exercise of outstanding share options would decrease the

basic loss per share and therefore there is no dilutive effect.

The weighted average number of ordinary shares is calculated as

follows:

Six months Six months Year ended

ended 30 ended 30 31 December

June 2022 June 2021 2021

'000 '000 '000

Number of issued ordinary shares at the

start of period 330,515 286,528 286,528

Effect of shares issued during the period - 841 23,576

----------- ----------- -------------

Weighted average basic and diluted number

of shares for period 330,515 287,369 310,104

=========== =========== =============

GBP'000 GBP'000 GBP'000

Loss and total comprehensive expense (787) (929) (1,931)

Loss per share (0.24)p (0.32)p (0.62)p

8. Cash flow adjustments and changes in working capital

Six months Six months Year ended

ended 30 ended 30 31 December

June 2022 June 2021 2021

Total Total Total

GBP'000 GBP'000 GBP'000

Adjustment for non-cash items

Depreciation, amortisation and impairment

of non-financial assets 134 117 244

Lease liabilities 5 2 (3)

(Profit) / loss on disposal of non-financial

assets (2) 3 -

IFRS 16 interest adjustment (1) (1) -

Decrease in deferred tax asset - - 3

FX effect on goodwill - 1 -

Total adjustments 136 122 244

====================== ====================== =============

Net changes in working capital:

Decrease / (increase) in inventories (114) 188 92

Decrease / (increase) in trade and other

receivables (86) 110 (1,223)

Decrease / (increase) in long term receivables 13 - 60

Increase / (decrease) in contract liabilities (18) (3) (13)

Increase / (decrease) in trade and other

payables 380 (812) (548)

Total increase / (decrease) in working capital 175 (517) (1,632)

====================== ====================== =============

9. Called up share capital

Ordinary Share Capital 6 months to 6 months to 30th Year to 31st

30th June 2022 June 2021 December 2021

Number GBP'000 Number GBP'000 Number GBP'000

-------------------------- ------------ -------- ------------ -------- ------------ --------

At the beginning of

the period 330,514,660 331 286,527,511 287 286,527,511 287

Arising on exercise - - - - 127,500 -

of share options and

warrants

Other issue for cash - - 43,859,649 44 43,859,649 44

At the end of the period 330,514,660 331 330,387,160 331 330,514,660 331

-------------------------- ------------ -------- ------------ -------- ------------ --------

Deferred share capital 6 months to 30th 6 months to 30th Year to 31st December

June 2022 June 2021 2021

Number GBP'000 Number GBP'000 Number GBP'000

------------------------------ --------- ---------- ------------ -------- -------------- ---------

At 1 January - - 161,527,511 15,991 161,527,511 15,991

Share capital reorganisation

to create deferred shares - - - - (161,527,511) (15,991)

At the end of the period - - 161,527,511 15,991 - -

------------------------------ --------- ---------- ------------ -------- -------------- ---------

Total Share Capital 6 months to 30th 6 months to 30th Year to 31st December

June 2022 June 2021 2021

Number GBP'000 Number GBP'000 Number GBP'000

Ordinary Share Capital 330,514,660 331 330,387,160 331 330,514,660 331

Deferred share capital - - 161,527,511 15,991 - -

330,514,660 331 491,914,671 16,322 330,514,660 331

======================== ============ ======== ============ ======== ============== ========

10. Borrowings

Six months Six months Year ended

ended 30 June ended 30 June 31 December

2022 2021 2021

GBP'000 GBP'000 GBP'000

Current borrowings (due

< 1 year)

Lease Debt 60 32 32

Total current borrowings 60 32 32

Non-current borrowings

(due > 1 year)

Lease Debt 49 16 12

Total non-current borrowings 49 16 12

Total borrowings 109 48 44

=============== =============== =============

11. Contingencies

The RiverFort EPSA was described in the 2020 and 2021 accounts.

In summary, in 2020 the company issued 14m ordinary shares and

received a GBP1.5m mezzanine loan under the RiverFort EPSA. At the

same time under the EPSA the company issued 14m shares and booked a

sundry debt of GBP1.75m. The loan was to be repaid and the sundry

debt settled by selling down the shares. The mezzanine loan was

fully repaid in December 2020. As at the 30 June 2022 there

remained shares still to be sold and a residual sundry debt for

those shares. Because of the low share price, had the remaining

shares been sold at 30 June 2022 there would have been a loss of

GBP 1,066,000 (31 Dec 2021: GBP885,000) on this debt. However, the

shares do not have to be fully sold at this time; and there is

reason to believe that it will be at a price higher in the future

than the current price level which will be enough to recoup the

losses.

In February 2021, Clydesdale Bank PLC trading as Yorkshire Bank

offered the Group an overdraft and other banking facilities. As a

condition of these facilities the Company entered into a

multilateral charge and guarantee in respect of bank overdrafts and

other facilities of all companies within the Group.

12. Events after the Reporting Period

There were no material events which occurred after the Period

end.

13. Copies of interim financial statements

A copy of these interim financial statements is available on the

Company's website, www.wsg-corporate.com and from the Company

Secretary at the company's registered office, Westminster House,

Blacklocks Hill, Banbury, Oxfordshire, OX17 2BS.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR SFMFMWEESESA

(END) Dow Jones Newswires

August 18, 2022 02:00 ET (06:00 GMT)

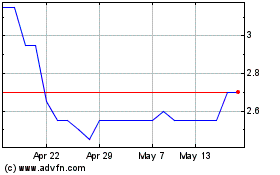

Westminster (LSE:WSG)

Historical Stock Chart

From Jun 2024 to Jul 2024

Westminster (LSE:WSG)

Historical Stock Chart

From Jul 2023 to Jul 2024